By: Pepperstone

U.S. Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: Risk aversion and trouble in Europe drove investors back into the U.S. Dollar late last week, with the Dollar Index closing at multi-week highs by 9,725. With the Dow falling more than 300 points, the Greenback traded higher against all of the major currencies with the exception of the Japanese Yen,which only serves to confirm that increasing uncertainty is driving the price action in the foreign exchange market. Market participants will continue to watch the political landscape in the U.S. to see just how willing Congress is to pass President Obama’s jobs plans. The U.S. President must be very disappointed by the market's reaction to his bold and aggressive jobs plan. At $447B, the plan was much larger than most people had expected, with most analysts anticipating a positive market reaction to anypackage larger than $400B. The week ahead will be a busy one for the Greenback, with a heavy economic calendar that includes retail sales, consumer and producer prices as well as the Empire State and Philly Fed manufacturing surveys. In addition, the Treasury International Capital flow report is also scheduled for release along with the University of Michigan Consumer Sentiment index. With only 2 more weeks to go before the FOMC meeting, investorswill be watching next week’s reports closely to see if they give the Federal Reserve any reasons to act quickly. If retail sales or inflationary pressures surprise to the downside, expectations are for investors to add to their pre-QE3 trade positions.

TECHNICALS: “The Dollar has exceeded its triangle line and reversed, which is common for E waves of triangles. If a triangle has formed from the April low, then the U.S.Dollar will head lowerfrom here and thrust below 9,323 into its final low before staging a reversal. Exceeding 9,682 would suggest that the low is already in place. Buying Greenback dips is the preferred strategy”. Indeed, Friday’s close above 9,682 points to continuing Greenback strength through September and as such we maintain a bullish U.S Dollar bias in the week ahead.

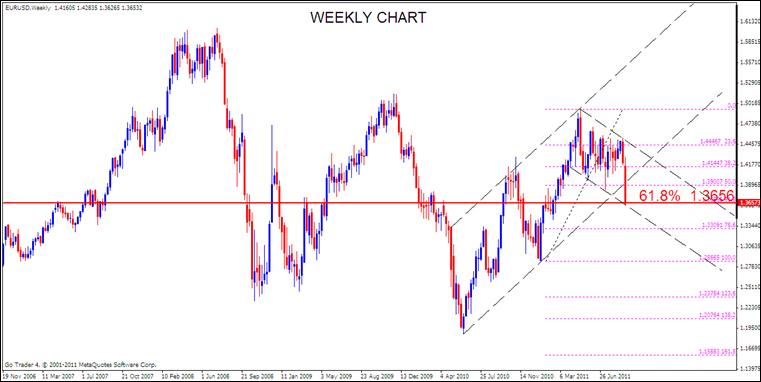

Euro. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: The Euro fell close to 500 pips against the U.S. Dollar late last week, extending a sell-off that has taken the currency pair from 1.4500 at the end of August down to an intraday low at Friday’s close by 1.3653. European sovereign debt troubles have long plagued the currency but investors have turned a blind eye to the fiscal troubles purely due to the hawkishness of the European Central Bank as the ECB was one of the only central banks raising interest rates in 2011. Even though countries like Greece, Ireland and Portugal were burdened by slower growth, German and France, the two largest countries in the Euro-zone were still enjoying relatively steady growth. However, the rose colored glasses came off on Thursday after ECB President Trichet slammed the door on additional tightening by downgrading the region’s GDP forecasts, emphasizing the uncertainty in the global economy and expressing less concern about inflation. Additionally, there was the surprise resignation announcement by ECB member Jurgen Stark. Stark is considered one of the most hawkish members of the central bank and losing him at a time when the ECB as a whole is moving towards a more dovish stance is very bearish for the Euro. On top of that, rumours circulated around the market that Greece could default as early as the weekend. Greece has denied the possibility of default but credit default swap spreads are through the roof with CDS swaps showing a 90% chance of a Greek default. There was a bond swap that expired on Friday and the fear is that bondholders will prefer to eat the loss than swap into longer dated bonds. If the number of bond swaps fall short, Greece may find themselves locked out of the credit market and forced to default. Germany isalready preparing for a Greek default according to Bloomberg who cites a source as saying that Angela Merkel is preparing an emergency plan to shore up capital for German banks that have extensive exposure to Greek debt. The Euro-zone economic calendar is very light this week with only current account, CPI and trade numbers scheduled for release. Although the fate of the Euro will depend upon whether a default by Greece is avoided - for the time being - the path of least resistance in the currency pair is still lower.

TECHNICALS: “Price is currently testing the trendline that extends from the 2010 low and a break would shift focus to the 61.8% retracement of the rally from the January low, at 1.3655. Resistance is seen at 1,4150-1.4200 and selling rallies to these levels is the preferred strategy”. Indeed, Friday’s sharp fall stopped on a dime at said 61.8% fib level, with a bounce expected to test 1.3835 levels (the July 12th low) before further declines. As such, we maintain a bearish Euro bias in the week ahead.

