By: Christopher Lewis

Looking at the USD/CAD pair, you can see that it has broken out to the upside recently as the markets are becoming more and more risk adverse. The Canadian dollar is also very sensitive to the oil markets, which are also very risk-sensitive as well. Because of this, the USD/CAD could be finding itself in a bit of a “perfect storm”.

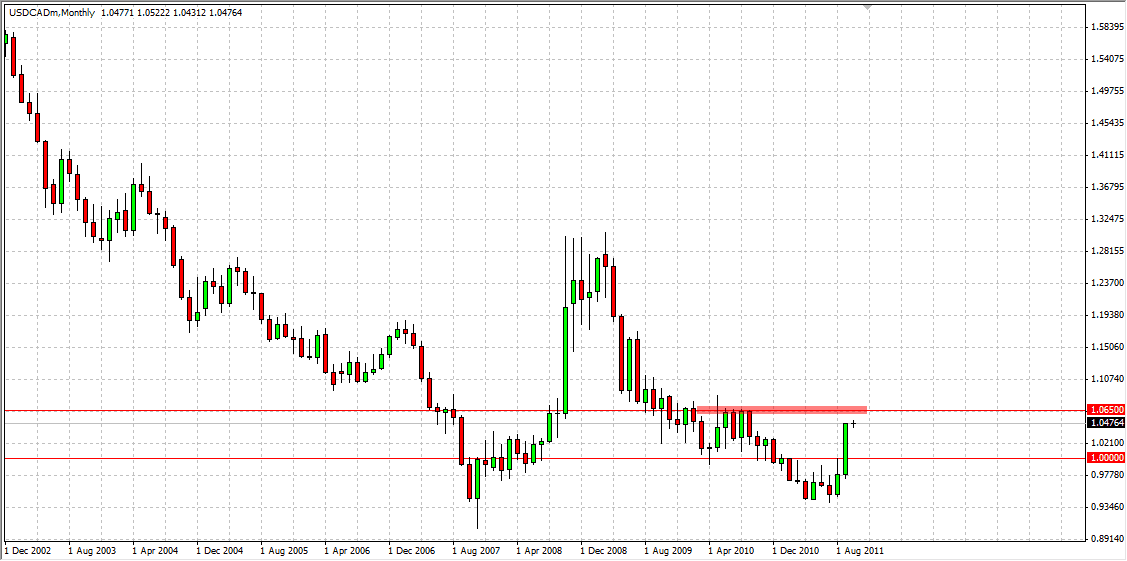

Attached to this article is the monthly USD/CAD chart. Traders typically don’t pay attention to the monthly time frame, and that is to their detriment. The monthly chart might be difficult to trade off of directly, but they can show you massive inflection points, places where trends change and momentum can pick up to one direction or another.

Looking at the USD/CAD monthly chart, we see the 1.0650 level as massive in its importance. Notice how the September candle has been a straight shot up – these types of candles mean something, as they close at the top of the range. This means that traders are dumping the CAD in droves at this point as the candle is so long. It isn’t often we see these candles on a monthly chart, and this should make you stand up and take notice.

The red line shows our level on the chart, and the area should see massive resistance. This is the very reason it is so important, as if it gives – there will have to be massive short covering, which of course will push the pair even higher. If this level gets broken above on the weekly time frame, we fell this pair will be in an uptrend at this point.

For this to happen there has to be a catalyst of course. However, we think there are at least three possible ones, which means it very well could happen, and much quicker than most people think. The Friday Non-Farm Payroll number could disappoint. If it does – people will sell off riskier assets, and this will punish the CAD. Also, the situation in the EU continues to push people out of riskier assets, and this will punish the CAD. Thirdly, the oil markets could sell off as a result of risk aversion. If this happens, the CAD loses in that scenario as well.

The USD/CAD pair is one you should be watching. If you look at the move it made during the last major financial crisis, you can see it raced all the way up to 1.30. While it is impossible to suggest it will do the exact same thing, it does show what can happen when panic sets in.