U.S. Dollar. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: Standard & Poor’s after-market hours downgrade of the U.S. economy is not necessarily that big of a surprise as the credit agency had put the U.S. on credit watch with negative implications (suggestion a 50/50 chance of a downgrade within 90 days) back on July 14th. Following Saturdays announcement, investors are now faced with two concerns; 1) The possibility of forced liquidation. Many of the largest holders of U.S. Treasuries have mandates that state that they cannot hold anything with less than an equivalent AAA rating, and while many fund managers are no doubt scrambling to find waivers to negate this mandate, there will inevitably be a contingent of major portfolios that can’t avoid it. 2) The speculative fallout. If markets are panicked into believing there will be a mass unwinding of U.S. Treasury exposure this week, it will play out as a self fulfilling prophecy as investors scramble to get ahead of the wave. Longer-term, a gradual shift away from the Greenback and U.S. Treasuries is almost certain and this credit downgrade will simply accelerate the process. However, in the short to medium-term, markets face the reality that there are no immediate equivalents to U.S. Treasuries as they are still the most liquid market and one notch below a triple AAA rating is still exceptional. Looking at the week ahead, Wednesdays sees the now highly anticipated Fed Funds Rate and FOMC statement. Given the latest developments, the prospect of a 3rd round of Quantative Easing is undoubtedly on the minds of market participants and we may see this start to be priced in as early as next week.

TECHNICALS: After registering a new low at 9,322, the Dollar Index has soared. The rally is unfolding in 5 waves suggesting a major low is in place. Near term support is at 9,503. Buying dips against the August 9,322 low is the preferred strategy, however, expected early week major volatility will require caution until a clearer picture develops.

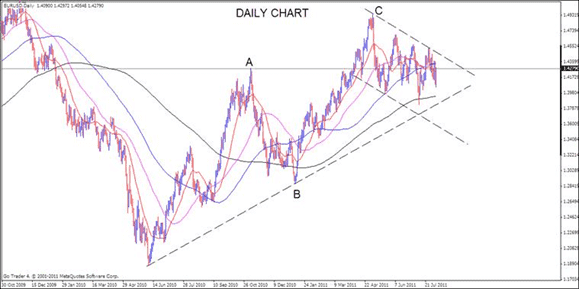

Euro. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: Euro-zone fiscal tensions are again laid bare as the spread between Italian and German bond yields grew last week to its widest in 15 years. As the Euro-zone does not have the capital to bail out a country the size of Italy, further bond stresses could truly shake the foundation of the EMU. Meanwhile, market fears were soothed somewhat by announcements that Italy would speed up austerity measures and produce a balanced budget a year ahead of schedule and analysts believe that this was done in order to secure the European Central Bank’s support in international bond markets. Indeed, there is speculation that the ECB could purchase Italian bonds as soon as this week to stem the recent sell-offs. Yet with total government debt of approximately 120% of GDP, this is hardly a guarantee that ECB support can ward off further Italian fiscal stress. The pressure is on for the EMU in the week ahead, as it is shaping up to be a make-or-break time across financial markets. Sudden financial market pessimism and the S&P 500’s worst week-over-week performance since the global financial crisis warn that the week ahead will likely expose further Euro-zone financial stresses. Additionally, how the U.S. Dollar reacts to the highly-anticipated U.S. FOMC rate decision and statement on Wednesday is likely to set the tone for the major currencies - particularly the Euro - in the remainder of 2011.

TECHNICALS: EURUSD’s rally from the 2010 low is in 3 waves. Since the May top at 1.4939, the pair has traded sideways to down which indicates consolidation and general market uncertainty surrounding the fiscal governance of both sides of the Atlantic. Ultimately, as long as price remains below the 26th July high of 1.4525, the bearish Euro outlook remains.

