Editor’s Verdict

Tradier, founded in 2012, offers demanding traders the option to choose from 100+ trading platforms from one brokerage account. Power traders can create a custom trading experience in a low-cost pricing environment. I reviewed the Tradier trading environment to gauge its competitiveness and rate it as a sensible option for US-resident traders who value technology and customization. Should you open an account with Tradier?

Overview

Tradier provides traders with cutting-edge technology and low trading fees.

Headquarters | United States |

|---|---|

Regulators | CFTC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2012 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Other, Proprietary platform |

Average Trading Cost EUR/USD | Not applicable |

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Not applicable |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Tradier Five Core Takeaways:

- No minimum deposit for a cash account, $2,000 for a margin account

- 1B+ monthly API calls

- 100+ third-party trading platforms connect to Tradier, including TradingView

- No volume-based rebates for high-volume traders

- No Forex or cryptocurrency trading

Tradier Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations and verify them with the regulator by checking the provided license with their database. Tradier has one regulated subsidiary with a clean track record.

Country of the Regulator | United States |

|---|---|

Name of the Regulator | CFTC |

Regulatory License Number | 104982 |

Regulatory Tier | 1 |

Is Tradier Legit and Safe?

My review found no misconduct or malpractice by this broker. Therefore, I can recommend Tradier as it is a legitimate broker.

Tradier regulation and security components:

- Regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association

- Founded in 2012

- Segregation of client deposits from corporate funds

- No negative balance protection

What would I like Tradier to add?

Optimus Futures lacks investor protection features. It is typical for US-based brokers but does not make it right. Investor protection only applies to unleveraged share investments via the US SIPC. I would appreciate it if Optimus Futures offered third-party insurance if nothing else.

Fees

Average Trading Cost EUR/USD | Not applicable |

|---|---|

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Not applicable |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | true |

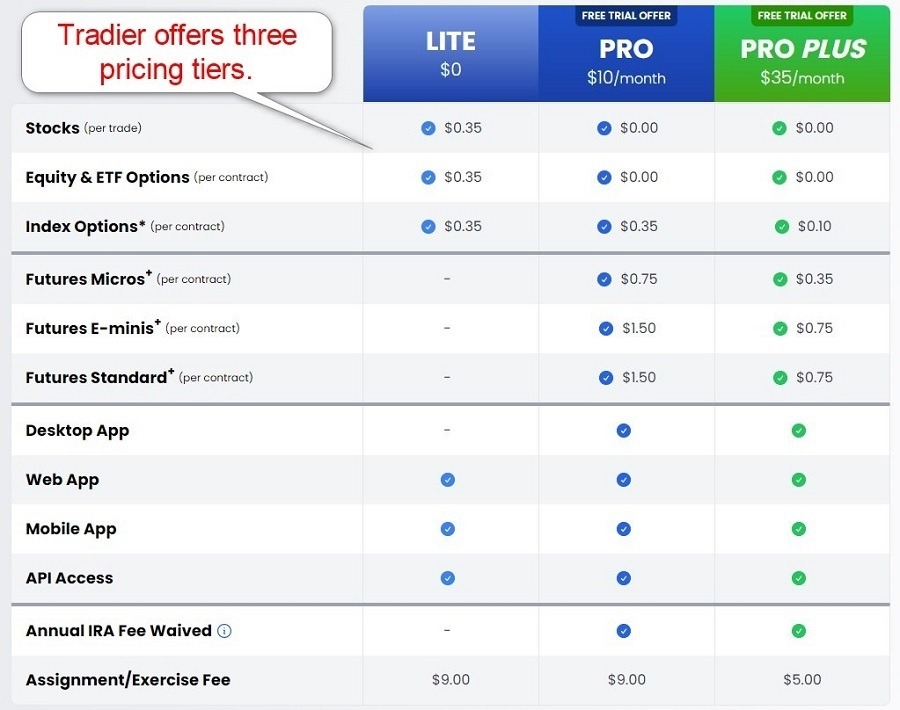

fee of $50 for accounts with less than $2,000 and two executed trades per year existed I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Tradier features low trading fees, especially for a US-based broker. It starts with $0.35 per equity trade and $0.35 per equity, ETF, and index contract. A $9 option assignment/exercise fee applies. Mutual funds transactions cost $30.

