Trades placed by optionFair

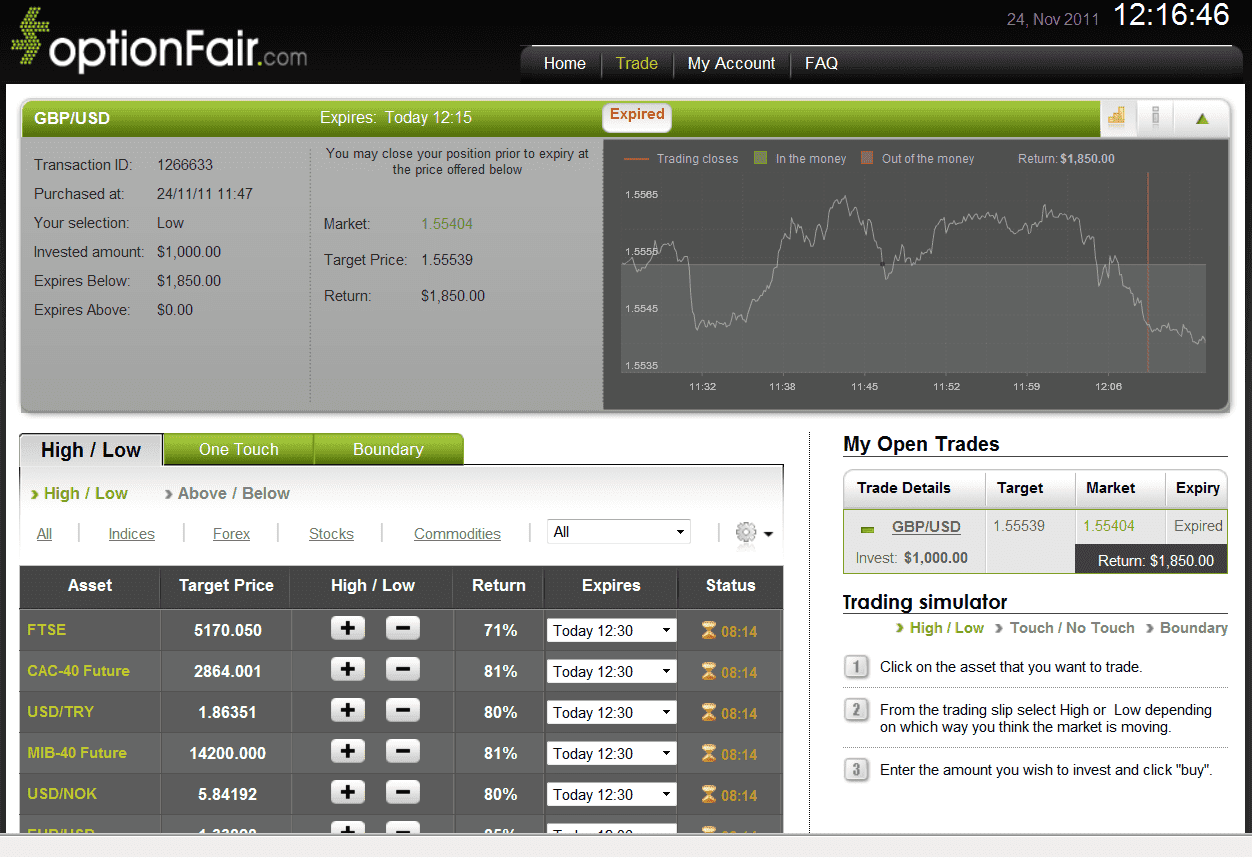

GBP/USD

GBP/USD is expected to drop according to Doug’s analysis even though it isn't correlated with the USD/CHF. Correlation is computed into what is known as the correlation coefficient, which ranges between -1 and +1. Perfect positive correlation implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random.

Instruments that are sensitive to this behavior are: “Low”, “Touch Down” and “No Touch” instrument.

I placed $1,000 on “Low” at optionFair™ Binary Options Trading Platform, so that if this option expires below the strike price, I will receive a 85% return, or $850 on my investment. At the buying time, 11:47, the GBP/USD traded at 1. 55539 and the target price was 1.55404 at the expiry time of 12:15. The market was below the strike price therefore I earned 85% on my $1000 investment.

