By: Mike Kulej

The New Zealand Dollar staged a very impressive rally lately. It advanced broadly, gaining on most currencies, including the US Dollar. During the last two weeks, the NZD-USD appreciated over 500 pips, strong performance when compared to preceding moves.

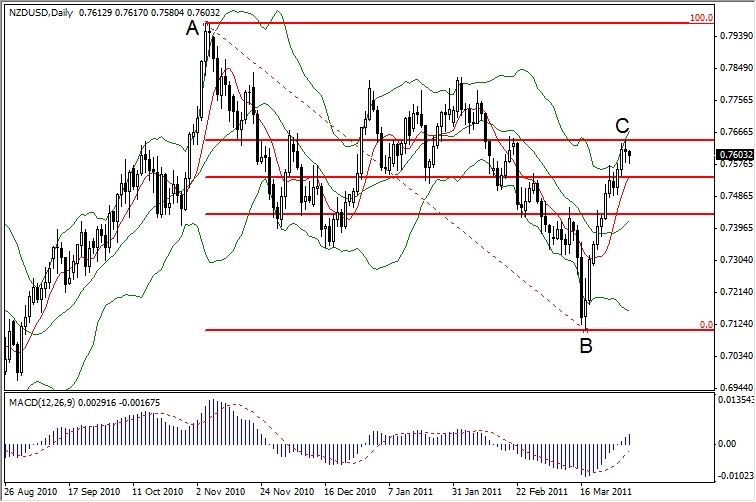

This particular price swing may be ending. Numerous technical factors suggest a possibility of a reversal/correction soon. When looking at the daily chart of the NZD-USD, we can see how the recent run up fits within the larger picture. Thursday’s high of 0.7645 (C), happens to be at 62% Fibonacci retracement level of the major swing down from 0.7974 (A) to 0.7108 (B). Markets often reverse at the 62% level, and that could be the case here as well.

Fast pace of the latest advance also pushed it just outside the upper Bollinger bands, meaning that the price is out of norm. We can see what happened in the past when this situation occurred – a correction of some magnitude in almost every instance.

In addition, the daily candlesticks are bearish. The last complete one is a doji, or a small body variation of one, indicating indecision and possible reversal. If the current candlestick is bearish at closing time, a probability for a pull back/correction in the NZD-USD would become even stronger