U.S. Dollar. Our bias BULLISH, we’ll be looking to buy on dips.

FUNDAMENTALS: Following a week of extreme market volatility, the U.S. Dollar Index closed relatively unchanged against its major counterparts, as illustrated by most liquidly-traded currency pair (EURUSD) which remains locked in an astonishingly narrow 3.3% range since mid July. Economic data for the Greenback in the week ahead would normally be highlighted by Fridays CPI report. However, the Fed made its position crystal clear last week in declaring that interest rates will remain at record lows of 0-0.25% throughout 2013. While the FOMC’s announcement should have removed a key piece of uncertainty surrounding the U.S. Dollar, quite the opposite has happened - stocks fell sharply in the immediate aftermath and volatility reigned supreme. Historically, extreme volatility in U.S. stock markets typically precedes important price bottoms - or much larger declines - and as such it is difficult to forecast with reasonable certainty where markets are headed in the week ahead. Given this uncertainty, the focus for investors is likely to be on the safe-haven Swiss Franc, Japanese Yen and U.S. Dollar until a clearer medium to long term picture emerges.

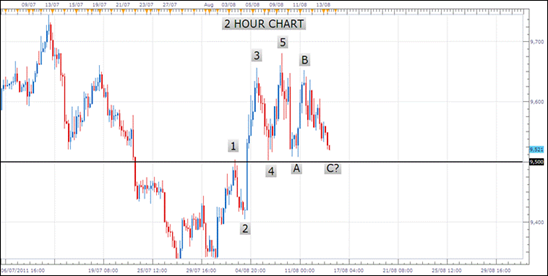

TECHNICALS: After registering a record low at 9.323, the U.S. Dollar Index has rallied in 5 waves, finding resistance at 9,680 levels. The implications are bearish early this week as a setback to key support at 9,500 (and wave C correction) is expected before the next bull leg gets underway. As such, given the anticipated near-term market volatility, we remain bullish U.S Dollar in the week ahead.

Euro. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: For the Euro last week, investors fears were centered on Societe Generale amid speculation that the French bank would soon be in need of a financial bailout. This particular rumour was later quashed, but the general health of the region’s funding situation and the market’s sensitivity to the troubles are genuine. Additionally, the ECB reported demand for overnight lending surged to 4.06 billion Euros - reflecting that either a specific bank was at severe risk of liquidity shortage or perhaps many banks facing more moderate troubles. Either way, boosted liquidity demand, rising market rates, increased risk due to sovereign exposure and a general decline in sentiment trends are likely to create problems for the EU’s banking system. In the week ahead, German, Spanish, Portuguese and Euro-zone GDP figures will be notable, however, austerity efforts, financial stability and liquidity will all go out the window should speculation over said banking structure gather pace and prove to be a reality.

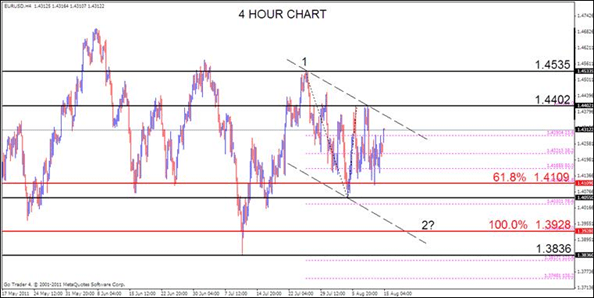

TECHNICALS: Expectations are for EURUSD to break its range-bound price action soon. The 100% extension of the decline from 1.4535 to 1.4055 is at 1.3928 and intersects with channel support early this week. The 1.3920-1.3950 area is further supported by the 200 SMA. Given the anticipated market volatility in the week ahead, we remain Euro bearish as safe-haven plays look to be the most likely near-term scenario.

