U.S. Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: By Friday, the U.S. Dollar Index had slumped to 74.29 after equity markets posted impressive gains over the week - their best since July 2009 - with the DJIA up 5.4%, S&P500 gaining 5.4% and NASDAQ surging 6.2%. Greenback price action revolved around the critical parliamentary votes on the Greek government's five-year austerity plan. Ahead of the initial vote, fears about the government's slim 155 majority in a parliament of 300 members provided a certain amount of market volatility as individual members declared for and against the measures. In the end, the ruling party held together and passed the austerity program despite the massive street protests against it. Whether or not the U.S. Dollar can stage a larger reversal will likely depend on labour market data, with all eyes on Friday’s Nonfarm Payrolls report. The disappointing May NFP results dimmed the outlook for the future of Federal Reserve monetary policy and expectations likewise point to an underwhelming June labour market growth, but dour forecasts arguably leave Dollar risks to the upside on any potential surprises. As the Fed’s second wave of Quantitative Easing (QE2) comes to a close, markets will look to U.S. employment and inflation data for clues as to when the Fed may begin to tighten monetary policy.

Seasonality studies show that the first week of every month typically sets the pace for monthly performance, the first month of the quarter predicts quarterly performance, and the first quarter of the half often predicts moves through the rest of the period. Thus, the coming week’s developments could set the tone for the rest of the year and such factors make reactions to U.S. NFP data especially significant.

TECHNICALS: Support at 73.50, resistance 75.50. The implications are bearish for the coming weeks after the Dollar failed in its attempt to close above the descending trend-line connecting the June 2010/January 2011 highs and establish above the 24th May high at 75.95. Accordingly, we remain U.S. Dollar bearish in the week ahead and will look to sell on rallies.

Euro Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: The Euro closed at 1.4524 against the U.S. Dollar on Friday, rallying 300 points from Mondays open following Greece’s successful passing of a new deficit-reduction plan. The package includes tax hikes, spending cuts, and government asset sales - paving the way for the disbursement of a critical tranche of EU/IMF aid in August as well as a second bailout worth EURO110B that ought to tide the country over to 2014. Celebrations however, should be restrained as markets begin to look past the Greek crisis that dominated financial circles in recent days and are reminded of the shaky macro-economic landscape emerging in the second half of 2011. Last week, indicators of manufacturing sector activity from across the world’s leading economies proved largely disappointing. Chinese factory sector growth slumped to the weakest post Great Recession level, the final revision of the analogous reading for Germany - the leading European economy - downgraded the pace of activity from an already alarming initial result, and a similar gauge from the U.K. printed dramatically below expectations. The U.S. ISM manufacturing gauge was a conspicuous standout, snapping a three month losing streak and posting an increase despite forecasts calling for another decline. Looking at the week ahead, the European Central Bank is widely expected to raise interest rates by another 25bps on Thursday, with the move having been priced in for weeks. An unexpected decision to hold off given the slide in Euro-zone economic data over the past month is likely to heavily on the single currency. Additionally, Fridays NFP jobs report will no doubt cause volatility across all the majors - in particular the Euro - as expectations are for a weak June growth in employment (89K vs 54K prior).

TECHNICALS: Support at 1.4300, resistance 1.4600. EURUSD has met triangle resistance with a coiling of the 10/20/50/100-Day SMAs suggesting that a near-term break is imminent. Given this weeks ECB policy meeting and U.S. jobs report, we anticipate a break-out to the upside and a test of the 4th May high at 1.4939. Accordingly, we remain Euro bullish in the week ahead and will look to buy on dips.

