Editor’s Verdict

Overview

Review

The Vanguard Group, established in May 1975, is one of the “Big Three” index funds, dominating US corporate America, the other two being BlackRock and State Street. With over thirty million clients globally and more than $7.1 trillion in assets under management (AUM) across is a wide selection of mutual and index funds, Vanguard is a household name among US retirement planning and passive investing. I reviewed Vanguard to evaluate if its trading environment offers passive investors the tools they require to succeed. Should you manage your retirement portfolios at Vanguard?

Summary

Vanguard - The top mutual fund provider and second-largest ETF provider globally

Headquarters | United States |

|---|---|

Regulators | ASIC, FCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1975 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Trading Platform(s) | Web-based |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

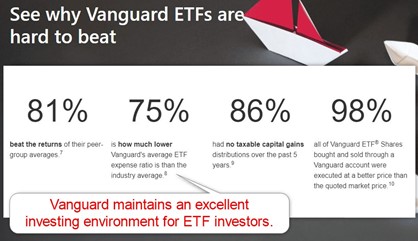

I like that Vanguard expanded into ETFs, where it became the second-largest provider behind BlackRock. While it broke with the founder's vision of passive investments and retirement planning, it presents one of the fastest-growing sectors in finance.

Vanguard - The first look:

- Its history dates to 1975, and Vanguard pioneered passive investing

- Vanguard is the largest provider of mutual funds and is the second largest ETF provider

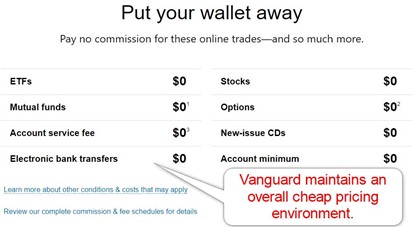

- Investors get one of the lowest pricing environments in the passive investment arena

- Investors and shareholders own Vanguard, aligning corporate-client interests

- A Robo-Advisory team and actively managed funds complement passive and self-directed investments

- Numerous account options cater to various long-term investment requirements

- Excellent security features

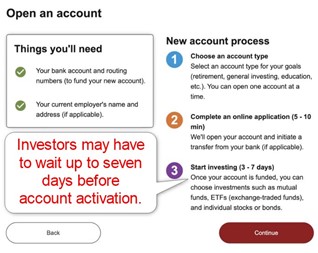

- Lengthy account opening process with wait times of up to seven days after submitting application

Vanguard Main Features

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | No |

Minimum Deposit | $0 - $50,000 (product-dependent) |

Demo Account | No |

Managed Account | Yes |

Islamic Account | No |

Inactivity Fee | No |

Deposit Fee | Third-party |

Withdrawal Fee | Third-party |

Funding Methods | 2 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Vanguard presents clients with three well-regulated entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

US | Financial Industry Regulatory Authority (FINRA) | CRD # 105958/SEC#: 801-11953 |

UK | Financial Conduct Authority (FCA) | 527839 |

Australia | Australian Securities and Investments Commission (ASIC) | 227263 |

What is missing?

- Third-party insurance

Noteworthy:

- The ultimate regulator remains the US Securities and Exchange Commission (SEC)

- Vanguard maintains membership with the non-profit Securities Investor Protection Corporation (SIPC), protecting clients up to $500,000 per net equity or $250,000 for cash claims

- All funds not held in a brokerage account by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, but by The Vanguard Group Inc., are not protected by SIPC

- Vanguard publishes financial statements audited by PricewaterhouseCoopers (PwC)

- Vanguard Advisers Inc. is a registered investment advisor, and so able to provide clients with investment advice

- Vanguard National Trust Company may also offer this service and is a federally chartered, limited-purpose trust company

- Vanguard maintains several operating subsidiaries outside the US, which remain compliant with their respective regulators

- Investors have numerous account security features, including voice verification, security keys, and trusted contacts

Being client-owned, over 95% of investors feel confident with Vanguard, as their interests are 100% aligned. Overall, Vanguard is one of the most trusted US-based investment advisors.

