Editor’s Verdict

Overview

Review

Webull is a Chinese-owned, US-based brokerage offering its proprietary trading platform, an advanced mobile app, and a commission-free cost structure. It prides itself on its technology, counting Xiaomi and Shunwei Capital as its financial backers among other private equity firms. Webull provides traders with extended hours trading and promises advanced trading tools. I conducted an in-depth review to determine if Webull backs up its claims. Should you open an account at Webull?

Summary

Headquarters | United States |

|---|---|

Regulators | SEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2017 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $0 |

Trading Platform(s) | Proprietary platform |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like that Webull deploys a quality proprietary trading platform, but it lacks support for algorithmic trading solutions. Since Webull prides itself on technology, I find the absence of API trading unfortunate. Manual traders get access to Level 2 data, and extended hours trading provides a unique benefit for committed traders, unavailable at many competitors.

Webull Main Features

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Undisclosed |

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | Not applicable |

Minimum Deposit | $0 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | No |

Deposit Fee | Third-party |

Withdrawal Fee | Third-party |

Funding Methods | 2 |

Regulation and Security

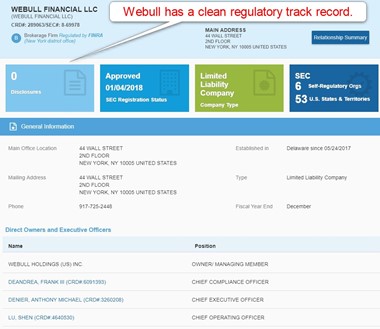

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Webull presents clients with one regulated entity.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

US | Securities & Exchange Commission (SEC) | Undisclosed |

My observations:

- The owner of Webull is Webull Financial LLC, a Chinese-owned, US-based company registered in Delaware by Wang Anquan, a former employee of Alibaba Group, who owns 35% of the Webull Financial LLC.

- Chinese electronics conglomerate Xiaomi owns 14% of Webull Financial LLC.

- Other notable owners include Shunwei Capital, Hongdao Capital, Bojiang Capital, and Gopher Asset Management.

- Webull Financial LLC is a broker-dealer registered with the Financial Industry Regulatory Authority (FINRA), the private US corporation acting as a self-regulatory organization (SRO) member brokerage firms and exchange markets.

- It is also a member of The New York Stock Exchange (NYSE), the NASDAQ, and the CBOE EDGX Exchange (CBOE EDGX).

- The Securities Investor Protection Corporation (SIPC), the federally mandated, non-profit, member-funded, US corporation, protects clients up to $500,000 per net equity or $250,000 for cash claims.

- APEX Clearing Corp is the clearing firm, which has taken an insurance policy of $150 million, with a $37.5 million limit per individual security claim and $900,000 for cash claims per client.

- Webull operates under a capable and competitive regulatory framework, where it maintains a spotless record.

- Client deposits remain segregated from corporate funds.

What is missing?

- Transparency concerning the corporate owner and core management team on its website, but it provides a link to the FINRA Broker Check, where clients can access some necessary information.

Webull follows the industry standard for US brokers with SEC regulation, FINRA membership, and SIPC protection. I like the clean regulatory track record at Webull, which some of its US-based competitors lack.

Noteworthy:

Webull Financial LLC initiated IPO talks in June 2021, valuing the financial firm at approximately $400 million.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability.

The Webull pricing environment consists of the following:

- Margin interest rates, or swap rates, on leveraged overnight positions

- Regulatory and exchange fees

- Exchange proprietary index fees

- Short-selling fees

Webull offers commission-free trading and does not profit from regulatory and exchange fees, as it merely passes them on from third parties.

Webull generates income through:

- Stock loans

- Interest on free credit balances

- Margin interest

- Selling its order flow information

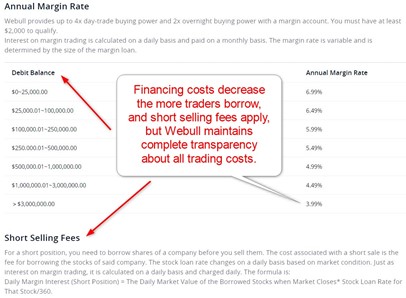

Here is an overview of the two most dominant fees at Webull:

Noteworthy:

- Webull does not advertize its spreads.

