Editor’s Verdict

Taurex, founded in 2017, is a multi-asset broker with offices in the Seychelles and the UK. It offers ultra-low trading fees and a well-balanced asset selection, exceeding 1,500 trading instruments, on the MT4/MT5 trading platforms. Passive trading opportunities exist via copy trading and PAMM accounts. I evaluated Taurex’s trading conditions to determine its competitiveness and suitability for different types of traders. Want to know if Taurex is the right broker for you? Keep reading to find out.

Overview

Taurex offers ultra-low trading fees in a highly competitive trading environment.

Headquarters | Seychelles |

|---|---|

Regulators | FCA, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2017 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Average Trading Cost EUR/USD | 0.2 pips ($2.00) |

Average Trading Cost GBP/USD | 0.4 pips ($4.00) |

Average Trading Cost WTI Crude Oil | $0.054 |

Average Trading Cost Gold | $0.34 |

Average Trading Cost Bitcoin | $41.92 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.2 pips |

Minimum Commission for Forex | $4.00 per round lot |

Funding Methods | 10+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Five Core Taurex Takeaways:

- Raw spread trading with spreads from 0.0 pips for a $4.00 commission

- A well-balanced asset selection featuring 1,500+ assets

- Excellent beginner education, including live trading sessions and one-hour consultations

- Actionable trading signals, trading ideas, and AI News Sentiment

- No volume-based rebates for high-volume traders

Taurex Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations and verify them with the regulator by checking the provided license with their database. Taurex has two regulated subsidiaries with a clean track record.

Country of the Regulator | Seychelles, United Kingdom |

|---|---|

Name of the Regulator | FCA, FSA |

Regulatory License Number | SD092, 816055 |

Regulatory Tier | 4, 1 |

Is Taurex Legit and Safe?

My review found no misconduct or malpractice by this broker. Therefore, I can recommend Taurex as it is a legitimate broker.

Taurex regulation and security components:

- Financial Services Authority in Seychelles and the Financial Conduct Authority in the UK

- Founded in 2017

- $1 million insurance coverage per client

- Segregation of client deposits from corporate funds

- Negative balance protection

- Data encryption via state-of-the-art systems

- Security infrastructure includes advanced firewalls, restricted file access, and the latest anti-virus and anti-malware systems

- Continuous monitoring and updating of systems to meet evolving cybersecurity standards

What Would I Like Taurex to Add?

Taurex ticks all the boxes for a secure and trustworthy trading environment. If I must criticize something, it would be the absence of verified trading statistics, audited financial statements, and information about its core management team.

Fees

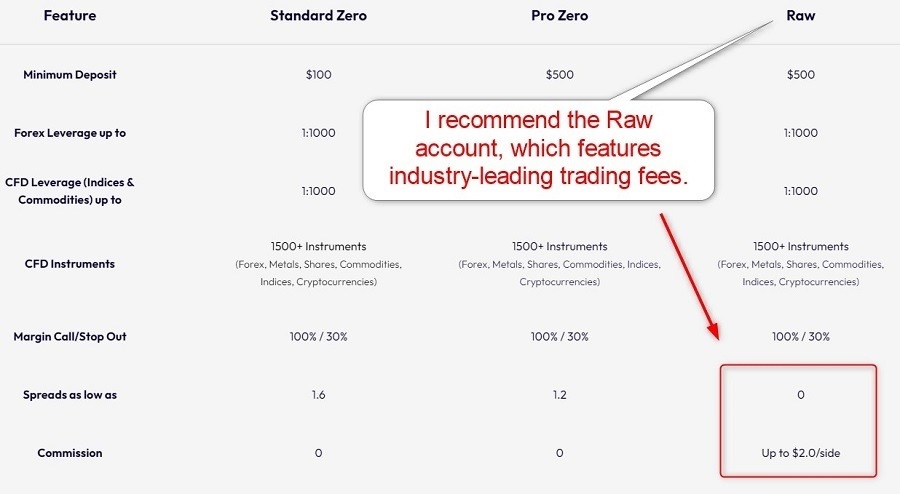

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Taurex offers two expensive commission-free cost structures and one ultra-competitive commission-based alternative.

Taurex does not levy internal deposit fees, while withdrawal fees depend on the payment processor and withdrawal amount. Traders may face third-party processing costs, and currency conversion fees may apply. During my Taurex review, there was no inactivity fee.