Fees

Minimum Raw Spreads | Not applicable |

|---|---|

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability.

Vanguard offers investors the following core cost structure:

- Commission-free investments on equity trading ETFs

- Select mutual funds are also commission-free, while others cost $20 per transaction

- Phone assisted trading, and third-party funds, face a $25 fee

- Front-end loaded mutual funds cost as much as 5.75%, but investors may qualify for discounts

- Investors must pay a $50 redemption fee for buying and selling a fund within 60 calendar days

- Options cost $1 per contract

- Personal advisory services incur a fee of 0.30% of assets under management

- The digital advisory service commences at 0.20% of assets under management

- A $50 processing fee for non-DTC-eligible securities (not applicable to ADRs) plus commission applies to foreign securities transactions

- An annual fee of $20 exists for any Vanguard account

Noteworthy:

- The Vanguard ETF expense ratio is up to 75% cheaper as compared to its competition

- The average Vanguard mutual fund expense ratio is 83% less than the industry average

- Select Vanguard funds incur a redemption fee between 0.25% and 1.00%

- ETFs and equities have a minimum transaction size of one share

Here are my observations:

- Vanguard maintains a complete cost structure on its website, which is straightforward to understand

What Can I Trade

Vanguard does not publish a complete asset list, but investors may search the website to see if a particular asset is available. Vanguard offers mutual funds, ETFs, stocks, options, bonds, CDs, and money market funds. The focus remains on US financial markets, but American Depository Receipts (ADRs) grant limited exposure to foreign equities.

Vanguard does not cater to traders and exclusively engages in lifetime investments, dollar-cost averaging, and the reinvestment of dividends. ETFs and mutual funds achieve primary cross-asset and international diversification. Long-term investors and those favoring passive investing have excellent and cost-effective choices at Vanguard.

What is missing?

- Vanguard does not offer Forex, cryptocurrencies, or commodities, but investors may locate ETFs offering exposure

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Vanguard Leverage

Vanguard offers margin trading in its brokerage account, where retail traders can get 1:2 leverage. All other accounts remain free of leverage and operate on a 1:1 basis.

Vanguard Trading Hours (EST Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Not applicable | Not applicable |

Commodities | Not applicable | Not applicable |

European Assets | Not applicable | Not applicable |

US Assets | Not applicable | Friday 17:30 |

Noteworthy:

- Equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies

- Vanguard offers access to after-hours trading but not pre-market trading

Account Types

Vanguard offers investors six account options, with sub-account choices, depending on the long-term investment goals.

My observations concerning the Vanguard account types:

- Retirement planning, saving, and tax-efficient investment accounts form the core offering at Vanguard, but regular investment accounts are also available

- Vanguard offers traditional, Roth, and spousal IRAs for retirement accounts

- Individual and joint brokerage accounts are also available

- Small businesses may offer their employees Vanguard SEP-IRA, 401(k), and a SEP-IRA or SIMPLE IRA

- A 529 plan for education accounts, and Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account as trust funds.

- All account options are ideal for long-term financial planning, as Vanguard does not cater to short-term traders

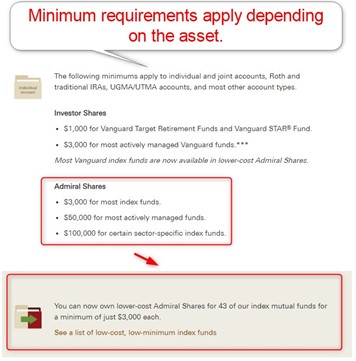

- While there is no minimum deposit noted, various mutual funds carry minimum investment requirements to discourage short-term trading

- Vanguard Personal Advisory services require a minimum portfolio of $50,000

- Vanguard offers wealth management to clients with $5M+ portfolios

- Digital advisory services are available for portfolios from $3,000

My recommendation:

- ETF traders have an excellent offer at Vanguard due to a lower expense ratio

Vanguard Demo Account

Vanguard does not offer a demo account.

