For the second week in a row, EUR/USD continues to fall below the 1.1000 psychological support, reaching its lowest level since April 2017. This contributed to the weakening of the Euro. German and European preliminary manufacturing PMI figures are below the 50 level, signaling the contraction of this important sector due to the global trade war. The German version was of particular concern, dropping to just 41.1, compared to expectations for a reading of 44.6 points. IFO's German business climate improved slightly to 94.6, but it is still far from the readings we saw earlier in 2019.

From the US, the second quarter estimated GDP was 2.0%, confirming the second estimate. This was well below the strong gains of 3.1% in the first quarter. On the political front, Democrats have begun to sue President Trump for possible abuse of power. Trump made a phone call to the Ukrainian president and discussed the business dealings of Joe Biden and his son. However, the accountability process is long and unlikely to affect the currency markets, at least for the time being.

Learn about the most important economic data and events that will affect the performance of the euro this week:

At the beginning of this week’s trading, the German CPI will be released. As Germany is the largest economy in the euro zone, German inflation data will be closely watched. The August release showed a decline of -0.1%, marking the first drop in inflation in seven months. On Tuesday, Eurozone inflation data will be released. A slight change is expected in the initial estimate of October inflation. Core CPI is expected to rise to 1.0%, from 0.9%. The headline reading is expected to remain unchanged at 1.0%.

On Thursday, the Eurozone Services PMI will be released. The services sector was stronger than the manufacturing sector, with all the major Eurozone economies expected to release readings for the index above the 50 level, which separates growth from deflation.

On the same day, retail sales data in the Eurozone will be announced. Retail sales have shrunk in three of the last four issues. The July reading came at -0.6%, but investors are hoping for a rebound in August, with sales forecasts for a 0.3% increase.

Learn about the most important economic data and events that will affect the performance of the dollar this week:

The beginning will be on Tuesday with the release of the ISM Manufacturing PMI. The important sector witnessed a contraction in the latest issue as the trade dispute with the second largest economy in the world continues, and after falling to 49.1, it is expected to rebound to 50.4 in this release. The sector is likely to decline if the global trade war lasts longer.

Wednesday: The ADP Non-Farm Payroll Survey will be announced in the United States, and it is an early indicator of new jobs and is usually released before the official jobs report. After adding 195,000 jobs in the previous release, the index is expected to fall to only 140,000 new jobs.

Thursday: The ISM Services PMI is released and the US service sector remains strong and unaffected by the trade dispute with China. The latest reading of 56.4 is expected to reach 55.1 and as long as it is above the 50 level it will maintain its strong growth.

Friday: It will be the most important and most influential day on the US dollar, as investors awaits the US jobs report figures by the Labor Department amid expectations that the US economy will add a total of 140,000 new jobs in the non-farm sector after it recorded 130,000 jobs in the latest release. Average hourly earnings are expected to fall to 0.3% from a 0.4% rise in the previous release. The US unemployment rate will remain unchanged at 3.7%. Any weaker-than-expected results could weigh on the US dollar and increase pressure on the Federal Reserve to make further rate cuts.

At the end there will be remarks by Federal Reserve Governor Jerome Powell.

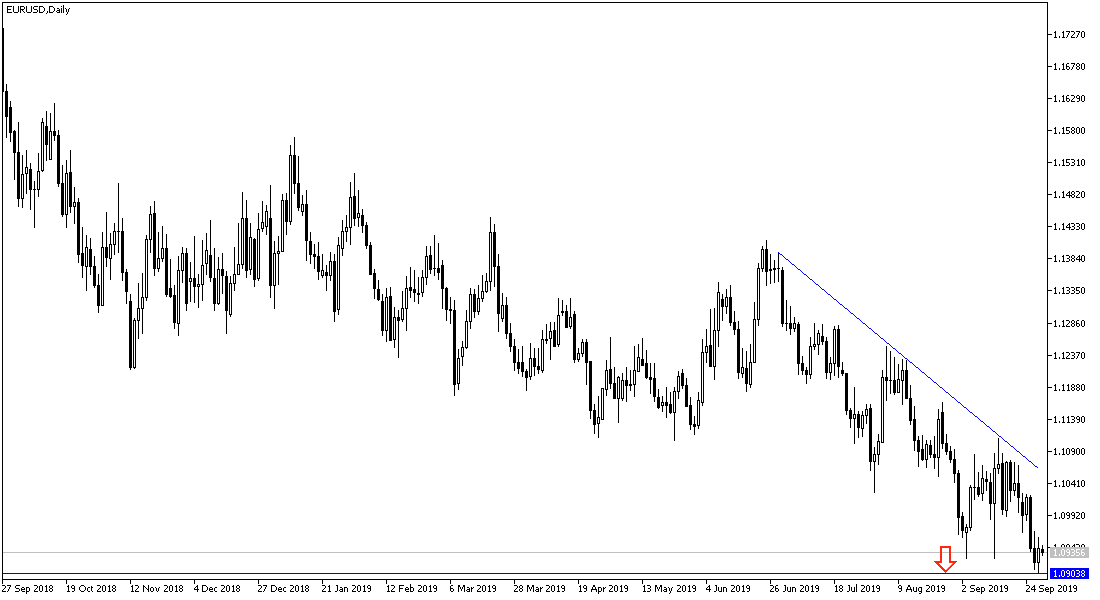

EUR/USD technical outlook for this week:

The general trend for EUR/USD will remain bearish as it fails to cross the 1.1000 psychological barrier. The slowdown in the Eurozone economy continues to negatively affect the single European currency, and the deflation period seems to be prolonged despite the recent ECB stimulus measures. Weak global conditions and the US-China trade war have caused heavy losses in Germany's manufacturing sector and the rest of the bloc's economies. At the same time, if Britain leaves the EU without a deal, the EU economy will be affected as well, and this could hurt sentiment towards the euro.

The most important support levels for the EURUSD this week: 1.0845, 1.0690 and 1.0580 respectively.

The most important resistance levels for the EURUSD this week: 1.1025, 1.1130 and 1.1345 respectively.