- The more capital traders borrow, the lower the financing cost, where Webull earns interest like a bank loaning capital to consumers.

- Financing costs are high compared versus US-based competitors and sometimes more than double many international competitors.

- Equity and ETF trades face a fee of $0.0000051 multiplied by the total US dollar trade amount with a minimum of $0.01 regulatory transaction fee per sell order, and a FINRA regulatory cost of $0.00013 multiplied by the total trade volume with a minimum of $0.01, and a maximum of $6.49 per transaction per sell order.

- Options trades pay the same regulatory transaction fee, plus a FINRA charge of $0.00218 multiplied by the number of contracts with a minimum of $0.01, and an options exchange levy of $0.02135 multiplied by the number of contracts per buy and sell orders.

- Index option fees range between $0.00 and $0.66 per contract.

My recommendation and observation:

- Each trader should check the costs applicable to them and understand the third-party costs involved.

- While Webull provides commission-free trading, it must substitute lost income elsewhere, which it does via higher financing costs and undisclosed compensation for payment for its order flow.

What is missing at Webull?

- Clarity about spread statistics, which Webull fails to publicly disclose.

My additional comments concerning trading costs at Webull:

- Webull does not charge an inactivity fee

- A $75 fee per outgoing stock transfer exists

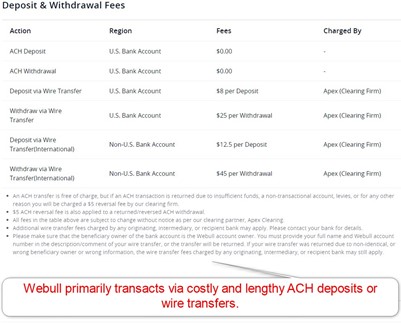

- Domestic deposits face an $8 cost, international deposits a $12.50 fee, charged by APEX Clearing Corp.

- Withdrawal charges, also by APEX Clearing Corp, are $25 for domestic and $45 for international withdrawals.

- The overall trading costs at Webull remain more competitive than most of its US-based competitors.

Webull Trading Hours

Asset Class | From | To |

|---|---|---|

Stocks (non-CFDs) | Monday 10:00 | Saturday 02:00 |

ETFs | Monday 10:00 | Saturday 02:00 |

Options | Monday 10:00 | Saturday 02:00 |

What Can I Trade?

Webull is primarily an equity broker, where its trading platform lists 7,016 equities from the NYSE, the NASDAQ, and the AMEX. It also offers 3,057 Canadian equities, including small caps listed on the TSXV, which I like, as it offers more trading opportunities for seasoned traders. Completing the equity selection are 4,687 Chinese stocks, making it ideal for traders seeking exposure to China.

ETFs are also available, with options contracts, nine currency pairs, and 48 cryptocurrencies.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Noteworthy:

- I’d like to see more information outlining available trading instruments, ideally via a product specification page.

- Webull offers fractional share dealing from as little as $5 on select equities and ETFs, assisting smaller portfolios with asset diversification, lowering their risk profile, and expanding their profit opportunities.

- OTC stocks are not available at Webull.

- IPO trading is available, but depends on whether Webull can secure stocks, which it claims remains a challenge for in-demand IPOs, while it works on improving access with its partners.

Webull Leverage

Traders get maximum leverage of 1:4 for day trading and 1:2 for overnight trading, which is the law in the USA but can be low compared to international brokers. However, if you want to trade US stocks, you can’t own these stocks with less margin even if you use an international broker.

Webull Trading Hours (EST)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | 24/7 | 24/7 |

Forex | Undisclosed | Undisclosed |

Commodities | Undisclosed | Undisclosed |

European CFDs | Undisclosed | Undisclosed |

US CFDs | Monday 04:00 | Friday 20:00 |

Noteworthy:

- Equity markets open and close each trading session and are not continuously operational like Forex and cryptocurrencies.

Account Types

Webull has a traditional brokerage account for all clients and added IRA (individual retirement account) accounts for retirement planning.

Traders can choose between the following:

- A cash account

- A margin account

- A traditional IRA account

- A Roth IRA account

My observations concerning the Webull account options:

- The cash account requires no minimum deposit but prohibits day trading, margin trading, and short selling.

