Analysis by: Pepperstone

U.S. Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: The U.S. Dollar finished sharply lower on Friday against its key counterparts on government credit rating fears and lackluster interest rate prospects. Markets began pricing in the previously unthinkable - a US Treasury default - on risks that U.S. legislators may not agree to a budget deal as the government will soon run short of cash. Fed Chairman Ben Bernanke likewise sunk the Greenback as he struck a dovish note on the future of monetary policy, and indeed risks remain weighed to the downside in the week ahead. Ratings agencies Moody’s and Standard & Poor’s rocked bond markets last Tuesday as they downgraded the outlook for the U.S. sovereign credit rating. This caused investors to question the U.S. Treasury bond’s traditional role as the world’s risk-free asset as politicians remain retrenched in tense budget negotiations. The U.S. debt ceiling is clearly grabbing the major headlines at the moment, but the biggest long-term driver of Dollar volatility will come from inflation and employment data going forward. The Fed’s next steps will almost certainly depend on U.S. economic data, and markets will prove especially sensitive to major surprises. A relatively quiet calendar this week promises little in the way of fireworks, but it will be critical to monitor data going forward as we may be entering an extended period of pronounced U.S. Dollar volatility on clear doubts over the U.S. Treasury and Federal Reserve.

TECHNICALS: Support at 9,500, resistance 9,700. The Index closed on Friday above the descending trend-line connecting the June 2010 and January/ May 2011 highs. A daily close above the May highs by 9,763 is required to relieve downside pressure on the Greenback while said trend-line and 9,500 supports over the near term with a close below these levels exposing the May lows by 9,341. Momentum coupled with uncertainty over the U.S. government debt ceiling points to further losses for the Dollar and as such, we remain bearish the Greenback in the week ahead and are looking to sell on rallies.

