U.S. Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: The U.S. Dollar Index closed on Friday at 75.08, following a week of steady gains buoyed by an impressive ADP Non-Farm Payroll report that suggested an impressive official government print the next day.

Then on Friday morning the June U.S. payrolls report hit markets with a thud, delivering an anemic +18K gain versus expectations for +105K nonfarm jobs. When the birth-death adjustment was taken into account, the June payrolls were in negative territory. U.S. indices fell only modestly on the news as many investors noted the jobs data is a lagging indicator that could still show improvement in coming months. For the week the S&P500 rose +0.3%, the DJIA gained +0.6% while the NASDAQ added +1.6%. Looking ahead to the coming days and weeks, two particular events stand out as major catalysts for U.S. Dollar price action: the Euro-zone sovereign funding crisis and the impending end of the Federal Reserves’ QE2 program. The cloud of euphoria generated by the passage of the Greek austerity program cleared up last week, revealing the myriad of peripheral problems facing the Euro-zone. European finance ministers may have approved the next tranche of Greek aid over the weekend, but there was no agreement on the key problem of facilitating the participation of private investors. S&P offered its own spin, commenting that the debt rollover plans offered so far may put Greece in selective default, reinforcing the sense that the ratings agencies do not believe the French alternative for voluntary Greek bond rollovers into longer maturities would fly. Moody's slashed Portugal's sovereign credit rating four notches to junk territory and noted that there is a risk that the country will require a second round financing before it can return to the private markets. Additionally, the ECB raised its key rate to 1.50%, while at the same time suspending the minimum credit threshold for Portugal, which is a clear departure from its hitherto strict credit rules. Given that the Greenback’s safe haven appeal is unique in that it stands out when there is a need for liquidity (the ability to access your money), European debt contagion is likely to see the Dollar as the currency of choice, along with the Swiss Franc and Japanese Yen. During the 2008 financial crisis, the sudden collapse of the mortgage-backed and other derivatives markets threatened the liquidity of even the most liquid money markets; and the U.S. Dollar shone as the world’s most liquid. Also, with the winding up of QE2, markets will now be looking for the eventual rebound in U.S. rates & the timing of this will undoubtedly be in the minds of most investors. Economic data this week from the U.S. will be highlighted by Thursday’s retail sales and PPI reports followed on Friday by the June CPI print.

TECHNICALS: Support at 74.00, resistance 75.85. The Dollar Index closed on Friday right at the trend-line off of the June 2010 & January 2011 highs and the implications are bearish for the coming week given the markets preference for the Franc and Yen as safe harbours over the Dollar. A daily close above the May highs at 76.35 would be required to relieve downside pressure and as such, we remain bearish U.S. Dollar in the week ahead and will look to sell on rallies.

