By: Dale Todd

EUR/USD dropped sharply yesterday, confirming the end of the ST up-cycle (light blue) and creating a ST down-cycle (orange), that may already be complete with three channels. The testing of the 1.3444 low resulted in a sharp rebound, but a further decline is possible to the 1.3333 LT target of both the purple and black cycles. Resistance is at 1.3580 and 1.3678. A move beyond that level indicates an upside breakout for the consolidation pattern, and increases the chances for a LT bottom.

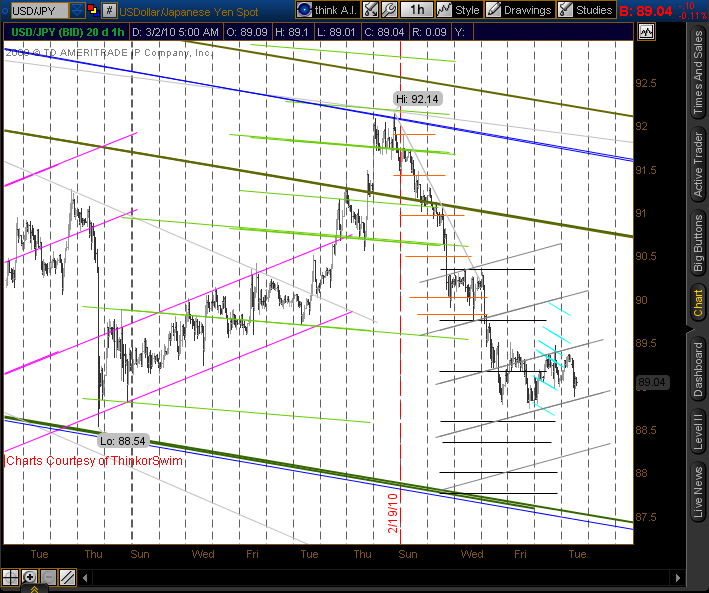

USD/JPY Extends Sideways Pattern

USD/JPY held resistance at 89.50 yesterday, and appears to be targeting support at 88.74 as we trade within this sideways range. The MT flat down-cycle (black) has not hit at key targets, so an alternate angled cycle is shown (gray) with 3rd channel support near this morning’s low at 88.88, and 4th channel target at 88.27. Resistance on a rally should be at 89.47. In the LT picture, a drop below the 87.40 area signals an acceleration of the slow decline from the high of 93.77, indicating a possible test of the low at 84.80.