For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

VersusTrade is a relatively new broker incorporated in 2024 and registered in Saint Lucia, with additional FSC licensing in Mauritius. The firm operates under registration number 2024-00586 (in St. Lucia) and provides access to trading via the popular MetaTrader 5 (MT5) platform. The standout feature of VersusTrade is its innovative CFD instruments - Versus Pairs, which allow traders to speculate on the relative performance of two assets — such as BTC vs. Gold or Tesla vs. Ford — offering an original approach to CFD trading. VersusTrade also offers traders high leverage of up to 1:2000, a low $10 minimum deposit, with no fees, and withdrawals processed in under one hour. However, the broker lacks educational materials, research tools.

Overview

VersusTrade is a new regulated broker offering a wide range of assets and competitive trading conditions with some unique features.

Headquarters | Saint Lucia |

|---|---|

Regulators | FSC Mauritius |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2024 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $10 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 5 |

Average Trading Cost EUR/USD | 0.8 pips |

Average Trading Cost GBP/USD | 0.9 pips |

Average Trading Cost WTI Crude Oil | 0.2 pips |

Average Trading Cost Gold | 1.2 pips |

Average Trading Cost Bitcoin | 230 pips |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 5+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

VersusTrade Five Core Takeaways:

- Founded in 2024 — Registered in Saint Lucia, under number 2024-00586

- License: FSC Mauritius License awarded in October 2025

- Platform: MetaTrader 5 (MT5)

- Maximum leverage 1:2000

- Minimum deposit $10

- Product coverage: Forex, Commodities, Crypto, Indices, Stocks, Versus Pairs CFDs, Basket CFDs

VersusTrade Regulation & Security

Trading under a regulated broker helps ensure client fund safety and transparency. VersusTrade is registered in Saint Lucia (No. 2024-00586) and holds a Financial Services Commission (FSC) investment license in Mauritius. The company operates with standard AML/KYC controls, segregated client funds, and negative balance protection.

Country of the Regulator | Mauritius |

|---|---|

Name of the Regulator | FSC Mauritius |

Regulatory License Number | GB25204646 |

Regulatory Tier | 4 |

Is VersusTrade Legit and Safe?

VersusTrade is legitimate and compliant under its Saint Lucia registration and Mauritian License. There have been no reports of misconduct or client issues that I could find. The firm has a Trustpilot score of 4.5. The company’s transparency and growing regulatory coverage make it a promising broker; however, its limited operational history means it must still be considered a new entrant to the market.

VersusTrade regulation and security components:

- A regulated broker

- Founded in 2024

- Segregation of client deposits from corporate funds

- Negative balance protection

What would I like VersusTrade to add?

While VersusTrade has a strong core offering, a few additions could enhance its appeal even further. The inclusion of the classic MT4 platform would cater to traders who still prefer its specific interface and ecosystem of EAs. Expanding their services to include dedicated educational resources and market research tools, such as daily analysis articles or webinars, would provide significant value, especially for the beginners drawn to the accessible Cent account.

Fees

I consider trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. VersusTrade offers competitive spreads and transparent trading conditions. The broker does not charge trading commissions on most account types and maintains zero deposit and withdrawal fees. I also like that there is no inactivity fee.

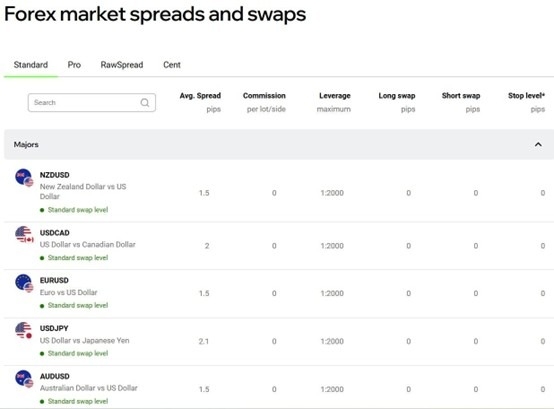

Average Spreads (Standard Account):

I am very impressed by the transparency here, as VersusTrade publishes the average spreads of every asset in every different account type, and the claimed averages look very honest. Few new brokers show this level of proactive fee transparency.

