Biden Coronavirus Plan Packages and the Federal Reserve Sparking Speculation

President Joe Biden will reportedly introduce another tranche of proposed stimulus later today. Just a couple of weeks ago, the White House was able to push through a massive trillion-dollar package to combat the implications of coronavirus on the US economy.

Biden is expected to outline the first part of the newest proposal and it is expected to be a stimulus package which will be worth around $1.9 trillion. There is also a new second proposed package which will likely be mentioned which will make the two packages reportedly valued at almost $3 trillion.

While the Biden and Trump administrations have already initiated a massive amount of cash to confront the economic effects of coronavirus, it is an open secret that these stimulus packages have more to do with spending on infrastructure and a host of special interest projects. This has left the door open to criticism that the new stimulus packages are unneeded spending by a ‘wasteful government’.

When the massive stimulus packages are combined with the Federal Reserve’s current monetary policy, which includes near-zero interest rates and the stated belief that interest rates will remain extremely low for the next few years, investment houses led by their analysts have become nervous regarding the potential for a “coronavirus inflation” to creep into the American economy. The fear is that the onslaught of cheap money from the US stimulus combined with the Federal Reserve’s low interest rates will fuel inflation.

Interest Rates and Bond Yields: A Complex Game

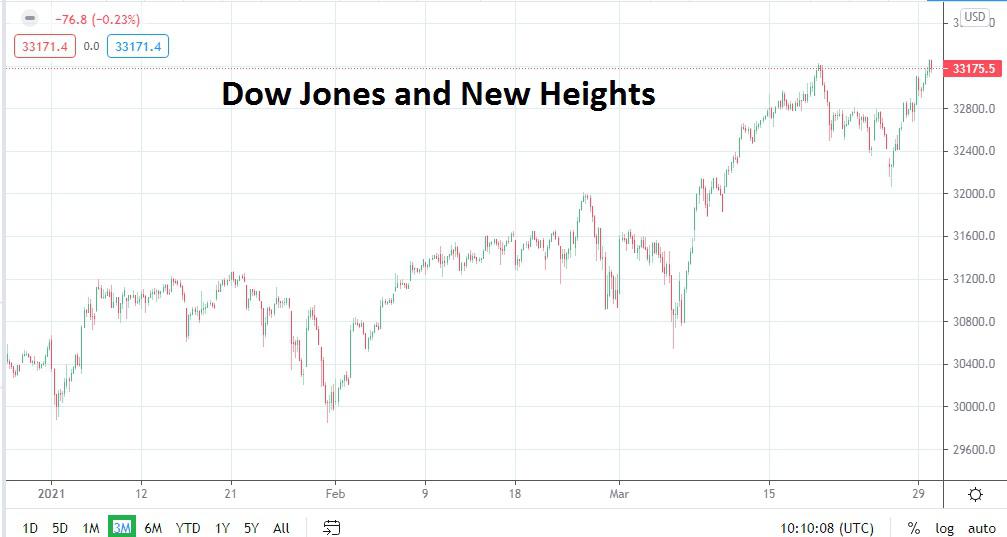

Interest rates on ten-year US treasuries have incrementally risen the past months. The road to accessing why bond yields have risen is complex, but indicates that speculative money is pouring into stock markets based on the notion that money is cheap. Theoretically, if bond yields are higher, it means it is because traders are putting their money into risker assets like stock markets via indices. The Dow Jones 30 Index is gyrating near record highs.

However, cheap money and its implications also clearly affect the value of the US dollar. The USD has delivered choppy trading conditions the past month and half as the US government has gone ahead with more stimulus packages and the promise of more spending. While this has temporarily increased the value of the USD against other major currencies in the past month because of turmoil in the US bond market, it has not killed the notion that the underlying price of the USD remains fragile. This can be seen via technical charts as the USD has gained recently but also remains within weaker value ranges against many other currencies in Forex, like the EUR/USD.

The effect of the massive stimulus packages and monetary policy have combined to create a fear that inflation while quite low currently may begin to incrementally increase and perhaps even get out of control. This is where a clash of economic philosophies and data collide as experts argue over the meaning and outlook of current policies compared to the historical track record of previous economic environments which have experienced financial crisis. The advent of coronavirus came on top of global central bank policy which was already dovish.

Implications are Known, Real Outcome is Not

While traders can listen to the so-called experts and go crazy by trying to trade based on their opinions, it might not prove to help their bottom lines. The cheap money that exists within the global markets is certain to spur on speculative buying by financial institutions which only have a limited number of places they can justifiably invest their clients’ money. Meaning, the major stock indices around the world may remain bullish even as fears grow about long-term results.

Final Thoughts

The notion that stimulus from the US government will cause a sudden spring of inflation into the economy remains debatable. The prices of certain commodities like energy via crude oil have certainly gotten higher, but that may have more to do with the current room temperature of US government policy regarding clean energy compared to the older energy sector. One tell-tale sign that rampant inflation is not an overwhelming concern is the price of gold remaining quite tranquil, and even losing value the past few months as stimulus packages have been introduced and approved.

The ability of the stock markets to up on cheap money because there are limited places to speculate exists, but this has not stopped the question and fear of speculative asset bubbles. Are asset bubbles forming because of a fear of potential inflation or more from the notion money is abundant and speculating can be done relatively safely and without harm in the current riskier speculative environment?

Markets are likely to remain speculative and the fear that inflation is suddenly going to cause a massive and volatile attack remains theoretical short term. Long term, there is an argument which can be made in favor of an outbreak of inflation, but short-term and even mid-term traders should continue to monitor the results of the major stock indices and the underlying weaker value of the USD as speculative, but not a new phenomenon.