Editor’s Verdict

Weltrade, founded in 2006, caters to 600K+ traders from 180 countries and features 30-minute withdrawals. It offers the core MT4/MT5 trading platforms, fully supports algorithmic and copy trading, maintains a high-paying partnership program, and generous bonuses and incentives. The low trading fees at Weltrade prompted my comprehensive review to determine whether traders get a competitive trading environment. Should you open and fund a trading account at Weltrade?

Overview

Low trading costs in a commission-free pricing environment with generous bonuses

Headquarters | Saint Vincent and the Grenadines |

|---|---|

Regulators | FSCA |

Year Established | 2006 |

Execution Type(s) | Market Maker |

Minimum Deposit | $1 |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 7 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the trading fees at Weltrade, which are competitive despite the commission-free pricing environment. The fast withdrawal times, including cryptocurrencies, and low minimum deposit requirements add to the Weltrade advantages. Active traders can benefit from generous incentives, and negative balance protection exists.

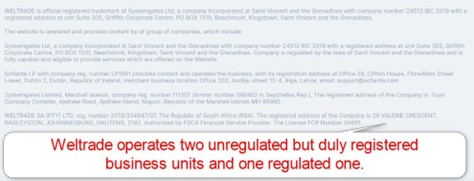

Weltrade Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Weltrade presents clients with one regulated entity and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

South Africa | Financial Sector Conduct Authority | 50691 |

St. Vincent and the Grenadines | Financial Services Authority | Unregulated but duly registered |

Marshall Islands | Global Financial Services Authority | Unregulated but duly registered |

Is Weltrade Legit and Safe?

Weltrade operates two unregulated but duly registered branches in St. Vincent and the Grenadines, its headquarters, company number 24513 IBC 2018, and the Marshall Islands, registration number 111207, relocated from Seychelles, company number 099482. Since 2022, Weltrade has also catered to clients from its regulated subsidiary in South Africa. Given the spotless operational record spanning 16 years and 600K+ traders from 180 countries, Weltrade provides its clients with a legit, safe, and trustworthy environment.

I would be pleased to see Weltrade add one additional security layer, either via a third-party insurance program or membership with the Hong Kong-based Financial Institution.

Fees

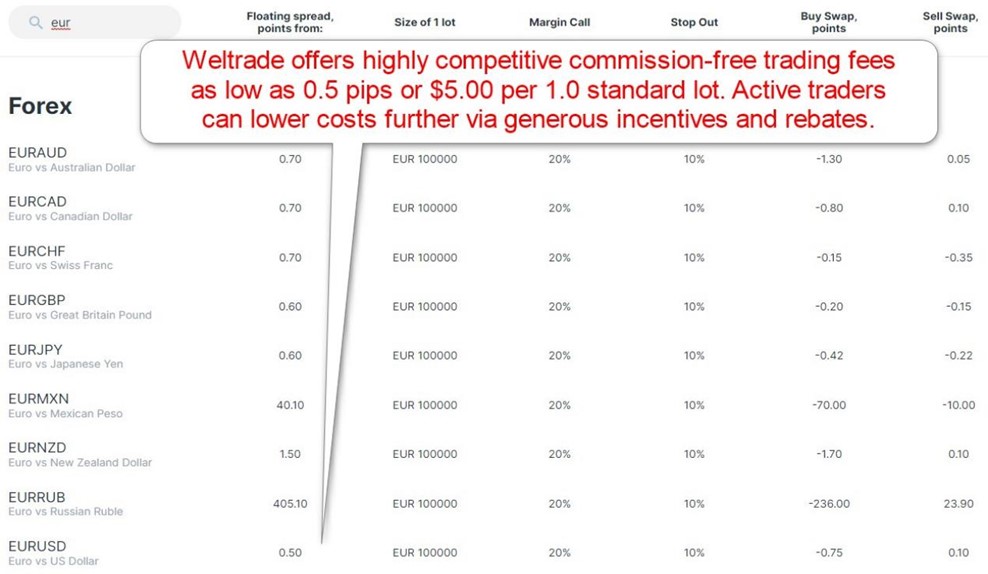

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Weltrade features one of the most competitive commission-free cost structures in the industry, with minimum high trading costs with spreads from 0.5 pips or $5.00 per 1.0 standard lot.

