Vanatge Editor’s Verdict

Australian-headquartered Vantage grew into an international multi-asset broker over the past decade. Traders get a low-cost pricing environment, an active trader program, high leverage, and fast order execution. I conducted an in-depth review to determine if traders get advertised raw spreads of 0 pips. Should you consider Vantage as your primary broker?

Overview

A Low-Cost International Broker with a Competitive Trading Environment.

Headquarters | Australia |

|---|---|

Regulators | CIMA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2009 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $200 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Web-based |

Average Trading Cost EUR/USD | 0.1 pips |

Average Trading Cost GBP/USD | 0.2 pips |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.80 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $4.00 per round lot |

Funding Methods | 10 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Vantage - The first look:

- Ideal trading conditions scalpers, high-frequency, high-volume, and algorithmic traders

- High leverage and fast order execution

- Upgraded MT4/MT5 trading platforms

- Transparent trading environment

- Third-party social trading services and VPS hosting

- Quality trading tools for manual traders

- Bonuses and promotions

- 30+ global offices with 1,000+ staff

- Indemnity insurance

- 50,000+ active traders

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Vantage presents clients with three regulated entities.

Country of the Regulator | Australia, Vanuatu, South Africa |

|---|---|

Name of the Regulator | CIMA |

Regulatory License Number | 428901, 51268, 700271 |

Regulatory Tier | 1, 2, 4 |

Reasons I prefer the Cayman Islands/Vanuatu subsidiaries:

- Higher leverage

- Negative balance protection

- Competitive regulator

- Segregation of client deposits from corporate funds

- Flexible trading conditions

- Bonuses and promotions

What is missing?

- Investor compensation fund

- Financial Commission membership

- Profiles of core management

Noteworthy:

- Vantage has a clean regulatory track record

- A UK subsidiary exists, but Vantage does not list it on its website with other regulators while noting it under its Legal Documents section

Vantage has 10+ years of experience and transparently notes National Australia Bank (NAB) and Commonwealth Bank of Australia (CBA) as financial institutions, where client deposits remain segregated from corporate funds. Vantage also has Indemnity Insurance, but I prefer a deposit insurance policy, securing client funds in the event of an unlikely default.

Fees

Average Trading Cost EUR/USD | 0.1 pips |

|---|---|

Average Trading Cost GBP/USD | 0.2 pips |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.80 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $4.00 per round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

Vantage offers traders three cost structures:

- Commission-free trading costs start at 1.0 pip or $10.00 per 1 standard lot, which ranks it among the more expensive Forex brokers

- Commission-based accounts commence with a minimum spread of 0 pips and a commission of $6.00 per round lot for a final cost of $6.00

- A professional account where the commission is $4.00 per round lot

Noteworthy:

- Equity CFDs minimum cost range between $5.00 and €10 per trade, depending on the market

Which pricing environment should Forex traders select?

I recommend the following:

- The commission-based cost structure is 40% cheaper

- Traders with a deposit of $20,000 can lower base costs by 60%

- The minimum deposit of $500 for the commission-based account, versus the $200 for the commission-free alternative, offers active traders with notably lower trading costs

- Traders who prefer the commission-free account must deposit $100,000 to lower trading costs to what the commission-based account offers

What is missing at Vantage?

- A volume-based rebate program for the commission-based trading account, as the absence of it makes Vantage less competitive versus competing brokers who offer one

Here is a screenshot of Vantage live quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD in the commission-based Vantage Raw ECN account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.0 pips | $6.00 | $6.00 |

Noteworthy:

- Traders with deposits of $10,000 qualify for volume-based rebates, but they only apply for the expensive commission-free trading account

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Vantage offers a positive swap on EUR/USD short positions and other assets where market conditions warrant them, meaning traders get paid money

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-based Vantage Raw ECN account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $6.00 | -$4.26 | X | $10.26 |

0.0 pips | $6.00 | X | $0.64 | $5.36 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $6.00 | -$29.82 | X | $35.82 |

0.0 pips | $6.00 | X | $4.48 | $1.520 |

My additional comments concerning trading costs at Vantage:

- No inactivity fees

- No currency conversion fees

What Can I Trade

I like the choice of commodities and indices at Vantage, but the Forex selection is below average. It suits traders with a focused trading strategy, who require fewer but highly liquid assets. I find the absence of cryptocurrencies unfortunate.

Equity traders get large-cap CFDs, ideal for retail traders who follow trending names on social media, but Vantage fails to offer ETFs, which is another regrettable oversight.

What is missing?

- I am missing mid-cap and small-cap alternatives from the equity CFD list

- Vantage does not offer ETFs

- Cryptocurrencies are also missing from the asset selection

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Vantage Leverage

Traders at the Vantage Cayman Islands and Vantage subsidiaries get maximum leverage up to 1:500. I recommend it for active traders as it presents more overall trading flexibility, directly influencing profitability.