.png)

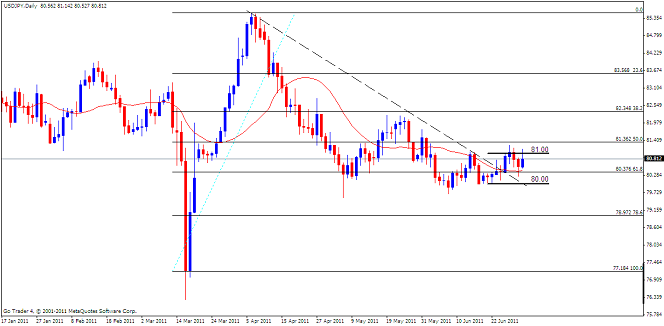

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: By Friday last week, the Japanese Yen weaken against most of its major counterparts as markets increased their appetite for yields, and the rise in carry interest may continue to bear down on the Yen as risk appetite sentiment dictates price action in the foreign exchange market. Longer term however, we may see a shift away from risk-taking behavior as the Federal Reserve unwinds the additional $600B in quantitative easing, and the central banks across the industrialized nations may continue to gradually normalize monetary policy in the second-half of the year as inflation becomes a growing concern. Although some advanced economy continue to face ‘vulnerabilities,’ the Bank for International Settlements said world policy makers need to start raising interest rates in its annual report, and warned that monetary stimulus may need to be withdrawn faster than historically seen as price pressures are ‘rising rapidly.’ The BIS went onto say “that the prolonged period of loose policy could distort the financial markets”, and argued that the need for continued extraordinary monetary accommodation has faded. As heightening price pressures dampen purchasing power for households, global policy makers may adopt a hawkish policy stance in the second-half of the year, and central banks could look to wind down their balance sheets over the coming months in order stem the risk for inflation. In light of the recent comments by Bank of Japan Governor Masaaki Shirakawa, the BoJ looks poised to preserve its wait and see approach as he warns about the adverse effects of prolonged period of accommodative policy, and risk may subside going forward as central banks across the global look to withdraw monetary stimulus. Should risk taper off in the week ahead, the shift in sentiment is likely to increase the appeal of the low yielding Japanese Yen and it may regain its footing in July as carry interest falters.

TECHNICALS: Support at 80.00, resistance 81.00. There are signs that a major USDJPY shift is at hand. Price bounced from its 61.8% retracement of the rally from the March low twice in the last 2 months and has also broken above the trendline that extends off of the April and May highs. As such, USDJPY looks to have finally found support in the 80.00 area and is in the process of carving out a material base. Accordingly, we remain Yen neutral in the week ahead until a clearer picture develops with risk sentiment.

British Pound. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Last week, Sterling pushed higher against the Swiss Franc, Japanese Yen and the U.S. Dollar, up 2.44 %, 1.21%, and 0.72% respectively on risk appetite flows. This was notable, as economic data out of Britain was disappointing, which exposes further weakness in the Pound going forward. Final gross domestic product figures from first quarter 2011 showed that the economy had grown less than forecast, up 1.6% year-over-year, down from the 1.8% original reading. Additionally, total business investment declined in the first quarter, down 3.2% from the fourth quarter. Looking at the week ahead, the U.K. housing market is expected to have continued to have suffered in June, with PMI construction data forecasted to have shown a slower rate of expansion, down from 54.0 in May to 53.8 in June. The PMI services data is expected to show a similar deterioration in June, down to 53.5 from 53.8 May. The U.Ks most important data however, comes out on Thursday when industrial production data for May will be released which is expected to show a 1.1% increase from April; nonetheless, production is forecasted to have remained down from the year prior, with a 0.5% contraction on a year-over-year basis. Manufacturing data, on the other hand, paints a more bullish picture for Sterling, with a 2.1% expected increase in May on a yearly basis. While the manufacturing data could prove bullish for Sterling, the data that markets are eyeing is the rate decision from the Bank of England on Thursday, The BoE is expected to maintain its official rate at 0.50%, while simultaneously holding its asset reserve purchase program at £200 billion. This comes despite the country facing an inflation rate of 4.5%, more than double its target of 2%. Traditionally, an inflation rate of this level would be a signal for the MPC to increase the bank rate, but policy makers believe that inflationary pressures will ease once food and oil prices come down. On June 9, the MPC voted to maintain the Official Bank Rate at 50 basis points, leaving it unchanged for eleven consecutive quarters, and Thursday’s rate is expected to remain unchanged, with only a 3.0% chance of a 25.0 basis point rate hike. Any further dovish tones this week from the BoE can only further weigh on the Pound going forward

TECHNICALS: Support at 1.5950, resistance 1.6150. GBPUSD has broken below its trendline from the 2010 low, confirming a head and shoulders top and although the structure remains bearish, setbacks seem to be well supported in the 1.5900’s for now Last weeks consolidation may lead to a break higher that tests 1.6200 and the 20 SMA before Cable rolls over. Accordingly, we remain Sterling bearish in the week ahead and will look to sell on rallies.