Average Trading Cost EUR/USD | 0.2 pips ($2.00) |

|---|---|

Average Trading Cost GBP/USD | 0.4 pips ($4.00) |

Average Trading Cost WTI Crude Oil | $0.054 |

Average Trading Cost Gold | $0.34 |

Average Trading Cost Bitcoin | $41.92 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.2 pips |

Minimum Commission for Forex | $4.00 per round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

The minimum trading costs for the EUR/USD at Taurex are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.6 pips (Standard Zero) | $0.00 | $16.00 |

1.2 pips (Pro Zero) | $0.00 | $12.00 |

0.0 pips (Raw) | $4.00 | $4.00 |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based Taurex Raw account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the Taurex Raw account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.2 pips | $4.00 | -$7.3920 | X | -$13.3920 |

0.2 pips | $4.00 | X | $2.574 | -$3.4260 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD at the average spread and holding it for seven nights in the Taurex Raw account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.2 pips | $4.00 | -$51.7440 | X | -$57.7440 |

0.2 pips | $4.00 | X | $18.0180 | $12.0180 |

Noteworthy:

- Taurex forwards positive swap rates on qualifying assets

- Taurex swap rates rank among the lowest industry-wide

Range of Assets

Traders get a well-balanced asset selection of 1,500+ trading instruments covering six sectors. I like the inclusion of cryptocurrencies and ETFs. Taurex offers equity trading on shares listed in the US, the UK, Germany, and France. While the selection is good, I would appreciate other markets for better diversification.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Taurex covers the following sectors:

- Forex

- Cryptocurrencies

- Commodities

- Indices

- Equities

- ETFs

Taurex Leverage

Maximum Retail Leverage | 1:2000 |

Maximum Pro Leverage | 1:2000 |

What should traders know about Taurex leverage?

- The maximum retail Forex and index leverage is 1:2000

- Commodities max out at 1:200

- Equity traders get 1:20

- Cryptocurrencies max out at 1:10

- Not all assets within a class qualify for the maximum leverage

- Taurex offers intelligent dynamic leverage, decreasing the maximum leverage via a multi-tier system as the trade size increases

- Negative balance protection exists, ensuring traders cannot lose more than their deposit

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses

Account Types

While traders can choose among three account types, I strongly recommend the commission-based Raw account, the only one with ultra-competitive fees. The two commission-free alternatives have high costs, which make no sense to me due to the minimum deposit requirements. I believe Taurex would do well to simplify its account structure to only the Raw account and offer volume-based rebates for high-volume traders.

During my Taurex review, unrestricted demos and Sharia-compliant swap-free Islamic accounts were also available.

Key features of the various Taurex account types include:

- A $100 minimum deposit requirement for the Standard Zero account

- A $500 minimum deposit requirement for the Pro Zero and Raw accounts

- Ultra-low commission-based trading fees

- Industry-leading swap rates

- USD, EUR, and GBP as account base currencies

- $1 million insurance coverage per client

- A maximum leverage of 1:2000

- Negative balance protection

- A margin call at a 100% margin level on all accounts

- An automatic stop-out at a 30% margin level on all accounts

- A minimum transaction size of 0.1 lots

Taurex Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

What stands out about the Taurex demo account?

- Fully customizable via MT4 and MT5 demo accounts

- The Taurex demo account has no time limit

- Convenient demo account management via the secure dashboard

Trading Platforms

Taurex offers MT4/MT5 upgraded with Trading Central and Acuity. MT4 and MT5 are available as powerful desktop clients. I recommend the latter, as they feature all the functions, including algorithmic trading. Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs, while MT5 features 10,000+. A proprietary Taurex mobile app is also available.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

During my Taurex review, the in-house copy trading service, PAMM accounts for traditional account management services, and the FIX API for advanced algorithmic traders stood out. Taurex also caters to prop trading firms, including tailored trading solutions.

Research and Education

Traders receive high-quality research at Taurex via third-party services from Trading Central and the Acuity Signals Center, available as MT4/MT5 plugins. These include actionable trading ideas, AI News Sentiment, and Featured Ideas. Taurex VIP clients receive expert trading analysis from the in-house team, who publish market commentary on the Taurex blog.

What about education at Taurex?

Beginners should consider the high-quality educational content at Taurex, featuring trading guides, webinars, daily live sessions, one-hour consultations with analysts, premium trading support for Raw account holders, and a service by Swiset. This service includes a trading mentor, customizable trading plans, trading journals and insights, funding simulations, Telegram integration and real-time notifications, tournaments, and competitions.

