Editor’s Verdict

Overview

Review

Tastyworks, created by tastytrade, founder of thinkorswim, now part of TD Ameritrade, acquired by Charles Schwab, offers traders a powerful proprietary trading platform and a low-cost pricing environment. Traders may also benefit from its growing trading community, and tastyworks accepts international clients with growing reach. I reviewed tastyworks to evaluate if this broker delivers on its statement of providing traders pricing, technology, and inspiration. Should you trade with tastyworks?

Summary

tastyworks - A cutting-edge trading platform with low trading costs

Headquarters | United States |

|---|---|

Regulators | ASIC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2017 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Trading Platform(s) | Proprietary platform |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the proprietary trading platform at tastyworks, but beginner traders may need some time to become fully familiar with it. However, tastyworks offers instructional videos to flatten the learning curve.

tastyworks - first look:

- tastyworks offer a cutting-edge proprietary trading platform

- The cost structure is highly competitive except for moderately higher financing costs on leveraged overnight positions

- tastyworks, via tastytrade, presents a growing trading community

- The FAQ section remains one of the best industry-wide, offering easy-to-understand explanations and example

- tastytrade continuously expands the list of international traders it accepts

- Traders must enable cryptocurrency trading in their accounts if they wish to trade crypto, as it remains disabled by default

- Distinct focus on options trading

- Best suited to advanced traders with a preference for options and futures trading

tastyworks Overview of Main Features

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | No |

Minimum Deposit | $0 |

Demo Account | No |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | $0 |

Deposit Fee | Yes + Third-Party |

Withdrawal Fee | Yes + Third-Party |

Funding Methods | 3 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. tastyworks presents clients with two well-regulated tier 1 entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Australia | Australian Securities and Investments Commission (ASIC) | 508867 |

US | Financial Industry Regulatory Authority (FINRA) | CRD#: 277027/SEC#:869649 |

Noteworthy:

- The ultimate regulator of tastyworks remains the US Securities and Exchange Commission (SEC)

- tastyworks is also an NFA member

- tastyworks maintains membership with the non-profit Securities Investor Protection Corporation (SIPC), protecting clients up to $500,000 per net equity or $250,000 for cash claims

- SIPC protection does not apply to futures accounts

- Apex Clearing Corporation segregates customer futures account positions and cash balances

- tastyworks has a clean regulatory track and seasoned management team with profiles on its website

- tastyworks does not provide investment, tax, or legal advice

What could be better?

- Third-party insurance

Since 2017, tastyworks has offer traders, especially options and futures traders, a low-cost trading alternative with an expanding asset base from a secure and trustworthy trading environment.

Fees

I rank trading costs among the most defining aspects in evaluating a Forex broker, as they directly impact profitability.

tastyworks offers traders the following core cost structure:

Asset | Opening Commission | Closing Commission |

|---|---|---|

Options on Stock & ETFs ($10 max per leg) | $1.00 per contract ($10 max per leg) | $0 |

Options on Futures | $2.50 per contract | $0 |

Options on Micro Futures | $1.50 per contract | $0 |

Stock & ETFs | $0 unlimited shares | $0 |

Futures | $1.25 per contract | $1.25 per contract |

Micro Futures | $0.85 per contract | $0.85 per contract |

Smalls Futures | $0.25 per contract | $0.25 per contract |

Smalls Futures Options | $0.50 per contract | $0 |

Cryptocurrency ($10 max) | 1% of total crypto purchase | 1% of total crypto sale |

Here are the Single-Listed Exchange Proprietary Index Options Fees:

Symbol | Description | Fee per Contract |

|---|---|---|

SPX | S&P 500 Index | $0.65 |

RUT | Russell 2000 Index | $0.18 |

VIX | CBOE Market Volatility Index | $0.65 |

OEX | S&P100 Index (American-style exercise) | $0.40 |

XEO | S&P 100 Index (European-style exercise) | $0.40 |

DJX | Dow Jones Industrial Average Index 1/100 | $0.18 |

NDX | NASDAQ 100 Index | $0.18 |

XSP | Mini-SPX Index 7 | $0.00/$0.04 |

The following exchange, clearing, and regulatory fees apply to all opening and closing trades except for cryptocurrency orders:

- Option Exercise / Assignment - $5

- Options Regulatory Fee - $0.02915 / contract

- FINRA TAF - Stock Sales - $0.000119 / share (The FINRA TAF for stock is currently $0.000119 per share with a per-transaction cap of $5.95)

- FINRA TAF - Option Sales - $0.002 / contract

- SEC Fee - $5.10 / $1,000,000.00 in sales

- Clearing Fees - Equities - $0.0008 / share

- Clearing Fees - Options - $0.10 / contract

- Clearing Fees - Futures - $0.30 / contract

- Clearing Fees - Warrants - $20 / transaction

- NFA Fee - $0.02 / contract

- Voluntary Corporate Actions (Reorg/Tender Offers) - $50

- Warrant Exercise Fee - $50 / instruction

- Treasury Bill Fee - $25 / transaction

- Paper Confirms - $2 / confirm

- Paper Monthly and Quarterly Statements - $5 / statement

- Paper Tax Statements - $5 / statement

- Paper Prospectus - $2.50 / mailing

- Third Party Distribution Notification - $2

- DTC Delivery - $25

- Mutual Fund Liquidation - $20 / fund

- Non-Transferable Security Fee - $10 / mo. per security

- ADR Fees where applicable

What could be better at tastyworks?

- tastyworks delivers a highly competitive pricing environment but lacks a commission-rebate program for high-volume traders

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Here are the financing costs (swap rates) at tastyworks:

Debit Balance | Rate | Base Rate +/- |

|---|---|---|

$0 - $24,999 | 8.00% | Base Rate + 1.00% |

$25,000 - $49,999 | 7.50% | Base Rate + 0.50% |

$50,000 - $99,999 | 7.00% | Base Rate |

$100,000 - $249,999 | 6.50% | Base Rate - 0.50% |

$250,000 - $499,999 | 6.00% | Base Rate - 1.00% |

$500,000 - $999,999 | 5.50% | Base Rate - 1.50% |

$1,000,000 + | 5.00% | Base Rate - 2.00% |

Option price comparison between tastyworks and five US-based competitors:

25 Puts/Calls (50 total contracts) | 25 Verticals (100 total contracts) | 25 Iron Condors (200 total contracts) | |

|---|---|---|---|

Tastyworks | $15.00 | $30.00 | $60.00 |

E*TRADE | $32.50 | $65.00 | $130.00 |

Fidelity | $32.50 | $65.00 | $130.00 |

Interactive Brokers | $35.00 | $70.00 | $140.00 |

Schwab | $32.50 | $65.00 | $130.00 |

TD Ameritrade | $32.50 | $65.00 | $130.00 |

Noteworthy:

- tastyworks notes the base rate of 7.00% for margin traders remains subject to change without notice

- Financing costs at tastyworks are moderately higher than competing brokers

- tastyworks maintains a complete cost structure on its website, which is easy to understand, with trading cost examples and comparisons

- Overall trading costs at tastyworks are notably lower, resulting in higher profitability for traders

- tastyworks has no inactivity fee

- The fees and commissions section does not list a currency conversion fee

What Can I Trade?

While tastyworks remains an options and futures broker at the core, I like that it has begun expanding its asset list. It now offers commission-free equity trading and ETFs while also adding low-cost cryptocurrencies. The most recent addition includes fractional share dealing as part of its dividend reinvestment plan (DRIP).

Regrettably, foreign-listed equities and OTC/penny stocks are not available at tastyworks, neither are mutual funds. The latter may disappoint investors and their retirement planning, but tastyworks caters more towards traders than investors, at least for now.

What could be better?

- Adding Forex and commodities

- tastyworks does not publish a more in-depth asset list and should at least note how many trading instruments exist

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

tastyworks Leverage

Margin accounts get maximum leverage of 1:2, which is normal for US stocks under US FINRA regulation.

