U.S. Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The U.S. Dollar Index closed out the week at 74.83 on the back of increasing risk aversion which saw the DJIA lose 1.6%, while the NASDAQ and S&P500 had their biggest weekly declines since August 2010, falling 3.3% and 2.2% respectively. As we have written previously, the most tangible catalyst that can lift the Dollar in the coming weeks is a significant shift in investor sentiment. This was the primary source of the U.S. currency’s strength last week as the S&P 500 extended its string of losses from Wednesday onwards. However, it can be argued that fear has not yet permeated across all markets. This Dollar Index’s descent from January is still rather controlled as market participants are not yet rushing for the exits. Certainly we have yet to see a true break lower on the Asian (Nikkei 225 below 9,320) and European (DAX 30 below 7,000) equity markets. Moving forward, the sense of imbalance between high prices and slowing growth/returns is there, but as traders we need a clear spark that can ignite a flame of panic that sweeps through the global markets. Key U.S. economic data on tap this week will be Tuesdays PPI and retail sales reports followed on Wednesday by the inflation data for May. With the expiration of QE2 at the end of this month, the jury is still out on where the U.S Dollar is headed for the second half of 2011, with the majority of analysts maintaining a wait and see position in light of QE2s’ wind up and the potential global economic slowdown.

TECHNICALS: Support at 73.50, resistance 76.00. Price trading off of 73.50 levels is significant and should the Dollar Index maintain above 74.95 in the week ahead, the indications are that a secondary low is likely to be in place. A daily close below 73.50 would negate last week’s fledgling bullish move and open the door for a test of the descending trend-line from January at 73.00. We maintain a neutral Dollar bias this week until a clearer picture develops with regard to risk trends.

Euro. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: A sharp fall during late Friday trade saw the EURUSD close at 1.4345 following further turmoil for Greece and broader Euro-zone stability as market concerns mount over Greek government solvency and contagion to broader periphery nations. This was despite European Central Bank president Jean Claude Trichets’ hawkish “Strong Vigilance” phrase to virtually guarantee that the central bank would raise rates at its July meeting. A relatively mild economic Euro calendar in the week ahead leaves EURUSD to trade off of moves in broader financial markets, but it will be critical to listen to the commentary on a second fiscal aid package for Greece. ECB President Trichet made headlines on Friday when he unequivocally denied the possibility of an ECB sanctioned Greek debt restructuring. He went as far to say that the central bank would no longer accept Greek debt as collateral for loans on a debt restructuring - a shot across the bow to those that believe it will be a solution for the Greek sovereign debt crisis. Meanwhile, Germany’s Finance Minister Wolfgang Schäuble defied the President Trichet when he said that “a restructuring of privately-held Greek debt would be a requirement for a EFSF bailout”, and now policy officials are set for a showdown on the clear disagreement. It seems a foregone conclusion that the embattled Greek treasury will need assistance but clear uncertainty on the “how” and “who” has only further destabilized market sentiment with the cost to insure against Greek sovereign credit default surging to a fresh record highs amidst the uncertainty. These ongoing debt concerns have had a negative effect on broader financial market risk appetite, as seen in the declines in the DJIA, S&P500 and NASDAQ. Given the recent sharp week to week swings in market sentiment, it is difficult to form a lasting bias for EURUSD but a continuation of recent market concerns and declines in equity markets going forward would benefit the safe-haven U.S. Dollar while negatively affecting the Euro.

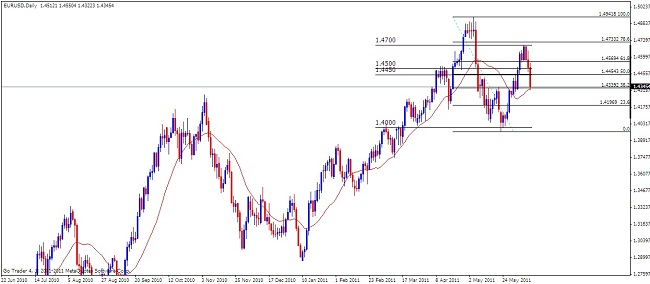

TECHNICALS: Support at 1.4300, resistance 1.4500. Fridays close below 1.4400 is significant with price carving out a fresh lower top by 1.4700 ahead of the next major downside extension back towards 1.4000 levels. Going forward this week, intraday rallies should be well capped ahead of 1.4650 with only a daily close above 1.4700 negating the late week bearish momentum. Given Fridays sharp decline and that price stalled out by the 20 SMA and 38.2& retracement of the 4th - 23rd May decline, a retest of the 50.0% Fib of said decline at 1.4450 levels is possible before a resumption of the recent downward momentum. We maintain a neutral Euro bias this week until a clearer picture develops with regard to risk trends.

Japanese Yen. Our bias BULLISH, we’re looking to buy on dips.

