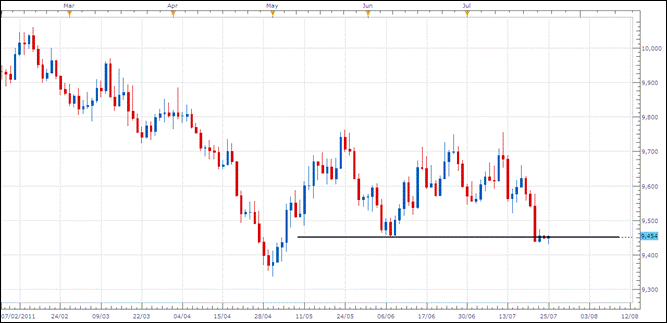

U.S. Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: The Greenback closed lower on Friday at 9,456 on strong risk appetite flows following the successful conclusion to Thursdays EU summit. Additionally, the S&P500 gained 2.2%, the Dow jumped 1.6% and the NASDAQ spiked 2.5% on increased investor confidence. Heading into the new trading week, the ongoing debt ceiling debate carries the greatest sway over the U.S. Dollar, but as the deficit ceiling won’t be officially breached until August 2nd, there is still time for political maneuvering as Democrats and Republicans gain points for sticking to their guns. There is an extremely low probability that this situation ends in a technical default and the likelihood of a solution before the deadline is high. A busy U.S. economic calendar this week sees consumer confidence and new home sales reports on Tuesday followed the next day by the core durable goods orders data. Friday sees the potentially market moving advance 2Q GDP report (1.6% exp vs 1.9% prior), with market participants keenly watching for clear evidence of a stronger U.S. economic recovery .

TECHNICALS: Support at 9,637, resistance 9,500. The range bound consolidation from the May favours the downside low until a new low is registered. After testing the June low at 9,459, a bounce may materialize over the coming sessions but any strength is expected to prove corrective as 9,500 is seen as firm resistance. As such we remain U.S. Dollar bearish in the week ahead.

Euro. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: Fridays close saw the Euro at 1.4357 against the U.S. Dollar after rallying over 400 points from its lows on Monday. The impressive price action preempted Thursday’s breakthrough agreement on further aid for Greece which removed a great deal of uncertainty surrounding the at-risk country and the broader Euro zone. While the European periphery debt crisis is far from over, the agreement now puts the markets focus back on economic fundamentals and not on government solvency. The week ahead sees German Unemployment Change, Consumer Price Index and Retail Sales reports as the focus for Euro traders which will make a refreshing change from the recent emergency meetings of policy officials and finance ministers. Ultimately, the Euro’s price direction should depend on traditional fundamentals - not ongoing struggles with periphery nation debt. There remain details to be sorted out with the new deal on Greek debt, and individual parliaments must ratify the deal, yet the long-term nature of the deal suggests troubles with Greece are now less relevant to day to day price action. Spanish and Italian bond yield surges remain a concern, but stability at or around current levels would decrease fears of further debt stresses. Going forward this week, the Euros short term price action will likely be determined by the U.S. debt ceiling debate, with an expected positive result further supporting Euro upside momentum.

TECHNICALS: Support at 1.4260, resistance 1.4500. EURUSD broke higher toward the end of last week and is closing in on 1.4450 (100% Fib extension). 1.4300 and 1.4260 are short term supports. Price should remain within the short term bullish channel and above the confluence of 20, 50 and 100 SMAs if the larger trend is up towards the May high above 1.4900. As such, we remain Euro bullish in the week ahead.

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: Last week, the Japanese Yen remained in the middle of the pack against most of the other major currencies. While risk appetite found some footing, the Yen, the Swiss Franc and the U.S. Dollar were relatively even across the board, reflecting the uncertainty concerning the state of the two major financial pillars of the global economy - the Euro-zone and the United States. While there was some resolution in the near-term in regards to the European sovereign debt crisis, there is remaining uncertainty as to what is happening with the United States’ debt ceiling. The week ahead sees Japans retail sales data on Wednesday, with trade expected to have gained 1.5% in June, slightly down from the 2.4% rate in May. On Thursday, the consumer price index is expected to show a slight uptick to 0.2%, marking the third month in which price pressures have increased. Later, industrial production data is due, which is expected to rebound on a monthly basis by 4.5% in June. As the Yen is considered a store of safe haven in times of crisis, the currency will likely be bid higher on any poor news regarding the debt ceiling problems the United States.