Other things worth noting about tastyworks leverage:

- While tastyworks does not specify negative balance protection, it will close positions if traders fail to meet margin calls

- Given the available margin, I find the absence of negative balance protection acceptable, as tastyworks has proven its ability to manage risk

tastyworks Trading Hours (CST Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 00:00 | Saturday 24:00 |

Forex | Not applicable | Not applicable |

Commodities | Not applicable | Not applicable |

European Equities | Not applicable | Not applicable |

US Equities | Monday 07:30 | Friday 16:00 |

Noteworthy:

- Equity markets open and close each trading session and are not operational continuously like cryptocurrencies

- tastyworks offers 24/7 cryptocurrency trading

Account Types

tastyworks presents six primary account types, some with sub-account choices, for a total of twelve choices

My observations concerning the tastyworks account types:

- Most retail traders will manage their portfolios in the individual account, available as either a cash or margin account

- There is no minimum deposit for cash accounts, while margin accounts require an acceptable $2,000 minimum, equal to the industry standard for all US brokers

- Two joint account options are also available, Tenants in Common (TIC) and With Rights of Survivorship (WROS)

- tastyworks expanded its offering to retirement planning, but it fails to provide mutual funds, while the fee list includes a $20 mutual fund liquidation cost per fund

- The asset selection fails to list treasuries and bonds, but the fee overview notes a $25 fee per transaction

- The six retirement account choices are Traditional IRA, ROTH IRA, SEP IRA, Beneficiary Traditional IRA, and Beneficiary Roth IRA

- tastyworks caters to US-based corporate clients through C Corp, S Corp, LLC, and Partnership accounts

- Trust accounts, for a revocable or an irrevocable trust, are also available

- tastyworks caters to international traders via cash, margin, and portfolio margin accounts and constantly expands its list of accepted countries

- UGMA/UTMA and Coverdell Education Savings Accounts, two custodial accounts, will become available soon

- tastyworks engages in payment for order flow

Noteworthy:

- Indian traders qualify for cash accounts only

- Australian traders get a subsidiary with oversight from its domestic regulator, the ASIC

- tastyworks maintains a list of eligible and restricted countries on its website

tastyworks Demo Account

tastyworks does not offer demo accounts, but it publishes in-depth YouTube videos labeled tastyworks Platform Demo Day. Given the complexity of the cutting-edge proprietary trading platform, it would be great if tastyworks offered a demo version, allowing users to familiarize themselves with its functionality.

