By: Mike Kulej

After making the all time high at 1.0182, the AUD-USD dropped sharply, reaching as low as 0.9535 last week. This good size sell off was followed by a few days of advance, with the price closing on Friday at 0.9927.

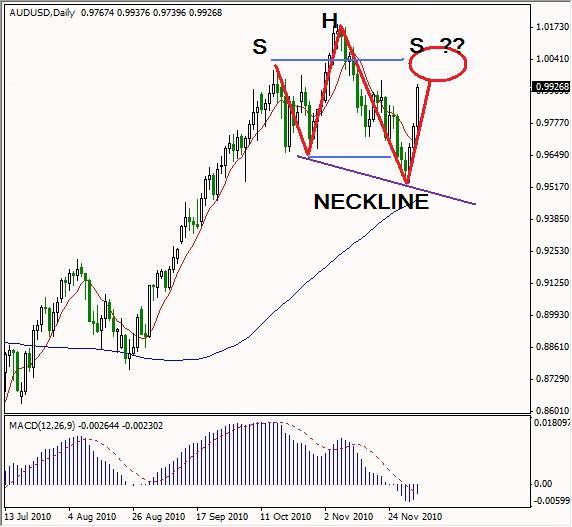

Within a larger picture of the Australian Dollar-US Dollar pair, this recent rally could be completing a Head and Shoulders reversal pattern. The possible Left Shoulder was established at parity in mid October and the Head formed at 1.0182 in early November. Since the price moved under the low 0.9865, the Neckline is skewed down, which statistically increases probabilities for a successful Head and Shoulders pattern. In order to complete it, the AUD-USD must form the Right Shoulder.

For that to happen, we must see a reversal candlestick pattern around the parity level. That could be an engulfing line, a shooting star, a hanging man or a doji. Should one form near the 1.0000 level, that would be in line with the Left Shoulder, possibly creating a symmetrical Head and Shoulders.

At this time, we have a helpful intersection of technical and fundamental influences. On Tuesday the 7th, the Reserve Bank of Australia holds its rate decision meeting. How the Australian Dollar responds to the announcement will probably decide if the Head and Shoulders pattern is confirmed. Therefore, the daily candlestick for Tuesday could be either the Right Shoulder, or a validation of the current advance.