Other things I want to note about Vantage leverage:

- Vantage default leverage is 1:100, and there is a capital limit for the maximum of 1:500, which I find acceptable, as it assists with risk management

- Negative balance protection exists, ensuring traders never lose more than their deposit

- The Australian unit limits it to 1:30 amid regulatory restrictions

Vantage Trading Hours (GMT+1 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Monday 00:01 | Friday 23:57 |

Commodities | Monday 01:00 | Friday 24:00 |

European CFDs | Monday 09:00 | Friday 17:30 |

US CFDs | Monday 15:30 | Friday 22:00 |

Noteworthy:

- Equity markets open and close each trading day and are not operational continuously like Forex and cryptocurrencies

- The asset selection may vary between operating subsidiaries

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

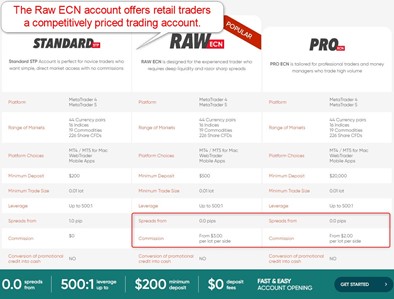

Vantage offers three account types to traders, where conditions remain identical, but trading costs vary notably from expensive to cheap.

Traders must decide between the following:

- Commission-free versus commission-based account

My observations concerning the Vantage account types:

- The commission-free account is expensive but features conflict-free STP execution from a $200 minimum deposit

- A volume-based rebate program is available for the commission-free option but requires 10,000 to qualify and $100,000 to lower trading costs to levels available in the commission-based alternative

- The Raw ECN account requires a minimum deposit of $500, higher than most brokers, but trading costs drop 40%

- The Pro ECN account requires $20,000, but traders see a reduction of $50 in commissions from $6.00 per round lot to $4.00

- Available account base currencies are AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, and HKD

- Islamic and corporate accounts are available

My recommendation:

- Traders who want to trade at Vantage should deposit a minimum of $500 for the Raw ECN account, as the cost savings over the commission-free Standard STP account remain significant

Vantage Demo Account

Vantage offers traders unlimited demo accounts ideal for testing EAs or different trading strategies. I like the absence of a time limit, as traders have sufficient time for bug fixing and back-testing. I want to caution beginner traders about using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology negates the educational value.

My recommendation:

- MT4/MT5 offer flexible deposits, and traders should select one similar to what they plan for their live trading account

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Traders get the full suite of MT4/MT5 trading platforms, consisting of a desktop version for algorithmic traders, a lightweight web-based version for manual traders, and a mobile app. Vantage also developed a proprietary mobile trading platform, Vantage App. Vantage ProTrader powered by TradingView offers another alternative for manual traders to consider.

Vantage upgrades the core MT4/MT5 trading platform via the Smart Trader Tools package. It transforms the sub-standard out-of-the-box version into a more advanced trading terminal.

What is missing?

- API trading for advanced algorithmic trading solutions

My observations:

- Traders with MT4/MT5 EAs must use the desktop client

- ProTrader powered by TradingView lacks the advanced infrastructure available in MT4

- Vantage offers trading services by Trading Central but does not advertise them adequately as an advantage

- Besides the built-in copy trading service in MT4/MT5, Vantage offers three third-party platforms

- VPS hosting is available

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | Yes |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons | Yes |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Upgraded MT4/MT5 trading platforms |

Unique Feature Two | High leverage and fast order execution |

Unique Features

Vantage advertises free VPS hosting, but it requires a minimum deposit of $1,000. The same applies to the Smart Trader Tools upgrade for MT4/MT5 and the ProTrader Tools. While it remains a reasonable request, I believe it should come as part of the Raw ECN account, which requires a minimum deposit of $500, the same amount traders must commit to getting trading signals provided by Trading Central.

Regrettably, Vantage appears to not offer Trading Central services as the popular MT4/MT5 plugin but opted for the e-mail service.

Social traders can connect their Vantage MT4/MT5 trading account to services provided by ZuluTrade, Myfxbook Autotrade, and DupliTrade. Forex sentiment indicators and calculators are also available but not within the MT4/MT5 trading platforms.

Vantage FX deploys the oneZero MT4 bridge price aggregator, connecting the broker's dark pool to the clients' MT4 platform. Xeon E7 processors with Turbo Boost Technology power the trading infrastructure at Vantage, including the oneZero MT4 bridge, ensuring traders have high-speed access. I find this the most notable unique feature at Vantage.

Research and Education

Vantage provides traders with in-house research, published daily, and presented in a quality format consisting of written content and a chart. Traders can also sign-up for trading signals generated by Trading Central, delivered to their inbox.

