Is the Bitcoin market one that you should be interested in? The answer may be yes, but the entry point will depend on what type of investor you are. This special blog, provided by Alan Edwards of will provide some insight for investors and traders who are considering whether to enter the market of the crypto currency Bitcoin.

Alan Edwards is a Quant Strat with 15 years experience in risk management in The City of London.

Bitcoin market problems

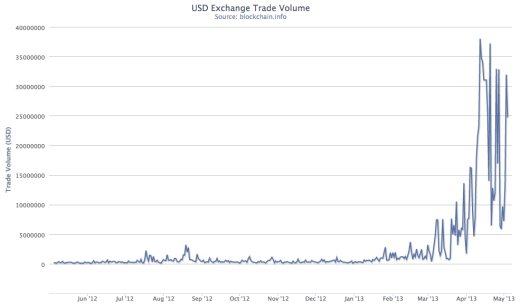

Liquidity concentration risk is a major problem for variety of reasons, the currency needs to penetrate more into the world economy to increase diversification and the infrastructure of exchanges need to be more robust. Until risk concentration diversifies and exchanges increase in size, robustness and quality, Bitcoins will remain a high risk asset that can only be traded in relatively small volumes with high spreads and lag that makes leveraged trading unfeasible. In traditional Forex economic news events are the primary source of valuation volatility. The concentration of volatility around publication of key economic data acts as the drivers for trends on the market. Without the underlying financial fundamentals of currencies, Bitcoin valuations are not driven by the same drivers which will require Bitcoin FX traders to develop new valuation methods in a very dynamic environment. As a result the number one concern for traditional investors is the unpredictable volatility which the above all contribute to to different degrees. But Traders love volatility, at least volatility that they can predict trends from.

Who, Why, and How one should invest in Bitcoin

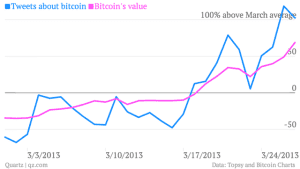

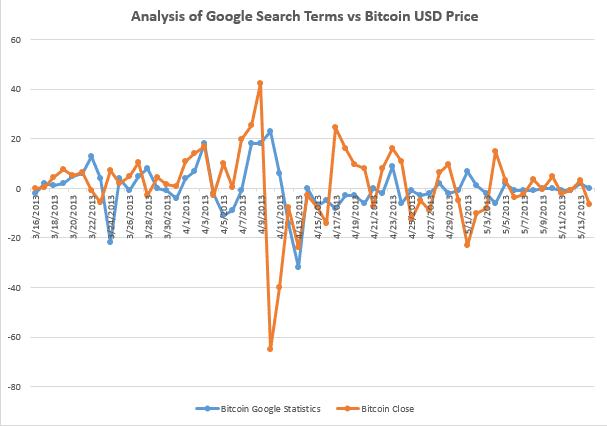

The above chart that has been widely circulated suggests that Bitcoin's value is driven by media interest, though it is so broadly presented that you could conclude quite a number of relationships or not between media and Bitcoin valuations. A comparison of 2 normalized sets of data below based on Google Trend data and Bitcon Close prices shows that the media interest lags the valuation changes, reflecting the interest of main stream media following the reporting of large changes in the price. Media spikes are therefore not driving the price, just lagging the reporting of the price changes which are being driven by geo political events and normal momentum based dynamics of an Forex market (admittedly a not very dynamic one).

An important aspect of this relationship in financial engineering terms is the potential for Graph Theory to replace the financial engineering framework which like Value at Risk we already know does not work. Bitcoin and Graph Theory will provide the missing link between the market momentum of psychology and the index price changes.

The Bitcoin economy outside speculation is largely driven by the miners or early participants who have acquired Bitcoins and are in the money, which means that have a specific reason that they want to use Bitcoins as a traditional currency. They do not have to worry about "?moneyness" of their position and will spend them alongside real world currency. The Bitcoin scheme is a rare example of a large scale global payment system in which all the transactions are publicly accessible (but in an anonymous way). Drawing from the analysis here and the inherent risks of the current infrastructure entering the market now to actually own Bitcoins in any serious quantity is only advisable for long term investors, who can afford to, or have the knowledge to both acquire and to secure Bitcoins in large quantities. After the event hedging of Bitcoins rather than predictive hedging, as a consequence of the problems raised above, makes long term investment the current optimal solution for Bitcoin ownership. Accurate price prediction is difficult but expected returns within the year would make this type of investment worthwhile.