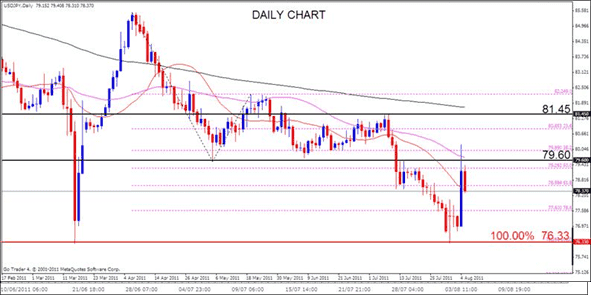

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops

FUNDAMENTALS: Last weeks long anticipated intervention from Japans Ministry of Finance has diluted Yen strength somewhat at the time of writing, however, S & Ps’ credit downgrade of the U.S. economy threatens to negate these efforts as the global shift towards risk aversion sentiment gathers pace. As USDJPY is firmly correlated with U.S. Treasury yields, an increase in U.S. borrowing costs as a result of the S & P downgrade could be expected to send the pair higher - under normal circumstances. However, if S & P’s decision produces a crisis of confidence in U.S. Dollar-based assets, the Greenback is likely to find itself under pressure regardless of how much more attractive bond yields appear. This then raises the prospect of further intervention from Japanese authorities, who could step back into the markets to support USDJPY if a mass exodus from the Greenback sends the Yen uncomfortably higher. In the week ahead, risk aversion points the way higher for safe haven plays like the Japanese Yen, Swiss Franc and U.S. Dollar. However, with last weeks deliberate weakening the Yen and Franc, and the downgrade for the Dollar, a clear safe harbour alternative (with the exception of gold, which falls short on the liquidity front) is not readily apparent. A wait and see approach for the Yen is the best option at present.

TECHNICALS: Technically, USDJPY needs to overcome 81.45 in order for the series of lower highs since April to be broken. This area is likely to prove formidable as it is reinforced by the 200 SMA (currently at 81.70). Price action late last week was rejected by the 50 SMA and May/June lows by 79.60. Skepticism of central bank intervention efforts to significantly influence price action remains high so long as USDJPY trades below 81.45. Staying on the sidelines with this pair until a clearer picture emerges would be the most prudent move at this stage.

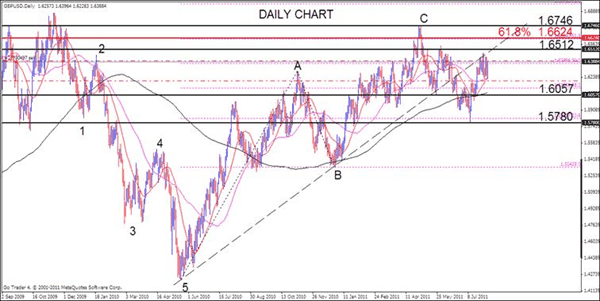

British Pound. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: As recent developments coming out of the U.K. dampen the outlook for future growth, Wednesdays Bank of England Inflation report is likely to see the central bank highlight the increased risk of undershooting the 2% mandated inflation target. The bank may also provide a lower growth forecast as private sector activity dissipates, and could open the door to expand its asset purchase program beyond GBP 200B as the government’s initiative to balance the budget deficit bears down on the recovery. In turn, we may see a growing shift within the BoE, and the policy meeting minutes on August 17th could show board members Spencer Dale and Martin Weale scaling back their votes to increase the benchmark interest rate by 25bp as the U.K. faces a risk of a double-dip recession. Should these events unfold, Sterling will certainly struggle to hold its ground, and will likely face a sharp sell off as interest rate expectations falter. Indeed, Credit Suisse Overnight Index Swaps for the BoE have dipped into negative territory, implying that investors see a greater likelihood for a rate cut over the next 12 months, and Sterling may trade heavy over the near term as market participant’s price in lower borrowing costs for the U.K.

TECHNICALS: Similar to EURUSD, Cables’ rally from the 2010 low is also in 3 waves and may be complete. The rally from the December low (1.5343) is slightly higher than the 61.8% level (at 1.6624) of the rally from the 24th May low (1.6057). Near term, GBPUSD is holding up well and price trading above 1.6512 may complete an expanded flat (in a 2nd wave) from the 24th May low. As such, we remain bearish Sterling in the week ahead.

Canadian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: The Canadian Dollar was down against the U.S. Dollar last week following a mixed batch of economic data, an unwinding of riskier assets and the global sell-off in oil prices. Looking at the week ahead, more of the same is expected as Loonie traders digest the implications of the U.S. credit downgrade and how it will affect Canada’s economy going forward. As the U.S. is Canada’s largest importer of oil (80% of Canada’s oil is exported south of the border), the energy commodity will now become more expensive for U.S. firms to purchase - leading to lower demand, which leads to lower Canadian economic output. As with all of the major currencies, these are uncharted waters for the Loonie, but the combination of risk aversion, declining oil prices and market uncertainty for the troubled Greenback can only bode ill for the Canadian currency in the week ahead.