My conclusion:

- Traders can start with the available educational content at Taurex

- I also recommend beginners seek in-depth education from third parties, starting with the topics of trading psychology and the relationship between leverage and risk management

- Avoid paid-for courses and mentors

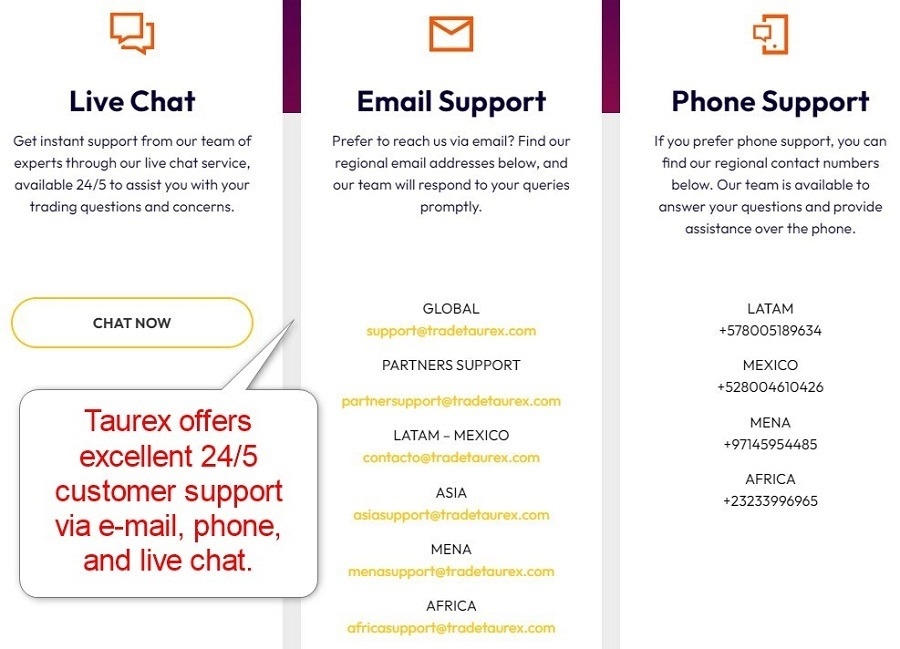

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |        |

Taurex offers excellent 24/5 customer support via e-mail, phone, and live chat, but I recommend traders browse the FAQ section before contacting customer support, which answers some common questions. During my Taurex review, I used live chat, where the response time was fast, customer support was friendly, and representatives promptly responded to a question about swap rates without asking questions. Therefore, I rate Taurex customer support among the best across the industry.

Noteworthy:

- Phone support exists, but I miss having a direct line to the finance department, where most issues can arise.

Bonuses and Promotions

During my Taurex review, Taurex did not offer bonuses but hosted a demo trading competition with a prize fund of $2,000 payable to the top five performers. Terms and conditions apply, and I urge traders to read and understand them while considering the negatives of demo trading competitions.

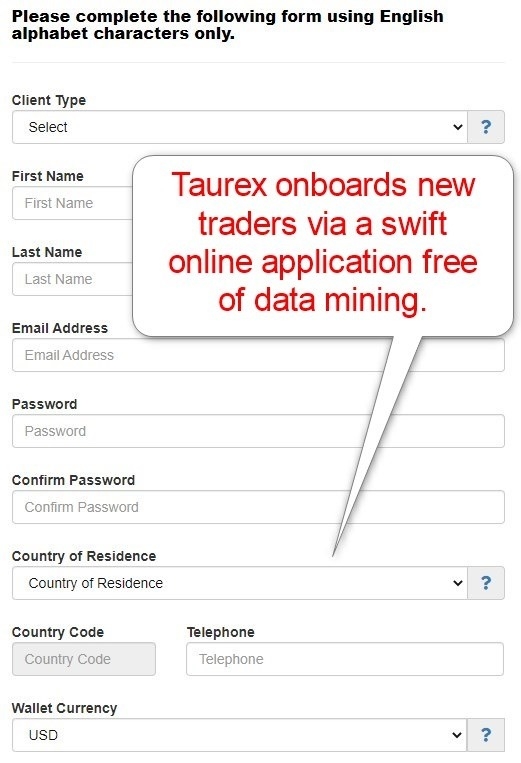

Opening an Account

Taurex onboards new traders via a swift online application. Traders must select their client type, submit their name and e-mail address, select a desired password, and specify their country of residence, phone number, and wallet currency. Clicking “Register Now” completes the registration. I appreciate the absence of data mining.