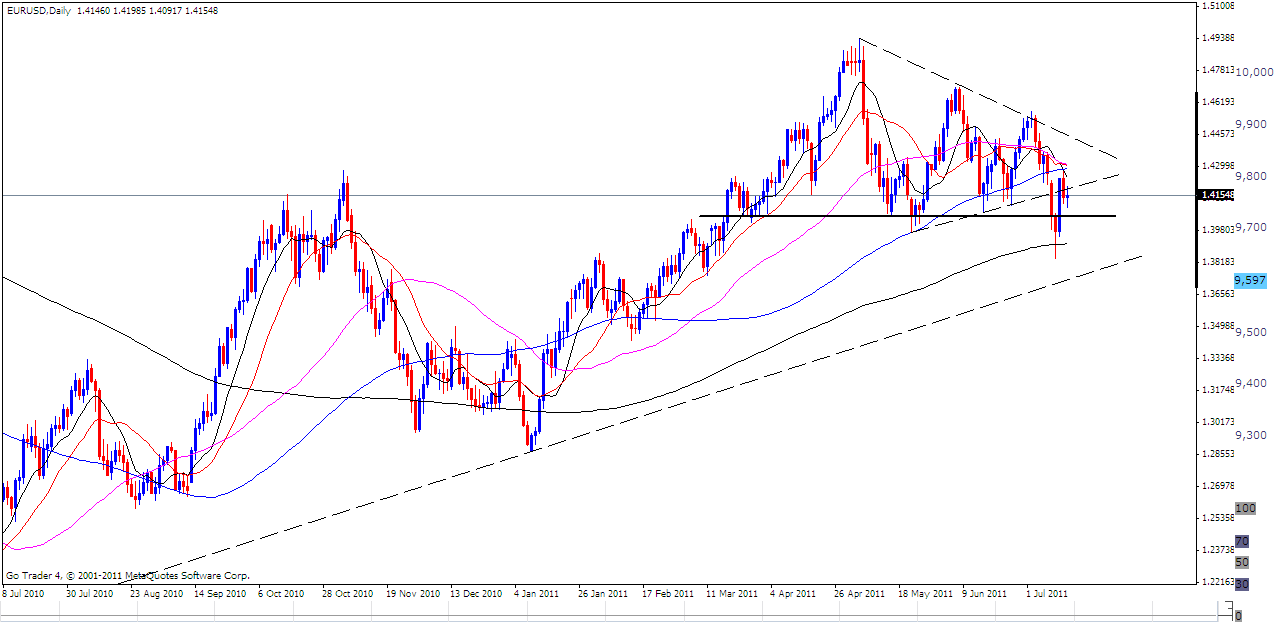

Euro. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Euro closed the week at 1.4154 against the U.S. Dollar, ranging a turbulent 440 points following headlines that included Italian debt contagion fears, Fed Chairman Bernankes congressional testimony, Moodys/S & Ps’ announcement to downgrade the U.S. government credit rating to “credit negative” and Irelands credit rating slashed to “junk status”. Speculation over Fridays European Bank Stress Test results also added to the uncertainty surrounding the Euro. Releasing the stress test results after the close of the trading day in Europe is a well thought out plan to curb volatility as analysts and investors have a chance to digest the details over the weekend. Of the 90 banks whose statistics were released (one German Landesbank refused to have its test results released because they disagreed with the means for measurement), only 8 banks failed to meet the 5% Tier 1 capital ratio. Furthermore, this created a shortfall of only 2.5 billion euros. This wasn’t much different from the 7 failures for 3.5 billion Euros in the 2010 stress test - and the scepticism won’t be much different either. The most glaring problem with this review is the EBA’s refusal to consider a Greek default (what seems near-certain at this point) in the stress test terms of reference. When the European markets are back online Monday we’ll see whether market participants simply ignore it or sell off the Euro in belief the risks are undervalued. It should be noted however, that market sentiment can play a considerable role as appetite for yield can temporarily overwhelm fears of more distant financial troubles for the Euro. The FX market can very well price currencies by establishing the ‘best of the worst’ and if the threat of a U.S. sovereign downgrade and/or acceptance of QE3 gains traction, the Euro will likely fill the role of the worlds most liquid alternative. Notable Euro economic data this week includes Tuesdays German ZEW Economic Sentiment survey, a plethora of PMI reports on Thursday and Fridays German Ifo Business Climate report.

TECHNICALS: Support at 1.4050, resistance at 1.4300. The confluence of 10, 20, 50 and 100 day moving averages by 1.4300 proved to be an area of formidable EURUSD resistance last Thursday. The May, June and 4th July highs have formed the upper bounds of the short-term wedge pattern and a test of 1.4400 over the coming week is possible to form the 4th lower high before the pair rolls over for a sizable move below the 200 SMA. Near term support is at 1.4050. The confused price action of late has us on the sidelines until a clearer picture emerges and as such we remain Euro neutral in the week ahead.

