Editor’s Verdict

Trive is a well-established and globally regulated broker with a history dating back to 1999. It stands out for its robust regulatory framework, holding licenses from top-tier authorities like FINRA (USA), ASIC (Australia), and the FSCA (South Africa). Offering both MT4 and MT5 platforms, alongside a dedicated social trading app, Trive caters to a wide range of trader types. Its fee structure is competitive, with commission-free accounts and a true ECN option, making it a strong contender for both new and experienced traders.

Overview

Trive Core Takeaways:

- A globally regulated broker with entities licensed by FINRA, ASIC, FSCA, and US clients accepted

- Leverage varies by regulator, from 1:30 in the EU to 1:2000 for some international clients.

- Multiple account types, including commission-free and raw spread ECN options.

- The full MetaTrader suite (MT4 & MT5) plus a dedicated social trading app.

- A wide range of funding methods with no deposit or withdrawal fees.

Headquarters | Netherlands |

|---|---|

Regulators | ASIC, FINRA, FSC Mauritius, FSCA, MFSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2020 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 1.2 pips |

Average Trading Cost GBP/USD | 1.6 pips |

Average Trading Cost WTI Crude Oil | 0.04 Pips |

Average Trading Cost Gold | 28 pips |

Average Trading Cost Bitcoin | 95 dollars |

Retail Loss Rate | 68% for its european entities |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.2 |

Minimum Commission for Forex | no commission |

Funding Methods | 10 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Trive Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations within their region and verify them with the regulator by checking the provided license with their database. Trive has multiple regulated entities across the globe, making it one of the more secure brokers available.

Country of the Regulator | Australia, Indonesia, Malta, Mauritius, United States, South Africa |

|---|---|

Name of the Regulator | ASIC, FINRA, FSC Mauritius, FSCA, MFSA |

Regulatory License Number | CRD: 21946, AFS: 424122, FSP: 27231, CRES IF 5048, GB21026295, 01/BAPPEBTI/SI/05/2024 |

Regulatory Tier | 1, 1, 2, 1, 3, 3 |

Is Trive Legit and Safe?

Yes. With a history spanning over two decades and licenses from some of the world's most stringent financial authorities, Trive is a legitimate and secure broker. My review found no evidence of misconduct.

Trive regulation and security components:

- Regulated by FINRA (USA), ASIC (Australia), FSCA (South Africa), MFSA (Malta), FSC (Mauritius), and BAPPEBTI (Indonesia).

- Founded in 1999.

- Segregation of client deposits from corporate funds.

- Negative balance protection for retail clients.

- Member of the Securities Investor Protection Corporation (SIPC) in the US.

Fees

Trive offers a transparent and competitive fee structure that varies by account type. The primary costs are spreads and commissions, with the latter only applying to the ECN Zero account.

Average Trading Cost EUR/USD | 1.2 pips |

|---|---|

Average Trading Cost GBP/USD | 1.6 pips |

Average Trading Cost WTI Crude Oil | 0.04 Pips |

Average Trading Cost Gold | 28 pips |

Average Trading Cost Bitcoin | 95 dollars |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.2 |

Minimum Commission for Forex | no commission |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | 10 EUR/USD/GBP per month. This fee is applied to an account if there has been no trading activity for a period of six consecutive months. |

Average Spread (EUR/USD) | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.2 pips (Standard) | $0.00 | $12.00 |

0.6 pips (VIP) | $0.00 | $6.00 |

0.0 pips (ECN Zero) | $10.00 | $10.00 |

Noteworthy:

- Swap Fees: Leveraged overnight positions will incur swap fees, which can be positive or negative. Islamic swap-free accounts are available.

- Inactivity Fee: Trive charges a monthly inactivity fee of €10 after six months of no trading activity.

- Deposit/Withdrawal Fees: Trive does not charge fees for deposits or withdrawals.

Overnight Swaps

Swap rates on leveraged overnight positions are the most frequently ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based ECN Zero account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the ECN Zero account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs (Long/Short) |

0.0 pips | $10.00 | -$7.90 | +$1.90 | $17.90 / $8.10 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the ECN Zero account will cost the following:

Average Spread | Commission per Round Lot | Swap Long (7 nights) | Swap Short (7 nights) | Total Trading Costs (Long/Short) |

0.0 pips | $10.00 | -$55.30 | +$13.30 | $65.30 / -$3.30 |

Noteworthy:

- Swap Fees: Leveraged overnight positions will incur swap fees, which can be positive or negative. Islamic swap-free accounts are available where these conditions will not apply.