FUNDAMENTALS: The Japanese Yen closed the week virtually unchanged against the U.S. Dollar at 80.29 as the currency continued to gain ground against most of its major counterparts and may appreciate further in the week ahead as investors scale back their appetite for risk. As the shift in risk-taking takes hold, we are likely to see carry trade interest deteriorate further in the days ahead, and the drop in risk appetite should continue to prop up the Yen as sentiment continues to dictate price action. Sustained daily closes below the 80.00 level however, may invite speculation for another currency intervention over the near term, and the Bank of Japan may step up its efforts to balance the risks for the region as the domestic economy faces a double dip recession. The International Monetary Fund encouraged the BoJ to expand its balance sheet to strengthen the recovery and said the “expansion in monetary policy could guard against deflation risks as the fundamental outlook remains clouded with uncertainties”. Additionally, the IMF noted that the BoJ should reinforce its commitment to maintain a zero interest rate policy, and went onto say that ‘the yen could weaken and affect other economies via trade and financial channels’ as the IMF sees the board retaining the expansion in monetary policy for some time. Although the BoJ is widely expected to keep the benchmark interest rate at 0.10% next week, Governor Masaaki Shirakawa may announce plans to expand its asset-purchase program in an effort to further stimulate the ailing economy, and the central bank may retain a cautious outlook for the region as it continues to assess the aftermath of natural disasters from earlier this year.

TECHNICALS: Support at 79.70, resistance 80.90. USDJPY remains well supported in the 80.00 area which coincides with the 61.8% Fib retracement of the 17th March - 6th April rally and may be in the process of carving out a material base. A daily close below 79.50 would give reason for concern, raising the speculation of central bank intervention. From here we see the risks for a fresh upside extension back towards the recent range highs at 85.50 over the coming weeks with a daily close above 81.00 confirming the upside scenario. We remain Yen bullish in the week ahead and are looking to buy on dips.

British Pound. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: Fridays close saw Sterling down 1.2% against the U.S. Dollar after the Bank of England held rates at 0.5% last Thursday. The BoE declined to release an accompanying statement, which suggests their sluggish outlook for the UK economy remains unchanged. The pound’s losses accelerated on Friday after a weaker than expected print on industrial and manufacturing production missed consensus estimates, fueling speculation that the domestic recovery may be losing momentum. Following Andrew Sentence’s departure from the Monetary Policy Committee, the BoE’s has lost its most vocal hawk and while the exact count for last week’s vote will not be known until the June 22nd when the MPC minutes are released, the result will be of interest as it will be the first for newcomer Ben Broadbent. In light of the recent string of weaker data, it is evident that the committee’s hold on rates last month was the right move. But with inflation concerns continuing to persist, it appears policy officials have shifted their focus more toward ensuring economic growth than curbing rising inflation. Credit Suisse Overnight Swaps now factor in only 25 bp in rate hikes for the next twelve months, down from nearly 30 bp at the start of last week. Key economic data for Sterling this week includes the May CPI and RPI data on Tuesday that are expected to hold at 4.5% y/y and 5.2% y/y respectively. UK employment figures hit the wires on Wednesday, with consensus estimates calling for the addition of 6.5K jobless claims, down from the previous print of 12.4K. While the employment rate is widely expected to hold at 7.7%, a weaker than expected print on these figures could exacerbate Sterling’s decline as concerns about the faltering U.K. economy take root.

TECHNICALS: Support at 1.6160, resistance 1.6310. Sterling continued to bottleneck into a horizontal wedge formation dating back to May 31st until last Friday when a break of the lower bound saw the Pound plummet nearly 0.9% against the Greenback on the session. While this move suggests further weakness for the U.K. currency, GBPUSD is still within the ascending channel from early February. A daily close below the lower bounds of this channel and the rising trend-line off of the May-December 2010 lows would signal a change in the longer term trend. We remain Sterling bearish in the week ahead and are looking to sell on rallies.

Canadian Dollar. Our bias BEARISH, we’ll be looking to sell on rallies.

FUNDAMENTALS: The Canadian Dollar closed virtually unchanged against the U.S. Dollar on Friday at 0.9796.