Trading Platforms

Regrettably, Vanguard makes no mention of its investment or trading platform. Consulting with an investment advisor for a 0.30% fee or using the digital alternative for 0.15% remains the preference at Vanguard. Vanguard merely maintains a core order placement interface, allowing low-frequency investors the minimum to make long-term purchases in their portfolios. It recently introduced a mobile app, ideal for checking portfolio performance but lacking tools for investors.

Rumors surfaced in October 2019 that Vanguard tests a peer-to-peer trading platform and seeks to compete in the Forex market, but to date, Vanguard has not released details. While trading, especially margin trading, is discouraged and goes against the philosophy of Vanguard, it does offer this option and should consider servicing it properly. The lack of information regarding the trading platform represents a significant error by Vanguard.

What is missing?

- Vanguard fails to introduce its investment and trading platforms and functions transparently

Overview of Trading Platforms

MT4 | No |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | No |

Social Trading / Copy Trading | No |

MT4/MT5 Add-Ons/Upgrades | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | No |

Unique Feature One | Low-cost ETF cost structure |

Unique Feature Two | Robo-Advisory unit |

Unique Features

I again note the excellent ETF investing environment, complementing the Vanguard mutual fund selection and its newly introduced ESG funds which can boost returns from the ETF portfolio, in line with the primary target and investment philosophy at Vanguard. It can also contribute to the compounded long-term portfolio growth of accounts. Vanguard also offers four money market funds for passive investors, which tend to beat the performance of their industry peers.

Research and Education

Vanguard does not provide research on its website but maintains a “News & Perspectives” section. It currently consists of 161 written articles and 22 short videos, often with how Vanguard can help investors navigate financial markets. Vanguard relies on its fee-based advisors to deliver personalized research and assistance to clients. Therefore, the information provided for free on its website lacks the quality and depth of its competitors.

Vanguard maintains an educational section geared towards its products and services. This presents just enough introductory information to entice interested investors to reach out to the fee-based advisory service. From a marketing perspective, Vanguard executes perfectly. Regrettably, new investors seeking quality educational content will be disappointed.

My takeaways:

- Vanguard fails to provide clients with research, relying on its fee-based services

- Vanguard maintains a News & Perspectives section with relevant content but no actionable trading ideas

- Beginner traders get limited educational content at Vanguard

My recommendations:

- Investors may access numerous free research available online, as Vanguard does not provide direct trading recommendations

- I also advise investors to seek educational content from trusted third parties free of charge as Vanguard fails to educate new clients, focusing more on marketing its services

Customer Support

Support Hours | M-F 8 a.m. - 8 p.m. |

|---|---|

Website Languages |  |

Vanguard customer support is available Monday through Friday between 8 a.m. and 8 p.m.

Vanguard aims to explain its products and services well. I doubt many investors will require customer support unless emergencies arise or during tax season. While an FAQ section answers common questions, investment advisors assist their clients. It continues with the personalized approach Vanguard maintains.

My recommendations and observations:

- Traders should read the FAQ section before reaching out to a customer service representative

- Live chat is not available

- Vanguard provides phone support, ideal for urgent matters, but has no dedicated finance department hotline

- Vanguard does not list its phone number on the personal investor website

Bonuses and Promotions

At the time of writing this Vanguard review, neither bonuses nor promotions are offered.

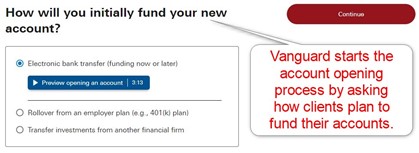

Opening an Account

While an online application form manages new account applications, it starts with limited funding options, an unusual approach. It takes up to 10 minutes to complete, and new investors may have to wait seven days for their new account to be fully open and ready for action.

Vanguard deploys a lengthy account opening process, an unusual step. New investors must provide their bank details and employer's name and address, but Vanguard fails to mention documents required for mandatory account verification.

I like that Vanguard includes a video on their account opening process, which makes things easier for clients, although they still tend to face a lengthy process.