Trading Platforms

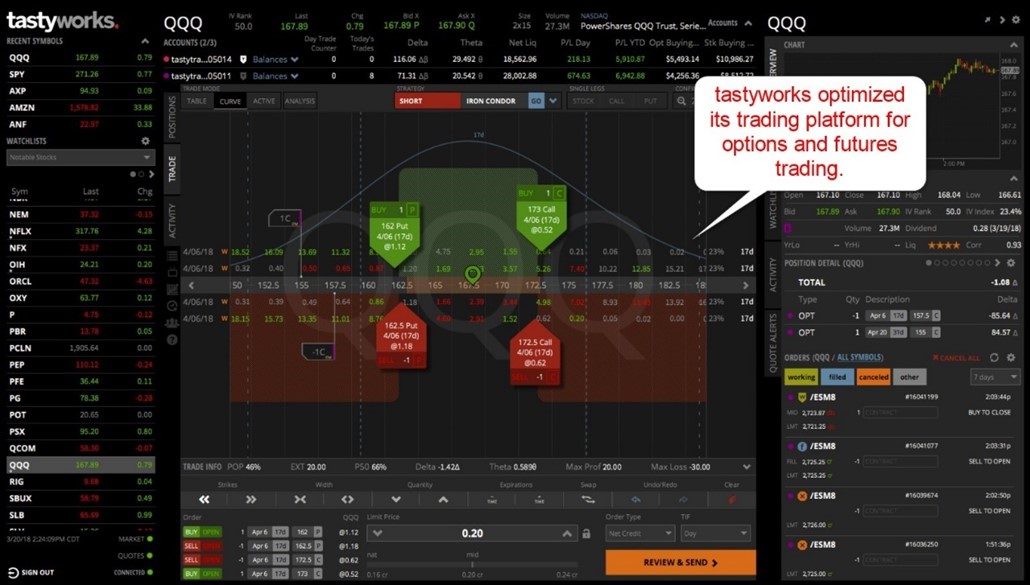

The proprietary trading platform at tastyworks offers options and futures traders a cutting-edge solution. It remains optimized for speed, and tastyworks describes it as “see it, click it, and trade it”, ideal for fast-moving markets.

It will require time for some traders to become fully acclimatized to the trading platform. tastyworks developed it for advanced traders and created an excellent trading platform available as a desktop client, with all functions available, a lightweight web-based alternative, and a mobile app.

While the trading platform fails to support algorithmic and API trading, it supports Autotrade, allowing traders with a Newsletter Service Provider (NSP) subscription to connect their tastyworks account, like a copy trading service.

The tastyworks trading platform includes:

- Curve Analysis

- Quick Roll

- Quick Order Adjustments

- Percent Of Profit Limit Orders

- ETF-Equivalent Futures Delta

- In-App Trading Inspiration (the tastytrade trading community)

What could be better?

- The tastyworks trading platform does not support algorithmic and API trading

Overview of Trading Platforms

MT4 | No |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | No |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons/Upgrades | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | No |

Unique Feature One | Cutting-edge trading platform |

Unique Feature Two | A fast trade execution process |

Unique Features

I like that tastyworks caps commissions at $10 per order, granting complete cost control to high-volume traders. Additionally, this allows tastyworks to compete with the cheapest brokers industry-wide, which I find the most notable benefit for traders, especially with higher transaction volume and frequent trading activity. The trading platform features an integrated video feed and trading community, which present a nice touch.

Research and Education

tastyworks relies on an active and growing trading community, provided via tastytrade for research and education. The Cherry Bomb newsletter remains the most popular, but the tastytrade research team also manages others.

Regrettably, access to tastytrade research and education requires a sign-up at tastytrade. I prefer an optimized approach where traders open one trading account and get all available services.

My takeaways:

- tastyworks relies on its trading community for research and education, which consists of newsletters, YouTube videos, webinars, and podcasts for well-balanced and interactive research and education

My recommendations:

- Traders may access numerous free research available online

- I also advise investors to seek educational content from trusted third parties free of charge to supplement what the trading community provides

- The Autotrade function, comparable to a copy trading service, may offer passive oriented traders a solution to consider

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |  |

tastyworks does not list customer support hours, but traders should access the in-depth help center before contacting support, as it covers the most common topics in detail.

I like the quality of the FAQ section, as it answers most questions. Tastyworks also describes its products in detail with examples, limiting the need to reach out to customer service.

My recommendations and observations:

- Traders should read the FAQ section before reaching out to a customer service representative

- For non-urgent questions, I recommend live chat

- Regrettably, tastyworks does not list a phone number for phone support

Bonuses and Promotions

tastyworks offers bonuses of $200 for deposits of $2,000 and $500 for deposits $10,000 to new accounts. Terms and conditions apply, and I urge traders to read and understand them before accepting incentives. I like the affiliate program at tastyworks, which offers a series of quality rewards geared towards younger traders, its core market. It is a well-executed program, and I rank it the best in the US.

Awards

tastyworks is an exciting and young broker, offering a breath of fresh air to the US brokerage industry. The core market of tastyworks is millennial and GenZ traders, for which it provides an excellent trading environment. A growing number of advanced professional traders flocked to tastyworks, taking advantage of its low-cost pricing environment for US-listed assets. For its competitive combination of pricing, technology, and inspiration, tastyworks received numerous awards.