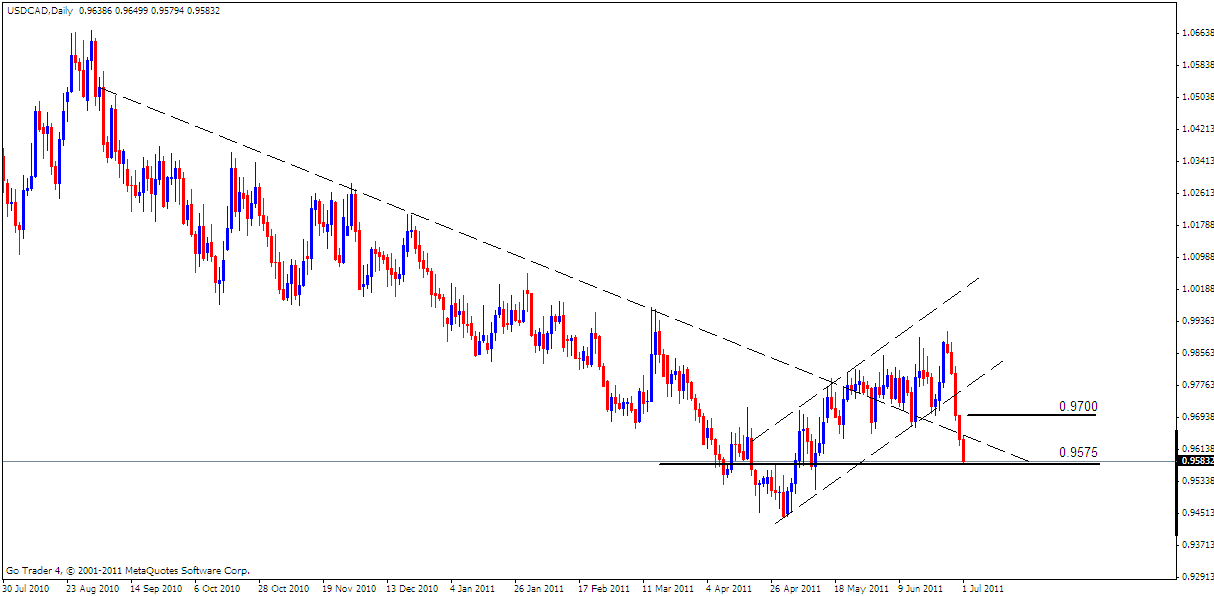

Canadian Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: Last week, the Canadian Dollar out-performed against the U.S. Dollar as the pair slumped some 300 points on better than expected CPI and GDP reports from Canada, as well as the market wide shift to riskier asset classes. According to Credit Suisse Overnight Index Swaps, market participants are now pricing the interest rate to increase by more than 50bp over the next 12-months, which has nearly doubled from June, and the Bank of Canada may see scope to normalize monetary policy further in 2011 as the headline reading for inflation continues to diverge from the 2% target. Indeed, the key economic development out of Canada this week will be the labour report for June, which is expected to show another 12.5K expansion in employment and the ongoing improvement in private sector activity could further instill expectations for a rate hike later this year. However, market participants may show a bearish reaction to Thursdays Ivey PMI report as business spending is projected to expand at a slower pace, and the development could spark a near-term correction in USDCAD following last weeks largest decline since July 2010.

TECHNICALS: Support at 0.9575, resistance 0.9700. USDCAD’s decline last week negates the rising trend-channel from 2nd May with the pair now testing former resistance at 0.9575 as support. Recent weakness in crude oil prices may see the pair rally off of said support. Accordingly, we remain Loonie neutral bearish in the week ahead in the week ahead until a clearer picture develops with risk sentiment.