- Webull lists a margin account with a balance up to $2,000 that allows traders to place three-day trades every five days but allows neither margin trading nor short selling.

- A margin account with a balance between $2,000 and $25,000 qualifies for maximum day trading leverage of 1:4 and overnight leverage of 1:2, can execute three day trades every five days, and can take short positions.

- Traders with an account balance over $25,000 trade free of day trading restrictions.

- Corporate accounts are available for a minimum deposit of $100,000, but Webull really lacks sufficient appropriate infrastructure to cater effectively to corporates.

Webull Demo Account

Webull offers unlimited Paper Trading from its trading platform, with two workspace set-ups and an option to customize one based on individual requirements. While the demo account can assist new clients in learning how to use the proprietary trading platform, I caution against using it to learn how to trade. Paper trading fails to showcase live trading results accurately for most traders and may promote wrong behavior.

My recommendation:

- I recommend traders use the demo account to familiarize themselves with the trading functions before opening a live account

Trading Platforms

Webull entered the US brokerage market as a mobile-first brokerage, a statement to its primary target group, millennial and GenZ traders with a preference for trading from their mobile devices. It created a cutting-edge mobile app, but I am pleased it expanded to offer a desktop trading platform and a lightweight web-based alternative.

Webull Mobile App features include:

- A clean user interface.

- Voice commands and voice-activated trading with features like buy, sell, and search.

- NASDAQ Level 1 and Level 2 quotes.

- Numerous order types for account and risk management.

Webull Desktop features include:

- 50 technical indicators and 12 charting tools

- Active trade widget supporting swift order placement using a price ladder, an option to reverse positions, cancel all open orders or close all trades with a one-click feature

- Paper trading

- A customizable workspace

- Heat maps

- Financial news and balance sheet information

- Order flow and analyst recommendations

- Corporate actions and SEC filings

- Option chains

- A profile of each company

- Watchlists

- A stock screener

- Account management

- Access to the Webull Learning Center

What is missing?

- Algorithmic or API trading

- Third-party developer support

- Multi-chart toggling

My observations:

- The absence of algorithmic trading places active algorithmic day traders at a distinct disadvantage.

- A first look at the workspace may overwhelm traders, but the user interface can be customized.

- The stock analysis screen remains clean and supports hassle-free manual technical analysis.

Overview of Trading Platforms

MT4 | No |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | No |

Social Trading / Copy Trading | No |

MT4/MT5 Add-Ons/Upgrades | Not applicable |

Guaranteed Stop Loss | No |

Negative Balance Protection | Undisclosed |

Unique Feature One | Broad-based equity and ETF selection |

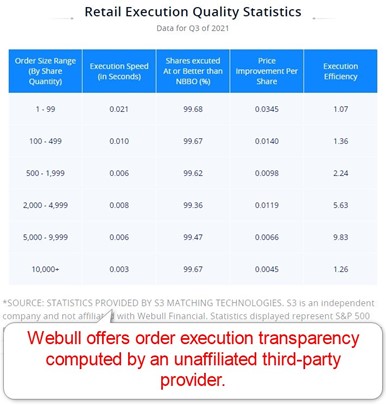

Unique Feature Two | Excellent order execution transparency |

Unique Features

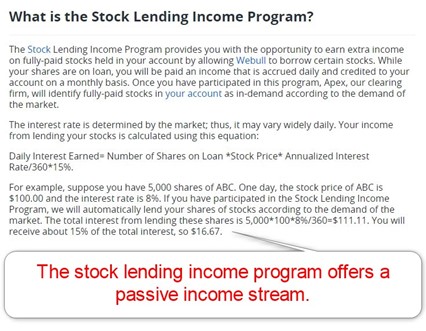

Webull offers a stock lending income program, where participating clients receive 15% of the earned interest, suitable for investors seeking a passive income stream.

I also like the Webull order execution quality and transparency, confirming an outstanding core aspect of its trading environment. Webull offers traders the possibility of price improvement and liquidity enhancement.

Research and Education

Webull is an execution-only broker focused on keeping trading costs low. It does not offer in-house research, and besides analysts' recommendations inside its trading platform, none is available.

The Learning Center grants new traders two videos and twelve tutorials about using the trading platform, while the blog features limited, isolated educational topics.