TECHNICALS: Support at 77.60, resistance 79.50. USDJPY has dropped to a new low to test the 61.8% extension of the decline from the April high and top side of the former resistance line from said high. If the long awaited bounce happens, price ideally turns near here. Trading above 79.50 would suggest a bottom has been reached; however, recent jaw-boning from the Bank of Japan has us on the sidelines until a clearer picture develops and we remain Yen neutral in the week ahead.

British Pound. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: Sterling closed last week higher by more than 1% against the U.S. Dollar as investors dumped the Greenback on concerns over the approaching debt ceiling deadline and improved risk appetite. Stronger than expected data from the UK also helped support the Pound last week with retail sales and the nationwide consumer confidence figures beating consensus estimates. However, fundamentals still suggest weakness ahead for Sterling with Wednesday’s Bank of England minutes revealing a vote of 7-2 to keep rates unchanged at 0.50%, weighing on interest rate expectations which continued to diminish. The minutes from the MPC meeting cited, “It was likely that the current weakness in activity would persist for longer than previously thought,” highlighting concerns that the recovery may be faltering. The members went on to say, “that weakness, together with the continued subdued behavior of earnings, reinforced the case that inflation was likely to fall back once the temporary factors pushing up on it had waned.” The dovish statement saw traders continue to discount future tightening from the BoE as inflation concerns eased. This week, U.K. economic data is highlighted by the 2Q GDP print on Tuesday (0.2% exp vs 0.6% prior). A weaker than expected print would see interest rate expectations pushed back even further with Credit Suisse overnight swaps already factoring in just 13 basis point in rate hikes for the next twelve months. Additionally, an update on the distressed U.K. housing market will also likely impact Sterling’s trajectory this week with forecasts calling for further deterioration in nationwide house prices (-0.1% exp vs 0.0% prior).

TECHNICALS: Support at 1.6260, resistance 1.6380. Cable has broken above its short term trend-channel and focus is now on the 1.6400 area. 1.6380-1.6420 is a level to keep an eye on (as resistance) as this is a confluence of Fibonacci measurements with 1.6380 being the 61.8% retracement of the decline from the April high and 1.6420 the 100% extension of the rally from 1.5778. Sterlings price action this week is expected to be subdued pre Tuesdays 2Q GDP report and we remain neutral until a clearer picture develops post this data.

Canadian Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Canadian Dollar finished last week at 0.9476 after weakening on Friday following the disappointing CPI report (-0.6% vs 0.0% exp). The Loonie remains firmly anchored to overall risk sentiment trends and with prices closely tracking the S&P500, Loonie price action in the week ahead will likely be determined by the weekends gathering of Republican and Democratic party lawmakers to hammer out a deal that will raise the US legal debt limit and formulate a plan to lower the budget deficit over the coming years. Indeed, with sovereign fears on the decline in the Euro-zone after the bold EU leaders’ summit outcome last week, the U.S. debt fiasco has taken center stage as the core macro-level issue guiding market sentiment over the remainder of July. Continued political brinksmanship will feed uncertainty, weighing on shares and the risk-linked Canadian Dollar, whereas the emergence of a viable solution is expected to have the opposite effect. An empty calendar for the Loonie this week sees the monthly GDP figure on Friday and a disappointing report could prove particularly market-moving after last week’s unexpectedly soft CPI reading, dimming the near-term prospect of a Bank of Canada interest rate hike.

TECHNICALS: Support at 0.9445, resistance at 0.9500. USDCAD’s’ down-trend is constructive as long as price remains below 0.9780. Focus is on the recent low at 0.9445 (also the 100% extension of the decline from 0.9912) and the 161.8% extension at 0.9240. Having broken to its lowest level since November 2007, expectations are for extended weakness to the 161.8% extension at 0.9240. We maintain a neutral Loonie bias in the week ahead pending an expected successful conclusion to the U.S. debt ceiling negotiations.

