Analysis by Pepperstone

U.S. Dollar. Our bias BULLISH, we’ll be looking to buy on dips

FUNDAMENTALS: The U.S. Dollar closed last week lower by 0.63% as volatility in equity markets persisted with the Dow Jones Industrial average falling more than 4% by Friday. The NASDAQ suffered the steepest decline with a loss of more than 6.6% after a flurry of disappointing economic data highlighted by the multiyear low in the Philadelphia Fed survey which plummeted to -30.7 vs the expected 4.0. The economic calendar this week sees the July new homes sales, durable goods orders, and GDP reports. Investors continue to eye housing data for any indication that this market has turned, with consensus estimates calling for sales to rise by 1.0% m/m after a decline of 1.0% a month earlier. Orders for durable goods are also expected to show signs of improvement with expectations calling for a read of 2.3% after a 1.9% decline in June. After the string of dismal data seen in recent days, an upbeat print could see market jitters ease as concerns over a possible double dip scenario abate. However the 2Q Prelim GDP data on Friday may weigh heavily on markets with consensus estimates calling for an annualized read of 1.1%, down from a previous print of 1.3%. The market moving event of the week will be Friday’s Jackson Hole Economic Policy Symposium where central bankers from around the world convene to discuss pressing matters facing the world’s developed economies. Investors will be watching for remarks made by keynote speakers Fed Chairman Ben Bernanke and ECB president Jean-Claude Trichet as markets continue to suffer from a mass exodus out of risk. Although it’s highly unlikely that policy makers will introduce further easing measures, investors will be eagerly anticipating the comments as uncertainty regarding domestic growth prospects take root.

TECHNICALS: The U.S.Dollar Index has turned up following the sharp move to risk aversion and the structure of the rally from 9,323 suggests that at least one more bull leg should unfold. Expectations are for a test of 9,680 and possibly 9,765. A rally to these levels could complete wave C of a flat or triangle and as such, Greenback strength is anticipated this week as risk aversion gathers pace ahead of the Jackson Hole Economic Policy Symposium. As such we maintain a bullish Dollar bias in the week ahead and will look to buy dips.

Euro. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: Last weeks market volatility left the German DAX nearly 30% off its multi-year highs, but surprisingly, the resilient Euro squeezed out some modest gains against the weakening U.S. Dollar. The week ahead promises more uncertainty and broader financial market tensions - which is normally a recipe for U.S. Dollar strength and Euro weakness. But forex markets remain far from normal at the moment, and the Euro’s resilience suggests it would take something stronger than stock market declines to force it significantly lower. A quick look at technical price patterns shows that the pair has been unable to break convincingly above a trend of lower highs dating back to May. A break of July highs near 1.4500 leaves risks plainly in favour of a run towards 1.5000 which would fit within the trend of broader U.S. Dollar losses. The early week European economic calendar is busy with French, German, Euro PMI and ZEW surveys due Tuesday and the German Ifo Business Climate report on Wednesday. However, this data will no doubt be of secondary importance as Euro investors focus on the end of week Jackson Hole Economic Symposium and scheduled speech from European Central Bank president Jean Claude Trichet.

