Bitcoin dropped below $87,000 over the weekend, marking a significant downturn amid escalating fears of a U.S. government shutdown and President Trump's aggressive tariff threats against key trading partners.

Bitcoin Wipes Out Liquidity in Tumble Below $87,000

On Sunday, BTC price fell as low as $86,000 on Bitstamp, reversing 2026 gains as whales sold into illiquid market conditions.

This extended the deviation from the Oct. 6 all-time high of $126,200 to 32% and was accompanied by massive liquidations across the derivatives market.

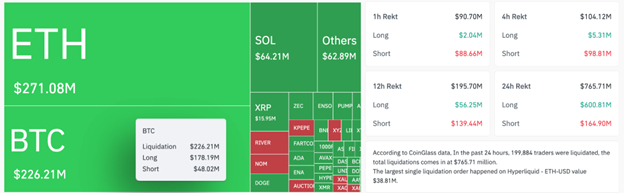

More than $600 million in short positions were liquidated, with Bitcoin accounting for $226 million of that total. Ether (ETH) followed with $204 million in short liquidations.

Across the board, a total of $765.71 million was wiped out of the market in short and long positions, as shown in the figure below.

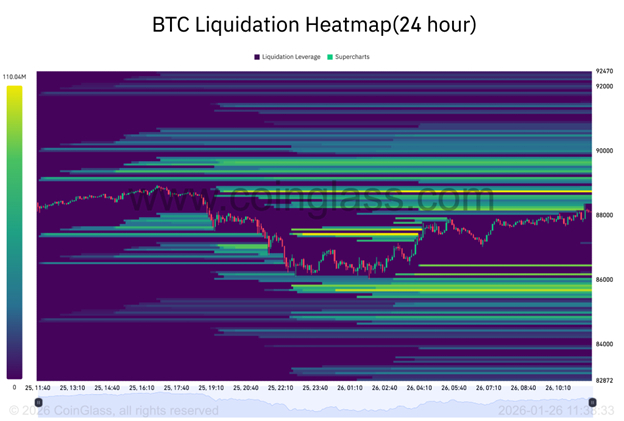

Additional data from CoinGlass showed intensive bands of buyer interest within the $84,800 - $86,000 range in the daily timeframe. More bid orders were building up down to $82,200 as shown in the chart below.

This suggests that Bitcoin’s price might drop further to sweep the liquidity within this range before staging a sustained recovery.

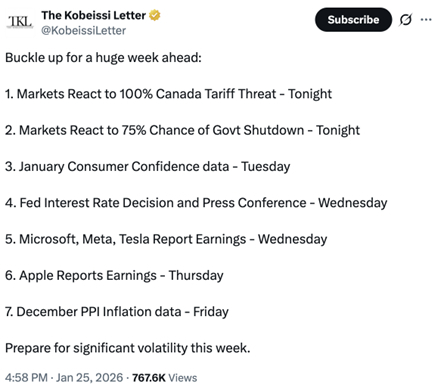

US Shutdown Fears Amplify Economic Uncertainty

The looming US government shutdown triggered layers of uncertainties and fear that have pushed Bitcoin deeper into the red. As Congress grapples with funding deadlines, partisan gridlock over budget allocations has raised the risk of a partial shutdown, potentially disrupting federal operations and economic stability.

This political impasse comes at a time when the market is fragile amid an uncertain global macroeconomic outlook. A shutdown could delay key economic data releases, halt regulatory approvals for crypto-related initiatives, and erode consumer confidence. Bitcoin, which thrives in environments of policy clarity, has historically suffered during such periods of US fiscal drama, as seen in past debt ceiling debates.

