U.S. Final GDP Exceeds Consensus Expectation

A short while ago, the U.S. released final annualized data on its quarterly economic growth statistic (gross domestic product). The consensus forecast was expecting an annualized increase of 4.1%, but the data exceeded expectations by a small yet significant amount, coming in at 4.3%.

An annualized growth rate of 4.3% in GDP is relatively large by historical standards for any advanced economy, although of course the deep contraction triggered during 2020 in the economy by the coronavirus shock has caused a natural bounce which has certainly boosted the GDP figure. Nevertheless, at the distance of approximately one year from the initial impact of the coronavirus, some analysts will argue that the 4.3% increase is a “natural” number, reflecting a U.S. economy that is truly booming again. I find this unconvincing when considering that the Eurozone, which is still very much in the grip of an expanding rate of coronavirus infection requiring a new round of lockdowns, has seen its 2021 GDP increase at an even higher rate of 4.8%.

Jerome Powell Explains the Boom

Jerome Powell, the Chair of the U.S. Federal Reserve, gave an interview to National Public Radio about an hour before the data was released. Anticipating the strong number, Powell stated two main factors which he sees as buoying the American economy: the increasingly rapid progress of America’s coronavirus vaccination campaign, plus the enormous level of fiscal support to the U.S. economy recently mandated by Congress to the tune of $1.9 trillion.

These statements will be no surprise to anyone, but the more significant part of the interview came as he made a firmer commitment to tapering off the Fed’s bond purchases, which he promised would be undertaken with “the greatest transparency”. He also maintained a strong commitment to meeting the official 2% inflation target “averaged over time”, which frankly was worded in a way which gives a large amount of ambiguity. His most interesting remark though was a somewhat touchy statement that U.S. debt is still at a level which can be comfortably serviced. This was a nod towards trying to calm increasing fears that the U.S. is generating an unsustainable level of federal debt.

Bottom Line: What Does this Mean for Traders?

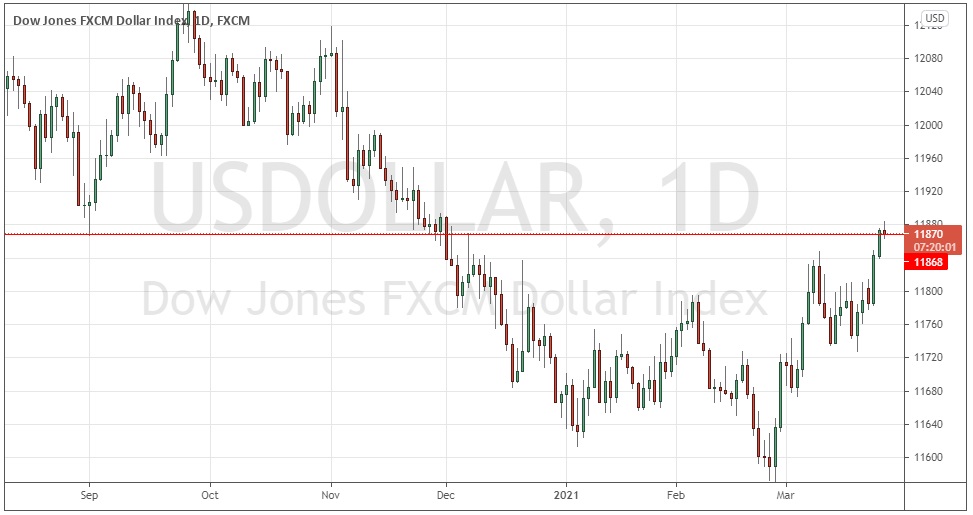

Although the data and policy rhetoric point towards a stronger U.S. Dollar and stock market, stock prices remain unmoved. The S&P 500 Index has been declining steadily if unspectacularly from its all-time high made last Monday. The U.S. Dollar, however, has been showing strength, especially against the Euro (where it hit a four-month high a few hours ago) and against the Japanese Yen. Perhaps significantly, the USDX (U.S. Dollar Index) is trading near its three-month high above the key resistance level at 11868: these are bullish technical signs.

U.S. Dollar Index, Daily, November 2020 – March 2021

Forex traders will likely be wise to look for long trades in the U.S. Dollar for the time being.