Japanese Yen. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: Yen traders are poised to act should Japanese officials intervene in the market while USDJPY continues to trade near record lows by 76.28 levels. In the week ahead, Japan’s 2Q GDP report highlights the economic calendar, with economic activity in the world’s third-largest economy expected to slow to a 0.6% pace and the ongoing slump in growth could sap demand for the Yen as the region struggles to recover from the devastating earthquake/tsunami earlier this year. Meanwhile, investors are well aware of the Japanese governments’ pledge to closely monitor the foreign exchange market as the marked appreciation in the Yen is undermining the economic recovery. A unilateral intervention is unlikely this time around however, as the recent Japanese Finance Ministry’s attempt to curb the appreciation in the USDJPY exchange rate was short-lived as the pair has quickly fallen back to a low of 76.30. In the absence of central bank moves this week, USDJPY will likely push lower, especially if market participants continue to diversify away from the U.S. Dollar in favour of the other two safe-havens, the Swiss Franc and Japanese Yen.

TECHNICALS: USDJPY continues to probe record lows at 76.30 and the recent sideways action likely composes a 4th wave.with a break lower would shifting focus to 72.60 (161.8% extension of initial decline from the April high). A bounce higher should encounter resistance at 78.40 levels (50.0% retracement of the decline from 4th August). BoJ intervention watch is still the play until a clearer picture develops and as such we remain Yen neutral in the week ahead.

.png)

British Pound. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Looking at the coming week, two notable releases are likely to stir the Pound. On Tuesday, the historically market moving consumer price index report will be released, though its effect on markets might be limited this month, as it comes after the quarterly Bank of England inflation report. However, a significant miss on the data would stoke considerable price action. Inflationary pressures continue to be a burden for the U.K. economy, as according to a Bloomberg News survey, economists forecast the inflation indicator to rise back to 4.4% for July. This is disconcerting news for the country, as growth figures released in July revealed that the economy grew slower than expected on a year over year basis. Interest rates are increased to contain inflationary pressures, but with the BoE’s primary focus of stimulating economic growth, rates are expected to remain at very low levels for an extended period, a view that will be confirmed upon the release of the Bank of England meeting minutes on Wednesday and a dovish outlook could weigh on Sterling in the near future, especially if risk appetite finds a revival.

TECHNICALS: GBPUSD has reversed from the 50% retracement at 1.6126, but the EURUSD wave pattern suggests U.S. Dollar strength so the potential for a drop the 61.8% retracement at 1.6046 levels exists. As such we maintain a bearish Sterling bias in the week ahead.

.png)

Canadian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: YTD the Canadian Dollar has surged from 1.0057 to 0.9400 against the U.S. Dollar as a play on the U.S. economic recovery, boosted by commodity production, explicit reserve diversification and sound Canadian finances. Now that play has sharply reversed with U.S. growth stuttering, commodities giving back all of their 2011 gains, and Canada posting a trade deficit last week. Loonie bull traders could be disappointed this week with the release of the BoC policy thoughts and inflation data on Friday which is likely to show further falls off the 3.1% high, perhaps to 2.8% or lower. The Canadian Dollar is set to remain in demand over the longer term, but near term risk aversion pressures are most likely to weigh on the Loonie in the week ahead.

TECHNICALS: USDCAD has exceeded the June 0.9911 high confirming a double bottom is in place with the April and July lows and indicate a significant shift in the longer term down-trend. A bullish objective would come in at 1.0400 - this level is determined by extending the width of the consolidation (0.9405-0.9911) upwards from the breakout level (0.9911). Key support is at 0.9850/0.9740 levels and dips to here would provide opportunities to establish long positions. As such, we maintain a bearish Loonie bias in the week ahead.