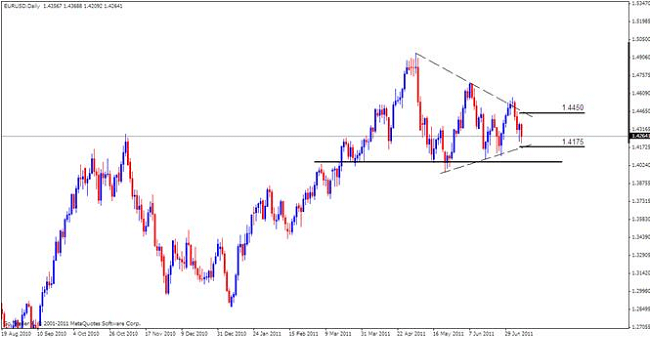

Euro Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Euro closed out last week at 1.4262 against the U.S. Dollar after being rocked by a Portuguese credit rating downgrade and a notable deterioration in Euro-zone bond spreads. Moody’s credit rating agency sent shock waves through European debt markets as it downgraded Portuguese bonds to “Junk” status, prompting similarly aggressive reactions out of regional policymakers and highlighting stresses in the EMU. The controversial move came as Moody’s claimed that any future sovereign bailouts would likely require involuntary private sector participation. In other words, private bond holders would likely be forced to take losses on periphery debt, making outstanding bonds worth less on perceived credit risk. Portugal’s bond yields soared, and similar moves in Irish, Italian, Spanish, and Greek yields suggest bond traders are pricing in higher default risk across the board - which is undeniably bearish for the Euro. In the week ahead, credit market activity puts the focus squarely on an upcoming Euro-group meeting on Tuesday, and it will be important to watch for developments surrounding the makeup of the second Greek bailout package as well as plans for similar episodes in the future. European officials seem likely to force private investors to roll over Greek bond holdings as they mature, but the S&P rating agency threw these plans into doubt when they said “they would rule any such action as a default”. This leaves key questions on how officials will deal with the inevitable fiscal aid package and places doubt over the stability of the broader Euro-zone as the Greek economy is only the 13th largest within the Euro-zone and less than 10% the size of Germany. Yet stresses in Greece have led to similar attacks on other sovereign debt markets, and the EMU’s third and fourth-largest economies Italy and Spain have seen bond yields soar as markets price in a drop in creditworthiness. Additionally, the spread between the Spanish 10-year bond yield and the benchmark German equivalent has recently soared to a fresh Euro-era high, warning of potential debt contagion. Noteworthy economic data this week for the Euro will be Tuesdays ECOFIN meetings, Thursdays Euro-zone Consumer Price Index inflation figures as well as a late-week European Bank Stress Test Results.

TECHNICALS: Support at 1.4175, resistance 1.4450. The relentless sideways grind of EURUSD within the triangle pattern continues and expectations are for more of the same going forward. In the interim, rallies should be well offered ahead of 1.4500 and any declines will find solid support at 1.4100/50 levels. Daily closes outside of these levels are likely to accelerate price movement and as such, we remain neutral Euro in the week ahead until a clearer picture emerges with risk trends.

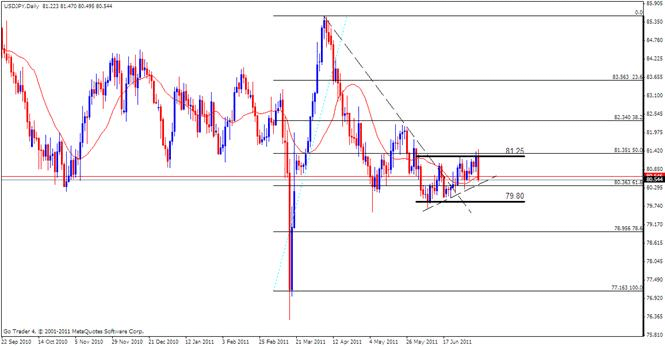

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Japanese Yen strengthened into Fridays close, finishing at 80.54 against the U.S. Dollar on risk aversion flows following the dreadful U.S. NFP jobs report. Relative interest rate spreads will remain in focus for the Yen going forward, a fact clearly highlighted as the currency reacted to the disappointing US Employment report with the yield advantage of 2 year U.S. Treasury bonds over comparable Japanese bonds tumbling 8 basis points - the most in over seven months - leading USDJPY to its biggest daily decline in six weeks. More of the same is likely in the week ahead, with correlation studies continuing to show a very robust relationship between USDJPY and the US-Japan 2-year bond yield differential. Tuesdays FOMC minutes are the most high-profile item on the calendar for the Yen , but the document’s potency is likely to be diminished considering markets have already heard its contents and priced it in following Ben Bernanke’s post-announcement press conference on June 22nd. Elsewhere, leading indicators are expected to yield broadly encouraging results with U.S. Retail Sales expected to grow at an annual pace of 8.0%, the fastest in four months, the CPI report is forecast to put core inflation at the fastest since January 2010, and Industrial Production as well as the University of Michigan consumer confidence readings are expected to rebound. On balance, these outcomes point toward upward pressure on U.S. borrowing costs, suggesting the Yen may reverse its late-week gains. The lingering Euro Zone debt crisis also cannot be overlooked. While Greece gained approval for a 3.2B Euro aid disbursement from the IMF, the larger issue now is contagion after Portugal was downgraded by Moody’s and the spread between German and Italian bonds opened up dramatically last week, feeding fears that the crisis has finally come to a country too large to be bailed out (Italy is the third-largest economy in the Euro Zone as well as the third-largest global bond market after the US and Japan). Needless to say, a mass exodus from risky assets driven by another turn for the worse in Europe would prove supportive for the Yen as traders unwind carry trades funded cheaply in the perennially low-yielding currency. Additionally, the sharp jump in Chinese CPI reported on Saturday (6.4% vs 6.2 exp.) may further reinforce risk aversion flows, weighing against global growth expectations on fears the PBoC will redouble its efforts to cool the Chinese economy.

