At the beginning of this week, the price of the USD/CAD stabilized lower around the 1.3225 support despite the price of crude oil reaching the $54 threshold a barrel and the pair ignored the strength of the US dollar against other major currencies. Since the Canadian dollar is a risk currency, it has been helped by investors abandoning safe havens with optimism in financial markets from the upcoming round of US-China trade talks.

One of the most important drivers of the strength of the Canadian dollar in recent months has been the superior performance of the local economy, enabling the Bank of Canada (BoC) to leave rates unchanged at 1.75% despite the US Federal Reserve cutting interest rates twice this year, and is expected to cut rates again in December.

Canadian traders are carefully watching the developments of the global trade war that directly affect world oil prices and the world economy as a whole. In the latest development, Bloomberg News reported on Friday that Trump was considering curbing some US investment flows to China, which would be an aggressive move pointing to another escalation in the trade dispute between the world's two largest economies. The two sides are scheduled to hold talks in Washington on October 10-11, but if no agreement is reached, the White House may rise tariffs on some $250 billion of China's annual exports to the United States, from 25% to 30%. Other tariffs are due to take effect on December 15.

Analysts expect the Canadian dollar to fall 2% against the US dollar and 10% against the British pound before the end of the year.

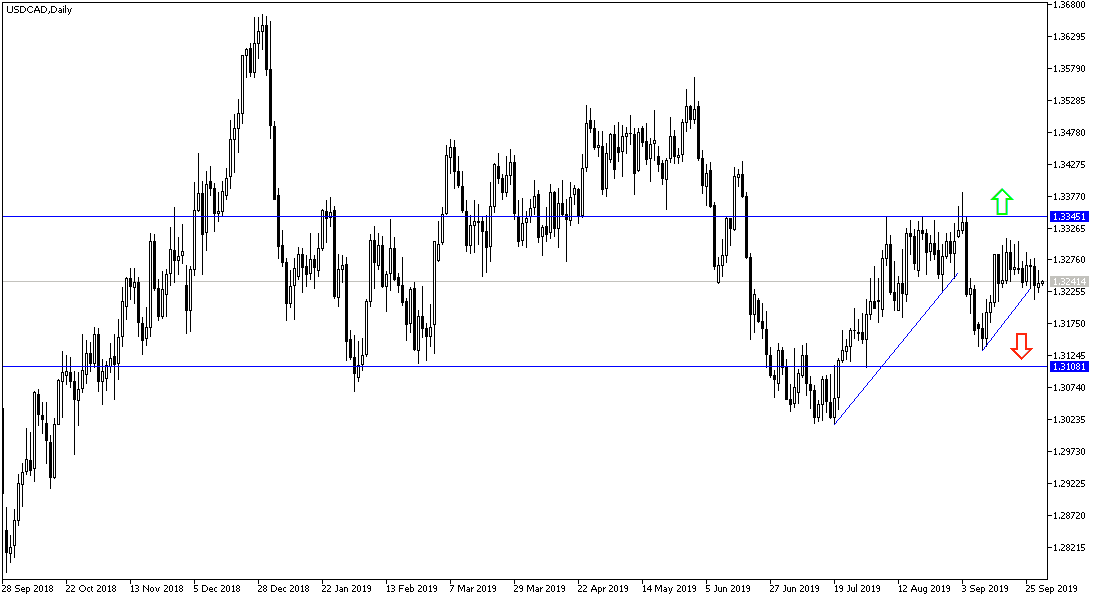

From a technical perspective: USD / CAD is now neutral on the daily chart with a bullish bias supported by a return to test the resistance levels of 1.3330, 1.3400 and 1.3485 respectively. In contrast, if the pair moves towards the support levels at 1.3180 and 1.3100, and the psychological support of 1.3000, then it will confirm the strength of the decline. Overall, we still recommend buying the pair from each bearish level.

The pair will be affected by the release of Canada's GDP growth rate and the US ISM manufacturing PMI.