Analysis by Pepperstone

U.S. Dollar. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: On Friday, Fed Chairman Ben Bernanke talked down speculation for another round of quantitative easing (QE3), stating that central bank is not promoting new steps to stimulate the ailing economy, and the committee looks as though it will preserve a wait-and-see approach throughout the remainder of 2011 as policy makers expect the U.S. recovery to gather pace over the coming months. As Bernanke encourages Congress to support the real economy, the U.S. government may face increased pressures to employ additional fiscal stimulus, but the Fed may keep the door open to expand monetary policy further as the FOMC is expected to hold a “fuller discussion” of the tools available at September’s rate decision and policy meeting. As such, the Greenback may continue to consolidate in the week ahead and trade within a broad range until market participants get a clearer picture on what the central bank intends to do over the medium term. The week ahead sees notable economic data in the form of pending home sales on Monday, consumer confidence and the Fed meeting minutes on Tuesday, Wednesday’s ADP Non-Farm employment report, ISM manufacturing PMI on Thursday and finally, the all important Non-Farm Payrolls data for August on Friday.

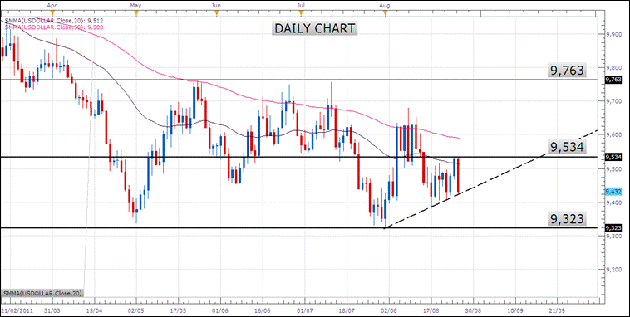

TECHNICALS: Last week, the U.S. Dollar failed at 9,535, bringing forth the possibility (again) that the larger trend remains down towards fresh lows below the 1st August low at 9,326. At Friday's close, price was testing the trendline drawn from the said low and notably, the 20 and 50 SMA’s are still lined up on the bearish side. However, given the absence of quantative easing for the foreseeable future, we remain Greenback bearish in the week ahead.

Euro. Our bias NEUTRAL, on the sidelines till a clearer picture develops

FUNDAMENATALS: The future of European Central Bank monetary policy remains a focus as investors increasingly price in ECB interest rate cuts through the coming months. Credit Suisse Overnight Index Swaps have previously predicted the ECB would raise rates by at least 25 basis points in the coming 12 months, yet those same instruments now predict at least one rate cut, and the shift removes a key pillar of support for the Euro. It is surprising to see the Euro remain so resilient in the face of monetary and fiscal headwinds, however, this speaks more to the poor fundamental outlook for the US Dollar and other major counterparts than underlying Euro strength. In the week ahead, investors will be watching out for key German Employment and CPI data. There is also the speech by ECB President Jean Claude Trichet from Saturday (August 27th) to digest that could force moves in key European assets. Concerns over Euro-zone fiscal crises seem to have hit a lull as recent ECB bond purchases sent Spanish and Italian bond yields sharply lower and markets will keep a close eye out for references to any future ECB policy moves.

TECHNICALS: EURUSD is expected to run up to 1.5000 levels over the coming weeks and months but it doesn’t make sense to get long until price either exceeds 1.4516 on a daily close basis or there is evidence to suggest that the correction is complete at lower levels. Near term weakness could find support at the trendline that extends off of the July and August lows. As such, we maintain a neutral Euro bias in the week ahead.

Japanese Yen. Our bias BULLISH, we’ll be looking to buy on dips

FUNDAMENTALS: Last week, Japan Finance Minister Yoshihiko Noda introduced a $100B program to help businesses deal with the ongoing strength in the Japanese Yen, and there could be increased pressures on the Bank of Japan to intervene in the foreign exchange market after Moody’s downgraded Japan’s credit rating by a notch to Aa3. In response, BoJ Governor Masaaki Shirakawa retained his well worn pledge to “carefully monitor the Yen”, and went onto say that the central bank can implement additional monetary tools to balance the risks for the region should the exchange rate pose a greater risk to the domestic economy. This increased reliance on the BoJ may lead the board to take additional steps to dampen demands for the low-yielding Yen, and the BoJ may look to increase its asset purchases further rather than stepping directly into the currency market. At the same time, the election scheduled for August 29th will also come into focus as the Democratic Party of Japan looks for Prime Minister Naoto Kan’s replacement, and the transition could derail confidence in the government’s ability to address the risks surrounding Japan as policy makers come under increased scrutiny. In turn, the BoJ may have little choice but to step up its efforts to shore up the economy, and we may hear the central bank announce additional policy measures in September.