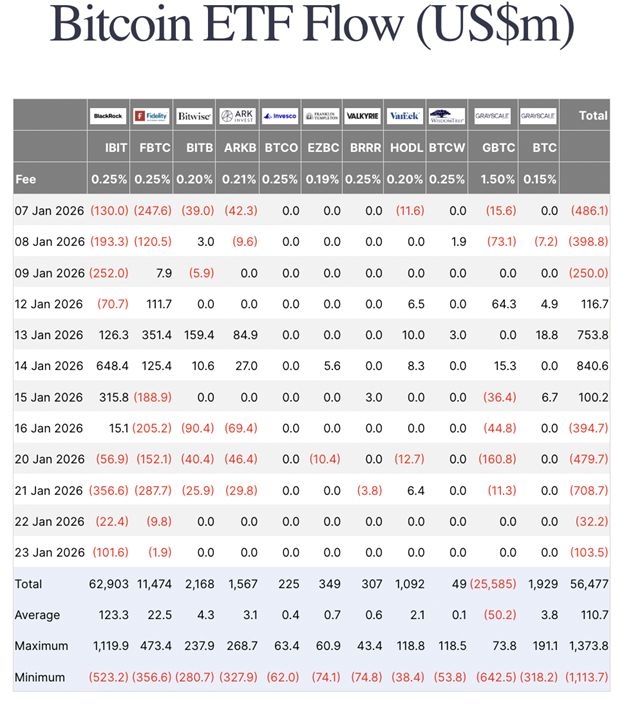

Outflows from the U.S.-based spot Bitcoin ETFs accelerated last week, with net redemptions totaling $1.7 billion. This signaled lack of conviction among institutional investors, adding to the tailwinds.

Coinbase's CEO highlighted how big banks now view crypto as an existential threat, but shutdown risks could slow adoption by complicating compliance landscapes. If a shutdown materializes, it might freeze government-backed stablecoin oversight, indirectly affecting liquidity in the broader crypto market.

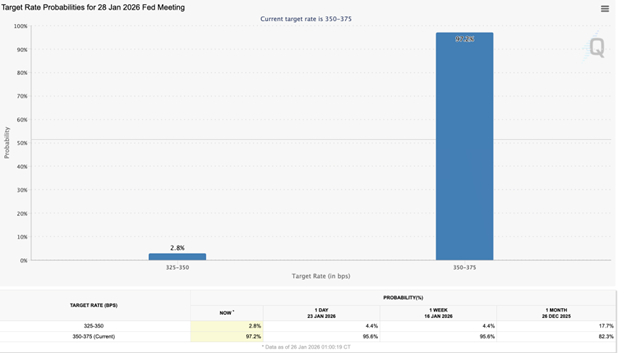

Investors are now focusing on the Federal Reserve FOMC meeting scheduled for Jan. 27 and 28. With futures markets pricing in only 2.8% of a 0.25% rate cut, a shutdown could complicate monetary policy transmission.

Bitcoin's correlation with traditional markets has increased, making it more susceptible to these domestic headwinds.

Tariff Threats Ignite Global Market Turmoil

President Donald Trump's recent tariff threats have also sent shockwaves through cryptocurrency markets, directly contributing to Bitcoin's slide below $87,000. In a series of statements, Trump warned of imposing up to 100% tariffs on goods from the European Union and Canada, ostensibly in response to disputes over U.S. efforts to acquire Greenland and broader trade imbalances.

“If Canada makes a deal with China, it will immediately be hit with a 100% tariff against all Canadian goods and products coming into the U.S.A.,” the president wrote in a Truth Social post on Saturday.

Trump's rhetoric, including specific mentions of 50% tariffs on EU imports, has particularly rattled European markets, leading to a broader risk-off sentiment. As U.S. stocks also dipped, with the S&P 500 shedding 2% in a single session, investors flocked to safe-haven assets. Gold surged to a record high above $5,000 per ounce, highlighting a stark contrast to Bitcoin's performance. This shift underscores how geopolitical tensions can pivot capital away from speculative investments toward traditional hedges.

These threats, announced late last week, revived memories of past trade wars that disrupted global supply chains and investor confidence.

When Trump first threatened to impose tariffs on key allies and China in March 2024, Bitcoin dropped 25% from $95,000 on March 2, bottoming around $74,500 on April 7.

Ready to trade our Bitcoin analysis? Here is our list of the best MT4 crypto brokers worth reviewing.