Crude Oil Value Surge: Biden, Supply and Demand

Early this week, President Joe Biden suspended oil drilling rights and explorations in a large part of the US Arctic territory, which will effectively stop new production of crude oil from the region during his presidency and reverses a pro-drilling philosophy that the Trump administration practiced.

Commodity price inflation has become a concern globally. Crude oil, copper, lumber and a host of other physical resources have surged in value. Biden’s suspension of oil drilling in the Arctic underscores the complications and potential for volatility in the energy sector and possible knock-on effects for other commodities.

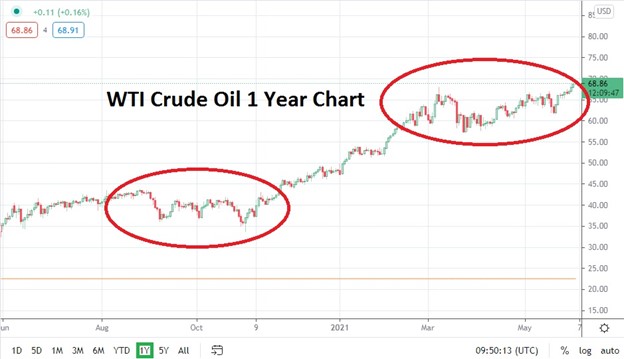

Restricting drilling and exploration for energy resources in the Arctic may seem negative for supply, but the news was largely anticipated. The decision from the Biden administration was not a surprise to oil companies who had anticipated the Biden policy pronouncements to protect the environment. The price of WTI Crude Oil started to effectively rise in value in September of 2020. When the Biden presidency was won in November, the price of the commodity did rise. It is possible that part of the jump in prices was because institutional players within the energy sector understood the potential for drilling restrictions about to occur. The supply of energy remains abundant in reality.

Lack of Inventory Not Meeting Manufacturing Needs

However, while some people are suggesting that the speculative buying of commodities is being driven by a fear of impending inflation, this can be argued. The surge in commodity prices that is taking place may be because of pent up demand. The need for companies to purchase raw materials to re-engage their manufacturing as the world’s biggest economies emerge from coronavirus must be taken into consideration. While the fears about the Biden administration energy policies may have had an effect on the energy sector, it is likely only one part of the puzzle.

WTI Crude Oil Price Daily Chart June 2020 – June 2021

Values and purchases of commodities have increased not only because speculators are abundant, but because there is a bottleneck of supply. Difficulties meeting demand, due to the fact that many companies which produce raw materials were not working at full capacity the past year due to coronavirus implication, are still being resolved. Solid supply of materials will likely become abundantly available as the bottleneck eases, and users of the physical resources may start to feel comfortable with their inventories. Coronavirus is subsiding in many of the major economies and industry is getting back to normal, but production problems still need to be resolved and this will likely happen.

Gold is an Important Inflation Insight

An important clue regarding the fear of inflation and why it potentially is misguided is because the price of gold has not traded significantly higher. Gold rose in value last summer as financial elements hedged their risks and looked for safe haven assets as coronavirus fears heightened in the US. But were financial institutions buying to guard against actual inflation? Probably not; they were likely doing it as a hedge against the possibility of inflation – and there is a difference.

Gold began to actually sell off and the commodity hit low values in March and early April of this year before starting to climb again.

Gold is a dynamic indication regarding inflation, because historically high net worth individuals and institutional financial houses typically hedge against concerns about real inflation by investing in gold. Gold’s investing formula has not changed. While many certainly speculate on its price to try and capture profits, gold remains largely an important hedge against perceived inflation to come. The price of gold has been rather tranquil recently.

XAU/USD (Gold) Price Daily Chart June 2020 – June 2021

Manufacturing Demand and Inventory Supply

Overall commodity demand for orders will likely become more cautious as manufacturers find that their supply needs are being met. The rampant surge in commodity prices being seen will likely subside and return to stable conditions. There is a rather strong potential commodity inflation may subside. Household prices for food, clothes and other goods have risen. However as the global economy stabilizes and nations and companies begin to return to normal, prices should stabilize too – due to supply and demand.