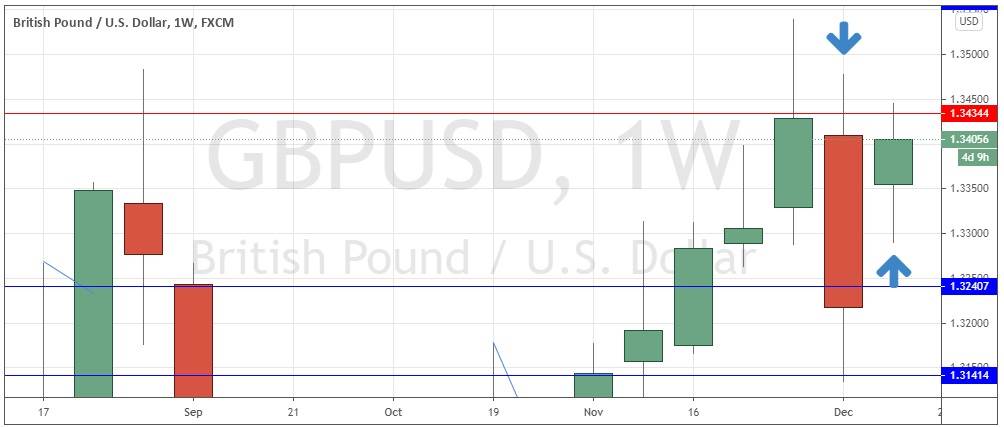

On Friday, 11th December 2020, the GBP/USD currency pair closed the week at 1.3218, down by 1.42% from its weekly open at 1.3409. This bearish movement in the pound, within a long-term bullish trend caused mostly by weakness in the U.S. dollar, was seen by analysts as caused by time running out for the successful conclusion of last-ditch talks between the U.K. and the E.U. on the terms of a trade deal. The parties had agreed a final deadline of Sunday, 13th December 2020 by which the terms of any deal would need to be finalized, or the U.K. would end its transitional Brexit arrangement with “no deal” on 1st January 2021.

As minutes ticked away to the Friday close, which marks the start of a 48-hour weekend period during which it is impossible to enter or exit from Forex trades, retail traders were mostly in short trades, many of which were exited. Professional and more sophisticated traders, however, were taking the risk of entering long trades in the GBP/USD currency pair and holding it open over the weekend in the hope of seeing a quick rise in the price as the next week opened.

The wishes of traders going long GBP/USD at the end of the Friday, 11th December trading session were quickly granted. The price gapped up at the weekly open on Monday, 14th December by approximately 140 pips, then quickly rose by another 90 pips during the first hours of the day’s London session, giving a fast opportunity to profit:

Why were these traders going long GBP/USD when the pound’s picture looked so bleak, and doing it at the start of a 48-hour period during which they would be unable to take any measures to limit their risk?

Fundamental: Early Deadline Had No Credibility

Many experienced traders just did not believe the official position of the negotiators that a deal had to be agreed by the end of Sunday 13th December. It simply was not a credible threat, as “no deal” would be economically damaging to both parties. There was no reason why the parties could not continue negotiating all the way up to the legal deadline of 31st December 2020. Therefore, it was logical late on Friday to expect that an announcement would be made during the weekend, when markets were closed, that the negotiations would continue. This is what happened – and as the threat of a “no-deal” Brexit was lifted at least temporarily, the pound of course rallied, as the pound is unquestionably much stronger with an E.U. trade deal than without one.

The most exciting opportunities for retail traders to make quick profit in the Forex market tend to come when central banks or national governments are making statements of intent which will quickly be exposed as not credible. Possibly the best example in history was the British government’s commitment to an artificially strong pound against the deutschmark in 1992. The pound was so grossly overvalued in real market terms that even the Bank of England could not keep it propped up for very long, regardless of the billions at its disposal.

Technical: Strong Retracements in Trends Reverse Following Week

It is well observed, but not well followed, that when a Forex currency pair such as the GBP/USD makes an unusually strong counter trend move against a long-term trend, there will more often than not be a movement over the following week back in the direction of the trend. This is exactly what happened to the GBP/USD currency pair over the week ending on 11th December 2020, and on at least the first trading day of the next week:

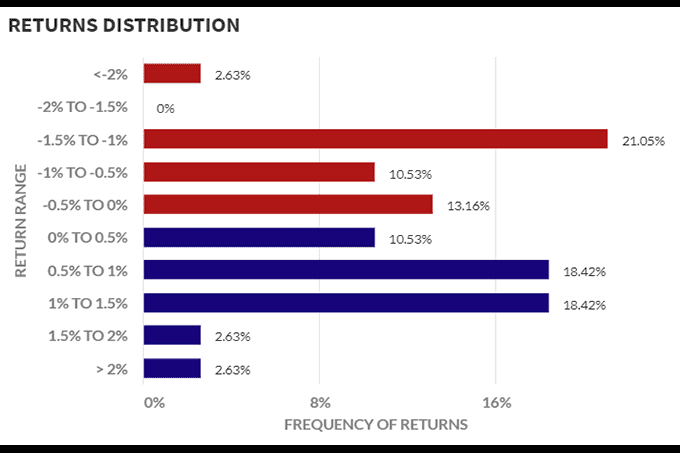

Although it is psychologically difficult to enter a trade on a Friday when it feels like the entry is an attempt to catch a falling knife, it has been a profitable trading strategy for a long time. One of the best ways to identify whether a weekly counter-trend movement is large enough to give a good entry is to take the average range from open to close of the previous four weeks. Trend is defined by whether the price is higher than it was both 13 and 26 weeks ago, or lower. If the current counter-trend week has a range from open to close of at least twice this four-week average, historical price data for the GBP/USD currency pair between 2001 and 2020 suggests the price had a 52.63% change of rebounding by the close of the following week, producing an average return of 0.05% per week from open to close. This is arguably a small edge, but a skillful trader should be able to improve upon it using intraday trade entry and exit strategies.