Minimum Raw Spreads | Not applicable |

|---|---|

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee |

Here is a screenshot of Weltrade quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The minimum trading costs for the EUR/USD currency pair at Weltrade are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.5 pips | $0.00 | $5.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Weltrade offers positive swap rates on qualifying short positions, where traders can get paid money to hold trades overnight.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Pro account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread in the commission-free Pro account and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.5 pips | $0.00 | -$7.50 | X | $12.50 |

0.5 pips | $0.00 | X | $1.00 | $4.00 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread in the commission-free Pro account, and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.5 pips | $0.00 | -$75.00 | X | $80.00 |

0.5 pips | $0.00 | X | $7.00 | -$2.00 |

Noteworthy:

- Traders can get paid money for holding positions overnight in select asses, assuming price action does not move, which is unlikely, but the example illustrates fair swap rates

Range of Assets

Forex traders have less than 40 currency pairs to choose from, which is a lower-range number but will be more than sufficient for most traders. Weltrade lists 6 commodities, and 14 index CFDs, while it has added 200+ equity CFDs focused on large-cap companies with higher leverage than the industry norm. Cryptocurrency traders get a choice of 39 crypto CFDs, an above-average choice of trading instruments for the sector. The overall asset selection suffices for beginner traders and scalpers requiring fewer but highly liquid assets.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

Weltrade Leverage

Weltrade offers maximum Forex leverage between 1:500 and 1:1000, dependent on the account type. Equity CFD traders operate with maximum fixed leverage of 1:100, five times higher than the industry standard, and cryptocurrency traders get maximum leverage between 1:3 and 1:100. Weltrade provides generous and flexible leverage. Traders should use strict risk management protocols if they use high leverage. Negative balance protection exists at Weltrade for all clients. This ensures traders cannot lose more than their deposits.

Weltrade Trading Hours (GMT +3)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:00 | Friday 23:59 |

Commodities | Monday 01:00 | Friday 23:59 |

European Equities | Not applicable | Not applicable |

US Equities | Monday 16:31 | Friday 22:57 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which essentially trade 24/5