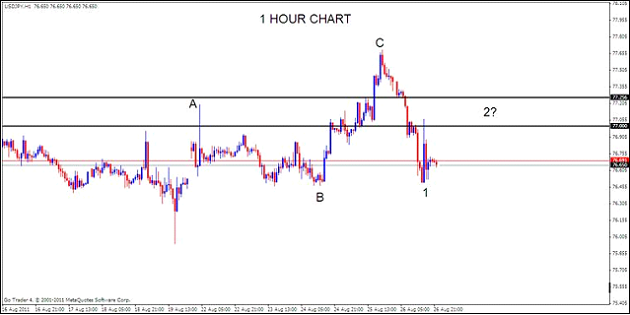

TECHNICALS: USDJPY’s rally from its record low at 75.95 is left as a 3 wave rally which is corrective and implies that price is vulnerable to new lows. Reinforcing the bearish USDJPY structure of the 3 wave rally is the sharp decline from last Thursday’s high at 77.68. Short term resistance extends to 77.00-77.25 levels. As such we maintain a bullish Yen bias in the week ahead.

British Pound. Our bias BULLISH, we’ll be looking to buy on dips

FUNDAMENTALS: The British Pound fell 0.71% against the U.S. Dollar last week as global equity markets remained in consolidation pending Jackson Hole and central bank speeches from Ben Bernanke and Jean-Claude Trichet. Economic data out of the U.K. last week was highlighted by the 2Q GDP print which showed the pace of growth slowing to 0.2% q/q from a previous print of 0.5% q/q. The data saw interest rate expectations for the Bank of England continue to diminish as fears that the U.K. economy may slide back into recession take root. With the BoE seen holding on rates for the foreseeable future and talk of further quantitative easing measures on the horizon, this is expected to weigh on the Pound. In the week ahead, the U.K. economic docket is rather subdued with the only notable data starting on Tuesday with the August GfK consumer confidence survey followed by nationwide house prices and manufacturing PMI on Thursday, with construction PMI due Friday.

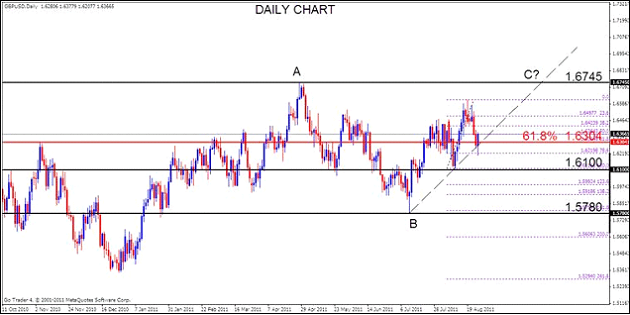

TECHNICALS: A trendline that extends off of the July and August lows keeps the bullish GBPUSD pattern valid as long as price trades above 1.6100 on a daily close basis. Price has dropped close to 1.6200 but the trendline is holding and expectations are for a move to the April highs by 1.6745 over the coming week. As such we remain Sterling bullish in the week ahead.

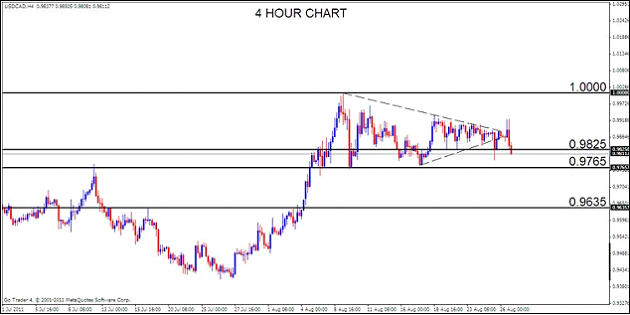

Canadian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: The Canadian Dollar continues to play its unique role amongst the majors. First and foremost, the currency is a proximate substitute to its U.S. counterpart, which is significant given that QE3 is still a possibility come the U.S. Federal Reserves September policy meeting. However, more pressing this next week is oil production for Canada in light of Hurricane Irene, as any disruption to U.S. oil supply is likely to see greater demand for the Loonie. In the week ahead, a quiet Canadian economic calendar sees the current account and RMPI data on Tuesday followed by Wednesday’s monthly GDP report.