EUR/USD – 1.5 pips

GBP/USD – 1.5 pips

XAU/USD – $0.19

BTC/USD – $342

US30 – 24.5 points

AAPL – 2.5 points

The average trading costs for the EUR/USD at VersusTrade are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.5 pips (Standard) | $0.00 | $15.00 |

0.8 pips (Pro) | $0.00 | $8.00 |

Swap charges (also known as overnight financing costs) apply when holding leveraged positions overnight. VersusTrade’s swap structure is in line with industry standards and depends on the base currency and interest rate differentials. The website didn’t show a swap rate for some pairs, but this may vary, so I have based the calculation on the expected costs or credit. These examples assume an average swap rate environment on MT5. Traders should confirm live swap rates within the trading platform, as values fluctuate based on liquidity conditions and market rates.

Below are examples of typical overnight and weekly swap impact for EUR/USD under the Raw Spread account type on a 1.0-lot position:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.8 pips | $0.00 | -$6.25 | X | -$6.25 |

0.8 pips | $0.00 | X | $3.85 | $3.05 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the Raw account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.8 pips | $0.00 | -$44.75 | X | -$51.87 |

0.8 pips | $0.00 | X | $27.95 | $22.95 |

Noteworthy:

- VersusTrade forwards positive swap rates on qualifying assets.

- Islamic swap free accounts are available, and Swap free account options come with certain terms and conditions.

- No swaps are mentioned on the VersusTrade ‘Versus Pairs’.

Range of Assets

Traders can achieve cross-asset diversification via the well-balanced VersusTrade asset selection. VersusTrade offers Forex, Commodities, Cryptocurrencies, Indices, Stocks (CFDs), and Versus Pairs CFDs.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

VersusTrade covers the following sectors:

- Forex

- Cryptocurrencies

- Commodities

- Indices

- Equities

- Versus Pairs: AMZNvsBABA, BTCvsUS500, US100vsWTI, BTCvsXAU, TSLAvsFORD

VersusTrade Leverage

Maximum Leverage | 1:2000 |

What should traders know about VersusTrade leverage?

- Forex, commodities, metals, and index traders get a maximum leverage of 1:2000.

- Indices, Cryptocurrency, and equity traders get 1:500.

- Leverage availability depends on equity size of account, the more equity you have the lower the leverage that can be used.

- Negative balance protection exists.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

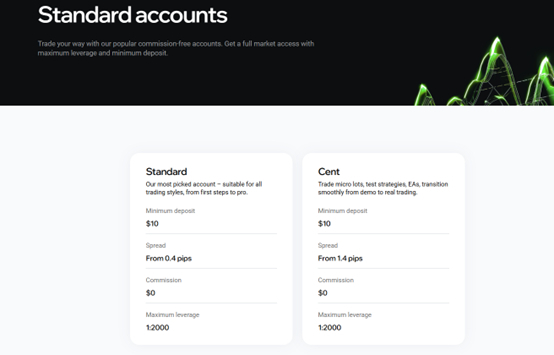

VersusTrade provides four distinct account types to cater to different levels of traders, all with a remarkably low minimum deposit of just $10.

- Cent Account: Ideal for absolute beginners, allowing trading with micro-lots to manage risk while learning.

- Standard Account: A good all-around option for most retail traders, offering commission-free trading with moderate spreads.

- Pro Account: Designed for more experienced traders, this account features tighter spreads with zero commission, making it excellent value.

- Raw Spread Account: For high-volume or algorithmic traders, this account offers spreads starting from 0.0 pips plus a competitive commission, providing the most direct market access.

VersusTrade Demo Account

A free MT5 demo account is available for practice. However, as with all simulated environments, demo trading lacks the psychological element of live markets and may not perfectly mirror live execution conditions.

What stands out about the VersusTrade demo account?

- A $10,000 default demo balance in MT5

- Real-time spreads

- No time limit

VersusTrade Copy Trading

VersusTrade offers a full-featured copy trading system, which can support advanced risk control and flexible copying models. Key features include:

- Ability to conduct multiple copying with different terms under a single account.

- Several position-sizing methods are supported: Multiplier, Fixed Volume, Auto-Scale, Lot-Proportional.

