Despite the optimism of an agreement between The United States and China, which positively contribute to the Australian Economy, the AUD/USD gains didn’t exceed 0.6810, and it seems that the AUD traders are awaiting the official announcement and details of the announcement. The Australian trust indicators are still weak. The NAB business trust index dropped to a reading of 0, the lowest in 5 months. The Westpac Customer Trust index followed, which dropped by 5.5%, the third decline in 4 months.

It is the United States. The Fed released the minutes of its last September meeting, in which the Fed cut US interest rates by a quarter-point, the second time this year. The tone of the minutes was mostly pessimistic, with members asserting that the risks to US economic growth were "leaning for the downside." Policymakers have raised concerns about weak global economic growth, the impact of the US-China trade war and low inflation in the country. The Fed seems ready to cut rates again. Expectations reached 75% that at the October meeting the bank will cut US interest rates for the third time this year. The drop in US inflation for September also fueled the strong expectations. CPI slipped to 0.0% and core CPI slowed to 0.1%. Thus, inflation remains low, well below the Fed's 2.0% target.

Learn about the most important data and events that will affect the Australian dollar for this week:

On Tuesday the RBA minutes will be released. It provides details of this month's monetary policy meeting, when the Reserve Bank of Australia cut interest rates for the third time since June. A cautious tone may increase the negative impact on the AUD performance.

On the same day, the Australian dollar will react to the announcement of new Chinese loans. The new bank loans improved to 1,210 billion Yuan ($ 170 million) in August. Loans are expected to increase to 1,350 billion Yuan (190 million US dollars) in September.

Thursday. Australian employment data. Overall, the Australian labor market remains strong, with the economy generating 75,000 jobs in the past two months, with the release expected to announce 15,300,000 jobs for September. In contrast, the country's unemployment rate is expected to remain at 5.3%.

By the end of the week's trading, the Australian dollar will be affected by the announcement of China's GDP. Overall, the Chinese economy is still losing ground as it saw a slowdown to 6.2% in the third quarter. On a year-on-year basis, GDP grew by 6.7%. The bearish trend is expected to continue with expectations of 6.1% growth.

Learn about the most important data and events that will affect the USD this week:

There will be a US holiday on Monday to celebrate Columbus Day. On Wednesday, US retail sales figures will be released and retail sales are expected to rise 0.3 percent from 0.4 percent last month and core retail sales are expected to grow 0.2 percent after falling 0.0 percent last month.

On Thursday, the US housing market figures, which remain strong despite the trade dispute with China, will be released. Housing starts are expected to read 1.32 million homes from 1.36 million previously.

On the same day, the jobless claims will be released, which still show positive figures showing the strength of the US labor market and that layoffs are still at historic lows. As for the industrial index, it is expected to decline to 7.0 after a historical reading of 12.0. On the same day, the US dollar will react to remarks by members of the Federal Reserve's monetary policy.

AUD/USD Outlook for This Week:

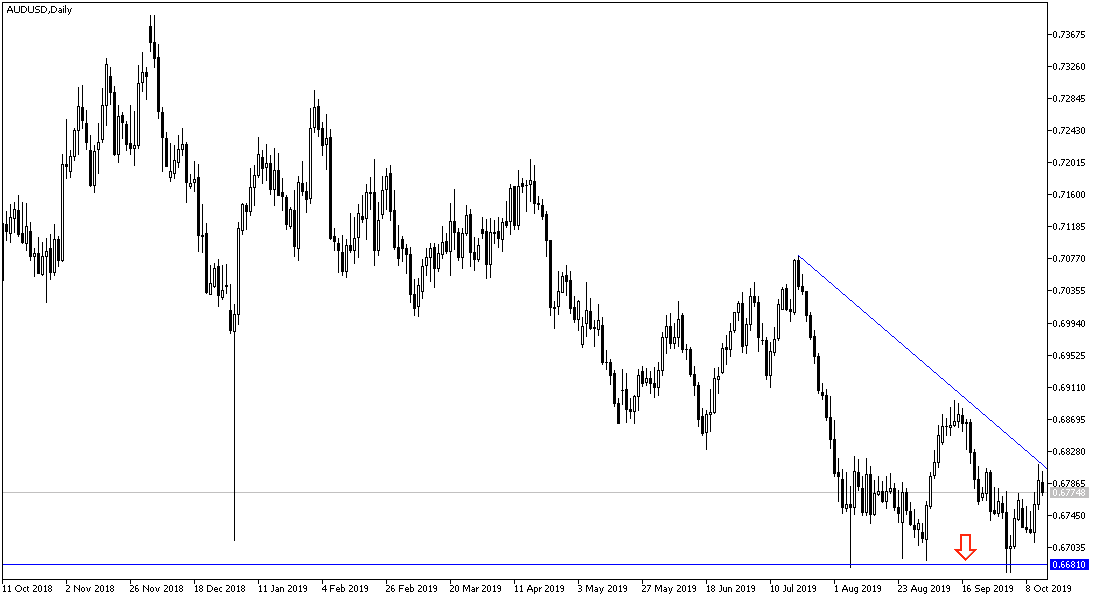

The general trend of AUD / USD remains bearish as long as it remains below 0.7000 psychological resistance. The Reserve Bank of Australia (RBA) cut interest rates several times, and the country's economy has not been affected by these measures so far. Weak global demand has weighed on the manufacturing and export sectors, and the Aussie will have difficulty attracting investors until the Bank is convincingly positive and the trade dispute between the US and China is resolved.

The most important support levels for the AUD/USD this week are: 0.6730, 0.6625 and 0.6500 respectively.

The most important resistance levels for the AUD/USD this week are: 0.6870, 0.6985 and 0.7045 respectively.