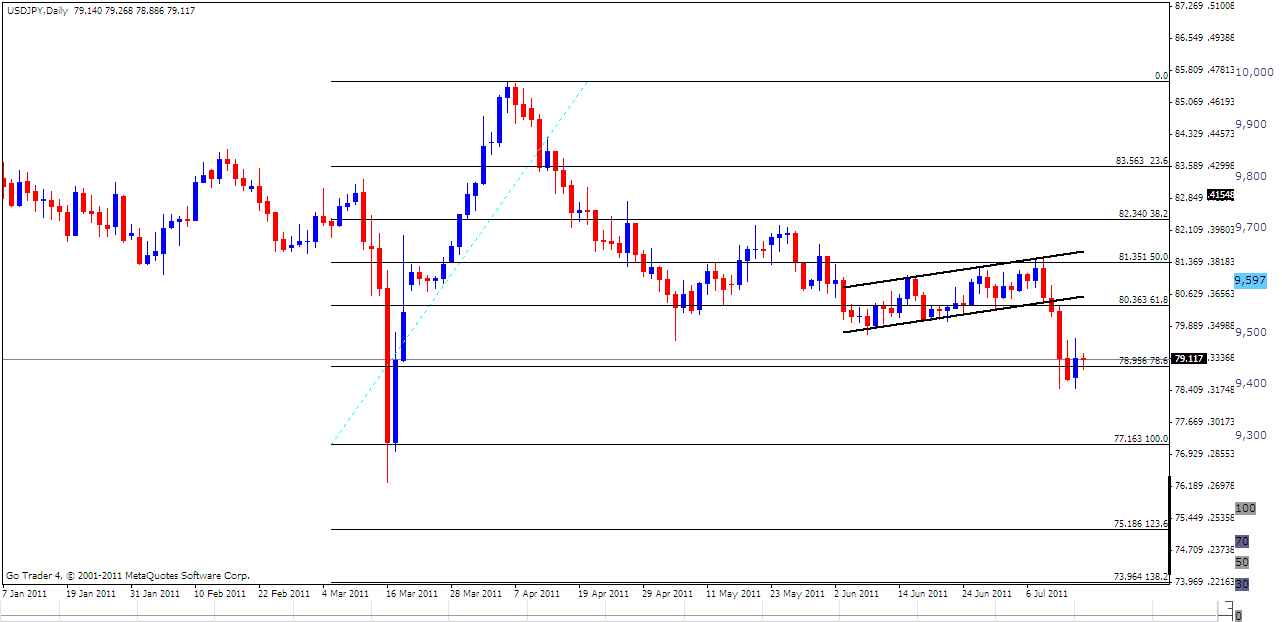

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Japanese Yen advanced more than 2% against the U.S. Dollar by last Fridays close as the Greenback came under pressure on concerns over the looming debt limit deadline. Additionally, Yen strength came on the back of safe-haven flows accelerated by concerns over sovereign debt downgrades and the threat of defaults in Europe. Economic data out of Japan also supported the Yen’s rally with Mays’ Tertiary Industry Index and the June domestic GDP figures topping estimates. Industrial production and capacity utilization followed suit, besting expectations as the economy continues to gather pace in the wake of the March disasters. As expected the Bank of Japan held interest rates at 0.10% with the central bank’s monthly economic report citing, “economic activity is picking up with an easing of the supply-side constraints caused by the earthquake.” This week’s economic calendar is highlighted by the June merchandise trade balance figures and the May all industry activity index. Merchandise trade is expected to show the deficit narrowing to 250.4B yen, an improvement from the -474.6B print seen the previous month. Meanwhile, consensus estimates on the activity index call for a print of 1.8% m/m, up from a previous gain of 1.5% m/m in April. Weaker than expected prints will once again see increased pressure on the BoJ to act and could threaten the Yen’s recent strength.

TECHNICALS: Support at 78.50, resistance 80.00. Last weeks USDJPY price action stalled out by the 78.6% Fib level of the 17th March - 6th April rally with the pair returning to a level that was last seen at the March panic low. The spike low seen just after the U.S. close last Tuesday following Bernankes congressional testimony has held and a move above 79.60 would indicate higher highs on an intra-day basis. A daily close back above 80.00 would be required at a minimum to relieve downside pressures, and as such we remain Yen neutral in the week ahead until a clearer picture emerges regarding risk sentiment.