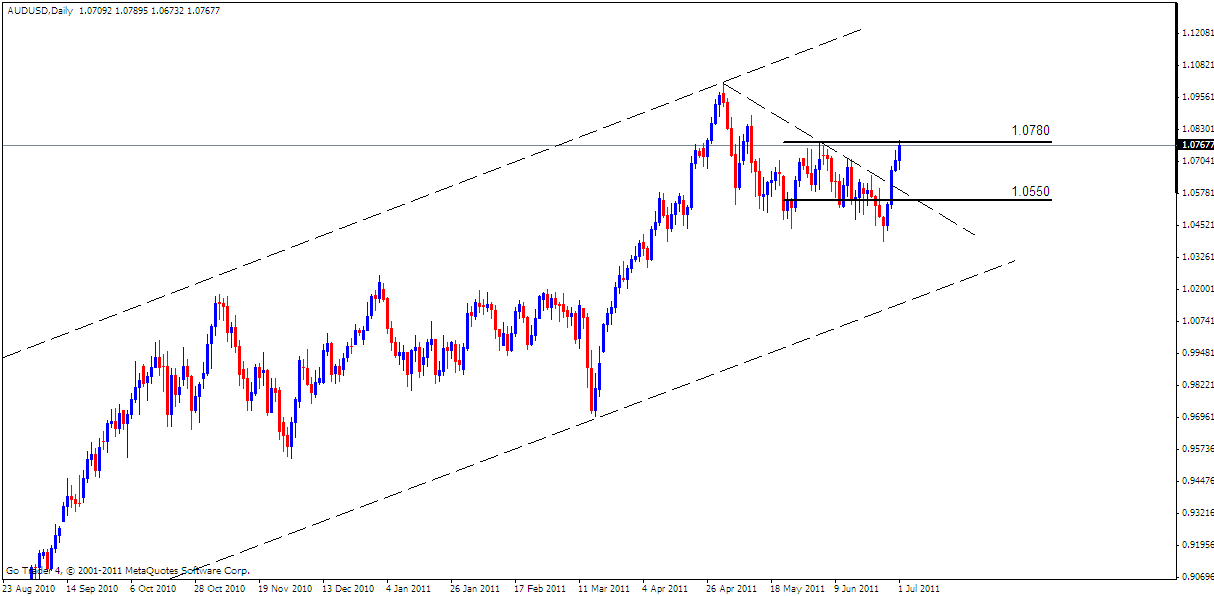

Australian Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: The Australian Dollar finished strongly on Friday against the major currencies, as a global shift to risk-appetite amid the passage of the Greek austerity package boosted investor sentiment, sending capital flows into higher-yielding assets. The Aussie gained the most against the funding currencies, the Swiss Franc, the Japanese Yen and the U.S. Dollar, up 4.28%, 3.07%, and 2.59%, respectively. In the week ahead, Tuesday sees a rate decision from the Reserve Bank of Australia. The RBA is widely expected to hold rates at 4.75%, according to the Credit Suisse Overnight Index Swaps. In fact, there is a -2.0 percent chance of a 25.0-basis point hike, which means there is a 2.0% chance of a 25.0-basis point rate cut with only 6.0-basis points of hikes are priced into the Aussie over the next 12-months. Price action will likely be shaped mainly by commentary by the RBA Governor Glenn Stevens following the meeting. Governor Stevens has noted that future rate hikes are possible to control inflation, which showed a 3.3% increase on a year-over-year basis in the first quarter, up from a 3.0% forecast, according to a Bloomberg News survey. The other key event that will spark price action next week will be the labour report for June. The Australian economy is forecasted to have added an additional 15.0K jobs in June, but this comes after a disappointing report in May. The economy added 7.8K jobs in the month prior, full time employment dropped by 22.0K, while part time employment increased by 29.8K; this divergence, while net positive, suggests that small businesses in Australia could be weakening and a continuation of this trend bodes poorly for the Aussie. Overall, the unemployment rate is forecasted to hold at 4.9% for the fourth consecutive month.