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: Last week, Japan’s economy contracted more than the government initially estimated in 2Q as capital spending decreased, fuelling concern the stronger Yen may cripple the nation’s recovery from the March earthquake. Grossdomestic product shrank at an annualized 2.1% rate in the three months ended June 30th, following the 1.3% contraction reported last month. Recent reports indicate that growth in Japan may stall toward the end of the year. Machinery orders, a leading indicator of capital spending, fell the most in 10 months in July. Companies continue to struggle with thestrong Yen which erodes overseas profits when they are repatriated. New Japanese Finance Minister Jun Azumi said on September 6th he will appeal to his G-7 counterparts meeting over the weekend about the danger a strong Yen poses to the Japanese economy as G-7 members have indicated intervention “should be done in agreement with the group asopposed to unilaterally.” Japan may encounter opposition to further Yen selling after acting by itself twice in the past 12 months. “There is a substantial consensus, at least among G-7 countries, that markets should determine foreign-exchange levels,” said Tamaki, Japan’s vice minister of finance. Therefore Azumi will likely have difficulty gaining support for a G-7 coordinated intervention to sell the Yen in the currency market. If Azumi is unsuccessful in convincing the G-7 leaders to coordinate in combating the strong Yen, we should see further weakening of the higher yielding currencies on safe-haven flows.

TECHNICALS: “The pair has pulled back following the test of 77. 70 but found support from just above the 77.00 figure. Despite the pullback, price is likely to drift higher to the top of the short term channel. The 100% extension of the rally from the low is potential resistance at 78.15 as is former support at 78.30. A move into the top of the channel would present aselling opportunity”. The late week dip below 77.20 does not alter our view as USDJPY continues to drift sideways to up with a selling opportunity at 78.00-78.50 levels. However, we still remain on the sidelines with this pair until a clearer picture emerges, most likely until post FOMC meeting on 20-21 September.

British Pound. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Last week, even though Sterling continued to sell-off against the U.S. Dollar, it rose to a 3 month high against the Euro which clearly indicates that Euro-zone fears will be the dominant theme in the financial markets this week. U.K. output prices climbed 0.1% from July as the prices charged at factory gates in August saw the smallest increase in a year. While margins are narrowing for U.K. manufacturers amid a dampened global recovery, the drop in energy costs provided temporary relief and the subsequent paring of inflationary pressure allows the Bank of England slightly more flexibility to supply more stimulus to the economy. Although U.K. Chancellor of the Exchequer George Osborne predicted an export-led recovery, the economy has encountered some headwinds from slow growth in both Europe and the U.S. Despite a stagnating economy, Mr. Osborne had been firm in reducing the country’s debt and implementing a firm austerity plan. The Organization of Economic Co-operation and Development (OECD) affirmed the U.Ks deficit reduction policy in its recentreport. Nonetheless, the OECD has grown more pessimistic toward the Britisheconomy forecasting a 1.4% annual growth. This latest estimate suggests that the U.K. economy could come to a virtual standstill toward the end of 2011, with theOECD stating "Growth is turning out to be much slower than we thought three months ago, and the risk of hitting patches of negative growth has gone up.” The pressure is on the BoE to implement more quantitative easing as the U.K. economy faces a grim outlook. Looking to the coming week, the CPI data on Tuesday could moderate slightly as Fridays PPI cooled. Additionally, the employment and retail sales reports are due on Wednesday and Thursday.

TECHNICALS: “Near term support comes in at1.6044 with resistance seen at 1.6250, a level that would offer selling opportunities. The daily close below the 100.00% extension of the 19th August high and 200 SMA is significant, which now exposes 1.5790 levels further down. Expectations are for short term rallies to 1.6050-1.6100 levels before the next leg lower. Expectations are unchanged and rallies to 1.6050-1.6100 present selling opportunities”. As such we maintain a bearish Sterling bias in the week ahead.

Canadian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Last week, the Canadian Dollar traded significantly lower against the U.S. Dollar as Canadian employment and housing numbers significantly disappointed. Canada lost jobs for the first time since March as employment fell by 5,500 after rising by 7,100 in the prior month, and the jobless rate rose to 7.3% from July’s 7.2%, which was the lowest since December 2008. The nearly stagnant job market in July andAugust follows a second quarter where the economy shrank for the first timesince a 2009 recession. Housing starts also disappointed significantly. The seasonally adjusted annual rate of housing starts was 185,000 units in August. This is down from 205,000 units in July 2011. These weaker than expected results for both releases will fuel fears that the Canadian economy will not rebound as sharply from its second quarter dip as policy makers would like to see. In the week ahead, the economic calendar is very light for Canada and expectations are for further Loonie weakness amid the global flight to safety.

