By: Dale Todd

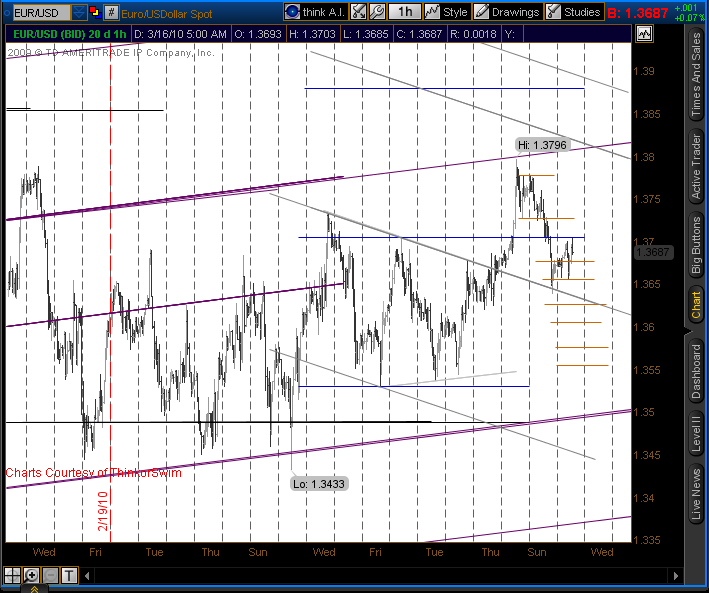

Yesterday’s analysis forecast a drop below 1.3704 would find support at 1.3644, and we bottomed yesterday at 1.3639, supporting the idea that EUR/USD dropped back to triangle support. From here there are two likely possibilities. In the bullish scenario, we hold support here and rally up to the 1.3879 area, which is the target for the MT flat cycle’s 2nd channel (blue), but also the target for the angled cycle’s 2nd channel extension (gray). In the bearish scenario, we continue with the ST down-cycle (orange) to the 4th channel extension target at 1.3554 before finding meaningful support.

USD/JPY Continues in Sideways Channel

USD/JPY dropped overnight below 90.11 support, but held above 89.60 support. This may be enough to have completed the sideways correction for a 1st channel of a MT up-cycle (light green). If we drop back later today below 89.96, the 89.60 support is still valid, as well as 89.43. Resistance should be found at 90.80 and 91.07. The 2nd channel target for this MT up-cycle would be at 92.53.