- Advanced risk management tools including auto-unsubscribe, drawdown limits, take-profit on subscription, and position close functions.

- Full compatibility with order types: supports pending orders, SL/TP price targets, and market execution.

Trading Platforms

VersusTrade exclusively uses MetaTrader 5 (MT5), accessible on Windows, macOS, iOS, and Android. Traders can access advanced charting, one-click execution, expert advisor (EA) automation, and a wide range of analytical indicators.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

The main feature about this broker that stood out for me was the addition of the Versus Pairs, the ability to trade one asset against another for example gold vs bitcoin.

Research & Education

VersusTrade offers an economic calendar and a real-time market news feed. This provides you with access to information about macro events in real time, and you don’t have to leave your trading platform to get it. These items are also available in several languages, not just English.

VersusTrade now offers the Versus Academy, a structured educational environment for both newer and more experienced traders.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |       |

VersusTrade provides customer support 24/7 via live chat, email, and social media. Response times are generally fast during the week.

Bonuses and Promotions

At the time of this review, VersusTrade runs an IB partner promotion granting a fixed Partner Level 5 for three months and a rebate payout of $12 per 1 lot of XAU/USD traded on Standard accounts.

VersusTrade offers a 100% deposit bonus which instantly doubles available trading margin. Key features of the bonus include:

- All profit generated from trading is fully withdrawable.

- The bonus amount itself cannot be withdrawn and does not affect drawdown.

- If a withdrawal is made from the deposit, the bonus is reduced proportionally to the withdrawal amount.

- The bonus is valid for 60 days.

Opening an Account

VersusTrade’s onboarding process is fast and fully digital. Traders can open an account in minutes by completing KYC verification with an ID document and proof of residence.

What should traders know about the VersusTrade account opening process?

- VersusTrade complies with global AML/KYC requirements.

- Account verification is mandatory for all users.

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document, account is instantly opened after document upload.

- VersusTrade may ask for additional information on a case-by-case basis.

Minimum Deposit

The VersusTrade minimum deposit is $10 or a currency equivalent.

Payment Methods

VersusTrade accepts bank wires, credit/debit cards, E wallets like Skrill, and Neteller and Cryptocurrencies.

Withdrawal options |      |

|---|---|

Deposit options |      |

Accepted Countries

VersusTrade actively focuses on traders in:

- Malaysia

- Thailand

- Vietnam

- Indonesia

- India

Specifically, residents of certain countries like the UK and USA are not accepted.

Deposits and Withdrawals

The secure VersusTrade back office handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at VersusTrade?

- Funding Methods: Clients can use a wide array of payment options, including local banks, internet banking, e-wallets, cryptocurrencies, and credit/debit cards.

- Fees: There are no fees for either deposits or withdrawals.

Processing Times:

- Deposits are processed instantly.

- Withdrawals are handled swiftly, typically within one hour, though it may take longer on weekends.

Accepted Currencies: While the primary account currency is USD, the broker accepts a wide range of currencies for deposit, including but not limited to: AUD, CAD, EUR, GBP, JPY, and SGD. They also accept several Southeast Asian currencies, reflecting their focus on that market. Note that some currencies like the Indian Rupee (INR) and Malaysian Ringgit (MYR) are restricted and cannot be funded directly.

Minimums:

- The minimum deposit is a very accessible $10 for the Standard and Cent accounts.

- The minimum withdrawal amount is generally between $5 and $10 for e-wallets, though it can vary depending on the method used.

Is VersusTrade a Good Broker?

VersusTrade is a young but fast-growing broker that combines modern infrastructure, innovative instruments, and favorable trading costs. While it lacks education tools and tier one regulation, it offers strong execution and a unique product range for 2025. VersusTrade offers the MetaTrader 5 (MT5) platform for desktop, web, and mobile devices. They are unique CFD instruments that allow you to trade the relative price performance of two different assets against each other, such as Amazon vs. Alibaba. This is known as “pairs trading”. The minimum deposit for all account types at VersusTrade is $10. Yes, the broker is regulated in Mauritius with an FSC license.FAQs

Which trading platform does VersusTrade use?

What are Versus Pairs?

What is the minimum deposit at VersusTrade?

Is VersusTrade a regulated broker?