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

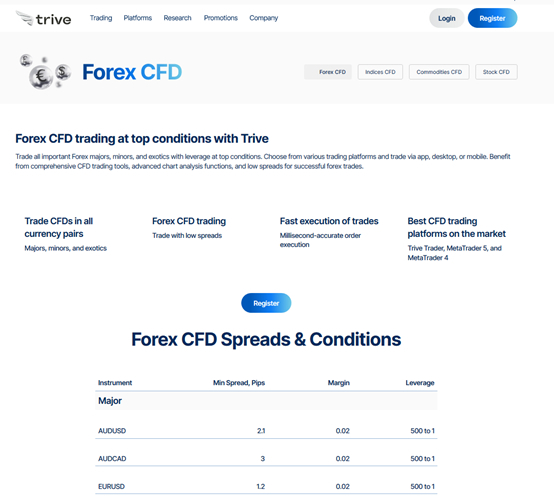

Traders can achieve cross-asset diversification via the well-balanced Trive asset selection.

Asset Class | Available? | Examples |

Forex | Yes | EUR/USD, GBP/JPY, USD/ZAR |

Stock CFDs | Yes | Apple, Tesla, Barclays |

Indices | Yes | US 500, UK 100, GER 40 |

Commodities | Yes | Gold, Silver, WTI Oil |

Cryptocurrencies | Yes | Bitcoin, Ethereum |

Trive Leverage

The maximum leverage offered by Trive depends on the regulatory jurisdiction of the trader’s account.

Maximum Retail Leverage (EU/Australia) | Maximum Leverage (International) |

1:30 | Up to 1:2000 |

What should traders know about Trive leverage?

- Leverage is a powerful tool, but it significantly increases risk.

- Negative balance protection is in place for retail clients, ensuring you cannot lose more than your deposited funds.

- Traders must always use appropriate risk management with leveraged trading.

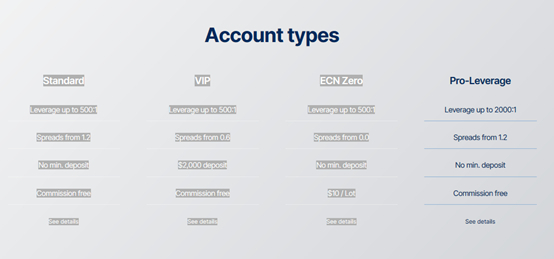

Account Types

Traders have a choice between several Trive Account types, designed to suit different experience levels and trading styles.

Account Type | Minimum Deposit | Spreads From | Commission |

Standard | $0 | 1.2 pips | None |

VIP | $2,000 | 0.6 pips | None |

ECN Zero | $0 | 0.0 pips | $10 per lot |

Pro Leverage | $0 | 1.2 pips | None |

My observations concerning the Trive account types are:

- Excellent flexibility for all budgets, with no minimum deposit for most accounts.

- EUR, USD, and GBP are available as account base currencies.

- Islamic (swap-free) versions of the accounts are available.

Trive Demo Account

Trive offers a free demo account, allowing new traders to practice their strategies and familiarize themselves with the MT4/MT5 platforms in a risk-free environment using virtual funds. Note that the disadvantage of demo trading is that it doesn’t expose the trader to the psychological factors involved when real funds are at stake.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Trive provides the full, globally recognized MetaTrader main trading platforms

- MetaTrader 4 (MT4): The industry standard, known for its reliability, user-friendly interface, and vast ecosystem of automated trading tools (Expert Advisors).

- MetaTrader 5 (MT5): The next-generation platform offering more advanced charting tools, additional timeframes, and access to a wider range of markets.

- Trive Social: A dedicated mobile app for social and copy trading.

Unique Features

- Trive Social App: A standout feature that provides a seamless copy trading experience, allowing users to follow and replicate the strategies of successful traders.

- Trading Central Integration: Trive provides all live account holders with access to award-winning technical analysis and trading signals from Trading Central, directly integrated into the client area.