TECHNICALS: Support at 79.80, resistance 81.25. Technical studies suggest that a major USDJPY shift is imminent. Price has bounced from the 61.8% Fib retracement of the rally from the March low twice in the last 2 months and has also broken above the trendline that extends off of the April and May highs. The confluence of said Fib level and short term rising trend-line from 8th June may see a USDJPY bounce early this week from 80.35/79.80 levels, however, in the absence of definitive risk sentiment, we remain Yen neutral in the week ahead until a clearer picture develops with risk trends.

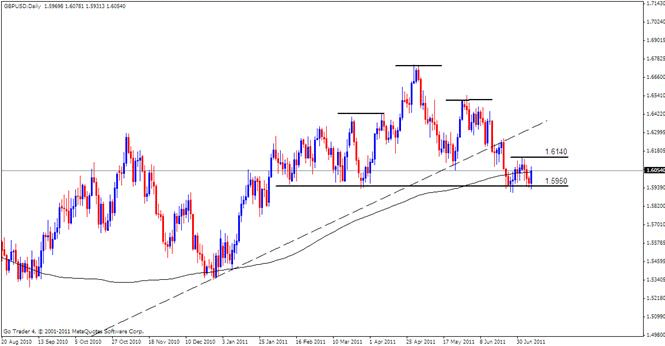

British Pound. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Sterling ended last week at 1.6054 against the U.S. Dollar, paring nearly all the losses seen earlier in the week after the Bank of England left interest rates unchanged at 0.50%. Weaker U.S. growth suggests that the Fed’s accommodative monetary policy will remain in place for some time, keeping interest rates expectations subdued. The Pound climbed as lower interest rate prospects and concerns about domestic growth in the U.S. had investors looking for alternative safe-haven plays. However, the gains may be limited this week ahead of key data on the economic docket, highlighted by the June CPI and RPI figures on Tuesday followed by a batch of key employment data on Wednesday. Consensus estimates call for a CPI to remain unchanged at 0.2% m/m and 4.5% y/y. With the MPC’s target for inflation at 2%, a stronger than expected print could spark volatility in Sterling crosses as interest rate expectations climb. Employment data will be closely eyed as concerns that the U.K. recovery may be faltering continue to take root. Jobless claims are seen printing at 15.0K in June, down from the previous months read of 19.6K, with the ILO unemployment rate expected to hold at 7.7%. The data would mark the 4th consecutive month claims have risen since February when claims contracted by 8.5K. With U.K. inflation more than double the targeted rate, markets will be paying close attention to wages as fast growth in payrolls is likely to accelerate rising prices. Average weekly earnings are expected to rise by 2.1% y/y, up from the previous read of 1.8%, and with economic data continuing to suggest a fragile recovery; the BoE will remain reluctant to move on interest rates despite rising inflationary pressures. Subsequently, the interest rate expectations are likely to remain firm with Credit Suisse Overnight Swaps factoring in only 20bp in hikes for the next twelve months. Markets will also be eagerly anticipating the BoE minutes which are scheduled to be released on July 20th for further clues as to the central bank’s outlook for the domestic economy

TECHNICALS: Support at 1.5950, resistance 1.6140. GBPUSD has broken below the rising trendline from the 2010 low and confirmed a head and shoulders top. With declines well supported in the 1.5900’s for now, expectations are for an eventual break of the neckline at 1.5950 to accelerate declines to 1.5740 and further down at 1.5480 levels. As such, we remain bearish Sterling in the week ahead and will look to sell on rallies.

