By: Christopher Lewis

The Australian dollar has many different hats that it wears these days, and as such the currency can act differently than “usual” at times. While it is often thought of as a “risk on” type of trade, you sometimes have to look at the gold markets in order to understand what could be driving the Aussie in the first place.

Traditionally, when traders felt that the economy around the world was good, they would buy certain currencies in order to express that fact. Some of the most popular are what some traders refer to as the “Comm-Dolls”. The name is simply an abbreviation of “Commodity Dollars”. The three favorite commodity currencies are all called “Dollars’, hence the name. These include the Aussie dollar, the New Zealand dollar, and the Canadian dollar.

Under those “traditional circumstances”, a trader might buy the Aussie dollar as a play on growth around the world. After all, when the construction industry is operating at a steady pace globally, many large firms will have to buy raw materials such as copper, iron, and aluminum – all of which can be found in Australia. So as they buy the resources from the Aussies, those suppliers will want to be paid in their local currency. This is a bit of a “built-in” mechanism to bid the exchange rate up. Add to this the fact that the Aussie has a higher interest rate than most other currencies, then you also have a bit of a “carry trade” aspect to it as well.

Recently, we have seen something a little bit different out of the Aussie though. In fact, it is acting as a “semi-safety play”. This is mainly because of the rapid ascension of the gold markets. Australia is one of the biggest producers of gold, and as a result – people buy the AUD/USD (and other AUD-related pairs) when the demand for gold rises. What has been interesting is that while the stock markets have been falling, this pair continues to rise. This leads me to believe that the gold markets are being driven based upon a bit of a “safe haven” bid, and as such it drives up the demand for the AUD, which traditionally doesn’t rise in “bad markets” like we have seen recently.

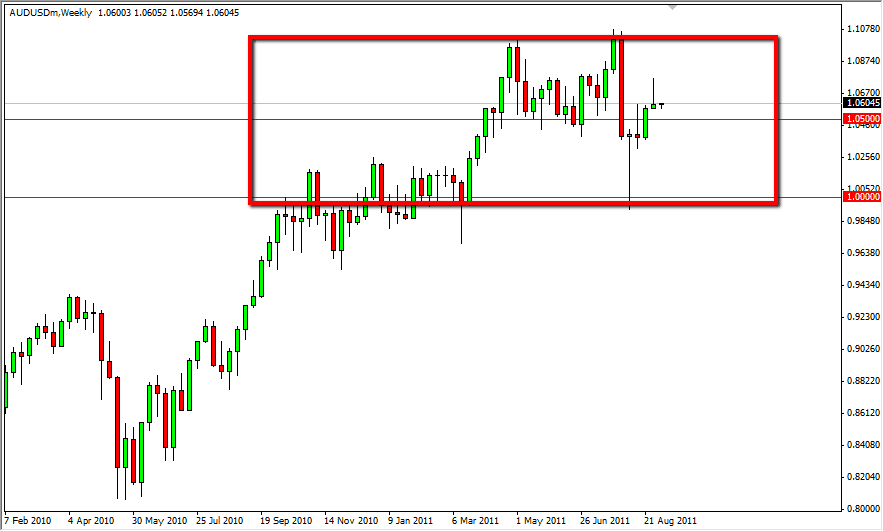

It is possible that we could see this continue, as the AUD/USD pair almost certainly has massive support at the parity level, as well as the 0.94 area. The recent weekly hammer that snapped back from the 1.0000 level is a great example of massive support. While we may not see skyrocket-type moves out of this currency, it does appear that the floor is set in. We could see this pair as a “buy on the dips” type of pair that is no longer following the “risk for appetite” mantra, but as a “safe haven by proxy” one instead.

Looking at the charts, it appears that we could see a floor at 1.0000, while we have obvious resistance at the 1.1000 level. This could be our range for an extended time as it is 1,000 pips, and gives traders plenty of room to wiggle around in for the next few months.