Australian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Last week, the Australian Dollar whip-sawed in a 500 pip range as the sharp global sell-off saw investors jettison risk currencies in favour of safe-haven plays into the Swissie, Yen, and U.S. Dollar. However, a rebound in stocks during the later part of the week saw the Aussie pare some of the steep declines on renewed hope that the Fed’s extended zero rate policy will avert a slide back into recession and that European leaders will be able to find consensus on a way to stem further contagion of the debt crisis that has sapped confidence in the region. Economic data out of Australia also contributed to the Aussie’s decline as weaker than expected prints on home loans, investment lending, employment data, and consumer inflation expectations weighed on interest rate prospects, fuelling speculation that the RBA will need to move in to keep the economy afloat. The economic calendar for Australia is relatively quiet this week, with no data of note apart from the minutes from the RBA policy meeting due on Tuesday. Investors will be closely eyeing the minutes after last week’s dismal data for the central bank’s growth outlook for the remainder of 2011.

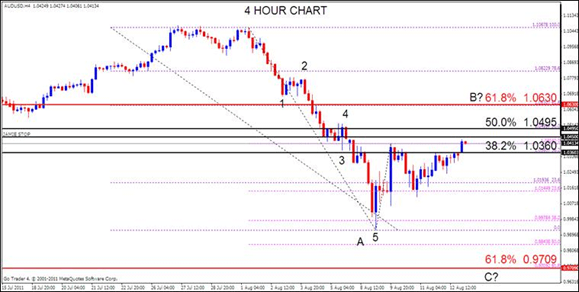

TECHNICALS: AUDUSD’s decline from the 27th July high at 1.1079 is an impulse and expectations are for a drop to below 0.9930 levels before a more substantial recovery. A secondary top is likely in place at 1.0414 (Tuesdays high) as the decline from that level is an impulse (see 15 min chart) and the weekly high was made on Monday at 1.0437. However, price trading above 1.0437 would then shift focus to 1.0525 (5th August high) and 1.0630 (61.8% of decline from July high) levels. The bearish bias remains and at this stage, failed rallies to 1.0360-1.0630 levels (38.2% and 61.8% of 27th July decline) would provide selling opportunities to target a low at 0.9709, the 61.8% extension drawn from the 1st August high and 9th August low/high.

New Zealand Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: The key to the New Zealand’s prospects are 1) How resilient is the NZ economy in the face of the global economic slowdown? 2) How committed are the bond investors who have driven it higher from 0.7115 levels from March this year? The NZ domestic economy appears sound with falling unemployment and rising wage growth. Output has exceeded expectations as the Christchurch rebuild gathers pace and could be enough for RBNZ Governor Bollard to reverse his 0.5% rate cut and return rates to 3.0% on September 15th. While there are obvious global headwinds, the Kiwi’s soft agricultural commodity production is likely to be favoured over the industrial production of Australia. Looking at the week ahead, apart from Tuesdays producer price index report the calendar for the Kiwi is empty which will see NZD price action largely determined by wider global market risk sentiment.

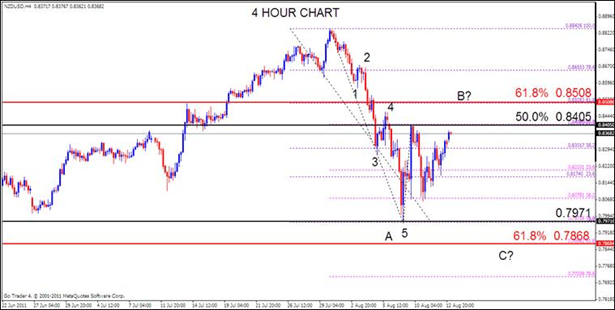

TECHNICALS: As with AUDUSD, the NZDUSD bearish bias is the same. Expectations are for a drop to at least 0.7971-0.7868 levels before a larger advance - providing price continues to trade below 0.8410 (last Tuesday’s high). Additionally, the confluence of the long term trendline connecting the March 2009-March 2011 lows and 61.8% retracement of the 13th March-31st July rally may produce the low for this pair at 0.7772 this week. Rallies to 0.8405-0.8508 levels would provide selling opportunities and as such we maintain a bearish Kiwi bias in the week ahead.