By: Carl Hayes

The Canadian Dollar has hit 1.0810 at 9:05 am in Toronto today, as positive news from commodity, and stock markets continues to fuel a rampant financial rally across the globe. The previous high of June 1st was broken earlier in the day as traders try to capitalize on the seemingly endless power of the ongoing bullish momentum.

On July 30th, Canada’s national statistics agency is expected to report on industrial production and raw materials prices, both of which are expected to encourage the bulls to drive the prices higher. One day later, the same institution will release the gross domestic product for the second quarter and in line with the general tune of the global economic momentum, a positive number is anticipated.

Forex analysts surveyed by the news agency Bloomberg predict that the CAD will weaken to around 1.15 once again later this year, as the impact unemployment and contracting trade globally make their impact felt in more decisive terms. However, commentators and analysts do not rule out a return to parity sometime next year as the dollar-bearish momentum takes over again once the world economy pulls out of the recession and investment and cross-border flows are revived.

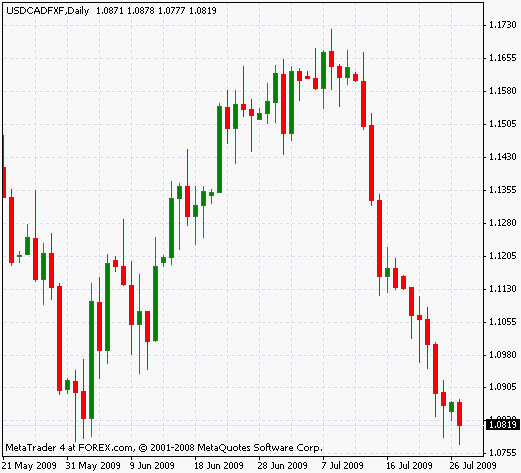

The chart of the USDCAD pair demonstrates the bullish picture clearly. Just as the commodity market is highly volatile, swings in this pair can be sharp, deep and powerful, as shown by the latest two-week ride of the USDCAD pair from 1.1655 to 1.08. As the CAD rises against the USD, correlation between oil and the currency is also increasing. The one-month correlation between the two assets was 0.87, compared to the yearly average of 0.72. In short, Forex traders are selling the dollar to buy Canadian companies and Canadian oil, and doing so they are purchasing the CAD with shovels. Of course, what goes up so fast can come down equally swiftly, as a reversal catches many speculators in flagrante delicto.

A close below 1.078 is expected to further empower the CAD bulls, with the next resistance being highlighted at 1.057. The Canada Dollar is already the best performer among the most liquid major currencies against the USD so far, having gained 7.6 percent.