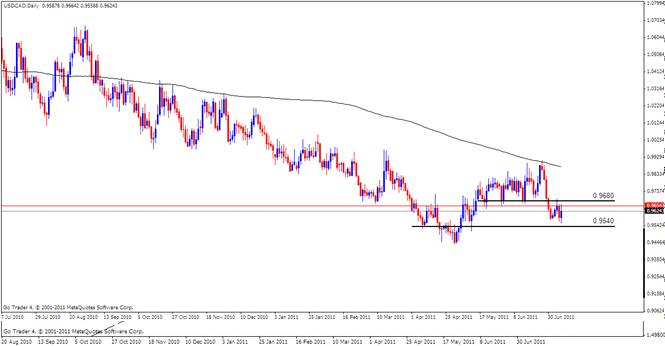

Canadian Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Canadian Dollar finished last week down against every other major currency apart from the Euro, where it strengthened 1.59% as concerns re-emerged from Europe that, despite the bailout for Greece, the major rating agencies (Fitch, Moody’s and S&P) could declare a “selective default” regardless. Looking at Canadian data from the first full week of July, industrial product prices, as well as the raw material price index, fell in May from April, showing that recent Loonie strength, coupled with a general depreciation in commodity prices, led to lower inflationary pressures. The housing sector continued to improve, with prices increasing by 1.9% in May, while the Canadian economy added 28.4K jobs in June, with the unemployment rate holding at 7.4%. The Loonie will continue to move at the will of broader market risk sentiment, considering there are only a handful of significant data releases due this week. The housing starts data on Monday, a gauge of the number of residential units on which construction has started each month, is forecasted to show further gains for June, up to 185.0K from 183.6K. The next significant piece of data comes on Friday, when manufacturing sales figures from May will be released but given the two-month delay, and the expectation that manufacturing remained depressed due to supply chain disruptions resulting from the natural disasters/nuclear catastrophe in Japan, the market impact is likely to be limited. In all likelihood, the Loonie will continue to trade as a proxy for speculators betting on the health of the U.S. economy. As noted with the extremely disappointing non-farm payrolls data on Friday, despite a strong labor market reading for the Canadian economy, USDCAD rallied 0.17% on the day, though price action was exceptionally choppy following the NFP release at 12:30 GMT. However, Loonie-based investors will be on watch for rhetoric deployed by Bank of Canada policymakers ahead of the July 19 BoC rate decision, with a small 3.2% chance of a 25.0bp rate hike, according to the Credit Suisse Overnight Index Swaps.

TECHNICALS: Support at 0.9540, resistance 0.9680. Following USDCAD’s sharp drop from the 200 SMA at 0.9900 levels, the pair has consolidated sideways of late. Any additional declines from current levels should be limited, with formidable support expected at 0.9540. A daily close above 0.9700 is required to relieve immediate downside pressure but in the absence of definitive risk sentiment, we remain Loonie neutral in the week ahead until a clearer picture develops with risk trends.

