By: Andrei Tratseuski

The Euro finally has fallen off the high horse and showing signs of weakness. EUR/USD has moderated to the downside breaking key levels. The pair came down below 1.28, showing signs of weakness. The once unparalleled uptrend is showing weakness. In order for the uptrend to remain intact EUR/USD needs to break through 1.30. Nonetheless, the probability of reaching the level within this week is highly unlikely. The mere fundamental announcement which may spur a rally in the currency is a positive interpretation of the bank's stress test. However, before the following can originate there are numerous amount of technical levels that need to be breached.

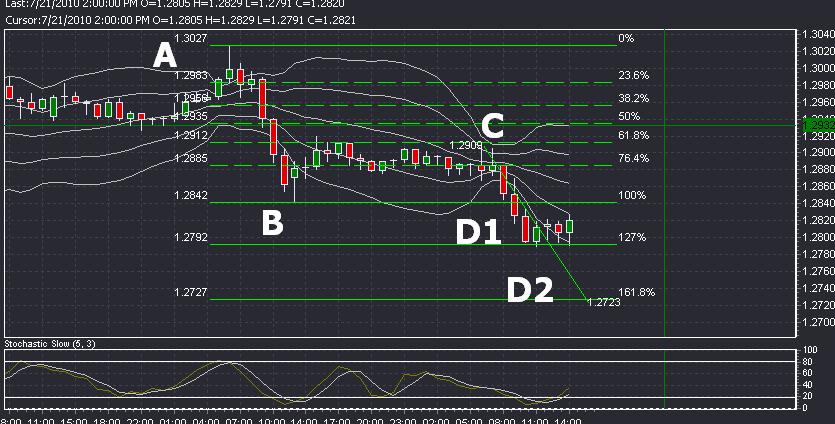

First and foremost, ABCD extension strategy is showing another possible leg to the downside. In ABCD strategy, AB line is equivalent to CD. A Fibonacci extension of AB line goes down to 161.8% which coincides with CD2 line. Current progress to the downside was subsided by a 127.1% extension of the AB line. Looking at future levels of resistance, we find that 20-day SMA will guide whether or not the pair can continue climb higher. A possible catalysis to the following event will be a testimonial speech by Fed Chairman Ben Bernanke. Nonetheless, the pair is showing a possible move to the downside with a support of 1.2730. If Bernanke states something positive for the US economy, EUR/USD might drop. Finally, a negative stress test will also have the legs to push the currency lower.