“Bitcoin season” maintains its staying power as curtails fall in the year 2025. Altcoins have struggled throughout the year, with capital flowing predominantly into BTC amid institutional adoption and regulatory clarity.

Altcoin Market Cap Turns Bearish

TOTAL2 —the total market capitalization of all cryptocurrencies excluding Bitcoin — has shown clear signs of weakness. As of late December 29, TOTAL2 sits around $1.21 trillion, down over 32% from its October peak of $1.77 trillion. This correction has pushed TOTAL2 below its 50-week simple moving average (SMA), currently near $1.29 trillion—a key long-term support level that has held in previous bull cycles.

Compounding this bearish setup, the SuperTrend indicator on the weekly chart flipped to a sell signal in mid-November and the moving convergence divergence indicator (MACD) which produced a bearish crossover earlier in October.

Historically, when TOTAL2 closes below the 50-week MA combined with a SuperTrend sell and bearish MACD, it has signaled the onset of extended downtrends. For instance, similar alignments preceded multi-month declines in prior cycles, with drawdowns exceeding 85% and 66% during the 2018 and 2022 bear markets, respectively.

Total crypto market cap excluding BTC. Source: TradingView

Moreover, the current price action consolidates below an ascending triangle pattern, with resistance at $1.35 trillion proving insurmountable. Without a decisive breakout above this level, altcoins risk further capitulation, potentially flushing toward $830 billion or lower. This technical deterioration underscores a shift away from broader altcoin strength, favoring Bitcoin's relative stability.

Bitcoin's Commanding Dominance

Bitcoin dominance (BTC.D) has solidified its upward trajectory, reinforcing altcoin underperformance. Since mid-September 2025, BTC.D has trended higher, consistently printing higher lows and reclaiming levels around 59%. As of December 29, 2025, Bitcoin holds approximately 59.7% of the total crypto market cap, up from earlier cycle lows and reflecting sustained capital rotation into BTC.

The chart below shows that Bitcoin’s dominance has remained in upward trajectory since the 2022 market low, just as was seen in the 2028 bear market. It is worth noting that BTC.D has not meaningfully dipped below 50% since 2023, a threshold often required for altseason ignition.

Bitcoin dominance, percentage. Source: TradingView

This rising dominance pattern typically coincides with weakening altcoins, as investors seek refuge in Bitcoin during uncertainty. Institutional inflows, particularly into spot Bitcoin ETFs, have exceeded expectations in 2025, tightening BTC's grip while altcoins lag. Higher lows in BTC.D indicate persistent buying pressure on Bitcoin relative to the broader market.

With macroeconomic headwinds and selective institutional focus on BTC, this trend points towards continued altcoin pressure into 2026, delaying any significant rotation.

It’s Still Bitcoin Season

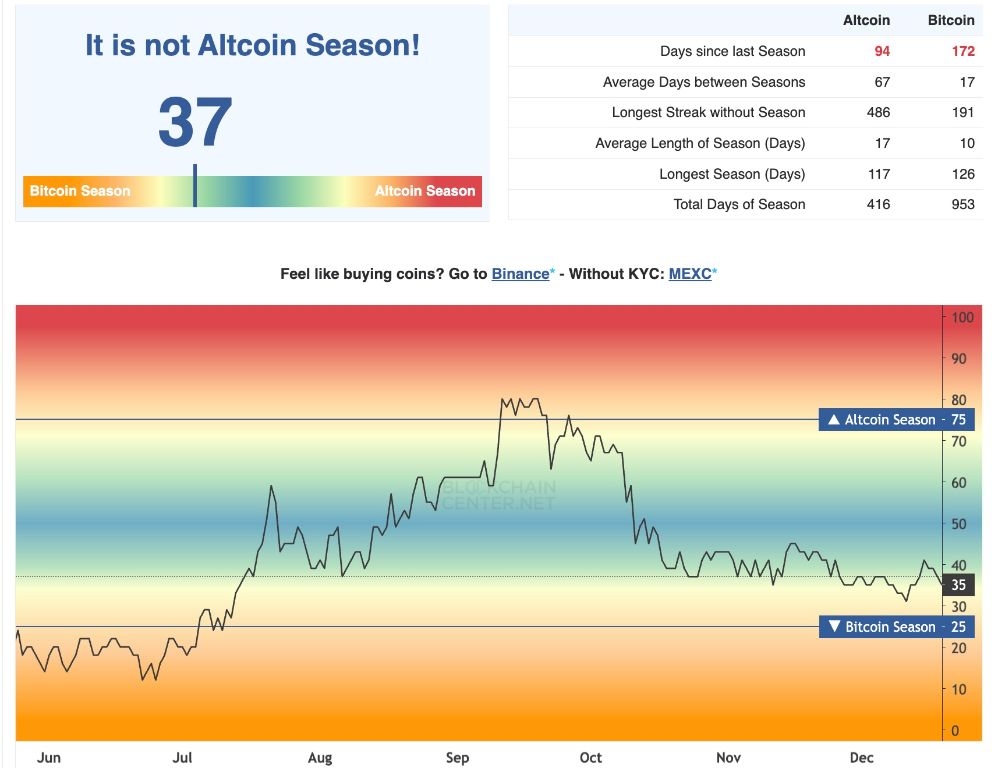

The Altcoin Season Index, which measures the percentage of top altcoins outperforming Bitcoin over the past 90 days, remains well below the 75% threshold needed for a confirmed altseason—reinforcing the reality that the market remains deep in Bitcoin season.