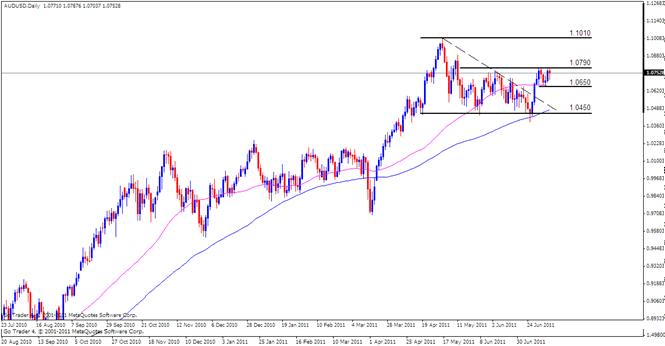

Australian Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Australian Dollar closed out the week at 1.0752 against the U.S. Dollar and may trend sideways in the week ahead, working its way back towards the lower bounds of its recent range as the shift away from risk appetite gathers pace. However, as the Reserve Bank of Australia highlights a weakening outlook for the Australia, a slew of disappointing developments this week could lead AUDUSD to threaten the rebound from June and the central bank may continue to endorse a wait and see approach in the second half of 2011 in light of the slowing global economy recovery. After holding the benchmark interest rate at 4.75% for the seventh consecutive meeting last week, the neutral statement accompanying the decision suggests that the RBA will keep borrowing costs on hold throughout the coming months as the fundamental outlook remains clouded with uncertainties. The event risks scheduled for this week could reflect expectations for a slower pace of growth, and the data may miss forecasts as the region continues to cope with the aftermath of the natural disasters from earlier this year. According to Credit Suisse Overnight Index Swaps, investors see Governor Glenn Stevens maintaining the current policy over the next 12 months, but speculation for a rate cut could materialize going forward as the central bank curbs its outlook for growth and inflation. As interest rate expectations deteriorate, the Australian Dollar could struggle to hold its ground, and the high yielding currency may break to the downside in the days ahead as market participants scale back their appetite for risk. Indeed, a very light economic calendar this week for Australia will likely see Aussie price action determined by wider market global sentiment.

TECHNICALS: Support at 1.0650, resistance at 1.0790. Last weeks consolidation above the 50 SMA suggests further upside gains ahead, however, with AUDUSD currently testing resistance at 1.0790, expectations are for a corrective pull-back to 1.0650 levels before further advances. A daily close below 1.0650 exposes the falling trend-line from 2nd May and key support by 1.0450 and the 100 SMA. In the absence of definitive risk sentiment, we remain Aussie neutral in the week ahead until a clearer picture develops with risk trends.

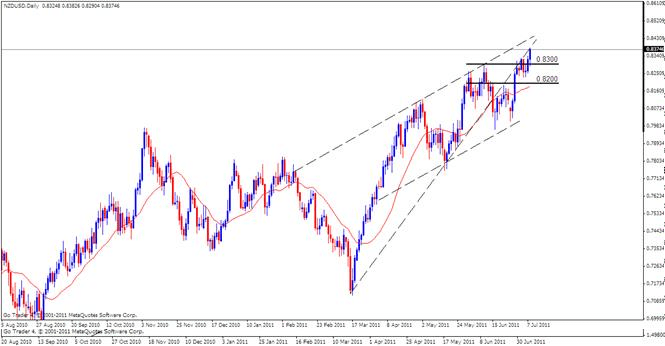

New Zealand Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: Last week, the New Zealand Dollar rallied to a fresh record high of 0.8370 against the U.S. Dollar and the Kiwi may continue to push higher in the week ahead as the 1Q GDP report on Wednesday is forecast to show a faster recovery in the New Zealand economy. Economic activity is expected to increase another 0.3% in the first three-months of 2011 following the 0.2% expansion during 4Q 2010, and the stronger rate of growth is likely to spark a bullish reaction in NZDUSD as investors expect to see higher borrowing costs in the region. As Reserve Bank of New Zealand Governor Alan Bollard sees scope to gradually normalize monetary policy, market participants see borrowing costs increasingly by nearly 75bp over the next 12 months according to Credit Suisse Overnight Index Swaps, and interest rate expectations may gather pace in the second-half of 2011 as the RBNZ adopts an improved outlook for the region. Nevertheless, risk sentiment is likely to heavily influence price action for the Kiwi ahead of the GDP report as the economic docket remains fairly light at the beginning of the week. At the same time, the potential remains for fresh record-high prices in NZDUSD should the GDP rate top forecasts, and the bullish sentiment underlying the high yielding Kiwi may gather pace over the near term as the economic developments show a strengthening recovery in New Zealand.

TECHNICALS: Support at 0.8300, resistance n/a. Focus remains on the resistance line that extends off of the April and June highs. Near term support is at 0.8300 and expectations are for a test of this level before further advances. Only a daily close below 0.8200 would negate the bullish scenario and as such we remain bullish Kiwi in the week ahead and will look to buy on dips.