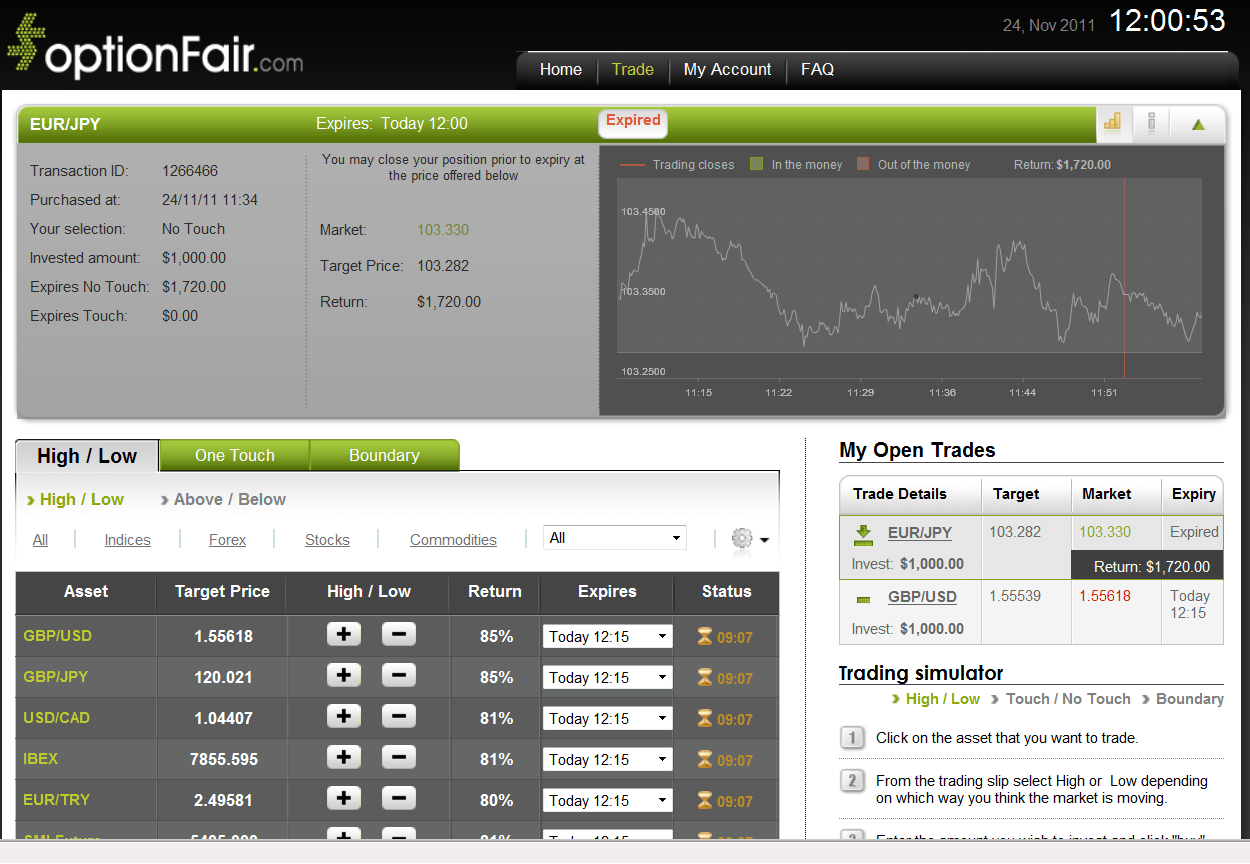

EUR/JPY

The EUR/JPY is showing bullish behavior according to Doug’s analysis. In other words, this means that a particular security, a sector, or the overall market is about to fall. Therefore it is recommended to invest in the following positions: “High”, “Touch”, and “No Touch Down”.

I placed $1,000 on “Touch” at optionFair™ Binary Options Trading Platform with the understanding that touches the strike price prior to expiration, I will have a 72% re-turn, giving me $720 on my initial investment. The difference between the underlying security's current market price and the option's strike price represents the amount of profit per share gained upon the exercise or the sale of the option. This is true for options that are in the money.

At the buying time, 11:34, the EUR/JPY traded at 103.353 and the strike price was 103.282 for the expiration time of 12:07.The market was in my favor giving me a $720 win on my initial investment. Very pleased with the markets performance, for less than 30 minutes of trade.