Editor’s Verdict

XTB, owned by the Polish-based and publicly listed XTB Group, established itself as a trusted market leader for Forex and CFD traders. It offers traders its proprietary xStation 5, a choice of more than 4,000 assets, deep liquidity, and a highly competitive commission-free cost structure. I reviewed XTB to determine if it offers traders a competitive edge. Should you open an account with XTB?

Overview

I like the transparency and security at XTB, which continues to expand its asset selection. XTB also maintains one of the cheapest commission-free trading cost structures due to its in-house liquidity service, X Open Hub, with 100+ partnerships in 30+ countries offering liquidity on more than 5,000 assets.

Review

Headquarters | United Kingdom |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2002 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Trading Platform(s) | Proprietary platform |

Average Trading Cost EUR/USD | 0.1 pips ($1.00) |

Average Trading Cost GBP/USD | 0.2 pips ($2.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.36 |

Average Trading Cost Bitcoin | $100.00 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

XTB - First look:

- Well-regulated with quarterly financial reports, audited by external auditors

- Low commission-free trading costs and high leverage of 1:500 for most international traders

- Competitive proprietary trading platform for manual traders

- 440,000+ traders with a remarkable growth rate over the past two years, client list more than doubling

- The MT4 trading platform is not offered and algorithmic trading is not supported

- Quality education for beginner traders

- XTB, a member of the Polish-based XTB Group, became the first CFD and Forex broker established in Poland in 2002 under the name X-Trade

- It rebranded into XTB in 2004 to comply with new regulations and became authorized by the Polish Financial Supervision Authority, Komisja Nadzoru Finansowego (KNF)

- In 2007, XTB became a member of the Warsaw Stock Exchange and the Polish National Clearing House, followed by a listing in 2016

XTB Overview of Main Features

Retail Loss Rate | 76.00% |

|---|---|

Regulation | Yes |

Average Raw Spreads | Not applicable |

Average Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | Commission-free |

Cashback Rebates | Yes |

Minimum Deposit | $0 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | Yes |

Inactivity Fee | $10 monthly after 12 months of inactivity |

Deposit Fee | Third-Party |

Withdrawal Fee | Yes + Third-party |

Funding Methods | 5 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. XTB presents clients with nine regulated entities, including one tier 1 jurisdiction (the UK).

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Poland | Komisja Nadzoru Finansowego | KRS # 0000217580 |

Belize | International Financial Services Commission | 000302/185 |

UK | Financial Conduct Authority | 522157 |

Turkey | Sermaye Piyasası Kurulu | FSA License Number SD076 |

Cyprus | Cyprus Securities and Exchange Commission | 169/12 |

Spain | Comisión Nacional del Mercado de Valore | Undisclosed |

Germany | Bundesanstalt für Finanzdienstleistungsaufsicht | Undisclosed |

France | Banque de France | Undisclosed |

Portugal | Comissão do Mercado de Valores Mobiliários | Undisclosed |

What could be better?

- Profiles of core management

Noteworthy:

- The UK subsidiary has an investor compensation fund of up to £85,000

- The CySEC subsidiary offers an investor compensation fund up to 90% or €20,000 of deposits but more restrictive trading conditions

- All client deposits above $20,000 have an Excess of Loss Policy with Lloyd’s of London up to $1 million

- XTB has a clean regulatory track record

- Since XTB is a publicly listed company, it adheres to strict capital requirements and external audits, adding an essential layer of security

- XTB changes auditors every two years but always picks one of the “Big Four” firms

- Client deposit remain fully segregated from corporate funds at all subsidiaries

XTB has earned a reputation as a trustworthy and secure multi-asset broker, deservedly so, and maintains an exemplary track record with all its regulators.

Fees

Average Trading Cost EUR/USD | 0.1 pips ($1.00) |

|---|---|

Average Trading Cost GBP/USD | 0.2 pips ($2.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.36 |

Average Trading Cost Bitcoin | $100.00 |

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

XTB offers traders the following cost structure:

- Commission-free trading costs average a minimum of 0.5 pips or $5.00 per 1 standard round lot

- XTB lists raw spreads of 0 pips in its website, apparent from its commission-based account, which XTB no longer offers, and another section notes them as 0.1 pips

Noteworthy:

- The commission-free cost structure is one of the cheapest industry-wide

- XTB offers commission-free CFD trading but adds a 0.30% mark-up on market spreads

Here is a screenshot of the XTB quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

What could be better?

