By: Mike Kulej

The EUR/CHF pair has been in the news a lot in recent weeks and months. The main reason behind it was the involvement of the Swiss National Bank, which was using EUR/CHF as a proxy for general strength of the Swiss Franc. Number of interventions took place but the CHF just kept getting stronger, pulling this cross down to an all time low 1.3543 yesterday.

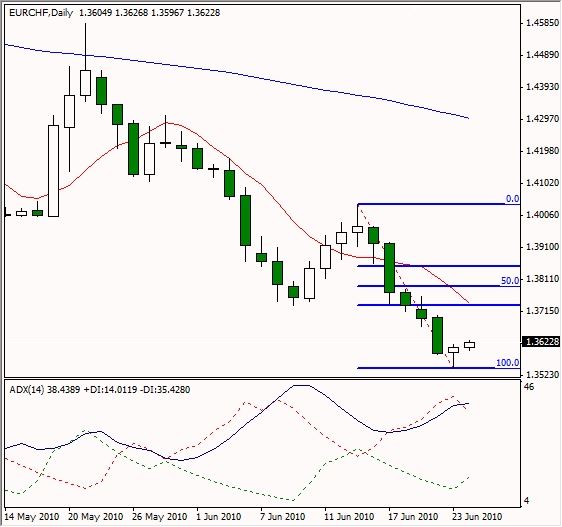

Few days ago, the SNB announced that is content with the current level of EUR/CHF, seemingly putting an end to the interventions. In an interesting twist, the market may be finding bottom here, something that the Swiss central bank failed to achieve. On the daily chart we see the price formed a possible reversal candlestick formation – the hammer. It is important after a prolonged down trend and it carries bullish implications. It does not guarantee reversal, but increases probability of a bounce, which in turn could become a trend-changing event. The Fibonacci retracement levels, as applied to the latest down swing, suggest price appreciation to 1.3800 or maybe even 1.3850.

The ADX indicator is at an elevated level, above 40, which indicates strong trend (down). However, since it has already had the high reading for some time, it is likely to drop, which would support the reversal/bounce scenario.