TECHNICALS: “The impulsive rally from 0.9725 reinforces the bullish scenario with key support at 0.9815 levels”. Fridays price action closed above key resistance at 0.9925 levels with a near term target at the 61.8% extension by 1.0000 and eventually 1.0330, the 100.0% extension from the 27th July low, 9th August high and 31st August low. As such, we maintain a bearish Loonie bias in the week ahead.

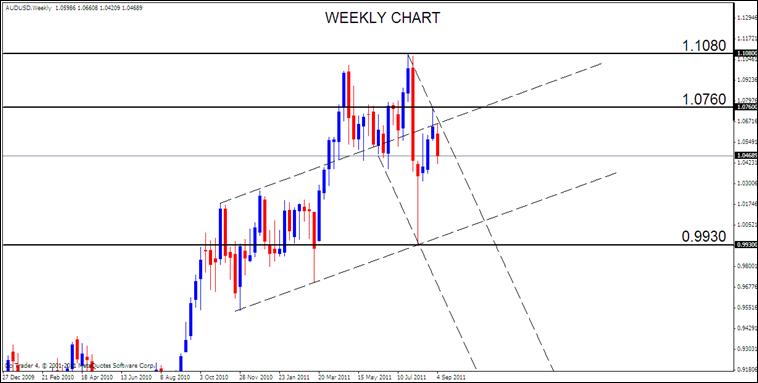

Australian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: By Last Fridays close, the Australian Dollar had given back all its gains against the U.S. Dollar. Reserve Bank of AustraliaGovernor Glenn Stevens is coming under criticism for the lack of transparency in the central bank’s rate decision vote last week. Stevens makes the call on adjusting borrowing costs without a publicly revealed vote of the board - an anomaly relative to the standard followed by peers in nations from the U.S. to Japan to Poland. A lack of accountability may undermine confidence in the RBA when Australia’s economy turns. The Australian Dollar is at its strongest level in three decades and is beginning to have a negative impact on jobs and production. Additionally, bond investors expectations of inflation in Australia are falling toward the lowest level in a year after nation’s unemployment rate rose to a 10-month high in August. The week ahead is light on economic data for Australia and as with the Canadian Dollar above, further Aussie weakness is anticipated as investors seek the safe haven Greenback, Yen and even perhaps the Swiss Franc.

TECHNICALS: “AUDUSD has been relentless in its rise since the August low with dips being quickly retraced. Bearish potential remains as long as price trades under 1.0760. A move above this level wouldsignal in all likelihood that AUDUSD is likely headed to new highs above 1.1080. The weekly chart suggests a top and combined with a hanging man monthly candle, this points to lower AUDUSD levels”. Indeed, Fridays close below key support at 1.0480 reinforces the downside AUDUSD scenario and as such we maintain a bearish Aussie bias in the week ahead.

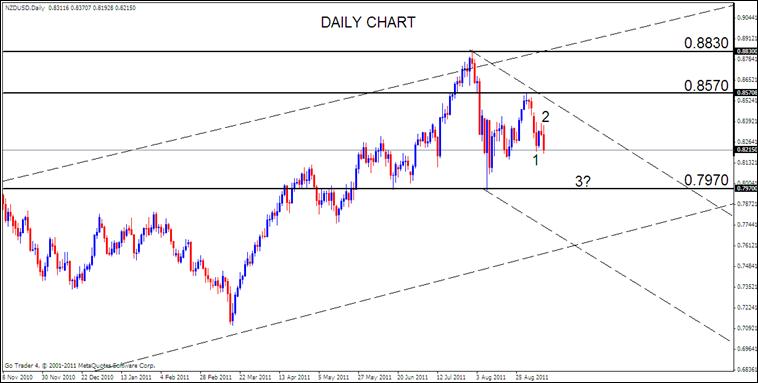

New Zealand Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: At its last meeting on July 27th, the Reserve Bank of New Zealand decided to maintain its key benchmark interest rate at 2.50%, citing that the economy is steadily improving following the earthquakes over the past few months. That decision kept the interest rate at 2.50% for the fourth consecutive month. It is widely expected that this weeks benchmark rate will again be kept at 2.50% on September 14th, with the Credit Suisse Overnight Index Swaps showing a mere 11% chance of a25.0-basis point rate hike. In light of such weak expectations hinging on slowing global growth, the number of basis point hikes priced into the Kiwiover the next 12 months has fallen to 40.0 in recent weeks. Apart from Wednesday’s rate decision, there are a number of economic releases from New Zealand, including the house price index, manufacturing sales and business manufacturing index. Like the commodity based Aussie and Loonie, the Kiwi is expected to come under pressure in the week ahead on safe-haven flows.

TECHNICALS: “The decline from 0.8570 appears to be unfolding in 5 waves and expectations are for a correction to extend into 0.8388 levels before the next sharp decline. As such, rallies to 0.8350-0.8400 would present selling opportunities”. As with the othercommodity currencies, we maintain a bearish Kiwi bias in the week ahead.