Editor’s Verdict

Shares.com is a unique social trading platform backed by the solid infrastructure of the globally recognized Capital.com group. This relationship gives traders access to an award-winning proprietary platform and a highly competitive, zero-commission fee structure. While the brand name can be misleading as the platform offers CFD trading exclusively, its true strength lies in the robust, multi-regulated environment and advanced technology provided by its parent company, making it a simple-to-use option for modern traders and those fairly new to trading as well.

Overview

Shares.com Core Takeaways:

- A Trading Name: Shares.com is a brand and service provided by the Capital.com group.

- CFD-Only Broker: All trading on the platform is via Contracts for Difference (CFDs). You do not own the underlying assets.

- Social Focus: The platform is built around a social community, allowing users to see and discuss trades.

- Multi-Regulated: The service is primarily regulated by the SCB (Bahamas) for international clients, while the parent group holds top-tier licenses from the FCA, ASIC, and CySEC.

- Competitive Fee Model: The platform is known for its tight spreads with no commission, deposit, or withdrawal fees.

Headquarters | United Kingdom |

|---|---|

Regulators | SCB |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2021 |

Execution Type(s) | Matched Principal Broker |

Minimum Deposit | $10 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.6 pips |

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | 0.03 points |

Average Trading Cost Gold | 0.25 points |

Average Trading Cost Bitcoin | 1.5% of nonimal |

Retail Loss Rate | 83.00% |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.6 |

Minimum Commission for Forex | no commission |

Funding Methods | 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Shares.com Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. The regulatory structure of Shares.com is backed by a globally recognized and secure parent company.

Country of the Regulator | The Bahamas |

|---|---|

Name of the Regulator | SCB |

Regulatory License Number | SIA-F245 |

Regulatory Tier | 04-Jan |

Is Shares.com Legit and Safe?

Yes. For many international users, the service is provided by Capital Com Online Investments Ltd, an entity regulated by the Securities Commission of The Bahamas (SCB). While this is the primary regulator mentioned on the Shares.com website, the platform's credibility is significantly enhanced by its connection to the wider Capital.com group, which holds licenses from top-tier regulators including the FCA (UK), ASIC (Australia), and CySEC (Europe). This multi-jurisdictional oversight ensures a high standard of security and operational integrity.

- Service provided by the Capital.com group, established in 2016.

- Primarily regulated by the SCB (Bahamas) for international clients.

- Parent group also holds licenses from the FCA (UK), ASIC (Australia), and CySEC (Europe).

- Segregation of client deposits from corporate funds.

- Negative balance protection for all retail clients.

What Would I Like Shares.com to Add?

While Shares.com has a solid foundation, there are several areas where it could improve to broaden its appeal. The biggest potential upgrade would be the introduction of automated copy trading. The current social feature allows users to see and discuss trades, but adding the ability to automatically replicate the portfolios of successful traders would make the platform far more powerful for beginners.

Fees

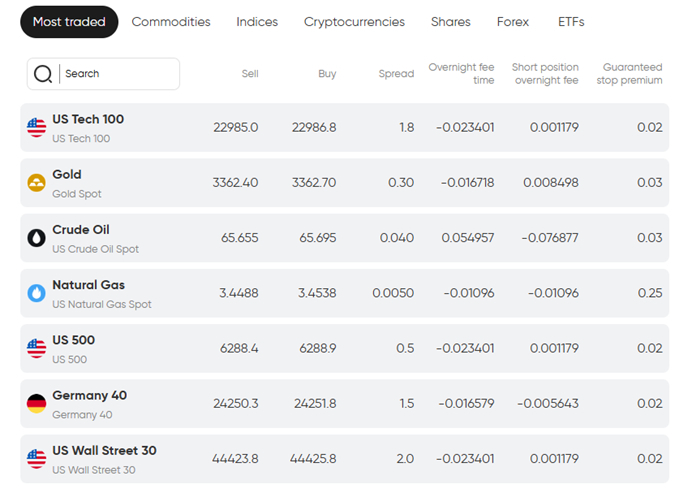

The fee structure at Shares.com is one of its most competitive features, inheriting the transparent and low-cost model of Capital.com. All trading costs are built into tight spreads with no additional commission ticket fee

Average Trading Cost EUR/USD | 0.6 pips |

|---|---|

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | 0.03 points |

Average Trading Cost Gold | 0.25 points |

Average Trading Cost Bitcoin | 1.5% of nonimal |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.6 |

Minimum Commission for Forex | no commission |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | 10 USD |

EURUSD trading costs

Average Spread (EUR/USD) | Commission per Round Lot | Total Cost per 1.0 Standard Lot |

~0.6 pips | $0.00 | ~$6.00 |

Noteworthy:

- Swap Fees: Leveraged overnight positions will incur swap fees, which can be positive or negative. Islamic swap-free accounts are not available.

- Inactivity Fee: An inactivity fee of $10 is charged to accounts after a prolonged period with no trading activity.

- No Deposit/Withdrawal Fees: Shares.com does not charge any fees for depositing or withdrawing funds.