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

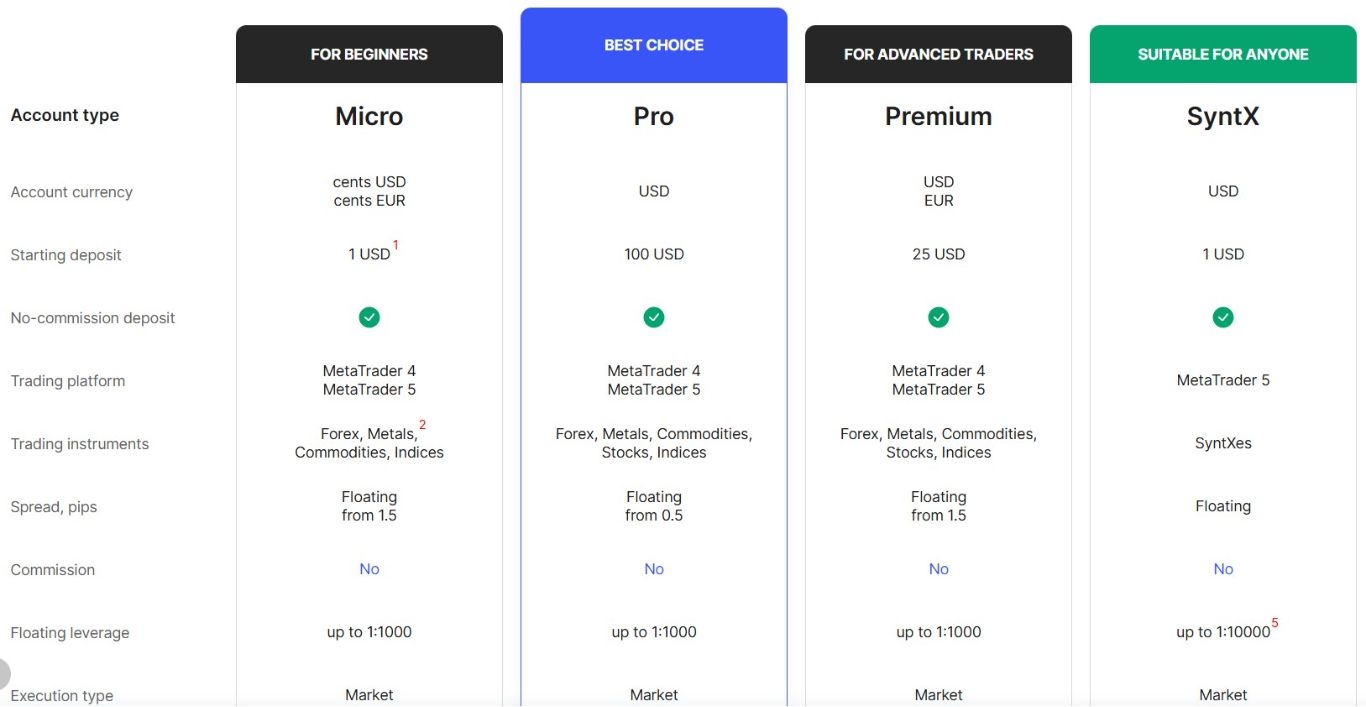

Account Types

Traders at Weltrade get a choice of 4 account types, consisting of:

- A Micro account, ideal for beginner traders to learn how to trade.

- A Pro account, which will be the best choice for most traders, and offers the most competitive trading fees, but requiring a minimum deposit of $100.

- A Premium account, which offers similar conditions to the Pro account but with a lower minimum deposit of $25.

- A SyntX account, which focuses on the trading of synthetic instruments, and offers a very high maximum leverage.

Weltrade Demo Account

Weltrade offers demo accounts, and I could not find a time restriction listed which implies they are offered at unlimited duration, making them ideal for algorithmic traders to bug-fix solutions, for traders to evaluate new strategies, and for beginners to get used to the trading platform. The MT4/MT5 trading platforms offer a demo registration, and I recommend traders use similar deposit balances and leverage settings as their planned live account.

While beginners may use a demo account to test account features and evaluate copy trading signal providers or EAs, I want to caution beginner traders against a demo account as an attempted full simulation. It creates unrealistic trading expectations, and the absence of trading psychology usually negates the simulation value. However, demo accounts are useful for learning the basics and for becoming familiar with a broker’s platform and user interface experience.

Trading Platforms

The core MT4/MT5 trading platforms, supportive of algorithmic and copy trading, are available as a desktop client, a webtrader, and a mobile app. Unfortunately, equity CFDs are only available on MT5. Manual traders get a user-friendly, lightweight, web-based trading platform that supports all assets and includes instant withdrawals. It has a cutting-edge charting package, and I recommend this platform for manual traders over the MT4/MT5 alternative.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

Weltrade presents its Safe Box service, a Euro and US Dollars depository earning between 2% to 6% annually, paid to clients monthly. The received interest depends on trading volume, and traders qualify with a minimum monthly trading volume of 5.0 lots. Weltrade features swift account transfers, allowing hassle-free access to accrued interest income.

It labels its service as a more profitable alternative to banks but does not list how it treats deposits, which differ from segregated account deposits. Therefore, while I like the appealing offer, interested traders must contact customer support and get written clarification about how Weltrade treats capital in its Safe Box.

Research & Education

Weltrade neither offers in-house research and market commentary nor sources it from third parties. It notes the availability of trading signals and EAs from within the MT4/MT5 platforms, and shows traders how to access them. While the absence of research creates a services gap to most competitors, I do not consider it a negative, given the availability online and free of charge.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |      |

Weltrade offers quality 24/7 customer support via e-mail, live chat, and a phone and call-back feature. Weltrade lists 16 customer support e-mails for its core markets, heavily focused on Asia and Latin America, and maintains eight representative offices, five in Asia and three in Latin America. I recommend live chat for non-urgent matters and the phone or call-back feature for pressing issues.

Bonuses and Promotions

Weltrade offers generous bonuses and incentives, which lie at the core of its growth strategy. They range from a 100% deposit bonus for MT5 trading accounts, demo contests for live cash deposits, partner promotions, and the Welcoin cashback program.

I recommend traders read the terms and conditions, understand how the bonuses work, and determine if they suit their trading style and if the rules are acceptable.

Opening an Account

Traders can open a Weltrade account via the online application in less than 20 seconds by submitting their name, e-mail, and phone number. Alternatively, traders may use their Google, Facebook, or Line IDs to register for a trading account. Weltrade does not collect unnecessary information and ensures a swift onboarding process..