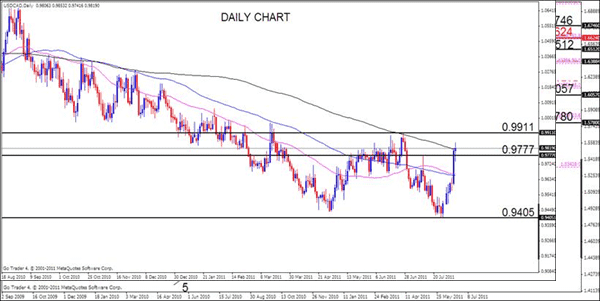

TECHNICALS: USDCAD has reached the 200 SMA. This level resisted the June rally but that outcome seems unlikely this time around. Exceeding the June 0.9911 high would put a double bottom in place with the April and July lows and indicate a significant shift in the longer term down-trend.

Australian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies

FUNDAMENTALS: Despite interventions from Japanese and Swiss officials last week, the Aussie was under increasing pressure with global sentiment taking a sharp turn to the downside, leading to a sell-off in equity markets as risk appetite evaporated. The net result was the Aussie falling by 7.67% against the Swiss Franc, 5.18% against the U.S. Dollar and 2.75% against the Japanese Yen. Looking at the coming week, the scheduled economic data is expected to spark some short-term volatility, but it will be broader global sentiment will guide the Australian currency in the coming days, as it remains the premier carry trade. On Tuesday, home loans are due, which are expected to show a decline in lending for June. The 0.8% figure is less than the 4.4% reading in May, as liquidity has begun to dry up as consumers and institutions alike are concerned about the state of the global economy. Also released at 01:30 GMT on Tuesday are the business conditions and confidence readings for July, which are expected to show whether or not China’s demand for commodities is slowing down. Considering Chinese demand has propped up Australia’s mining sector while non-mining sectors have struggled, confidence in the economy right now is waning. However, the key event for Australia this week will be the labour market report on Thursday (10.3K exp vs 23.4K prior). Australia was hit hard by floods late last year that hurt the economy and the labour market, resulting in negative employment change levels for much of early 2011. The unemployment rate for July is expected to remain unchanged at 4.9%, following a 0.1% drop in February. But a miss on Thursday’s employment data would only fuel concerns, potentially providing the catalyst to break the Aussie’s proverbial back as it moves closer towards parity with the U.S. Dollar.

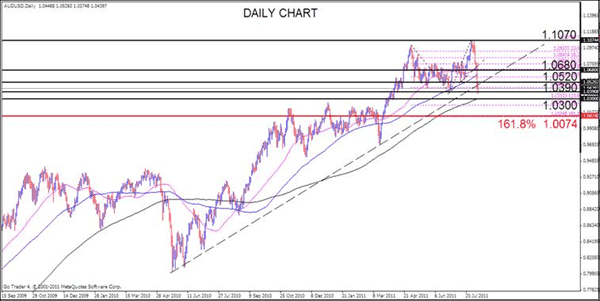

TECHNICALS: AUDUSD has continued to plummet and is now over 500 pips from its record high last week. The pair has dropped below a short term trendline, 50 /100 SMA’s and is testing the June low at 1.0390. Next key support comes in at the 200 SMA by 1.0300 levels. After such a sharp and aggressive decline, expectations are for a snapback rally to 1.0520 (the underside of the rising trend-line from May 2010) or possibly 1.0680 before further declines to parity. However, everything hinges on Mondays reaction to the U.S. credit downgrade and caution is warranted until a clearer picture emerges.

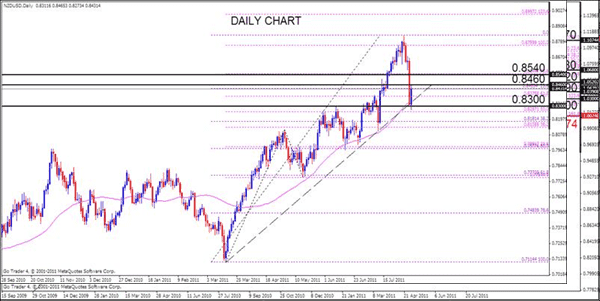

New Zealand Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops

FUNDAMENTALS: The New Zealand Dollar, similar to its trans-Tasman neighbour last week was also under pressure, falling some 500 points against the U.S. Dollar by Fridays close amid the global flight to safety. The commodity currency’s’ outlook over the coming week is admittedly unclear as traditionally, risk aversion sentiment doesn’t bode well for the Kiwi as the effort to unwind risk gathers pace. Additionally, this week’s economic calendar is particularly barren for NZD, which means price action will no doubt be determined by the broader global sentiment landscape.

TECHNICALS: NZDUSD is also plummeting and has reached 0.8300, a level that is expected to provide strong support. The level is defined by the 50 SMA and trendline that connects the March and June lows, Like AUDUSD, the near term move appears a bit overdone and strength would encounter resistance at 0.8460 and 0.8540 levels before further declines.