Main Refinancing Rate on Hold at Zero

The European Central Bank has left its main refinancing rate and all secondary rates unchanged. The main refinancing rate remains at zero. In effect, this means that in practice the Euro itself has zero or even a negative yield, and thus holders of Euros are indirectly encouraged to speculate or invest to preserve the value of their holdings.

ECB Accelerates Bond Purchase Program

Christine Lagarde, the President of the European Central Bank, announced today that although the total amount of the €1.85trn pandemic emergency purchase programme (PEPP) would remain unchanged into 2022, the pace of purchases would be immediately increased – meaning that the ECB will be buying more bonds over the coming quarter.

Clearly, the ECB is taking this measure to try to drive down bond yields, which have been rising. Lagarde stated plainly that this measure is required because the Eurozone is not recovering from the coronavirus pandemic economic shock quickly enough, which is pushing up yields, which further endangers the fragile recovery.

The market’s initial reaction suggested this move by the ECB is working, at least over the short term, as traders sold off bonds, thus reducing yields. The Euro itself was largely unchanged over the first two hours following the release, falling slightly to about 1.1930 against the USD.

ECB Fears Persistent Coronavirus

Lagarde herself cited persistently high covid-19 infection rates, virus mutations, and lockdowns as having a hurtful impact upon Eurozone growth. She is correct and I have noted this Eurozone vaccination problem recently. Unfortunately for the Eurozone, the pace of the coronavirus vaccination program remains painfully slow by the standards of most advanced economies – no Eurozone member has fully inoculated more than 4% of its population yet, while countries such as the former member the United Kingdom and the U.S.A. pull far ahead. This is largely due to poor vaccine procurement decisions made by the European Commission and shows no sign of being likely to change any time soon.

ECB Economic Forecast and Outlook

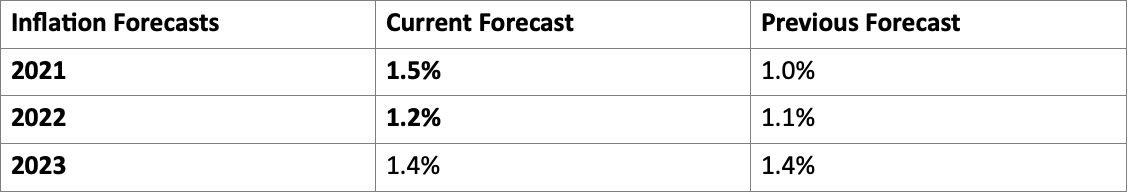

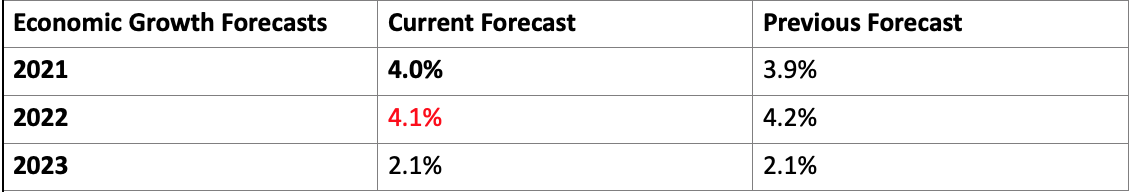

The ECB also revised its inflation and growth forecasts, with inflation receiving a stronger upwards adjustment than growth.

Lagarde stated that headline inflation is likely to likely to increase over the near term due to supply chain pressures. She saw real GDP as likely to contract again over Q1 2021 due to weakness in the services sector. However, she also said that the overall economic situation is expected to improve over 2021.

ECB Inflation Forecast

ECB Economic Growth Forecast

Bottom Line: What Does This Mean for the Euro?

The ECB release and press conference announcing faster QE will logically be perceived as likely to weaken the Euro slightly. However, the immediate market reaction to the news was muted regarding the Euro in the Forex market. The effect was instead felt more in the Eurozone bond market, with an immediate and meaningful fall in bond prices, which is likely to persist. The release may still contribute something towards weakness in the Euro over the near and medium terms.