- When you trade a market denominated in a different currency to your account, you pay an FX conversion fee of 0.7%

Overnight Swaps

Swap rates on leveraged overnight positions are often an ignored cost when trading. Depending on the trading strategy, particularly if the time horizon is longer than a day, these fees will have an impact. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the Standard Shares.com account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs (Long/Short) |

0.6 pips | $0 | -$7.50 | +$1.50 | $13.00 / $4.50 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long (7 nights) | Swap Short (7 nights) | Total Trading Costs (Long/Short) |

0.6 pips | $10.00 | -$52.00 | +$10.50 | $58.50 / -$4.50 |

Noteworthy:

- Swap Fees: Leveraged overnight positions are detailed on the website and platform unlike some other brokers

- The daily Swap fee uses the relevant interest rate benchmark +/- a markup of 0.01096%

- Shares.com refers to an ‘overnight fee’ this is the same as overnight swaps

Range of Assets

Shares.com provides a well-rounded selection of assets. All assets are offered as CFDs. The selection is robust, covering all major market sectors.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Shares.com Leverage

The maximum leverage available at Shares.com is determined by the regulatory body governing the client's account.

Maximum Retail Leverage (FCA/ASIC/CySEC) | Maximum Leverage (SCB- International) |

1:30 | Up to 1:200 |

What should traders know about Shares.com leverage?

- Leverage magnifies both potential profits and potential losses.

- Negative balance protection from Shares.com ensures retail traders cannot lose more than their account balance; if a loss extends beyond $0 the broker states it will be reinstated to zero.

- Always use risk management tools like stop-loss orders when trading with leverage.

- The firm offers guaranteed stops that the traders pay extra for but avoid extra losses due to gapping or slippage.

Shares.com Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 22:01 | Friday 21:59 |

Commodities | Sunday 23:00 | Friday 21:59 |

Crude Oil | Sunday 23:00 | Friday 21:59 |

Gold | Sunday 23:00 | Friday 21:59 |

Metals | Sunday 23:00 | Friday 21:59 |

Account Types

Shares.com offers a single, streamlined account type, ensuring all users have access to the same features and competitive pricing.

Shares.com Demo Account

A free demo account is available, allowing users to evaluate the proprietary platform and its social features with virtual money before making a real deposit.

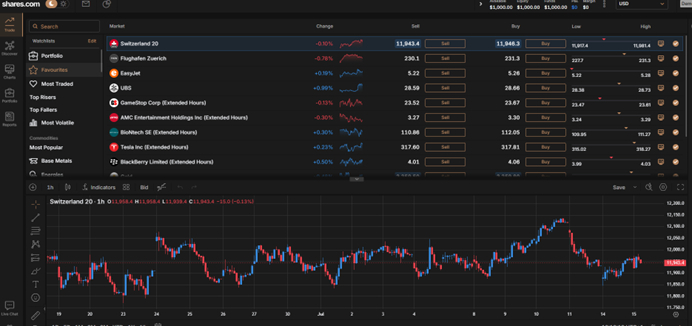

Trading Platforms

The service uses Capital.com's proprietary platform, which is known for its clean design and ease of use.

- Proprietary Platform: Available as a web trader and a highly rated mobile app, it's designed for simplicity and is ideal for beginners.

- No MT4/MT5: The platform does not support the MetaTrader suite.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

The core unique feature is social integration. The platform is designed to feel like a social network for trading, where users can create profiles, follow friends, and view each other's trading activity in a live feed.

Research & Education

Research tools are built into the platform, including news feeds and basic charting. However, there is no formal educational section, as the focus is on learning through community interaction. There is a comprehensive FAQ and knowledge section available on the website that has some detailed articles covering all the key aspects of trading.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 support |

Website Languages |   |

Shares.com offers 24/5 customer support through the following channels:

- Live Chat

Support is available in multiple languages, although the complete list is not specified.

Bonuses and Promotions

In compliance with its regulatory obligations, Shares.com does not offer bonuses or promotions to incentivize trading.

Opening an Account

The account opening process is fast, entirely digital, and can be completed in minutes through the mobile app. Standard KYC verification (ID and proof of address) is required. You can also signup using a Google or Apple ID which I like as it makes the process even quicker

What should traders know about the Shares.com account opening process?

- Shares.com adheres to global AML/KYC standards.

- Account verification is mandatory and requires a government-issued ID and a proof of residency document.

- The entire process can often be completed in under 10 minutes.

- Shares.com supports Google and Apple account registration

Minimum Deposit

The minimum deposit at Shares.com is low, starting from $10

Payment Methods

Withdrawal options |     |

|---|---|

Deposit options |     |

Shares.com supports a range of modern and traditional payment methods, including the list below.

- Bank Wires (Local and International)

- Debit Cards (Visa, Mastercard)

- Google and Apple payment methods

Accepted Countries

Shares.com accepts clients from many countries around the world but notably does not provide services to residents of the United States, UK, Canada, Japan, or certain other jurisdictions.

Deposits and Withdrawals

The client portal manages all financial transactions securely and efficiently.

What are the key takeaways from the deposit and withdrawal process at Shares.com?

- No fees are charged by Shares.com for deposits or withdrawals

- Deposits are typically instant; the website states an average time of 3 minutes

- Withdrawals are processed quickly, usually within 1-3 business days

- Withdrawals must be made back to the original funding source

- Debit card only no credit card allowed

Is Shares.com a Good Broker?

For the right user, yes, Share.com is a good broker. If you are a beginner looking for a simple, mobile-first CFD trading experience with a social twist and extremely low costs, Shares.com is an excellent choice. It's backing by the highly regulated Capital.com group provides a strong foundation of safety. However, if you are looking for a broker that offers real stocks or supports advanced platforms like MT5, this is not the right fit.