Beginner traders get a quality educational section, which provides a comprehensive introduction to trading. Manual and videos are also available, covering MT4, MT4, Smart Trader Tools, and ProTrader Tools. The Vantage webinars offer another layer of engaging educational content.

I recommend traders take their time reading and understanding the content in the Vantage educational section.

My takeaways:

- Vantage presents a quality research section, including tradeable ideas, generated in-house and via third parties

- The educational content offers a quality introduction for beginner traders

My recommendations:

- Traders can evaluate copy trading features embedded in MT4/MT5

- The third-party copy trading platforms include thousands of strategies

- MT4/MT5 have thousands of EAs, and traders may explore them to determine if they suit their trading style

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |             |

Customer support is available 24/7, via e-mail, phone, or live chat. Traders get account opening support Monday through Friday from 09:00 to 17:00.

Since Vantage explains its products and services well and ensures flawless operations, I doubt traders will require customer support.

My recommendations:

- Traders should read through the FAQ section before reaching out to a customer service representative

- For non-urgent questions, I recommend live chat

- Vantage provides phone support, ideal for urgent matters

Bonuses and Promotions

Vantage offers a 50% deposit bonus up to $500, and 10% on deposits above $1,000 up to $19,500. It is a non-withdrawable bonus, and terms and conditions apply. The bonus is not available to residents from all countries. A refer-a-friend program is also available, together with a quality affiliate program, allowing traders to create a passive income stream.

Opening an Account

An online application form processes new accounts, and according to Vantage FX, it takes less than five minutes. It suggests unnecessary steps Vantage might take, dictated under ASIC rules but not required elsewhere.

Traders need to submit a copy of their ID and proof of residency documents to satisfy AML/KYC conditions.

Minimum Deposit

The minimum deposit for the Vantage Standard STP account is $200 or a currency equivalent, while the Raw ECN alternative requires $500. Both are higher than many brokers but within a reasonable range. The Pro ECN alternative is available from $20,000.

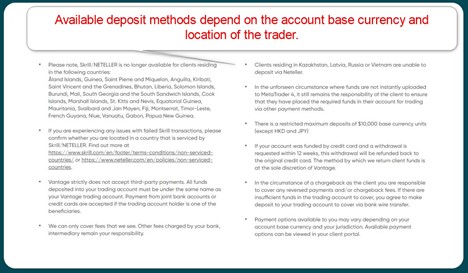

Payment Methods

Vantage offers bank wires, credit/debit cards, BPAY, POLi Payments, JCB, UnionPay, Skrill, Neteller, AstroPay, and FasaPay. Broker-to-broker transfers are also possible.

Accepted Countries

Vantage caters to most international traders and lists restrictions on its website. Traders from the UK, France, Vietnam, Malaysia, and Indonesia are welcome. Like most international brokers, US-based clients cannot open trading accounts at Vantage.

Deposits and Withdrawals

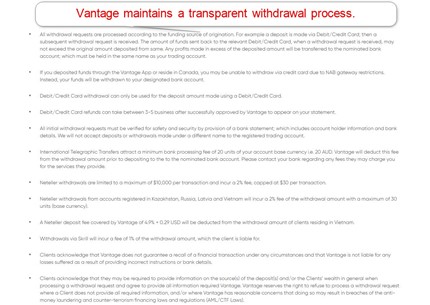

All financial transactions take place in the secure back office of Vantage. I like the variety of deposit and withdrawal methods.

My observations:

- Most deposits and withdrawals remain free of charge, but third-party processing fees may apply

- Not all deposit methods are available to all traders, dependent on the geographic location and account base currency

- Vantage processes all withdrawals in the account base currency

- Deposit times range between instant and five business days

- Vantage processes withdrawal requests Monday through Friday between 09:00 and 19:00 (AEST), requests after 19:00 roll over to the following business day

- Transaction limits for withdrawals apply

- Cryptocurrency deposits and withdrawals are not available

My recommendations:

- Traders should select the payment processor with the lowest fees

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations

The Bottom Line

I like the trading environment at Vantage for its low trading costs, high leverage, fast order execution, and upgraded MT4/MT5 trading platforms. Traders must deposit a minimum of $1,000 to unlock all features available at Vantage. Social traders have access to three third-party providers plus the embedded MT4/MT5 solution, ranking Vantage among the most competitive MT4/MT5 brokers. Trading conditions are ideal for scalpers, algorithmic, social, and manual traders alike. Vantage offers low trading costs, high leverage, fast order execution, and upgraded MT4/MT5 trading platforms. It ranks in the top quartile of international brokers. Vantage processes withdrawal requests Monday through Friday between 09:00 and 19:00 (AEST), requests after 19:00 roll over to the following business day. While Vantage may act as a market maker, like all Australian brokers, it deploys STP/ECN models across the board.FAQs

Is VantageFX a good broker?

How long does it take to withdraw from VantageFX?

Is VantageFX a market maker?