Eur/Usd held the strong gains made during the previous sessions as the Dollar continues to slide. The Dollar lost value verses the Euro again and has been losing for many days in a row. The pair past the last important resistance level of 1.4800 and has been hanging close to that level for most of the Asian session.

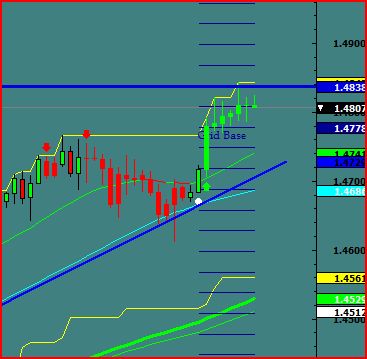

The pair is bullish and will continue to be bullish until some other signs give new signals and right now we see a ascending triangle on the 4hr chart which many times is a bullish signal as well. The current resistance level is 1.4838 and the next major resistance level is the psychological 1.5000 level this is a very important level just because of the number itself. Look for the pair to challenge this level soon in the next few days.

One major news item that is going to impact this pair is the FOMC Statement being held today at 2:15 PM. The most recent support levels are 1.4769 and 1.4669 watch the pair to slow down during a pullback at these level and find possible entry points on bounces or breaks of these levels.