Minimum Deposit

There is no minimum deposit, but certain accounts and products have minimum portfolio requirements. For most investors, they effectively range between $1,000 and $50,000.

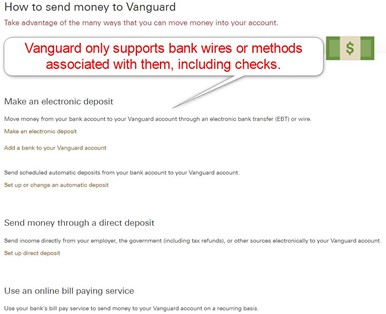

Payment Methods

Vanguard only offers bank wires, checks, or bill-paying services maintained by banks.

Accepted Countries

Vanguard primarily caters to US investors. It also has subsidiaries accepting investors from the UK, Australia, and Canada. Vanguard does not offer its services to Indian investors.

Deposits and Withdrawals

All financial transactions take place in the secure back office of Vanguard. Unfortunately, Vanguard only supports bank wires.

My observations:

- Vanguard only supports bank wires and electronic bank wires as direct funding methods, including checks

- Offering only bank-related payment methods remains disappointing and frustrating alike, giving investors no choices to manage their capital flows

- The absence of modern payment options places Vanguard well-behind international competitors

My recommendations:

- It is ideal to use an option besides the bank account used for day-to-day financial operations

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

The Bottom Line

I like the investing environment at Vanguard for ETF traders due to its lower cost structure. It is one of the “Big Three” index funds in the US, focused on long-term and passive investments. It recently expanded into ETFs, and equity trading is available through Vanguard Brokerage Services, but short-term trading is discouraged. Regrettably, Vanguard provides no details about its investment platform. The core of operations at Vanguard relies on its personalized fee-based services, which remain competitively priced at 0.30% of assets under management (AUM), or 0.20% for the digital advisory service.

With over $7.1 trillion under management, client-owned Vanguard is a household name for retirement planning and is well-known for its index funds. The Vanguard Total Stock Market Index Fund remains a staple in each three-fund portfolio across the US. Passive income earns a higher yield in the Vanguard Federal Money Market Fund versus its competitors. US-based clients focused on long-term passive investment have excellent and cost-effective investment opportunities at Vanguard. International clients will find a more complete, and competitive, offer elsewhere. Vanguard remains one of the most trusted brokers industry-wide with an excellent regulatory track record. It serves 30M+ investors and has become a household name for retirement planning and passive investments. While Vanguard fails to offer quality education, it remains an ideal choice for beginner investors with a set-and-forget mentality interested in passive and long-term investments. Vanguard remains one of the best companies for new long-term investors. Many US-based investment advisors cite the Vanguard Total Stock Market Index Fund as essential for three-fund portfolios. Vanguard is the custodian of your assets and does not own them. While you can lose money investing in financial markets, your capital at Vanguard from an operational perspective is secure unless an unforeseen criminal act occurs. Even if Vanguard would file for bankruptcy, your assets would remain separated and would be returned to you, as the beneficial owner. Vanguard offers some of the lowest-priced ETFs and passive investment vehicles, making it an excellent company for long-term investors. The personalized approach adds appeal, and being a client-owned company, interests between Vanguard and investors remain more closely aligned. It depends on the individual and their preferences. Vanguard has a more efficient after-tax return, per results from one independent analysis, while Fidelity maintains a lower expense ratio. Vanguard funds offer more diversity than Fidelity, but each investor needs to assess this individually. One of Vanguard’s most significant flaws, as noted by clients, is incorrect cost basis information displayed in their portfolios and wrong account balances. Another one remains problems with required minimum distributions for retirees. To their credit, Vanguard has addressed these bugs.FAQs

How trustworthy is Vanguard?

Is Vanguard good for beginners?

Can you lose money with Vanguard?

Is Vanguard a good company to invest with?

Is Vanguard or Fidelity better?

What is wrong with Vanguard?