Support & Resistance (S&R):

While the Forex Markets struggle to find direction to we thought it would be worthwhile to review S&R levels on the EUR and JPY versus the Greenback. We have mentioned in some of our recent pieces that when the markets move sideways we look for intra-day plays as volatility moves the market by 150+ swings a day, however, we never want to lose sight of the bigger picture.

USD/JPY:

The JPY has been weakening since mid December. There have been a number of contributing factors. Firstly, traders were funding the carry trade with dollars, but as soon as the dollar seemed like it may get more expensive, traders started unwinding their carry positions with the Greenback and shifting them to the JPY. Furthermore, we have heard countless times from the BOJ regarding their desire for a weaker Yen.

Current Position: JPY Short entered at 91.17 – Current Price 92.43

JPY Resistance: 91.57 (S1), 90.59 (100 SMA) 89.96 (50 SMA), 88.00 & 87.00 (Mid Term Resistance)

JPY Support: 93.46 (200 SMA), 95.10 (61.8% Fibonacci Retrace)

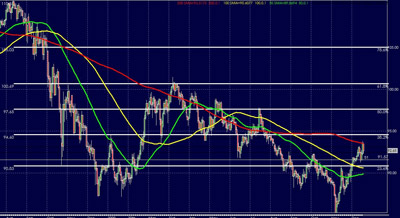

EUR/USD:

The EUR has fallen dramatically since taking out the 50 SMA, which had been acting as support for the EUR for nearly 9 months. From a pure technical perspective our Short EUR bias still remains in effect as the recent EUR retrace has yet to stop us out of our position.

Current Position: EUR Short entered at 1.4820 – Current Price 1.4398

EUR Resistance: 1.4480 (R1), 1.4509 (Fibonacci 23.6% Retrace), 1.4669 (100 SMA {yellow line})

EUR Support: 1.4242 (200 SMA {red line}), 1.4116 (Fibonacci 38.2% Retrace)

Remember, as traders we are all looking at the same data, just our perspectives differ. When markets move sideways as they are right now, traders strategize their next move. When the breakout does occur, as defined by a breach of S&R, then traders rush in to capitalize on the move. Therefore, always keep current on the bigger picture and it will also make your smaller picture clearer.