TECHNICALS: USDCAD has chopped sideways to down on Friday following the breakout of the recent triangle pattern. Exceeding the January high of 1.0105 would trigger an intra-year reversal and shift focus to the triangle objective at 1.0250 (length of triangle height extended from breakout). As long as price trades above 0.9765, the bullish USDCAD scenario is valid, while a daily close below 0.9765 would shift focus lower to 0.9635 levels. As such, we remain Loonie bearish in the week ahead.

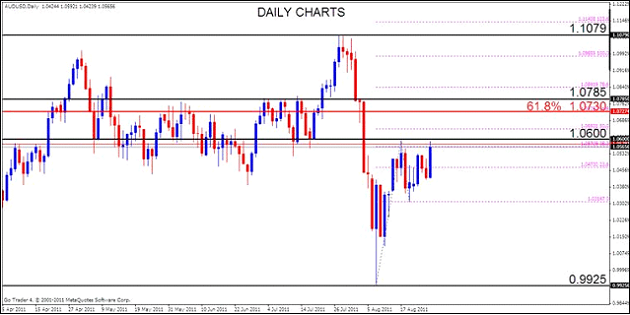

Australian Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops

FUNDAMENTALS: The RBA set the tone for the Australian Dollar last week after Governor Glen Stevens told parliament that “while confidence had taken a knock, underlying economic conditions remain strong”. Additionally, Deputy Governor Rick Battelino continued the bullish rhetoric saying that Australia’s’ fiscal condition was “very, very good”, which saw investors immediately scaled back their expectations of an RBA rate cut next month. In the week ahead, notable Australian economic data sees building consents on Tuesday followed by the private capital expenditure and retail sales reports on Thursday.

TECHNICALS: At Friday’s close, 1.0600 levels was being tested, so higher AUDUSD price action this week should be considered. Congestion from early August at 1.0680 and 1.0785 is an area that is likely to provide resistance with the Fibonacci extension at 1.0730 (61.8% extension of rally from the low) near the middle of this zone. As such, we maintain a neutral Aussie bias in the week ahead until a clearer picture develops.

New Zealand Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops

FUNDAMENTALS: The New Zealand Dollar was the best performing commodity currency last week, up some 2% against the U.S. Dollar following NZ trade data that showed a trade balance surplus of NZD 1.31B - the first in July for many years. As RBA officials across the Tasman talked up the Australian Dollar, investors were reminded that Reserve Bank of New Zealand Governor Alan Bollard still has the unwinding of the 0.25% emergency rate cut following the Christchurch earthquake up his sleeve, which may see the kiwi push higher over the coming week. The economic calendar for New Zealand is quiet in the week ahead, with the only notable data coming by the way of todays building consents and Thursdays NBNZ business confidence survey.

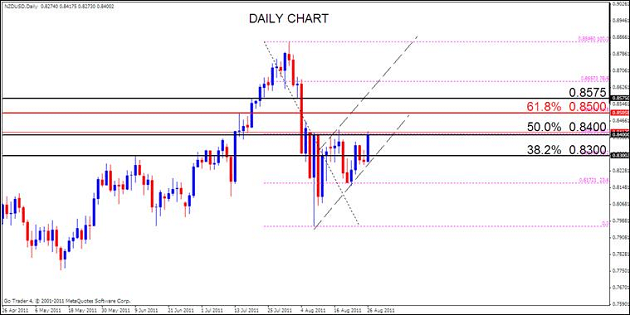

TECHNICALS: By Fridays close NZDUSD was on the verge of breaking through 0.8400. The focus now shifts higher towards the 61.8% retracement of the decline from 0.8842 at 0.8500 and former support from early August at 0.8575. As such, we maintain a neutral Kiwi bias in the week ahead until a clearer picture develops.