By: Dale Todd

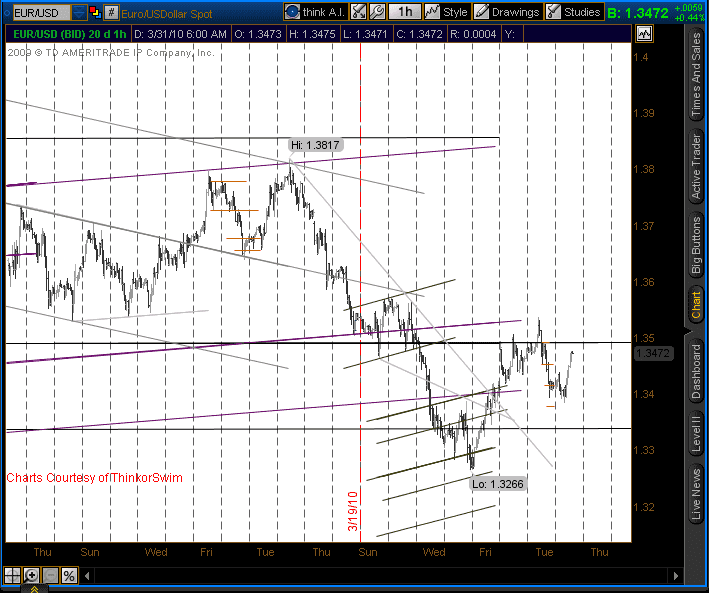

EUR/USD didn’t quite make it to the 1.3368 support level, which would be a 61.8% Fibonacci correction of the rally from 1.3266 to 1.3566, bottoming at 1.3384. We may find resistance at 1.3505 or 1.3536, forming a large 1st channel of a MT up-cycle. This should project up towards the 1.3650 to 1.3700 area. Support should be found around 1.3430.

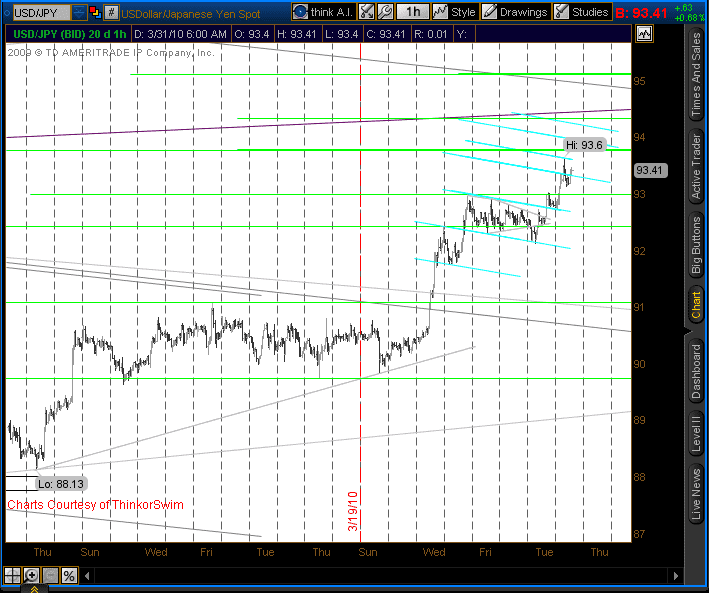

USD/JPY Reaches Short-Term Target

USD/JPY reached our 93.36 3rd channel target overnight, as well as coming within a few ticks of the 3rd channel extension target at 93.65. We have several important levels coming up in this current rally. The ST cycle (light blue) has the 4th channel and 4th channel extension targets at 93.93 and 94.20. The MT cycle (light green) has the 3rd channel and 3rd channel extension targets at 93.76 and 94.32. Finally, the LT angled cycle has its 2nd channel target coming in at 94.80. Support should be at 93.10 and 92.95.