U.S. Treasury Yields Continue to Rise

In recent hours, the 10-year U.S. Treasury yield has hit a new 14-month high at 1.77%. The 5-year yield has also been nudging a long-term high, registering 0.89% which is just a single basis point below the 1-year high it made less than two weeks ago on 19th March at 0.90%.

“Yield” is the annualized return represented by an investment in a U.S. treasury note or bill at a given price. The price of U.S. treasuries fluctuates on the open market while the coupon (interest) paid or implied by the issue price remains constant.

Rising treasury yields are typically seen as likely to boost the relative strength of the U.S. dollar against other currencies. The U.S. Dollar Index is at a long-term high, just as the yields shown above are, which fits the traditional template. Furthermore, yields can be a leading indicator, meaning that provided these yields continue to rise, so should the greenback in the Forex market.

U.S. Dollar Index at 4-Month High

The USDX (U.S. Dollar Index) is hitting a 4-month high. The Index is composed of the relative value of the U.S. dollar against a basket of other currencies.

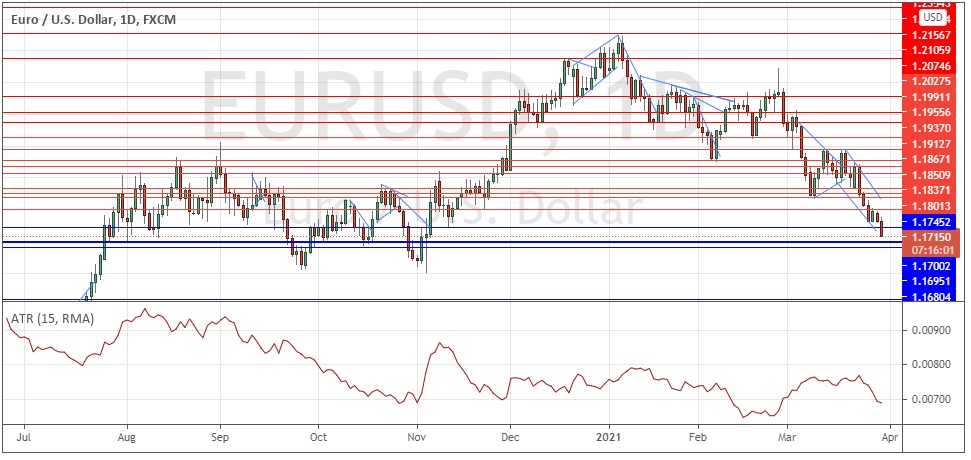

The rise in value by the U.S. dollar should be noted as especially strong against the euro and the Japanese yen, as shown in the price charts below.

.jpg)

It is worth noting that while the 15-day average true range volatility indicator is showing a daily average range of approximately 50 pips, today’s move by this currency pair at the time of writing is coming in so far at about 1.5 times that amount. This typically indicates that there is more left in the move over tomorrow and possibly also the coming several days. If so, this would not be a big surprise, as we also saw the price burst through the psychologically important 110.00 handle a few hours ago after a pause just underneath it, suggesting bulls fought and won against this resistance level to push the price up to a 1-year high.

Turning to the EUR/USD currency pair, we see the price at a new 4-month low, albeit on relatively low volatility.

Bottom Line: What Does this Mean for Me?

The USD/JPY currency pair is the “hot hand” in today’s Forex market and is breaking to new long-term highs on above-average momentum. This could be a great time to look for a long trade in USD/JPY, especially after a bearish dip in the trend begins to reverse back in the direction of the trend. A hard stop loss based upon volatility (the average true range of say the past 15 days) is a tried and tested effective stop loss strategy for such momentum-based trades.

EUR/USD short is also a good candidate as a potential trade.

Forex traders will likely be wise to generally look for long trades in the U.S. dollar for the time being.