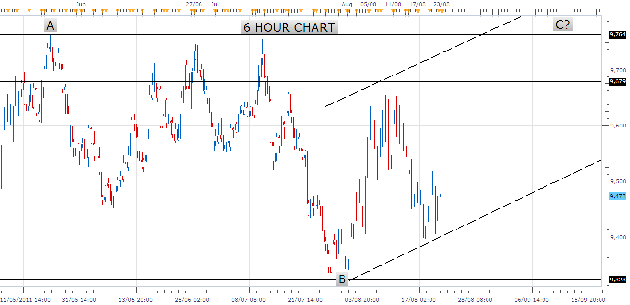

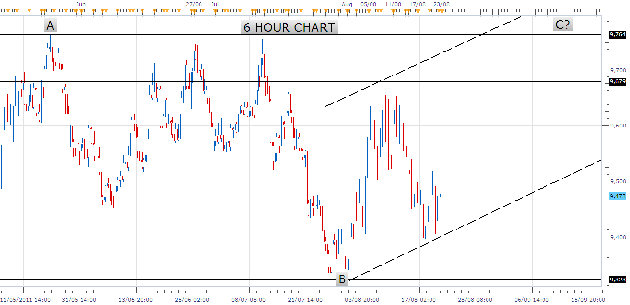

TECHNICALS: Friday’s price action saw a failed test of 1.4450 and the trend line connecting the May, June and July highs. Near term, the picture is confused with last week’s choppy price action continuing to consolidate sideways within the triangle pattern. Expectations are for more of the same early this week; however, a failed rally to 1.4500 levels would be a sell signal for setbacks to 1.4000 key support before the eventual push to 1.5000. As such, we maintain a bearish Euro bias in the week ahead and will look to sell on rallies.

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops

FUNDAMENTALS: Last week, the Japanese Yen rose against the Kiwi, Franc, Loonie and U.S. Dollar, while depreciating against the Sterling, Euro and Aussie. However, the currency pair all investors, including Japanese government officials continue to monitor is USDJPY, which gained a mere 0.21% this week, even as it touched a new record low at 75.95. The week ahead has no significant Japanese economic data, apart from Thursdays CPI report for July, expected to show no growth in price pressures with a 0.0% reading. The Bank of Japan has tried for years to boost inflationary pressures by injecting trillions of Yen into the markets, in hopes that rising price pressures would ultimately trickle down into higher wages. This hasn’t happened, and the resilient Yen has absolutely insulated the economy from inflationary threats. If the CPI reading comes in lower than expected (e.g. deflation in July) then expectations are for the time table to moved forward for an intervention. Looking forward, an intervention is becoming an increasingly likely scenario as government and Bank of Japan officials have noted, time after time, that they are “monitoring the currency markets,” - which notably has amounted to nothing since the August 4th MoF intervention. Now, the Bank of Japan is on the offensive and with USDJPY trading at post-World War II lows, and global uncertainty/volatility picking up once again, demand for safe-havens will rise driving the Yen higher. On balance, this leaves the BoJ with little choice but to take action in order to protect the export led Japanese economy.

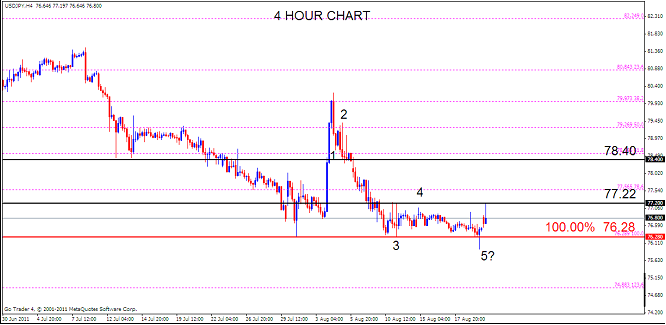

TECHNICALS: Friday’s price action saw USDJPY touch new record lows at 79.95, some 100 points lower than the August 4th MoF intervention. A break lower would shift focus to 72.60, the 161.8% extension of initial decline from the April high while a bounce higher is likely to encounter resistance at 78.40 levels, the 50.0% retracement of the decline from 4th August. Whilst the fundamentals point to a strengthening Yen, the looming threat of BoJ intervention will see us on the sidelines with Yen pair’s until a clearer picture develops.