My takeaways:

- Research is not available at Webull, and traders must source it elsewhere.

- Webull does not offer beginner traders a dedicated educational platform, despite catering to beginner traders.

- The platform’s videos and tutorials explain core functions of the trading platform, flattening the learning curve for traders.

My recommendations:

- Traders can access research online free of charge or via subscriptions since Webull does not offer it.

- Beginner traders must source in-depth educational content elsewhere before trading at Webull.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Webull states 24/7 customer support but does not feature a detailed Contact Us section with details. It just provides an e-mail address and a phone number, and 24/7 support applies to e-mail only. Phone support is available during business hours, where traders may also reach out via live chat.

My observations:

- Webull relies on its FAQ section to answer most questions.

- Dedicated support for financial transactions, where most traders may face issues, is not available.

- Live chat and phone support operate during regular business hours only.

- Phone support is ideal for urgent questions, but traders report about long waiting times and no response.

- Traders also report that e-mail support responds within hours for basic requests but can take weeks for complex questions.

- In-app support is available with the same outcome as e-mail support.

- Webull should improve its customer support but scores better versus other brokers catering to millennial and GenZ traders.

Bonuses and Promotions

New traders get two free stocks after opening an account and once their initial deposit settles. It can take up to nine business days for traders to receive these bonus stocks. Webull also awards free stock for friend referrals and a $75 bonus for clients who transfer their accounts to Webull. Terms and conditions apply.

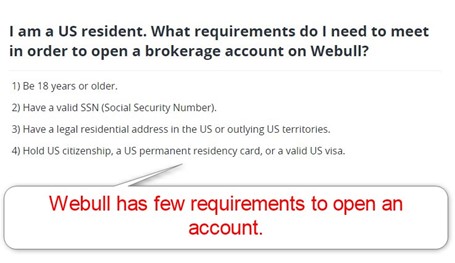

Opening an Account

Webull deploys a swift account opening process, which requires a valid mobile phone number to receive a verification code. This shows their dedication to keeping the account opening process uncomplicated while deploying a mobile-first approach, as demanded by its primary client base. New traders may also use their Google or Facebook accounts to open a brokerage account at Webull.

Account verification is mandatory, and most will satisfy it by sending a copy of their driver's license or passport.

Minimum Deposit

There is no minimum deposit at Webull, but margin accounts eligible for short selling require a minimum balance of $2,000, and unlimited day trading accounts must show a balance of $25,000.

Payment Methods

Webull offers bank wires and ACH plus broker-to-broker transfers above $500.

Accepted Countries

Webull only accepts US-based traders and operates a Hong-Kong subsidiary for Hong Kong-based clients. Traders from the UK, Australia, Malaysia, or Canada cannot open accounts at Webull.

Deposits and Withdrawals

All financial transactions take place in the secure back office of Webull. Regrettably, the options are limited, and I am missing the flexibility of many payment processors, but this is typical for US-based brokers.

My observations:

- Apex Clearing handles all transactions but only transacts via costly bank wires.

- ACH deposits take four business days to settle.

- Domestic deposits face an $8 cost, international deposits a $12.50 fee, charged by APEX Clearing Corp.

- Withdrawal charges, also by APEX Clearing Corp, are $25 for domestic and $45 for international withdrawals.

- Webull only accepts deposits in US Dollars.

- The deposit and withdrawal processes are out-of-date.

My recommendations:

- It is ideal to use a bank you do not also use for your day-to-day financial operations.

Bottom Line

I like the trading environment at Webull for seasoned US-based traders who look for an execution-only, equity-focused broker with a low-cost trading environment. Webull is a lightweight broker, free of advanced trading tools and services, which helps keep trading costs low. The proprietary trading platform takes a few moments to navigate through and allows complete customization. It offers manual traders everything they need to manage portfolios. Adequate support for algorithmic trading is missing, but this won’t be a problem for most potential clients, and Webull’s core trader base receives an advanced mobile trading app.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

FAQs

Is Webull legitimate?

Webull is a legitimate broker under SEC oversight with a spotless FINRA track record.

Is Webull good for beginners?

Since Webull lacks educational content, it is not an ideal choice for all beginner traders.

Is Webull fake money?

Webull is not fake money, but it offers a Paper Trading account.