- XTB has not clearly update all aspects of its website to communicate precisely current trading costs

XTB offers floating spreads and excellent minimum and average ones, thanks to its X Open Hub service.

The minimum trading costs for the EUR/USD in the commission-free XTB account:.

Minimum Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.5 pips | $0.00 | $5.00 |

Noteworthy:

- XTB maintains a volume-based cash rebate program, ideal for high-volume traders, as it lowers final trading costs

- Cryptocurrency traders pay a $4.00 commission per contract

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- XTB offers a positive swap on qualifying short positions, meaning traders get paid money to hold trades overnight

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free XTB account.

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the minimum spread, and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.5 pips | $0.00 | -$4.525 | X | $9.525 |

0.5 pips | $0.00 | X | -$1.032 | $6.032 |

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the minimum spread, and holding it for seven nights will cost the following::

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.5 pips | $0.00 | -$4.525 | X | $36.675 |

0.5 pips | $0.00 | X | -$7.224 | $12.224 |

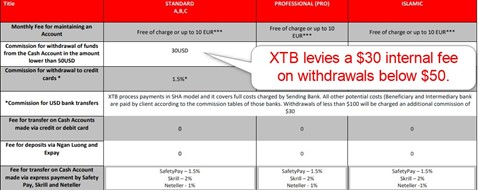

My additional comments concerning trading costs at XTB:

- XTB levies a $10 monthly inactivity fee after twelve months

- Withdrawals below $50 face an extra cost of $30

- Islamic accounts are charged a commission of $10 per 1.0 standard lot

- Trading costs vary between regulatory jurisdictions, creating advantages for some traders and disadvantages for others

- XTB does not list currency conversion fees

What Can I Trade

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

XTB offers a well-balanced asset selection, noting 2,100+ assets, while its trading platform page states 4,000+ assets, and its institutional liquidity service lists 5,000+. The final choice depends on geographic location, but XTB serves most traders well.

It is also an excellent choice for equity traders and asset managers with a preference for equity trading and well-sourced cross-asset diversification opportunities.

What could be better?

- I would prefer more currency pairs and cryptocurrencies

- A broader choice of ETFs

Asset List and Leverage Overview

| Currency Pairs | 57 |

| Cryptocurrency Pairs | 14 |

| Commodities and Metals | 24 |

| Index CFDs | 37 |

| Equity CFDs | 1,850 |

| Bonds | 0 |

| ETFs | 138 |

| Options, Futures, and Synthetics | 0 |

| Maximum Retail Leverage | 1:500 |

| Maximum Pro Leverage | 1:500 |

XTB Leverage

Retail traders at the Belize subsidiary get maximum Forex leverage of 1:500.

The other operating subsidiaries limit retail Forex leverage to 1:30, which is mostly imposed on XTB by local regulation.

Other things worth noting about XTB leverage:

- Negative balance protection exists, ensuring traders never lose more than their deposit

- Various assets have lower maximum leverage than the general cap, which XTB lists on its website

XTB Trading Hours (GMT +1 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 04:00 | Saturday 22:00 |

Forex | Sunday 23:00 | Friday 22:00 |

Commodities | Sunday 24:00 | Friday 23:00 |

European CFDs | Monday 09:00 | Friday 17:30 |

US CFDs | Monday 15:30 | Friday 22:00 |

Noteworthy:

- Equity markets open and close each trading and are not operational continuously like Forex or cryptocurrencies

- XTB does not offer 24/7 cryptocurrency trading, as it disables it for six hours

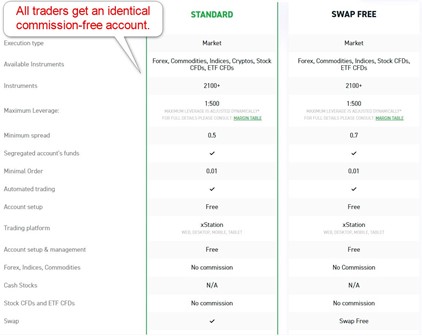

Account Types

XTB presents traders with an identical CFD account type, with the primary difference in the regulatory jurisdiction and various restrictions.