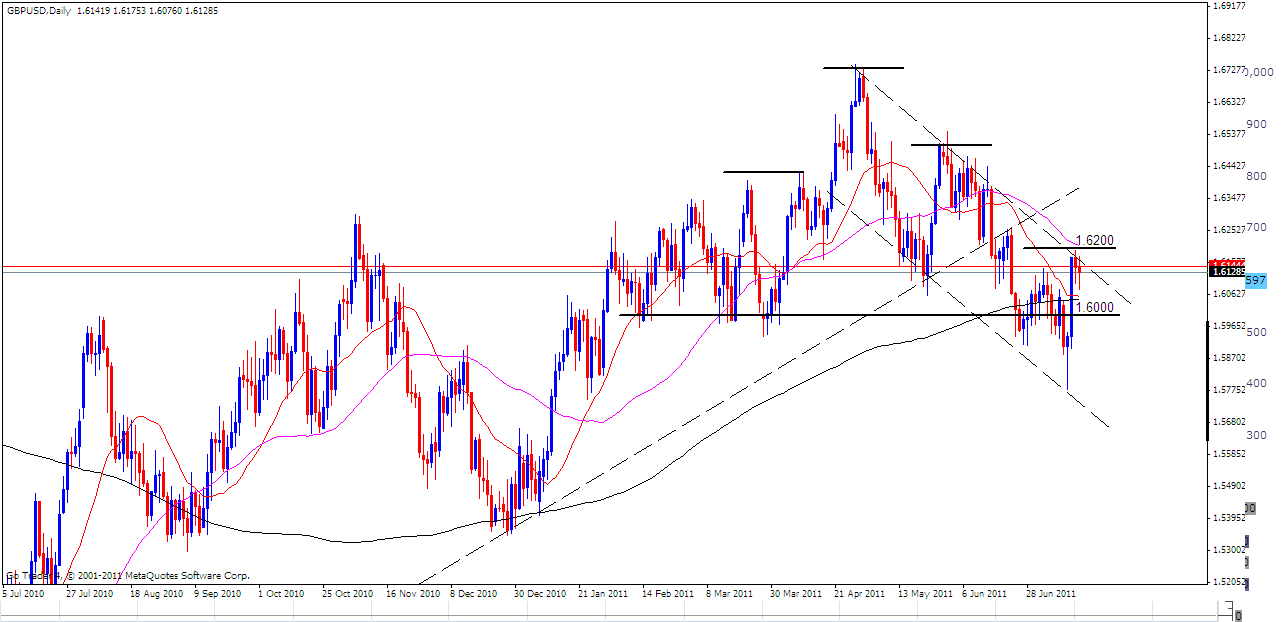

British Pound. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Sterling found strong support against the U.S. Dollar in the latter half of last week, after dropping nearly 200 pips on the Tuesday, after a worse than expected CPI print which indicated that inflationary pressures were easing. In line with the Bank of England’s consensus that it would leave rates on hold for an extended period in order to boost economic growth, rate hike expectations fell sharply, suggesting that on pure interest rate differentials, Sterling could come under heavy pressure in the coming weeks. Although the U.K. currency’s’ performance against the U.S. Dollar was strong, underlying economic conditions as indicated by other reports issued over the week, showed that everything is not as rosy as it might appear. Indeed, price softened across the board in June, with the core producer price index reading down to 3.2% from 3.4% in May, while the retail price index fell to 5.0%, short of the 5.2% expectation as well. The housing sector and labour market also showed signs of fragility, with the DCLG reading of United Kingdom House Prices contracting by 1.6% in May, and the ILO unemployment rate holding at 7.7% in May on the heels of 24.5K additional jobless claims being filed in June. The week ahead is relatively light on U.K. economic data, considering it comes after a week denoted by unemployment and price data, and ahead of the advance second quarter gross domestic reading in the last week of July. Nonetheless, two events on this weeks docket are notable and will spark volatility among Sterling based pairs. The Bank of England minutes from their most recent Monetary Policy Committee are due on Wednesday, which could be markedly different from prior notes, as arch inflation hawk Andrew Sentance was off of the MPC for the first time this year. Accordingly, with a decreasing pace of inflation, the minutes could be particularly dovish, which would cause the Sterling to depreciate across the board. Thursday sees the retail sales report for June. Consumer spending is projected to have risen with retail sales forecasted at 0.7% on a month over month basis, and 0.7% on a yearly basis. These reports aside, consumer spending will need to increase for several consecutive months in order for the Bank of England to change their continuous dovish stance going forward.

TECHNICALS: Support at 1.6000, resistance at 1.6200. Last Wednesday’s 240 point GBPUSD rally following Bernankes testimony and U.S. credit rating concerns stopped shy of the 1.6200 level and upper bounds of the descending trend-channel from April this year. Any intra-day rallies should be capped ahead of the 1.6250 level before the next downside extension below the 200 SMA toward key support by 1.5750. Only a daily close above 1.6250 negates the bearish scenario and as such we remain bearish Sterling in the week ahead and are looking to sell on rallies.