Canada’s economic growth and the path of its monetary policy is firmly anchored to trends in U.S. demand considering 80% of the country’s wares are exported to its southern neighbor. With the U.S. being the world’s top economy, the trajectory of its economic growth and the global economy are closely paralleled, highlighting the link between USDCAD and equity markets like the S&P 500. Since the beginning of May, this has broadly translated into losses for the Loonie as traders began to unwind bets on stocks going higher ahead of the expiration of the Federal Reserve’s QE2 monetary stimulus program. The logic here is two fold. From a short-term perspective, QE2 flooded the markets with money to bring down interest rates and traders capitalized by borrowing U.S. Dollars on the cheap to invest them into higher returning assets (stocks, commodities, etc). Speculative bets are not mortgages, and investors rarely lock in interest rates for extended periods of time to maintain flexibility; this means that as QE2 ends and borrowing costs begin to rise, investors will be faced with the reality that maintaining their U.S. Dollar funded positions will become increasingly expensive. Knowing this would likely be the case, markets began to unwind QE2 dependent positions, bringing shares and correlated currencies - the Loonie included - along for the ride. From a longer term perspective, higher borrowing costs will weigh on economic growth as individuals and companies find it more expensive to consume or invest on credit, slowing the recovery and trimming the earnings outlook for S&P 500 companies, pressuring the index as well as the Canadian Dollar lower. The economic calendar is light for Canada in the week ahead, so price action for the Loonie will likely be decided by broader global risk sentiment trends.

TECHNICALS: Support at 0.9720, resistance 0.9850. USDCAD remains supported by the 100 SMA and within the ascending trend-channel from 29th April. Fridays close above 0.9750 now projects additional gains towards the 200 SMA at 0.9930 levels over the near term. Only a daily close below 0.9650 would negate the bullish USDCAD scenario as we remain Loonie bearish in the week ahead and are looking to sell on rallies.

Australian Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The Australian Dollar had declined nearly 1.5% against the U.S. Dollar by the close of last weeks trading after the Reserve Bank of Australia left rates unchanged at 4.75%, but remarks made by Governor Glenn Stevens weighed on the Aussie as he acknowledged further weakness in the growth outlook for Australia. A weaker than expected employment report on Wednesday sparked a sell-off after the report showed the economy had added only 7.8K jobs in May, missing consensus estimates calling for a gain of 25K. Full-time employment fell by 22K jobs in May, with the previous month’s print revised down to -57.2K from -49.1K. The employment report suggests that the softness seen in recent data may not be as mild as expected. The Australian economic docket will be fairly subdued this week, with event risk for the Aussie peaking on Tuesday with the NAB Business confidence survey. Price action will be largely dictated by market sentiment after the steep declines seen in global equities saw traders jettison the higher yielding Aussie for the safety of the U.S. Dollar and Japanese Yen. With the recent global risk-on/off environment seen last week, traders will continue to weigh growth concerns as increased volatility in financial markets continues to heavily influence risk sentiment.

TECHNICALS: Support at 1.0500, resistance 1.0700. Fridays close below 1.0600 and the 20 - 50 SMAs is significant and opens the door for a test key support by 1.0400 levels and further down 1.0200. Only a daily close above 1.0700 would negate the downside scenario, however, given the Aussies high yield (4.75%), we maintain a neutral Aussie bias this week until a clearer picture develops with regard to risk trends.

New Zealand Dollar. Our bias NEUTRAL, on the sidelines till a clearer picture develops.

FUNDAMENTALS: The New Zealand Dollar closed the week at 0.8210 against the U.S. Dollar after rallying to a fresh record high at 0.8230 on Thursday. After holding the benchmark interest rate at 2.50% last week, the Reserve Bank of New Zealand said borrowing costs will be “gradually increased over the next two-years as faster growth raises the risk for inflation”, and expects the rebuilding efforts from the worst earthquake in 80 years to boost economic activity as policy makers see continue to see early signs of a resumption in growth. As the central bank holds an improved outlook for the region, speculation for higher interest rates may help to prop up the Kiwi, and the near-term rally in NZDUSD may gather pace in the days ahead as long as markets continue to see positive developments coming out of the region. Credit Suisse Overnight Index Swaps show borrowing costs to increase by more than 50bp over the next 12 months, and rate expectations may gather pace in June if fundamental developments reveal an improved outlook for future growth. A light economic calendar for New Zealand this week is highlighted by retail sales that are projected to increase 0.9% in the first quarter after contracting 0.4% during the last three months of 2010, and the rebound in household spending could spark a bullish reaction in the high yielding Kiwi. However, RBNZ Governor Alan Bollard may take steps to stem the marked appreciation in the local currency as he deems the New Zealand Dollar overvalued, and he may try to talk down expectations for higher interest rates after pledging to be “patient in normalizing monetary policy”. In turn, Mr. Bollard may show an increased willingness to keep the cash rate at 2.50% for the remainder of the year, which could see a near term correction in NZDUSD as the Governor warned that markets have over reacted to last weeks policy statement.

TECHNICALS: Support at 0.8190, resistance 0.8300. The intense uptrend looks to have finally found some form of a cap by 0.8300, with price stalling out to alleviate immediate topside pressures. Further declines open the door for a test of key support by 0.8100 and further down 0.8000. Only a daily close above 0.8300 negates the downside scenario, however, we maintain a neutral Kiwi bias this week until a clearer picture develops with regard to risk trends.