Research & Education

While Trive does not have an extensive in-house educational academy, the research and analysis provided through the integrated Trading Central tool are of exceptionally high quality and serve as a powerful resource for traders of all levels.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 support |

Website Languages |        |

Trive offers 24/5 customer support via:

- Live Chat

- Phone

Support is available in multiple languages, ensuring global accessibility.

Bonuses and Promotions

At the time of this review, Trive did offer a cashback promotion for users registering with its South African entity. There were no other offers for other jurisdictions, which is standard practice for brokers operating under strict regulatory environments like ASIC and FINRA.

Opening an Account

Trive has a straightforward and fully digital account opening process.

What should traders know about the Trive account opening process?

- Trive complies with global AML/KYC requirements.

- Account verification is mandatory and typically requires a government-issued ID and a proof of residency document.

- The process is generally completed within one business day.

Minimum Deposit

The Trive minimum deposit varies by account type. The Standard, ECN Zero, and Pro Leverage accounts have no minimum deposit, while the VIP account requires $2,000. Note that most payment processors have a minimum deposit of $100 dollars.

Payment Methods

Trive accepts a wide range of payment methods, including the list below

- Bank Wires (Local and International)

- Credit/Debit Cards (Visa, Mastercard)

- E-Wallets (Skrill, Neteller, Perfect Money, Sticpay)

- Cryptocurrency (Tether - USDT)

- Apple Pay and Google pay are accepted

Withdrawal options |     |

|---|---|

Deposit options |     |

Accepted Countries

Trive is a global broker and accepts clients from most countries, including the United States, through its FINRA-regulated entity. One notable exception is the UK, which is geo-blocked.

Deposits and Withdrawals

The secure Trive client portal manages all financial transactions.

What are the key takeaways from the deposit and withdrawal process at Trive?

- No deposit or withdrawal fees are charged by Trive.

- Deposits are processed instantly for most methods (bank wires may take 1-3 business days).

- Withdrawals are typically processed within one business day.

- The name on the payment processor and Trive trading account must match.

What Would I Like Trive to Add?

Trive could enhance its offering by providing in-house educational content. Whilst the Trading Central tool is excellent for research, Trive could benefit from developing its own educational academy, adding structured courses, video tutorials, and articles for beginner to advanced traders.

Expanded Asset Range: Although the current selection is strong, expanding the range of tradable assets would appeal to more traders. This could include offering a wider variety of individual cryptocurrencies or introducing other asset classes like government bonds and ETFs (as non-CFDs).

Removal of the Inactivity Fee: While common among brokers, eliminating the €10 monthly inactivity fee would make Trive more attractive to long-term, buy-and-hold investors or those who may not trade frequently.

Is Trive a Good Broker?

Yes. Trive is an excellent, highly trustworthy broker. Its long operational history, combined with top-tier regulation from authorities like FINRA and ASIC, provides a very high level of security. The combination of competitive fees, powerful platforms (MT4/MT5), and unique features like a dedicated social trading app and integrated Trading Central signals makes it a compelling choice for traders of all experience levels.

FAQs

How do I withdraw money from Trive?

You can withdraw money from the secure client portal on Trive's website. The process involves: Logging into your client account. Navigating to the withdrawal section. Choosing your preferred withdrawal method (e.g., bank wire, credit/debit card, e-wallet). Submitting your request. Withdrawals are typically processed by Trive within one business day.

What is the minimum deposit for Trive?

The minimum deposit depends on the account type you choose: Standard, ECN Zero, and Pro Leverage Accounts: $0 (no minimum deposit). VIP Account: $2,000.

Is Trive safe?

Yes, this review concludes that Trive is a very safe and trustworthy broker. It is regulated by multiple top-tier financial authorities, including FINRA (USA), ASIC (Australia), and the FSCA (South Africa). It also provides key security features like negative balance protection for retail clients, keeping client funds in segregated accounts, and SIPC protection for US clients.

Is Trive suitable for beginners?

Yes, Trive is generally suitable for beginners. It offers features like a $0 minimum deposit on its Standard account, a free demo account to practice with, and a social/copy trading app (Trive Social) that allows new traders to follow and learn from experienced ones. The integration of Trading Central for professional analysis is also a great tool. The main area for improvement is the lack of a dedicated in-house educational section.