Australian Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: The Australian Dollar closed at 1.0849 on Friday against the U.S. Dollar on strong risk appetite flows and looks likely to continue to retrace the decline from the May highs at 1.1011 levels. Looking at the week ahead, the economic docket is expected to show a heightening risk for inflation with Mondays producer prices forecast to increase at an annualized pace of 3.1% in the second-quarter after expanding 2.9% during the first three months of 2011. Wednesdays headline reading for inflation is expected to climb 3.4% during the same period, which would mark the fastest pace of growth since the fourth-quarter of 2008. However, in light of the recent comments by the Reserve Bank of Australia, it appears the central bank will endorse its wait and see approach throughout the second-half of 2011, and Governor Glenn Stevens may continue to soften his hawkish tone for monetary policy as the region faces an uneven recovery. As the RBA sees the economy operating below full-capacity until 2012, expectations for a delayed recovery from the Queensland floods may dampen the outlook for future growth, and the slowdown in economic activity is likely to weigh on the Aussie. Notably, according to Credit Suisse Overnight Index Swaps, investors see borrowing costs falling by more than 25bp over the next 12 months. Nevertheless, should Wednesday’s inflation report top market forecasts, the developments are likely to drive the Aussie higher.

TECHNICALS: support at 1.0800, resistance 1.0890. Near term resistance is at 1.0890-1.0920 (11th May high and 100% extension fro the 27th June low) but strength above 1.1011 is expected over the next few weeks. 1.0800 provides near term support. Last weeks strong rally points to further gains going forward and as such we remain Aussie bullish in the week ahead.

New Zealand Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: By last Friday, the New Zealand Dollar had continued its remarkable run, gaining over 2.21% against the U.S. Dollar, while also gaining against every other major currency. The Kiwi was particularly strong against the other safe haven currencies, gaining 2.69% against the Swiss Franc and 1.47% against the Japanese Yen. The Kiwi was bid higher as investors’ appetite for risk in an uncertain environment remained and the Kiwi is now up 16.97% against the U.S. Dollar since March 17, while up 16.60% against the Japanese Yen over the same time period. Looking ahead to the coming week, trade balance data is due on Monday and although a softer trade balance is expected (404M exp vs 605M prior), this is purely the result of a stronger Kiwi Dollar as a stronger domestic currency makes goods less appealing to foreigners and reduces foreigners’ purchasing power. The most important release of the week comes on Wednesday when the Reserve Bank of New Zealand announces its cash rate decision (2.50% exp vs 2.50% prior). At its last meeting, the RBNZ held its key benchmark interest rate at 2.50% for the third consecutive period, with the outlook that “the economy has been steadily improving”. Similarly, it is widely expected that the key rate will be kept at 2.50% at July 28 meeting, with the Credit Suisse Overnight Index Swaps showing a 6% chance of a 25.0-basis point rate hike. Despite such weak expectations, the number of basis points priced into the Kiwi over the next 12-months (94.0), has boosted the New Zealand Dollar since mid-March. In spite of such a strong domestic currency, recent data releases indicate that the economy is undergoing robust growth and inflation has risen faster than expected. GDP growth figures released on July 13 came in at 1.4%, blowing past the forecast of 0.5%, while recent inflationary data showed inflation increasing to 5.3%, topping expectations of 5.1% on a y/y basis. As rates are expected to remain on hold, policy official commentary following the decision will be key for the New Zealand Dollar going forward.

TECHNICALS: With the NZDUSD trading at record free floating highs, focus is now on the longer term trend-channel drawn off of lows in 2010 and 2011 and extended from the 2009 high. Whether or not this level provides any resistance remains to be seen but shorting NZDUSD is not advised. Weakness should encounter support at 0.8570 while 100% Fib extension reveals an objective at 0.8740. We remain Kiwi bullish in the week ahead.