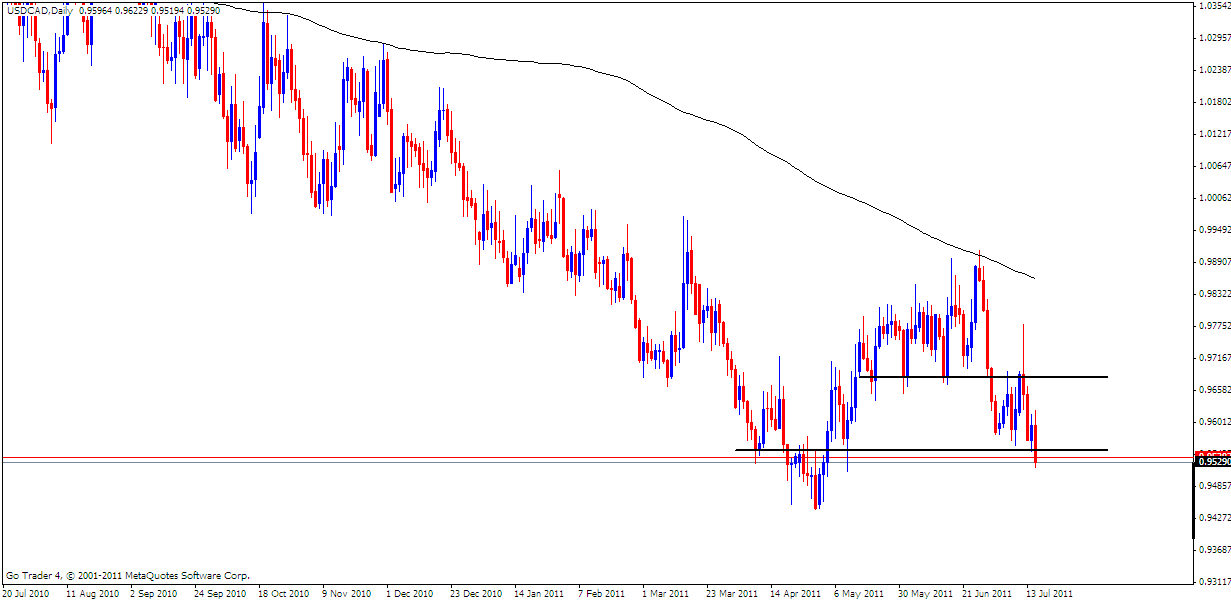

Canadian Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: The Canadian Dollar closed on Friday at 0.9529 against the U.S. Dollar and Loonie strength may accelerate this week should the Bank of Canada show an increased willingness to raise the benchmark interest rate off of 1.00%. According to Credit Suisse Overnight Index swaps, investors widely expect the central bank to retain its current policy on Tuesday, but see borrowing costs increasing by nearly 50bp over the next 12 months as growth and inflation gather pace. Indeed, a report released by the BoC last week showed a net 53% of the businesses surveyed intend to increase hiring over the next 12 months, which marks the highest reading since record-keeping began in 1998, and the ongoing improvement in the labor market may encourage the BoC to toughen its stance against inflation as price growth expands at the fastest pace since 2003. Additionally, the senior loan officer survey reinforced an improved outlook for the region as lending standards for businesses eased in 2Q 2011, and private sector activity looks poised to pick up over the remainder of this year as the economic recovery becomes increasingly broad-based. In light of the recent developments, BoC Governor Mark Carney may drop his pledge “to carefully consider future rate hikes”, and the central bank head may see a case to increase borrowing costs faster than initially warranted as economic activity accelerates. A busy Canadian calendar this week also sees the BoC Monetary Policy Report and press conference on Wednesday, and the CPI and retail sales prints for June on Friday.

TECHNICALS: Support at 0.9450, resistance 0.9585. Fridays close saw price trade below key support by 0.9550 with a daily close above 0.9700 required to relieve immediate downside pressure. Long-term momentum, U.S. debt ceiling concerns and the proximity of the April low point to USDCAD strength being a low probability here and as such we remain Loonie bullish in the week ahead and are looking to buy on dips (rallies in the case of USDCAD).

