By: Andrei Tratseuski

There is a solid set-up brewing for USD/JPY to the upside. This type of trade generally manifests itself over a couple of days and takes time to proliferate. Our strategy of ABCD lines with a combination of Fibonacci extensions point to the upside for this currency pair.

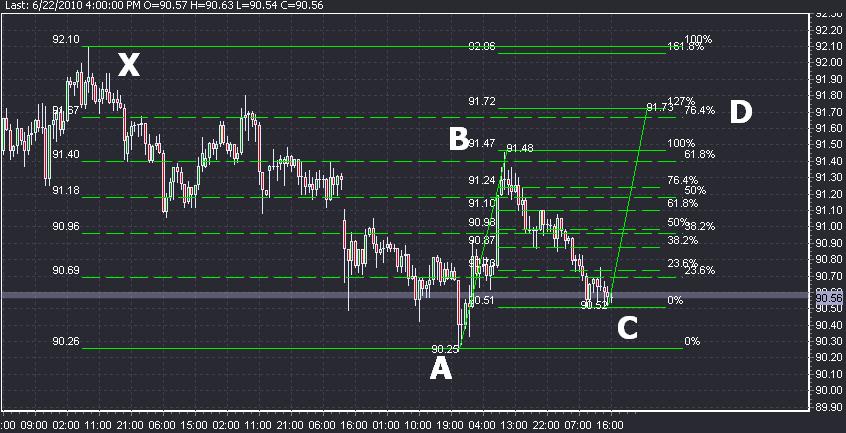

In order to enter this trade, we are looking for a little movement from the current lows. Therefore, an entry of 90.80 would seem to be ideal. A proficient stop-loss would be around 90.40. The level we are looking to get out at will be either 90.70 or 92.00. The way we determine our points of exit is through the following: Our first point of exit is manifested by having AB line equal to CD line. In order to formulate this we take a low to a high of AB, duplicating the line and placing the lowest point on C to generate point D. In the mean time we develop a Fibonacci extension of BC line. First off we are looking at 127.1% extension of the BC, which falls at the same level as CD line. In those terms, we get a point of exit at 90.70. Furthermore there is 76.4% retracement of XA line registering at the same level.

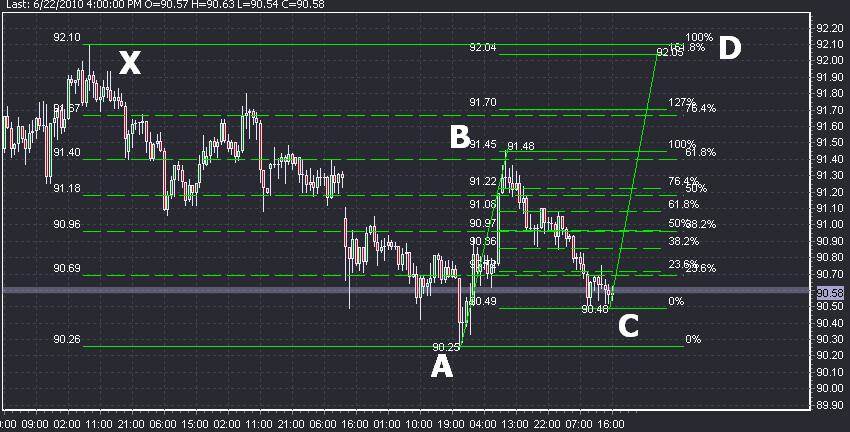

The second point of exit that we generated is slightly above at 92.00. This point reflects the same set up. However, the points of extension are a bit different. First off, CD line will be 127.1% of AB line. In our previous example CD line was 100% of AB or at the same level. Here CD line will be extended to 127.1%. The Fibonacci extension of the BC line will fall at 161.8%, while Fibonacci retracement of XA line will be 100%. Therefore, we get a valuable exit point of 92.00.

Either of the levels can be used to originated the trade.