The $10 monthly subscription for the Pro Plan grants high-frequency traders a pricing edge with $0 commissions for equity trades and $0 for equity and ETF options. It also adds futures trading for a commission of $0.75 for micro futures and $1.50 for minis and standard contracts.

The Pro Plus Plan costs $35 monthly and decreases commissions to $0.10 for index options, $0.35 for micro futures, and $0.75 for mini and standard future contracts. It also lowers the option assignment/exercise fee to $5.

The standard regulatory and clearing fees apply, typical for US-based brokers. Additional trading fees depend on trader requirements. For example, broker-assisted traders cost $10 plus the regular commission, and warrants incur a $25 fee.

Tradier levies deposit and withdrawal fees and traders may face third-party processing costs, and currency conversion fees may apply. During my Tradier review, an inactivity.

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Tradier charges a 9.50% swap rate and does not offer a tier-based approach, one of the more expensive choices for leveraged traders.

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

The asset selection at Tradier suffices for equity traders focused on US-listed stocks, but the absence of OTC and Pink Sheets diminishes the competitiveness. It suffices for day traders to manage moderately diversified portfolios, but I also miss international exposure to equities and ETFs. Forex, cryptocurrency, and index trading are only available via futures.

Tradier covers the following sectors:

- Equities (US-listed without OTC and Pink Sheets)

- ETFs (US only)

- Futures

- Options

- Warrants

- Mutual Funds

Tradier Leverage

Maximum Retail Leverage | 1:2 |

Maximum Pro Leverage | 1:2 |

What should traders know about Tradier leverage?

- The 1:2 leverage only applies to equities and ETFs trading above $3

- Equities and ETFs below $3, and those with less liquidity trade without leverage

- Negative balance protection does not exist

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses

Account Types

Instead of account types, Tradier has three pricing tiers, with equal trading conditions for most traders, except for lower trading fees. During my Tradier review, unrestricted demos and Shariah-compliant swap-free Islamic accounts were unavailable. Tradier also offers retirement and entity accounts.

My observations concerning the Tradier accounts type are:

- No minimum deposit to open a cash account

- A $2,000 minimum deposit for a margin account

- Equity and options accounts via Tradier Brokerage

- Futures trading via Tradier Futures

- Futures trading unavailable on desktop clients or mobile apps

- Low trading fees

- Uncompetitive leverage

- USD as the account base currenc

Tradier Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

What stands out about the Tradier demo account?

- Tradier offers a demo account for its Tradier Pro platform

- An excessive demo balance of $100,000

- No customization to reflect live portfolios

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Tradier offers its proprietary Tradier Pro desktop clients, a web-based alternative, and a mobile app. Tradier Pro requires the Pro account, which costs $10 monthly. Additionally, 100+ third-party trading platforms connect with Tradier, offering traders an unmatched choice primarily focused on options trading. I recommend that interested traders browse the trading platform selection and choose the one that fits their requirements.

The Tradier Pro desktop platform offers:

- Order entry for equity, option, and spreads

- Advanced order types, including OCO, OTO, OT-OCO

- Trade preview risk analysis

- Comprehensive charting package

- Monte Carlo Analysis

- What-if risk analysis

- Ability to send an order from “What if”

- Probability of profit/loss

- Analyzed orders for trade decision adjustments

- Implied volatility by strike analysis

- Multi-portfolio views

- Beta and Delta adjusted portfolio views

Unique Features

During my Tradier review, the unique feature was the availability of 100+ third-party trading platforms.

Research & Education

Tradier does not publish market research or actionable trading signals, as it focuses on DIY traders and investors. The Tradier Rundown weekly newsletter is a free newsletter that covers market events in under two minutes but is not a proper research piece.

What about education at Tradier?

Education at Tradier exists via Tradier Hub, a live education portal with daily shows curated for various topics. It is an interactive approach to education where traders can connect and interact with industry professionals.

