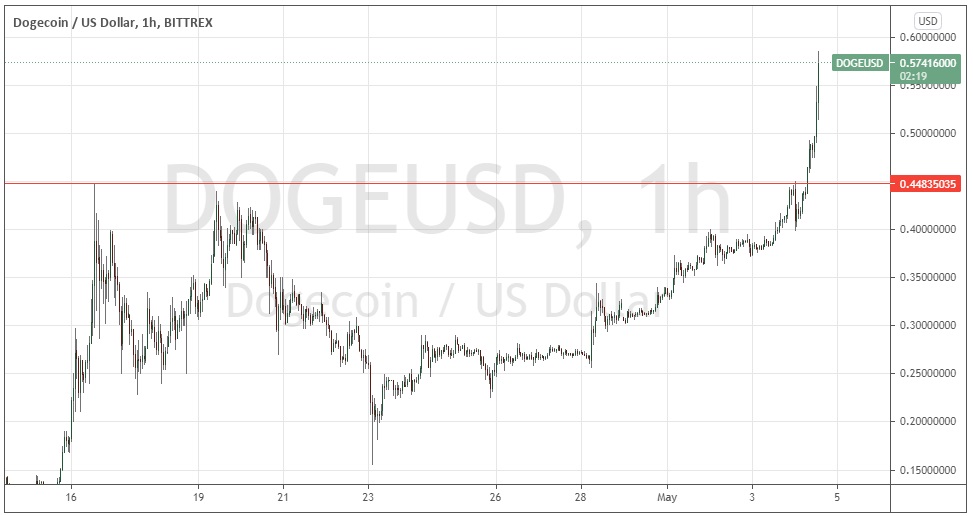

Dogecoin Technical Analysis

Dogecoin in USD terms has made what looks to be a very strong bullish breakout beyond what was a firm resistance level at about 45 cents. A few weeks ago, I wrote about how Dogecoin had reached a pivotal point at that level and would likely either make a strong breakout or a bearish reversal, giving traders an opportunity to profit either long or short by paying attention to the price action near this level.

This was a timely call, as the price topped out just below 45 cents and then fell all the way to 15 cents in only four days, giving a maximum short trade profit opportunity of almost 65%.

The price chart below shows how Dogecoin then went on to rally from this low in a classic cup and handle formation before making a very powerful bullish breakout above 45 cents just a few hours ago from the time of writing.

Trading Dogecoin Bullish Breakout

Traders watching a strong bullish breakout understandably want to participate but must be cautious. “Fear of missing out” is not a good reason to enter a new trade – you must be confident enough to wait until you see a trade entry point where your risk can be limited enough that the potential reward becomes truly worthwhile. It is tempting to just enter a long trade immediately and hope for the best, but this approach can be dangerous.

Traders wishing to buy Dogecoin right now should use a wide, hard stop loss based upon the high level of volatility seen today. It is quite possible that the price will again test the former resistance level at 45 cents. Therefore, the hard stop loss should either be clearly below 45 cents, or buyers should wait for a dip. One such dip-buying strategy could be to place a limit order to go long at 45 cents or a little way above 45 cents, below the current price. This might mean that you will miss out on the opportunity if the price simply takes off “to the moon”, but on the other hand, a successful limit entry could allow a much tighter stop which would significantly increase the potential reward to risk ratio.

Another approach could be to wait for a dip, and then enter following a bullish reversal ending the dip, even if the price has not reached the anticipated support level at 45 cents. Again, this can enable a much tighter stop.

It should be noted that Dogecoin has almost no intrinsic value and trading it is highly speculative. Its volatility is very high, and it could easily lose more than half its market value in a few minutes. However, there is no denying it has recently obeyed technical support and resistance, and its price movements are so large that they give skilled traders the chance to make very fast and large profits.

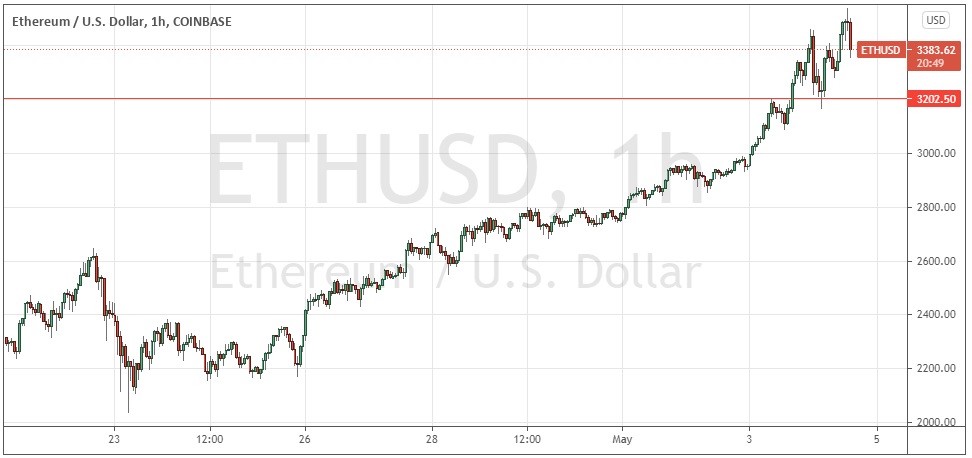

Ethereum at an All-Time High

Ethereum, the second-largest cryptocurrency by market capitalization, has been making new record highs for a week. Many analysts expected it to begin a major reversal from a seeming climax yesterday, but Ethereum has continued to trade higher still over the course of today.

The bullish momentum here is considerably weaker than we are seeing in Dogecoin, but Ethereum has much more a case of representing some intrinsic value or at least potential value.

Traders looking to go long here may do well to wait for a bearish retracement to likely support at $3,202.50.

Many Forex / CFD brokers do not offer Ethereum, but you can trade it with AvaTrade, a broker renowned for its cryptocurrency offering.