British Pound. Our bias NEUTRAL, on the sidelines till a clearer picture develops

FUNDAMENTALS: Last week, saw Sterling strength against most of its major counterparts mainly due to a large £7B acquisition of British firm Autonomy by American giant Hewlett Packard. As with most of the other major currencies, this week sees very little in the way of significant economic data for Sterling as markets remain focused on the end of week central bankers’ symposium at Jackson Hole, Wyoming. Notably, Sterling remains significantly correlated with the S&P 500 - a proxy for investors’ risk appetite - albeit to a lesser extent than more traditional sentiment geared currencies like the Australian, New Zealand or Canadian Dollars. As such, the Pounds price action this week is likely to be determined by wider global market risk sentiment.

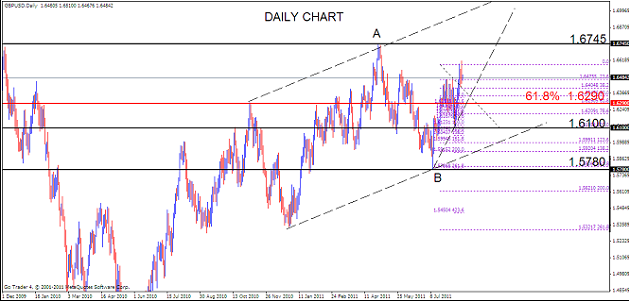

TECHNICALS: The longer term bullish bias remains valid but near term weakness is expected into the trend line that extends off of the July and August lows. Said trend-line is reinforced by the 61.8% retracement of the rally from 1.6100 and this fib level comes in at 1.6290. Weakness to 1.6290-1.6250 levels would offer buying opportunities and as such we maintain a neutral Sterling bias in the week ahead.

Canadian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: Fundamentally, investing in Canadian assets and the Loonie has been a leveraged play on the U.S. recovery, with the added bonus of commodity production without a monster U.S. budget deficit and associated politics. So, as actual data and economic forecasts are showing a marked slowdown in U.S. growth, the Canadian Dollar is taking the strain. A U.S. slowdown will hit Canada first and the hardest. For example 70% of their exports head south of the border and raw commodities account for 50% of their exports worldwide. The CRB (a commodity index) looks soggy and the trace of crude oil prices looks no better. On the interest rate front, July saw CPI remain flat at 0.2% and overall Canadian economic data implies zero to negative activity rates for Q2 2011 as a whole. Additionally, rates have been on hold even before slowing conditions in the U.S., Euro-zone or elsewhere. In the week ahead, there is little in the way of meaningful Canadian data apart from Tuesday’s retail sales report. The end of week Jackson Hole Symposium is expected to have a significant impact on the Loonie for the remainder of 2011 and comments/speeches will be keenly watched by investors for guidance going forward.

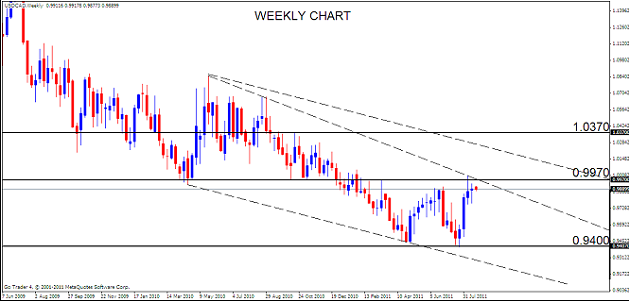

TECHNICALS: Last weeks price action stalled shy of a trendline that extends off of the 2010 highs and more importantly the January 2011 high of 1.0105. While another run at the recent high cannot be ruled out, price is vulnerable when viewed in a longer term context. Exceeding the January high of 1.0105 would trigger an intra-year reversal and shift focus to the November 2010 high of 1.0370. 0.9970 is key resistance and expectations are for price to remain capped at this level ahead of end of week market moving Jackson Hole Symposium. As such we maintain a bearish Loonie bias in the week ahead and will look to sell Loonie rallies.