If you're a trader who wants to take advantage of Bitcoin volatility and sufficient knowledge or systems to manage the volatility, it may be recommend to try spread betting with established institutions that have begun to offer these services. Still, spread betting provides a limited form of access to the underlying currency for traders and will always be secondary to real time broker based leveraged trading. Fortunately trading Bitcoins alongside traditional currencies will soon be a reality with brokers like OANDA already making announcements that indicate interest in future Bitcoin services. This is just further confirmation that the ecosystem around Bitcoin will grow and improve, and that the Bitcoin ecosystem looks more promising than ever.

The Future of Bitcoin

There is a rapid transformation taking place, with payment system providers such as PAYPAL and Venture Capitalists are all talking very publicly about their interest in Bitcoin. Google has entered the market in support the Bitcoin competitor, Opencoin. Silicon Valley is taking notice. The moment Paypal/OANDA confirm their future relationship with crypto currencies (yes there are many: Litecoin, PPcoin, and Terracoin to name a few) will be the alarm for you to start preparing for Bitcoin professional trading.

Bitcoin's geopolitical independence makes it perfect for trading since it can achieve what other currencies cannot; a purely market-driven currency free from political intervention by the states it is backed by. There is nothing to stop the USD being replaced by a crypto currency as a reserve currency. In fact in a world of economic currency wars, having a stateless currency such as Bitcoin could be considered to be an ideal scenario. If western financial interests continue their program of regulation to squelch Bitcoin, expect other markets to step up to the plate, adopt crypto currencies, and provide markets. Imagine if the Asian axis Hong Kong adopted Bitcoin as standard, essentially weaponizing cryptocurrencies against western currencies. Imagine rebel BRICS deciding to use Bitcoin as their currency of choice for trade. The 'game' of Bitcoin is not controlled by any nation, its regulators or its banks, it is a GLOBAL phenomenon, one entering existing currency wars.

Bitcoins are no more vulnerable than the rest of the financial system. If authorities were to close down the internet, how safe is any wealth stored electronically? Bitcoin has no central servers and the encrypted Bitcoins remain on your computer. The question, "how do you access your funds when the government shuts down the net?" applies to ATM networks and traditional banking just as much as it does to Bitcoin. Purists will point out that gold or cash doesn't need any power source to operate as Bitcoin does, to which It has been said,

Bitcoin's real opportunity comes when brick and mortar merchants adopt Bitcoin to save what have become for them exorbitant transaction fees, and adding to their bottom line. The markets will adjust to to these realities in order to participate in the opportunities Bitcoin and other crypto currencies present for investors. $1 billion in Bitcoin was traded in April - 16x the young currency's previous record. Whether Bitcoin behaves like a currency or a commodity is still being argued, while the markets for them only seem to be growing, and services in the Bitcoin environment are sprouting up from Main Street to Wall Street.

Bitcoin will not disappear or implode in the short term, though we expect to see a lot of price fluctuations occurring as institutional players from many sectors stake their claims both ideological and financial. There will be a storm of VC capital looking to get on the gravy train, and the normal rules apply: there will be winners and losers, a shakeout, and repositioning as events drive and influence each other.

Bitcoin will not disappear or implode in the short term - expect the midterm to be volatile but always on upward trend. Bitcoin is in fixed supply, just like land, but infinitely divisible, deflationary, and decentralized. Remember the digital 'real estate land grab' that the internet unleashed? Apply that concept to enforced scarcity baked into the digital protocol of a currency, outside of central control. There will be competition for the possession and use of this resource, just as there has been for other digital resources such as Intellectual Property. Bitcoin is nothing less than the digital expression of the idea of what a currency both is, and can be - a medium of exchange with an applied value agreed upon by various actors through the unfettered market of transactions utilizing it, competing to determine its value.

Though only available in fixed, limited supply, Bitcoin has demonstrated the demand for an exchange currency not controlled by a central authority. There is no central point to shut Bitcoin down. You can't point a gun at a prime number and expect things to change. And we all know how effective governmental attempts to shut down peer-to-peer networks have been. The digitalization of entertainment disrupted copyright monopolies, 3D printing machines are disrupting production monopolies, and crypto currencies are going to disrupt transaction monopolies.

Nobody can predict the long-term possibilities for Bitcoin. Either Bitcoin is worth zero, or is worth 10,000 to 100,000 each. It will take years for the market to figure out which it is. Until then, don't expect Bitcoin to go away.