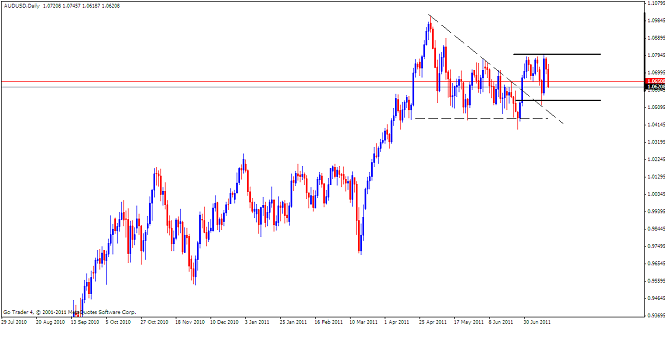

Australian Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: By Fridays close, the Australian Dollar was down against every major currency, particularly the safe-haven Swiss Franc (-3.61%), Japanese Yen (-2.88%) and U.S. Dollar (-0.96%) as broader market risk aversion sentiment weighed on the high yielding Aussie. Last weeks mixed batch of economic reports did little to help the currency as the National Australia Bank Business Confidence print dropped significantly, down to 0 from 6. Similarly, Westpac, one of Australia’s “big four” banks, released a report suggesting that the Reserve Bank of Australia would need to cuts the benchmark rate in the coming months in order to boost growth in non-mining sectors which have struggled in recent months. Looking ahead this week, the Australian Dollar is likely remain under heavy selling pressure, as the Euro-zone crisis appears to only be worsening at this point with Italy and Spain in the market’s crosshairs, while the negotiations as to raise the U.S. debt ceiling (or not) appear to be reaching a significant impasse, with both Democrats and Republicans alike digging deeper into their positions. Notable economic data for Australia comes on Tuesday with the release of the RBAs’ Monetary Policy Meeting Minutes which, as noted by the Westpac estimate, could show a more dovish tone among policymakers as economic growth appears to be cooling in Australia. Likewise, Thursday’s NAB’s Quarterly Business Confidence survey is likely to reinforce a softening outlook for the Australian economy and if the crises on both sides of the Atlantic worsen; the Aussie is likely to depreciate against its other major counterparts

TECHNICALS: Support at 1.0550, resistance 1.0800. Last Wednesday’s rally stalled out just shy of 1.0800 key resistance with Fridays price action closing below near term support by 1.0650. Similar to the Euro, last weeks risk on/risk off sentiment leaves us with a confused picture heading into this week and we will stay on the sidelines for now, remaining Aussie neutral until a clearer picture emerges regarding risk sentiment.

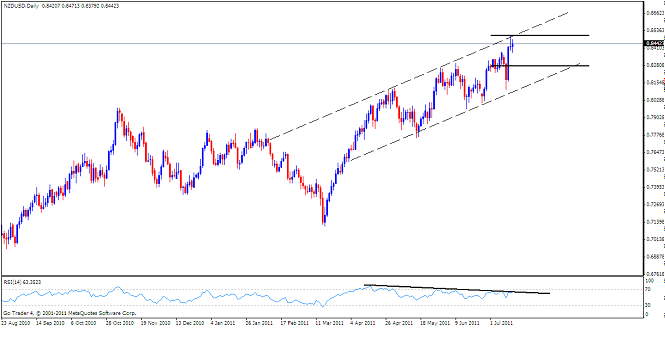

New Zealand Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: The New Zealand Dollar advanced more than 0.85% this week against the U.S. Dollar hitting record highs just above 0.8500 level after data showed that economic growth surpassed even the most optimistic estimates. Wednesday’s 1Q GDP figures bested forecasts with a print of 0.8% q/q and 1.4% y/y with both figures nearly tripling expectations. The Kiwi surged on the news as rate hike expectations climbed on speculation that the Reserve Bank of New Zealand would show an increased willingness to move on interest rates due to the faster than expected domestic recovery. The only downside to the Kiwi’s recent rally will be significant swings in market risk sentiment as traders jettison higher-yielding assets for the safety of the Swiss Franc, Japanese Yen, and the Greenback. Although the positive GDP data saw the Kiwi surge despite heightened risk aversion flows, rising concerns regarding a possible slowdown in Australian economic growth could cause some additional headwinds for the Kiwi. Speculation that the RBA may have tightened too much too quickly continue to fuel bets that the central bank will move to cut interest rates with Credit Suisse Overnight Swaps now factoring over 50 basis points in cuts for the next twelve months. As New Zealand’s largest trade partner, a slowdown in Australia is likely to weigh on the robust New Zealand recovery. Looking ahead this week, a relatively quiet economic calendar for the Kiwi sees the 2Q CPI print due Sunday and investors will be closely eyeing the inflation print with consensus estimates calling for a hold of 0.8% q/q while the year on year print is expected to climb to 5.1% from a previous read of 4.5% y/y. A stronger than expected print would likely see rate hike expectations climb as the RBNZ would be more inclined to raise interest rates to curb inflationary pressures.

TECHNICALS: Support at 0.8280, resistance n/a. Last weeks 390 point range saw NZDUSD trade to a fresh record highs by 0.8500 and reach the long cited resistance line and being in unchartered territory, upside levels are difficult to determine. Former resistance at 0.8280 has held as support thus far. There are warning signs that the trend is nearing its terminus - including increased volatility and RSI divergence with the highs from April, June and July 14th highs. As such, we remain Kiwi bullish in the week ahead and are looking to buy on dips.

Leveraged foreign exchange and options trading carries a significant level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Any opinions, news, research, analysis, prices or other information contained in this email is provided as general market commentary and does not constitute investment advice.