TECHNICALS: Support at 1.0550, resistance 1.0780. AUDUSD continues to advance at a relentless pace and 1.0780 is on the verge of giving way. A pop through there should result in a pullback, which ideally proves corrective with near-term support at 1.0650 and 1.0600 levels. Establishing long positions from these levels is our favoured scenario. Accordingly, we remain Aussie bullish in the week ahead and will look to buy on dips.

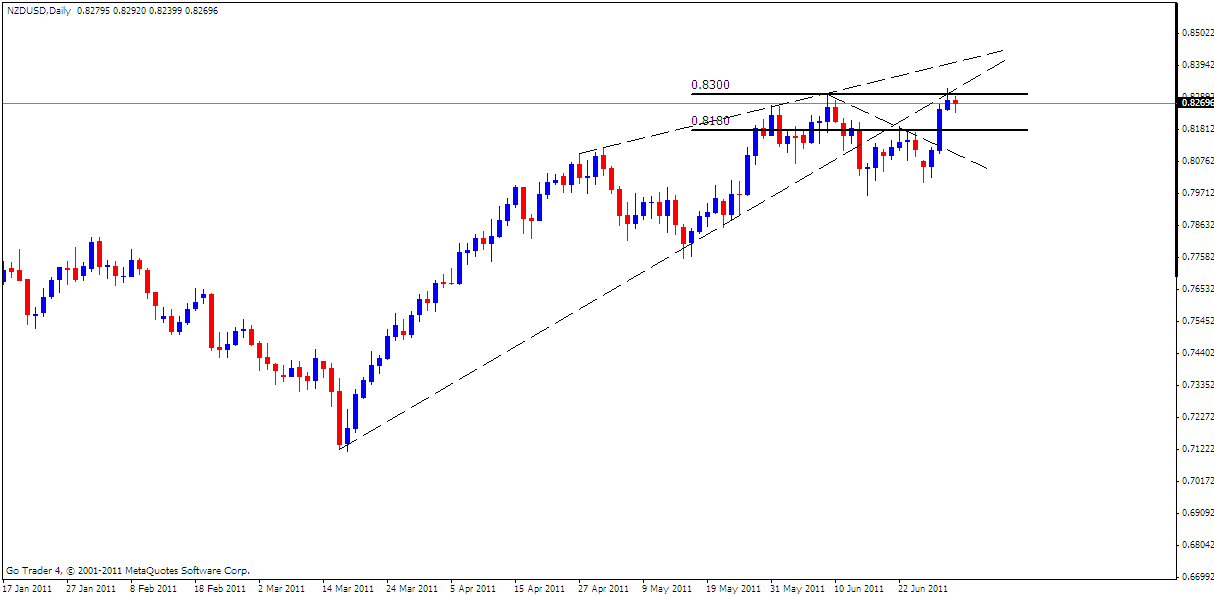

New Zealand Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: Last weeks rally in risk appetite saw the New Zealand Dollar surge against the U.S. Dollar, testing the record highs set back on 9th May. Despite weaker than expected trade balance figures, the Kiwi continued to ride the wave of risk appetite that swept over markets after Greece successfully passed the austerity measures needed to secure the next tranche of EU/IMF funds. Looking ahead this week, the 2Q NZIER Business optimism survey is due on Monday. The figure is derived by subtracting the percentage of companies that are pessimistic about the economic outlook from the percentage that are optimistic and is used as a gauge of business confidence and willingness to expand in their respective industries. This followed by the 1Q GDP print on Wednesday with consensus estimates calling for a read of 0.3% q/q, up from 0.2% the previous quarter. The year on year figure however is expected to soften with a print of 0.5%, down from a previous read of 0.8%. A weaker than expected release on the GDP figures could weigh heavily on the Kiwi, especially in light of the disappointing trade balance data released last week. However if the data comes in-line with expectations, NZDUSD is likely to see further gains as concerns about the real impact of the recent disasters in Christchurch ease with growth prospects continuing to improve.

TECHNICALS: Support at 0.8180, resistance 0.8300. Focus remains on the ascending trend-line that connects the March/May lows and the resistance line that extends off of the May/June highs. We are expecting price consolidation on a test of the March/May trend-line, before an eventual break targeting 0.8520. Accordingly, we remain Kiwi bullish in the week ahead and will look to buy on dips.