What should traders know about the Taurex account opening process?

- Taurex complies with global AML/KYC requirements

- Account verification is mandatory

- Traders can verify accounts by uploading a copy of a government-issued ID and one proof of residency document

- Taurex may ask for additional information on a case-by-case basis

- Traders must verify their payment method

Minimum Deposit

The Taurex minimum deposit is $100 for the Standard Zero account and $500 for the Pro Zero and Raw accounts.

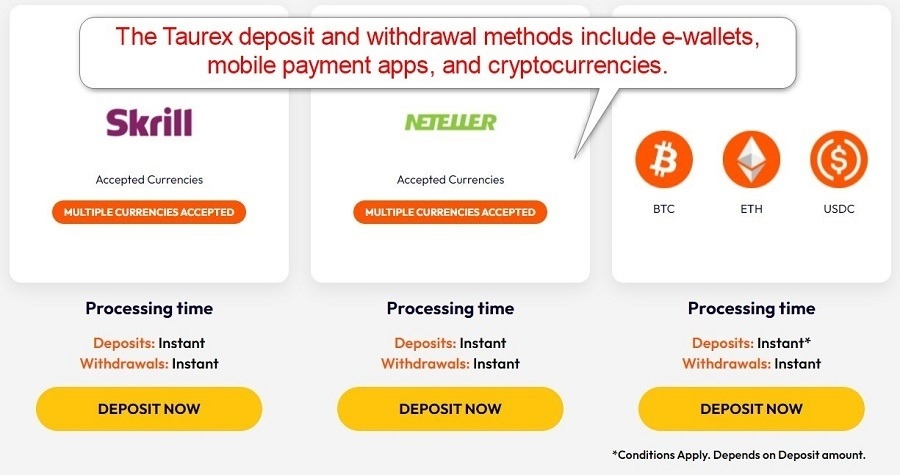

Payment Methods

Withdrawal options |        |

|---|---|

Deposit options |        |

Taurex accepts bank wires, credit/debit cards, mobile payment processors, Skrill, Neteller, cryptocurrencies, Apple Pay, and Google Pay.

Accepted Countries

Taurex accepts clients from many countries, but its website lists “the United States, Canada, North Korea, Iran, Belgium, Japan or any particular country and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation” as ineligible to open an account.

Deposits and Withdrawals

The secure Taurex dashboard handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Taurex?

- No internal deposit fees exist

- The minimum deposit is $100 or a currency equivalent

- Deposit currencies include the USD, EUR, GBP, BTC, ETH, and USDC

- Withdrawal fees depend on the payment processor and withdrawal amount

- Taurex does not list a minimum withdrawal amount

- Third-party payment processing costs and currency conversion fees may apply

- The withdrawal process can take between 24 hours and five business days

- The name on the payment processor and on the Taurex trading account must match, in compliance with AML regulations

- Payment processor availability depends on the geographic location of traders

Is Taurex a Good Broker?

I like the trading environment at Taurex for its ultra-low fees, ECN order routing, dynamic leverage with negative balance protection, and the FIX API for advanced algorithmic traders. Taurex also maintains a well-balanced asset selection, industry-leading customer support, PAMM accounts for traditional account management, and an in-house copy trading service. Beginners benefit from high-quality education, including a one-hour consultation with analysts and excellent research featuring actionable trading signals. Therefore, I rank Taurex among the best Forex brokers industry-wide and place it among the top five. The maximum Taurex leverage is 1:2000 with negative balance protection. The Taurex minimum deposit is $100, but I recommend the $500 to unlock all services and trade with ultra-low trading fees. Taurex operates out of the Seychelles and the UK. The Financial Services Authority in Seychelles and the Financial Conduct Authority in the UK regulated Taurex. The primary benefits of Taurex include ultra-low trading fees, ECN order routing, dynamic leverage with negative balance protection, the FIX API for advanced algorithmic traders, PAMM accounts for traditional account management, an in-house copy trading service, excellent beginner research and education, and industry-leading 24/5 customer support.FAQs

What is Taurex’s maximum leverage?

What is the minimum deposit for Taurex?

Where is Taurex based?

Is Taurex a regulated broker?

What are the benefits of Taurex?