My observations concerning the XTB account types:

- There is no minimum deposit

- Traders get a minimum commission-free spread of 0.5 pips, placing it among the cheapest brokers

- A swap-free Islamic account is available, where the minimum spread increases to 0.7 pips and a $10 commission applies

- Most retail traders will deal with the Belize subsidiary, where XTB offers its most flexible trading conditions

- The maximum Forex leverage is 1:500, but various assets have different lower maximums, which XTB lists on its website

- XTB only offers its proprietary xStation 5 trading platform, which lacks support for algorithmic trading, despite XTB noting automated trading in its account descriptions

Noteworthy:

- Despite the absence of a commission-based account, XTB maintains an excellent infrastructure for manual scalpers

- A volume-based cash rebate program exists, lowering trading costs for high-frequency traders

XTB Demo Account

XTB offers demo accounts but restricts them to a length of 30 days after which they expire, which is disappointing. While a 30-day demo account can allow traders to familiarize themselves with the trading platform functionalities of xStation 5, it is not long enough to effectively forward test trading strategies.

I want to caution beginner traders against using a demo account as an educational tool. It can create unrealistic trading expectations, as the psychological conditions of trading real money usually is a very different experience.

My recommendation:

- Traders must have an alternative broker to test their trading strategies, a regrettable oversight by the XTB management team

Trading Platforms

XTB offers xStation 5, its proprietary trading platform available as a desktop client, web-based alternative, and mobile app. It presents manual traders with an excellent trading environment. The design is user-friendly, and xStation 5 comes equipped with in-house analytics by XTB. Regrettably, it does not support automated trading.

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Notable xStation 5 features:

- User-friendly interface

- Choice of over 4,000 tradable assets

- A charting package allows manual traders to conduct proper research

- The trading platform features easy order placement and risk management

- In-house analytics assist traders with broad market coverage

- XTB also provides a market sentiment indicator based on positions by its traders

Overview of Trading Platforms

MT4 | No |

|---|---|

MT5 | No |

cTrader | No |

Proprietary Platform | Yes |

Automated Trading | No |

Social Trading / Copy Trading | No |

MT4/MT5 Add-Ons | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | User-friendly interface for manual traders |

Unique Feature Two | Low trading costs and deep liquidity |

Unique Features

XTB cannot really be said to offer specific unique features, instead XTB focuses on its core trading environment. It offers manual traders a competitive platform, low trading costs, and a broad asset selection suited for all traders and asset managers, which is much more important than any gimmicks.

One feature worth mentioning in this content is XTB’s institutional liquidity provider X Open Hub, which has more than 100 partnerships in over 30 countries, resulting in one of the lowest trading cost offerings to for retail traders in the market.

Research and Education

XTB provides daily market commentary and trading charts in its Market News section. Some are written-only, and others include charts but omit actionable trading ideas. Most articles are free, but some pieces require an XTB account for access. The overall research section is acceptable but lacks the quality of XTB’s core trading environment.

Beginner traders have a well-structured Trading Academy, where five subjects introduce the basics of trading together with more advanced topics, consisting of 35 lessons. It includes a brief MT4 tutorial despite the discontinuation of the trading platform by XTB.

Each lesson lasts for less than twenty minutes, enough time to fully cover the topics without overwhelming traders. They consist of videos, quality written content, charts, and examples with swift navigation and a user-friendly design. The XTB Trading Academy represents a hidden gem and is a must-read for new traders.

My takeaways:

- Beginner traders have access to a high-quality educational section

- XTB offers acceptable research but lacks actionable trading ideas

My recommendations:

- Traders can access free research and trading ideas elsewhere online

- Beginner traders may seek additional content-specific educational material to supplement the quality Trading Academy at XTB

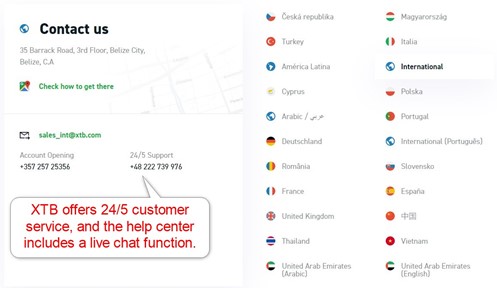

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |              |

XTB provides 24/5 multi-lingual customer support, but traders should access the help center before contacting support, where a live chat function is also available.

The help center answers 35 questions. Should traders require additional assistance, XTB ensures it is available 24/5.

My recommendations and observations:

- Traders should read the help center before reaching out to a customer service representative

- For non-urgent questions, I recommend live chat

- XTB maintains 24/5 phone support but no finance department hotline

Bonuses and Promotions

Traders from select jurisdictions may participate in a cashback promotion, rewarding high-frequency traders based on total monthly volume. Terms and conditions apply and interested traders may inquire about eligibility with customer support.

XTB also offers an attractive affiliate program, ideal for traders seeking a passive income stream to supplement their trading revenues. Affiliates may choose a three-tier CPA system or a 20% revenue share. The minimum deposit for qualified referrals is $400, something affiliates must consider.