The Investor's Business Daily tastyworks awards are:

- #1 Trade Execution Speed/Price

- #1 Website Security

- #1 Site Performance

- #1 Equity Trading Tools

- #1 Customer Service

- #1 Trade Ideas

- #1 Educational Resources

- #1 Mobile Trading Platforms/Apps

- #1 Options Trading Platform

- #1 Margin Investing/Margin Interest Rates

- #1 Access to IPOs

- #1 Original Programming

The Investopedia tastyworks awards are:

- Best for Low Costs

- Best Options Trading Platform

- Best Broker for Advanced Options Traders

- Best Broker for Mobile Options Traders

Opening an Account

An online application form handles new account applications, but it is a multi-step process.

Traders tend to report account opening is normal by US standards but a little slow by international standards. Account verification remains mandatory. US traders will usually satisfy this by sending a copy of a government-issued ID. It varies for international clients, and tastyworks may request additional documents.

Minimum Deposit

There is no minimum deposit for cash accounts, but margin traders must deposit a minimum of $2,000.

Payment Methods

tastyworks offers a choice between bank wires, online banking options, and checks.

Accepted Countries

tastyworks primarily caters to US traders but continues to expand globally. Traders from the UK, the Netherlands, Australia, and Malaysia may open an account and tastyworks.

Deposits and Withdrawals

All financial transactions occur in the secure back office of tastyworks. Only bank-related options are offered.

Here is an overview of applicable banking fees:

- ACH Deposits & Withdrawals - Free

- Outgoing Domestic Wire - $25

- Outgoing Foreign Wire - $45

- Reorg Wire Fee - $25 minimum

- ACH Notice of Correction - $5

- Domestic Check - $5

- Foreign Check - $10

- Dividend Check - $5

- Overnight Check Delivery - Domestic - $50

- Overnight Check Delivery - International - $100

- Returned Check / Wire / ACH / Recall - $30

- Check Copies - $15

- Stop Payment on Apex Issued Checks - $30

- Outgoing ACAT Transfers - $75

- Transfer and Ship Certificate - $235

- Certificate Processing - $300 minimum

- Certificate Processing Return - $100 minimum

- Restricted Stock Processing - $205

- IRA Closing Fee - $60

- Annual IRA Maintenance Fee - Free

- Prepayment Fee - Greater of 0.2% or $20

- Transfer on Death Account Transfer Fee - $50

- Incoming & Outgoing DRS transfers - $115 per symbol

My observations:

- tastyworks does not support modern, low-cost, online payment processors, which I find disappointing, but not unusual for US-based brokers, who rely primarily on banks and bank-related methods

- The ACH deposit cutoff time is weekdays at 02:00 p.m. CST and 01:00 for withdrawals, and tastyworks processes requests received after the cutoff time the following business day

- Withdrawals take between one and three business days

- tastyworks supports broker-to-broker transfers

My recommendations:

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

The Bottom Line

I like the trading environment at tastyworks for traders who require US-based assets and prefer options and futures trading. I find the cost structure the most notable advantage at tastyworks, as it delivers significant trading cost-savings for active, high-volume traders. The proprietary trading platform is a cutting-edge solution geared towards advanced traders and the trading community, available via tastytrade, providing research, trading ideas, and educational content is a hidden gem. tastyworks also maintains an excellent affiliate program, and its international ambitions make it a young and exciting broker to monitor. Tastyworks is a legit broker with a clean FINRA track record and additional regulatory oversight from ASIC. The active trading community, provided by its sister company tastytrade, offers engaging research, trading ideas, and educational content, making tastyworks ideal for beginners. The trading platform will require time to learn and understand, but overall, beginner traders have excellent resources at their disposal. There is no fee charged to open a tastyworks account, but margin traders must deposit a minimum of $2,000. The tastyworks infrastructure suits day traders well, as the trading platform remains optimized for speed, and the trading costs are highly competitive.FAQs

Is tastyworks com legit?

Is tastyworks good for beginners?

How much does it cost to open a tastyworks account?

Is tastyworks good for day trading?