Account verification is mandatory, and most traders will pass it after sending a copy of their ID and one proof of residency document. Weltrade might ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum initial deposit at Weltrade is between $1 and $200, while follow-on deposits depend on the payment processor.

Payment Methods

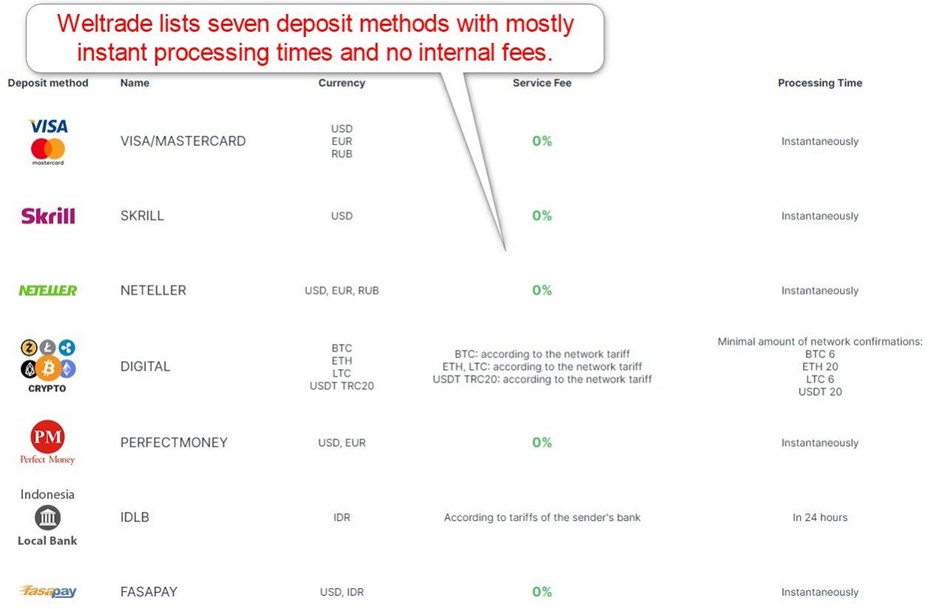

Weltrade notes 30+ payment methods but lists only 7. They consist of localized bank wires, credit/debit cards, Skrill, Neteller, Perfect Money, FasaPay, and cryptocurrencies.

Accepted Countries

Weltrade accepts traders resident in most countries except the USA, Canada, Belarus, Russia, and other unsupported countries it does not list specifically.

Deposits and Withdrawals

The secure Weltrade back office manages all financial transactions for verified clients.

Weltrade maintains a fast deposit and withdrawal procedure for verified clients, and the 7 payment processors include cryptocurrencies. Traders may deposit in US Dollars, Euros, Rubles, Indonesian Rupiah, Bitcoin, Ethereum, Litecoin, or USDT. A currency conversion fee between 1% and 2% may apply unless traders meet transaction minimums. The minimum deposit amounts between $1 and $200 ensure Weltrade remains accessible to all traders and offers flexibility to manage financial transactions free of broker-imposed minimums.

Processing times for most deposits are instant, and Weltrade notes it manages all withdrawal requests within 30 minutes, making it one of the fastest in the industry. Withdrawal fees apply, and traders should check third-party payment processing costs, but the overall deposit and withdrawal process is superb.

Is Weltrade a Good Broker?

I like the trading environment at Weltrade for beginners with smaller portfolios and traders who require fewer but highly liquid assets. The fast withdrawal processing times and low trading fees are notable. Weltrade offers its user-friendly web-based trading platform for manual traders. It caters to algorithmic and copy traders via MT4/MT5 but does not offer necessary third-party plugins or third-party services. Weltrade heavily relies on generous bonuses and incentives and features an interest-paying Safe Box service. With 16 years of experience, Weltrade established itself as a competent and competitive broker. Weltrade is not a scam but a legit broker with 16 years of experience and a spotless record. Weltrade has its headquarters in St. Vincent and the Grenadines and manages eight representative offices in Asia and Latin America. Weltrade is a trustworthy multi-asset broker offering a competitive trading environment and generous incentives. Weltrade offers low trading costs and fast withdrawal processing times. Traders get the MT4/MT5 platforms and a proprietary alternative. Overall, Weltrade established itself as a good broker, especially for beginners from Asia and Latin America.FAQs

Is Weltrade a scam?

Where is Weltrade based?

What is Weltrade?

Is Weltrade a good broker?