My conclusion:

- Traders should consider the interactive Tradier Hub

- I also recommend beginners seek in-depth education from third parties, starting with trading psychology and the relationship between leverage and risk management

- Avoid paid-for courses and mentors

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Monday through Friday from 8:00 a.m. to 5:00 p.m. |

Website Languages |  |

Tradier prides itself on fast, human customer support, available Monday through Friday from 8:00 a.m. to 5:00 p.m. EST via a ticketing service, e-mail, and phone. Before contacting customer support, I recommend that traders browse the FAQs in the support center.

Noteworthy:

- Phone support exists, but I miss a direct line to the finance department, where most issues can arise

Bonuses and Promotions

During my Tradier review, Tradier maintained a volume-based rebate program for options traders with an average daily transaction size of 5,000 contracts monthly.

Opening an Account

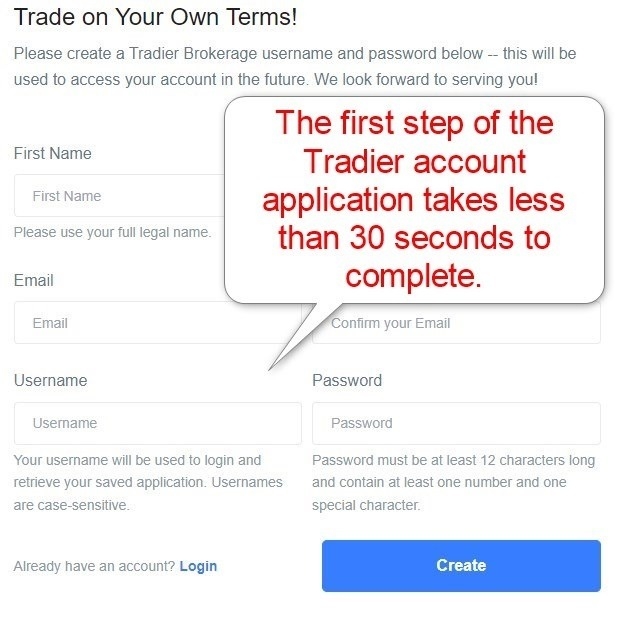

The Tradier online application asks for a name, e-mail, desired username, and password. Clicking “Create” grants access to the back office, where Tradier engages in data mining typical of US brokers to satisfy regulators.

What should traders know about the Tradier account opening process?

- Tradier complies with global AML/KYC requirements

- Account verification is mandatory

- Traders can verify accounts by uploading a copy of a government-issued ID

- Tradier may ask for additional information on a case-by-case basis

Minimum Deposit

A cash account has no minimum deposit requirement, while a margin account requires a $2,000 minimum deposit.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |   |

Tradier accepts bank wires, including ACH and ACAT, and checks.

Accepted Countries

Tradier caters to US citizens and residents who can open accounts from 150+ countries.

Deposits and Withdrawals

The secure Tradier back office handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Tradier?

- Tradier lacks modern payment processors

- A $30 domestic wire fee and a $40 to $75 international wire fee applies

- A $20 outbound check fee exists

- Tradier does not list a minimum withdrawal amount

- Traders must submit their wire transfers by 1:00 p.m. EST for same-day processing

- Third-party payment processing costs and currency conversion fees may apply

- The name on the payment processor and Tradier trading account must match in compliance with AML regulations

Is Tradier a good broker?

I like the trading environment at Tradier for US residents who favor options trading. The trading platform selection is unmatched, and Tradier has low trading fees for a US-based broker. I recommend the Tradier Pro or Pro Plus subscriptions for high-volume traders, as it decreases trading fees despite the monthly subscription fees. The interactive Tradier Hub offers beginners a fresh approach to education. Overall, I rank Tradier among the best choices for options traders and a quality brokerage for equity and ETF traders. Traders can have multiple accounts but only one margin account. Tradier is not commission-free, but Tradier maintains a competitive fee structure. Tradier connects to 100+ third-party trading platforms and has lower fees. The margin interest rate is 9.50%. A cash account has no minimum deposit requirement, while a margin account requires a $2,000 minimum deposit. Tradier is a legitimate broker founded in 2012 and regulated by the CFTC/NFA.FAQs

How many Tradier accounts can I have?

Is Tradier commission-free?

What is the difference between TradeStation and Tradier?

What is the margin interest rate for Tradier?

What is the minimum deposit for Tradier?

Is Tradier legit?