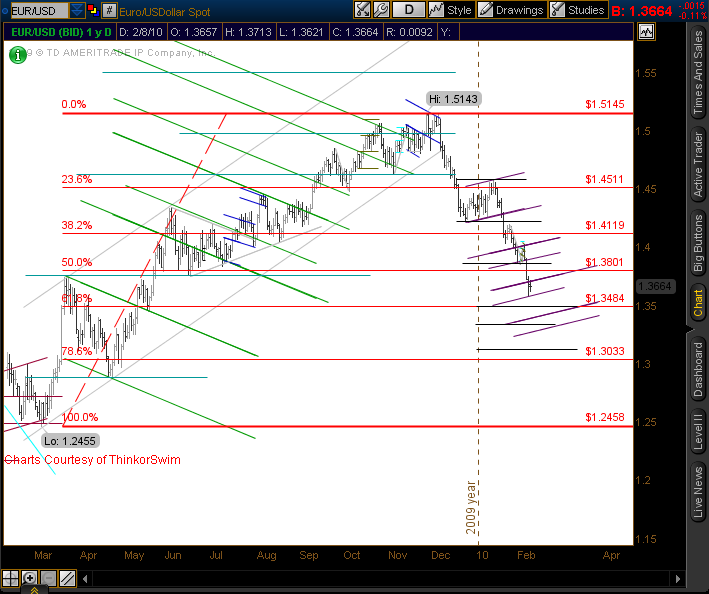

EUR/USD came within ticks of our 3rd channel extension target at 1.3570 Friday (dark purple), providing more confirmation that the dominant cycle is the angled one rather than the flat (black).

We are currently trading near 3rd channel resistance at 1.3708, with stronger resistance at 1.3855. The chart shows Fibonacci retracements, and the 61.8% level comes in at 1.3484.

This also happens to be the target for the flat black cycle’s 3rd channel extension, and the angled cycle’s 4th channel comes in at 1.3392. The bottom line is the LT cycles are nearing completion, so the euro may be poised for a comeback in the near term.

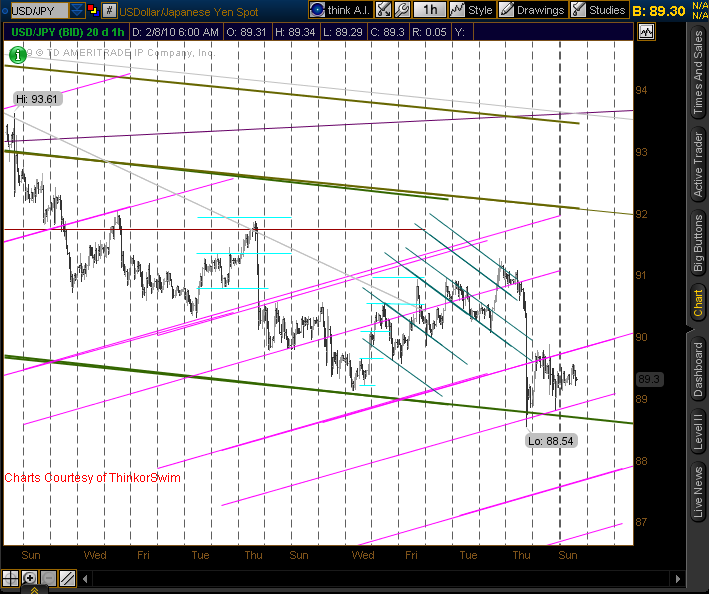

USD/JPY Trying to Bottom

USD/JPY traded sideways on Friday, basically staying within the boundaries of the purple angled cycle’s 3rd channel extension. Resistance there comes in at 89.81, and support at 88.90.

It is still unclear whether the low at 88.54 is the completion of the LT purple cycle, or if the sideways trade is just consolidation before another push down to the 4th channel target, coming in at around 87.72.

The longer-term cycles favor a reassertion of the up trend, as we have nearly completed a Fibonacci 61.8% retracement of the previous up-cycle from 84.80 to 93.77.

For a complete analysis, please visit www.quadricycletrader.com