Awards

Since 2019, XTB has received seven industry awards from well-respected sources. They are a statement of the ongoing efforts by XTB to maintain a competitive edge for its clients.

The seven XTB awards are:

- Best Polish Forex Broker - Invest Cuffs 2019

- Best Mobile App for Investing - Rankia Awards 2019

- The Best Execution Broker - Technical Analysis Exhibition 2019

- Best Mobile App for Investing - Rankia Awards 2020

- Best Forex Broker for Low Costs - Investopedia 2021

- Best NDD Forex Broker - Online Personal Wealth Awards 2021

- Best Customer Service - ForexBrokers.com 2021

I highlight the awards for low costs, best execution, and best NDD environment, as they are three areas that directly impact trading costs and profitability of traders.

Opening an Account

An online application processes new accounts, following well-established industry practices. The multi-step process takes several minutes to complete.

Account verification is mandatory, and most traders will pass it after sending a copy of their ID and one proof of residency document. XTB has been known to verify accounts in a matter of minutes if clients forward the required documentation.

Minimum Deposit

There is no minimum deposit at XTB.

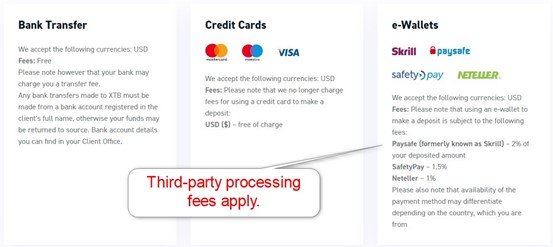

Payment Methods

XTB accepts bank wires, credit/debit cards, Skrill, Neteller, and SafetyPay. Availability of payment methods remains impacted by the geographic location of traders.

Accepted Countries

XTB caters to most international traders, including residents of the UK, Portugal, Romania, and India. Like most international brokers, XTB does not accept US persons as clients.

Deposits and Withdrawals

All financial transactions occur in the secure back office of XTB. The deposit and withdrawal options from the Bermuda subsidiary are the best, while others offer a more limited range of choices.

My observations:

- There is no minimum deposit at XTB

- XTB processes most withdrawal requests within 24 hours

- Regional payment processors are available in select geographical locations

- Deposits via bank wire and credit/debit cards do not incur a fee, but e-wallets face up to 2% of the deposit amount

- Withdrawal charges apply, both from XTB and payment providers

- Withdrawals below $50, or $100 for bank wires, face an internal XTB charge of $30

- Costs and processing times depend on the payment processor

- The overall choices are acceptable, but there is room for significant improvement

- XTB does not support cryptocurrency deposits

My recommendations:

- Traders should select the payment processor with the lowest fees

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations

The Bottom Line

I like the trading environment at XTB for its low trading costs and well-balanced asset selection. Regrettably, XTB discontinued MT4 and its support for algorithmic trading. Therefore, it only caters to manual traders from its proprietary xStation 5, a competitive trading platform. Beginner traders get a high-quality educational platform. XTB is a publicly listed CFD broker with an excellent regulatory track record and continues to expand its client base. Traders seeking the most flexible trading environment XTB offers will find it at its Belize subsidiary. Overall, XTB maintains a quality product and services portfolio and deserves genuine consideration by any manual trader.

For the best broker alternatives to XTB, Please review our page that compares 5 XTB alternative brokers. XTB is publicly listed, has nine regulators, offers an excess of loss insurance covering traders up to $1M, and has an exemplary track record, making it a legitimate multi-asset broker. XTB has regulatory oversight from nine regulators: the KNF, the IFSC, the FCA, the CMB, the CySEC, the CNMV, the BaFin, the ACPR, and the CMVM. XTB offers a broad asset selection, its proprietary xStation 5 trading platform, and a competitive cost structure. It is a well-regulated and publicly listed CFD broker and classifies as a good broker, especially equity traders. XTB is a market maker broker and profits directly from client losses where it acts as the counterparty. Yes, XTB allows scalping. Maximum leverage at XTB depends on the operating subsidiary, but traders are allowed a maximum leverage of 1:500 under the IFSC-regulated entity. No, XTB is not an ECN broker, it is a market maker.FAQs

Is XTB legitimate?

Is XTB regulated?

What can you trade with XTB?

Is XTB a market maker?

Does XTB allow scalping?

What is the maximum leverage at XTB?

Is XTB an ECN broker?