The AUD/USD pair continued its decline as losses reached the 0.6738 support, before closing the week around 0.6765, and the pair's losses may increase further as markets look for a new opportunity to cut interest rates. The disappointing results of Australian PMIs are a confirmation that the RBA's rate cut is in the right move to counter the slowing economy due to the global trade war continuation.

For the results. Australia's manufacturing PMI fell to the contraction zone (49.4), after a series of readings above the 50 level, which separates growth from deflation. The Australian Services PMI improved to 52.5, indicating weak growth.

From the United States, the most prominent headline in global markets was the isolation of Trump- where Democrats began the impeachment proceedings against US President Trump, after a leaked phone call showed that Trump discussed the business dealings of Joe Biden, the presidential contender, with the Ukrainian president. There were no surprises from the third estimated GDP for the second quarter, which came in at around 2.0%. Confirming the second estimate. This was well below the strong gains of 3.1% in the first quarter. Durable goods orders were better than expected - a reading of 0.2% while core durable goods orders posted a gain of 0.5%.

Learn about the most important economic data and events that will affect the Australian dollar this week:

The Australian dollar will react to the release of official and independent Chinese manufacturing PMI, as China is Australia's largest trading partner. On Tuesday, the most significant event affecting the Australian dollar will be announced; which is an interest rate decision from the RBA. A stronger expectation is that the RBA will cut interest rates from 1.00% to 0.75%. Although interest rate cuts have already been priced in by the markets, the move could push the Australian dollar lower. Investors will also monitor the RBA's rate statement.

Friday. Australian retail sales figures will be released and will also have a strong impact on the performance of the Australian dollar. By the end of the week, the Reserve Bank of Australia will release its financial stability report. The Central Bank publishes it twice a year. Apart from assessing stability, the publication also provides economic figures and may indicate current and future monetary policy.

Learn about the most important economic data and events that will affect the performance of the dollar this week:

The beginning will be on Tuesday with the release of the ISM Manufacturing PMI. The important sector witnessed a contraction in the latest issue as the trade dispute with the second largest economy in the world continues, and after falling to 49.1, it is expected to rebound to 50.4 in this release. The sector is likely to decline if the global trade war lasts longer.

On Wednesday, the ADP Non-Farm Payroll Survey will be announced in the United States, and it’s an early indicator of new jobs, and is usually released before the official jobs report. After adding 195,000 jobs in the previous release, the index is expected to fall to only 140,000 new jobs.

Thursday, The ISM Services PMI is released, and the US service sector remains strong and unaffected by the trade dispute with China. The latest reading was 56.4, and is expected to reach 55.1, and as long as it is above the 50 level it will maintain its strong growth.

Friday. It will be the most important and most influential day on the US dollar, as investors await the US jobs report figures by the Labor Department amid expectations that the US economy will add a total of 140,000 new jobs in the non-farm sector after it recorded 130,000 jobs in the latest release. Average hourly earnings are expected to fall to 0.3% from a 0.4% rise in the previous release. The US unemployment rate will remain unchanged at 3.7%. Any weaker-than-expected results could weigh on the US dollar and increase pressure on the Federal Reserve to make further rate cuts.

At the end, there will be remarks by Federal Reserve Governor Jerome Powell.

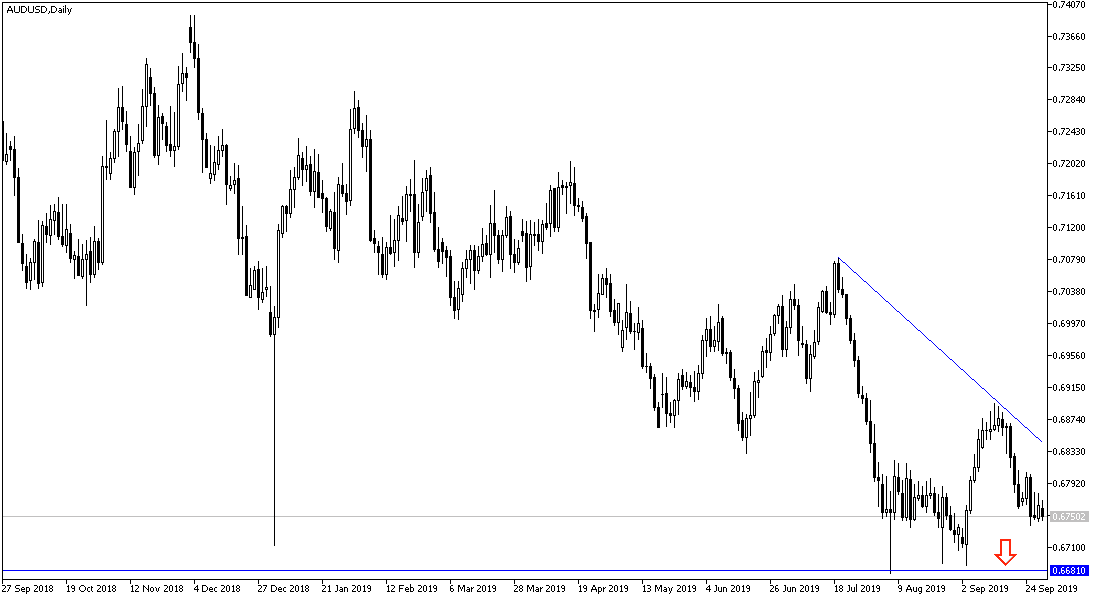

AUD/USD technical outlook for this week:

The general trend of AUD/USD remains bearish as long as it remains below the 0.7000 psychological resistance level. The RBA has cut interest rates twice this summer and is expected to cut rates again this week. This pessimistic stance points to concerns about the strength of the Australian economy, so the Australian dollar may lose some of its attractiveness to investors, which would be in favor of the US dollar.

The most important support levels for the AUD against the USD this week are: 0.6685, 0.6530 and 0.6460 respectively.

The most important resistance levels for the AUD against the US this week: 0.6830, 0.6988 and 0.7085 respectively.