Australian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: The minutes of the August 2nd Reserve Bank of Australia meeting were released last week and leaving aside the still booming resource sector (which by and large is concentrated in the less populated regions), they had a more dovish tone. The RBA spoke of some slowing in the pace of growth and that downside risks had become more pronounced. Current exchange and interest rates were considered to exert a reasonable degree of restraint on the slightly above target inflation rate. No surprise then that the benchmark figure was left at 4.75%. Australian data is turning soft; unemployment jumped to 5.1%, with projections of 5.5% for year end and 6.0% in 2012. And these figures are based on a continued resource boom as the entire Australian outlook is based on ever rising demand and prices for commodities. In the week ahead, the economic calendar for the Australian Dollar is fairly light with no data scheduled of significant importance, so the Aussies price action will likely be determined by wider global market risk sentiment.

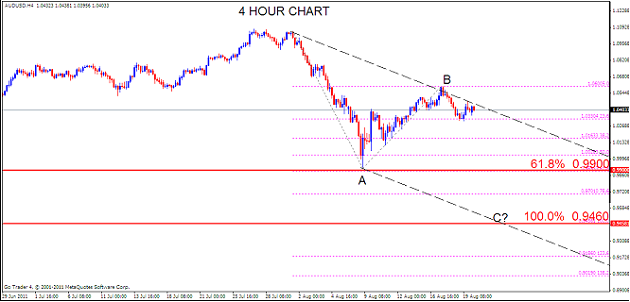

TECHNICALS: Expectations are for a test of the recent low by 0.9930 and possibly extended weakness towards 0.9500 levels. This next drop is expected to give way to a more important low that holds for at least several months. Of particular note is the intersection of the 100% extension and corrective channel at 0.9460 this week. 1.0435-1.0475 is key resistance and rallies to these levels would offer selling opportunities. As such, we maintain a bearish Aussie bias in the week ahead and will look to sell rallies.

New Zealand Dollar. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: Just

as

the

NZ

Dollar

has

been

driven

higher

by

the

Asian

recovery

story,

so the kiwi will

suffer

if expectations

are

not

met.

Last

week

saw

milk

powder

prices

fall

back

to a

1

year

low

as

supplies

rose

and

bullish

growth

projections

were

scaled

back.

Elsewhere

in

Asia,

second

quarter

growth in

Hong Kong was

slashed

to‐0.5%

when

a

positive

0.7%

was

expected,

with

exports

falling

by

1.1%.

Singapore

flooded

the

market

with

Singapore Dollars

to

lower

their

dollar,

and

the

ringgit

and

rupiah

reversed

off

highs

as

well. Reserve Bank of New Zealand

governor

Allan Bollard

had

given

warning

that

the

post quake 0.5%

rate

cut was

soon

to

be

reversed.

However

global

events

could

overtake

domestic considerations and NZ commercial

deposit

rates

are

already

signalling

that

the

next

move

in

rates

is

not higher

but

lower.

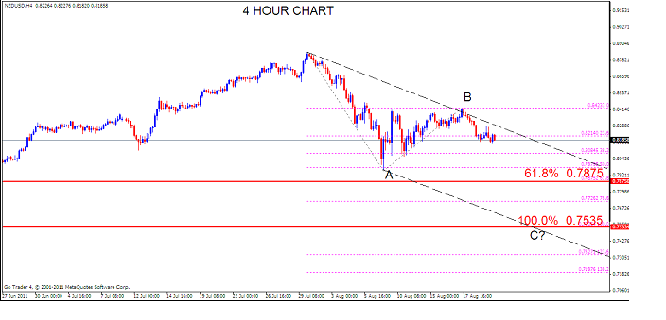

TECHNICALS: Expectations are for a test (or break) the 9th August low at 0.7960 before a more important low forms. Objectives are the 61.8% and 100% extensions at 0.7875 and 0.7535. The 0.7535 level intersects the corrective channel this week. 0.8300-0.8340 is near term resistance and rallies to these levels would offer selling opportunities. As such, we maintain a bearish Kiwi bias in the week ahead and will look to sell on rallies.