Data from Blockchain Centre shows that only about 37% of the top 50 altcoins have outperformed BTC in the last 90 days at the time of writing, with many large-cap alternatives posting relative losses amid Bitcoin’s resilience.

Altcoin Season Index. Source: Blockchain Centre

Similarly, CoinMarketCap’s Altcoin Season Index, which measures the top 100 cryptocurrencies against Bitcoin’s performance over the past 90 days, is reading a score of 18 out of 100, leaning toward a more Bitcoin-dominated market, referring to it as “Bitcoin Season.” Altcoin season is when the percentage is above 75%.

Top Regulated Brokers

This low outperformance rate highlights fragmented gains confined to a handful of projects, rather than the broad rally characteristic of past altseasons.

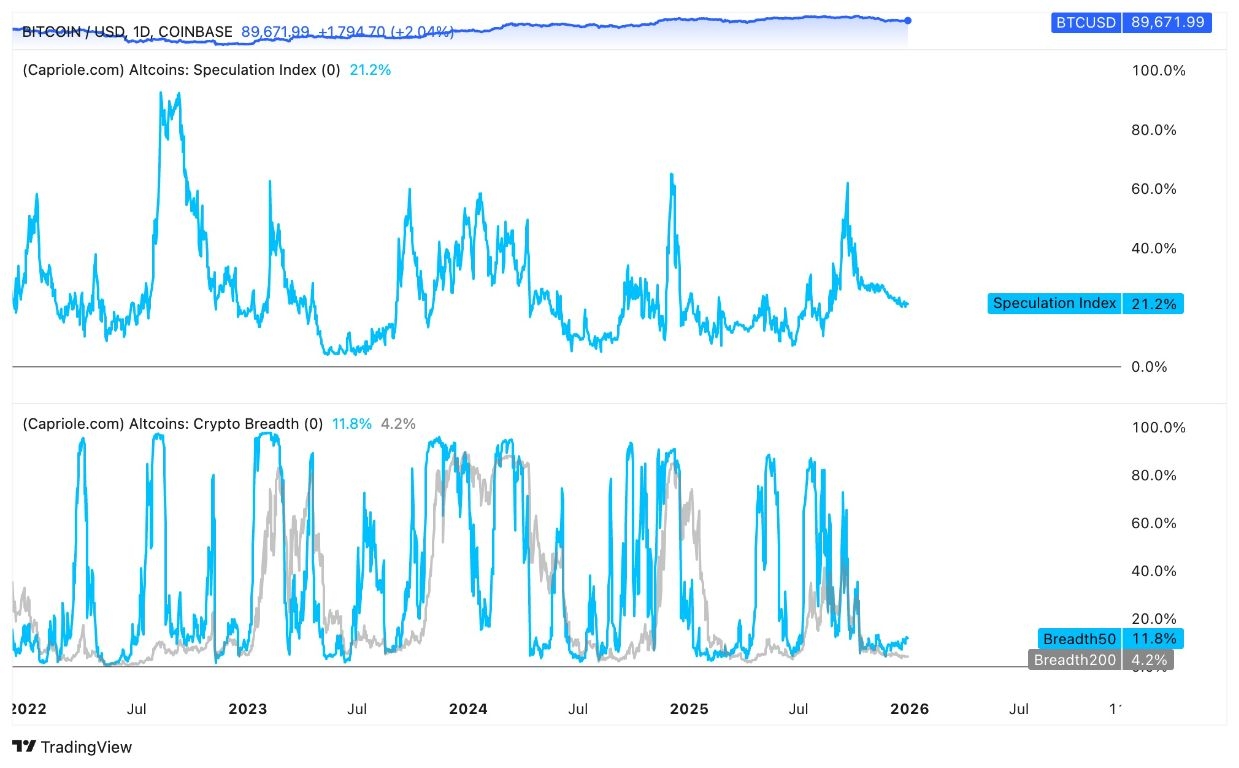

According to Capriole Investments’ Altcoin Speculation Index, only 21% of the top altcoins outperformed BTC during the last three-month period, suggesting capitulation among altcoin holders.

Additionally, the Crypto Market Breadth, a measure of market strength, reveals that only 11% of all altcoins are trading above their 50-day moving average, suggesting that the altcoin market is extremely weak.

Altcoin speculation index. Source: Capriole Investments

My Take on the 2026 Altcoin Outlook

Selective altcoin strength in areas like real-world assets, AI or privacy tokens, such as ZCash (ZEC), has not translated to widespread momentum. Combined with declining TOTAL2 and rising BTC dominance, the index at 37 suggests capital continues to favor Bitcoin, extending its seasonal dominance into the new year.

These indicators paint a challenging picture for altcoins heading into 2026, with structural shifts favoring Bitcoin's maturity over speculative alt rallies.